CCH Corporation Tax 2022.3: Release Notes

Overview

This release of Corporation Tax includes the following:

- New Form CT600M

- Changes to the CT600L

- S455 changes for Loans to Participators

- Freeport Plant & Machinery

- Freeport Structures & Buildings Allowance

- Updated RIM artefacts

Details of these and other changes are included in these release notes.

Prerequisites

This release is installed using the Central Suite Installer. This ensures that all prerequisites are in place and that all the products for which you are licenced are installed in the correct sequence. Click here to learn about the Central Suite Installer.

Legislative & Compliance Updates

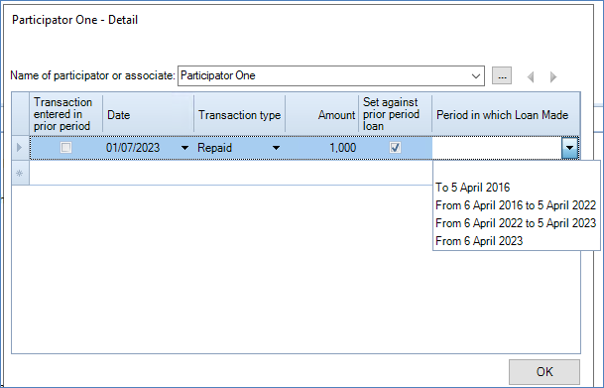

Form CT600A

We have implemented the change in the tax rate for s455 tax. This applies for Loans made to Participators within the period from 6 April 2022 to 5 April 2023 – it is charged at a tax rate of 33.75%.

For the repayment of loans brought forward from earlier years, we have implemented a drop down menu to show when the original loan was made – so the correct rate of tax is displayed.

Form CT600M

We have implemented the new form CT600M; this supports claims made for Capital Allowances within a Freeport and incorporates the disclosures for claims made for Structures and Buildings Allowances, and Plant and Machinery used within a Freeport. The forms and data entry screens are available for all Accounting Periods ended after 31 March 2021.

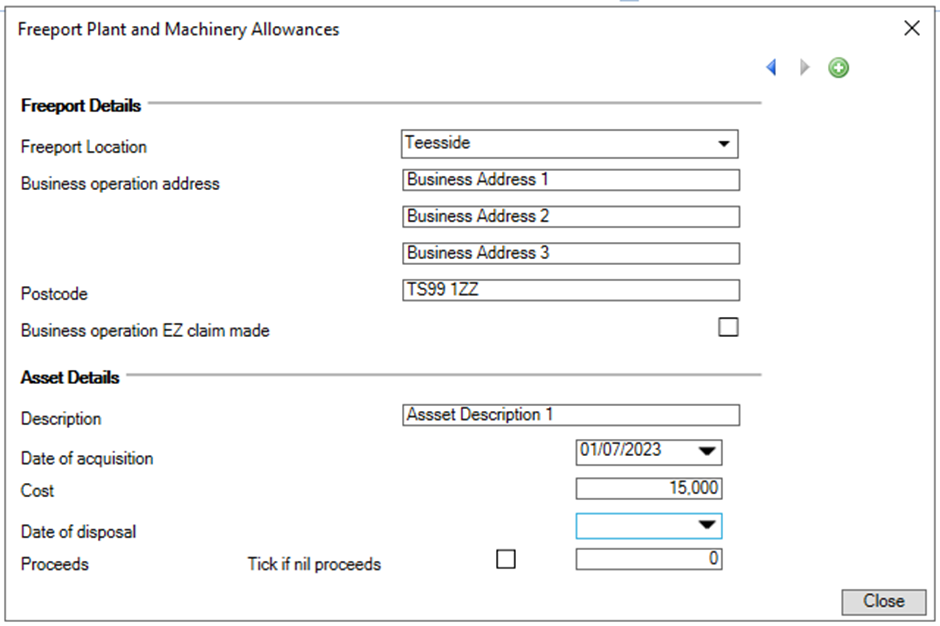

Freeport Plant & Machinery

The claims for Plant and Machinery used within a Freeport are made in the Capital Allowance area. We have included a new section just under the Main Pool to report details of additions and disposals.

When you access the screen, a menu appears. When you enter more than one addition – the freeport location is auto populated from the previous entry, it can be overwritten if necessary.

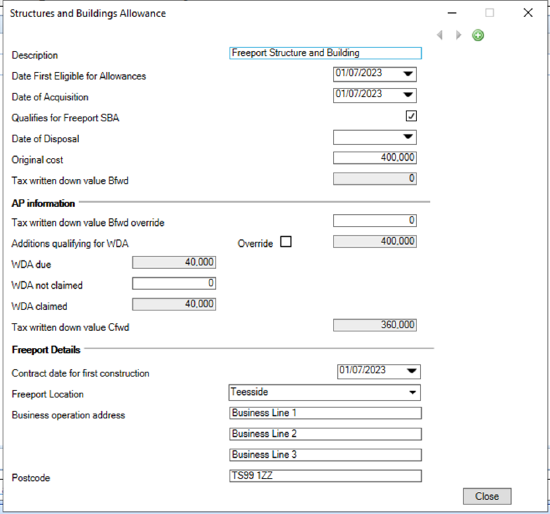

Freeport Structures and Buildings Allowance

Claims for Freeport Structures and Buildings Allowances are made via the claim for Structures and Buildings in the Capital Allowances aread. When the Qualifies for Freeport SBA tick box is selected then an additional data entry option appears at the bottom of the screen requesting details of where the Structure or Building is located:

It was not possible to complete the link from the Tangible Fixed Asset area to the Freeport Structures and Buildings capital allowance areas. All entries need to be manually entered.

Form CT600L

As part of the implementation of the new version of the RIM artefacts we have implemented changes to some of the formulas to populate the Form CT600L. This will enable the form to be validated and submitted to HMRC and not experience the validation issues experienced with the earlier version.

RIM artefacts

We have received the updated RIM artefacts; these changes are intended to overcome the majority of issues with online filing of form CT600L since the previous version was released by HMRC.

As part of this we have made adjustments to some of the calculations for the Form CT600L to accommodate the changes required to enable the return to pass validation. This incorporates changes to the calculation for the entries in Boxes 110, 168 and 169 of the form CT600L.

The updated RIM artefacts also include the extension of the rate of AIA to £1 million for the period to 31 March 2023.

Note: HMRC has very recently advised us of the following issues that may affect users following the d eployment of this updated version of the RIM artefacts:

eployment of this updated version of the RIM artefacts:

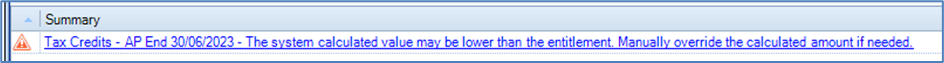

Creative Industry Tax Credits

In the 2021 Budget, HMRC made a temporary change to the rate of tax credits that can be claimed by surrendering losses from certain creative industries. The tax rates is effectively a sliding scale based on the date the expenditure is incurred and the type of creative industry. We have amended the warning message to advise the Tax credit claimed can be manually overwritten if the amount due is different.

Software Enhancements

Zoom Options

In the 2022.2 release of CCH CorporationTax, additional stepped options were included. When reviewing these options, it was not always possible to identify the ‘border’ on the page. This has been updated in this release.

Notable Issues