CCH Corporation Tax IE 2021.2

Prerequisites

Installing CCH Corporation Tax IE 2021.2

Prior to installing this update, you must ensure that you have 2020.2 currently installed on your system.

Installation of the update is straightforward; however, we recommend that you take a moment to review the Installation Guide

Introduction

As per Revenue guidelines and due to the implementation of the Finance Act 2020 and amendment in the taxonomy, we have made more than 70 changes in CCH Corporation Tax Version 2021.2 for the Tax Year 2021. The major and minor changes have been made to CCH Corporation Tax to comply with Revenue.

Major changes in Tax Year 2021

Major changes include several new tax fields and subsections to be filled in where applicable under

- Trading Results

o Option to enter plant and machinery excess capital allowances not claimed in this period under Trading Profits at 12.5%

o Option to enter losses obtained under Sec.400 under Trading Profits at 12.5%

o Option for the amount of capital allowance used under Sec. 291A(3) (Fixed Rate allowance) for this accounting period that relates to capital expenditure incurred before 11 October 2017, or on or after 11 October 2017 in Capital Allowance – Relevant Trade.

o Option for the amount of capital allowance used under Sec. 291A(4) (Fixed Rate allowance) for this accounting period that relates to capital expenditure incurred before 11 October 2017, or on or after 11 October 2017 in Capital Allowance -Relevant Trade.

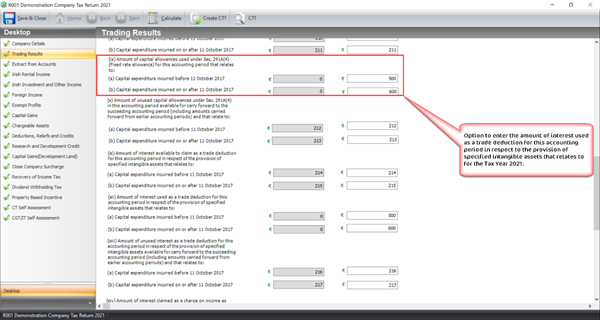

o Option for the amount of interest used as a trade deduction for this accounting period in respect of the provision of intangible assets that relates to capital expenditure incurred before 11 October 2017, or on or after 11 October 2017 in Capital Allowance- Relevant Trade.

- Extract from Accounts

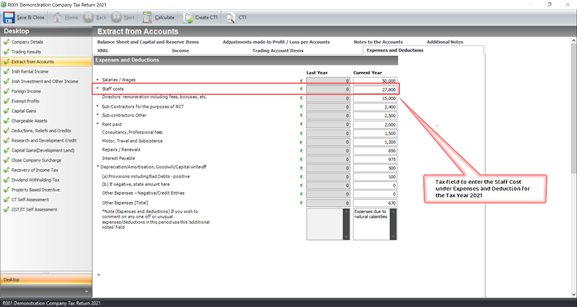

o Option to enter the amount for staff costs under Expenses and Deduction.

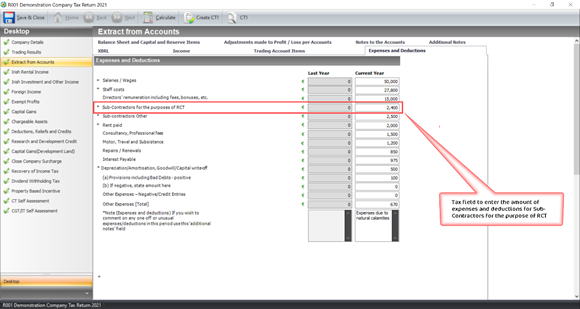

o Option to enter the amount for Sub-Contractors for the purchase of RCT under Expenses and Deduction.

o Option to enter the amount for rent paid under Expenses and Deduction.

o Option to enter the amount for Other Expenses [Total] under Expenses and Deduction.

o Option to enter the note (expenses and deductions), if you wish to comment on any off or unusual expenses/deductions in this period.

o Option to enter the amount of trade debtors under Balance Sheet and Capital Reserve Items.

o Option to enter the amount of trade creditors under Balance Sheet and Capital Reserve Items.

o Option to indicate that there is no adjustment required to profit/loss per accounts.

o Option to enter the amount of depreciation/ amortisation, goodwill/capital write-off in adjustment made to profit/ loss per accounts.

o Option to enter the amount of deduction of stock relief under S666.

o Option to enter the amount of deduction for the increase in the carbon tax under Section 664A

o Option to enter the amount of other deduction under adjustment made to profit/ loss per accounts.

o Option to enter the amount of other addbacks under adjustment made to profit/ loss per accounts.

o Option for Depreciation/Amortisation, Goodwill/ Capital Write-off in Detailed Adjusted Profit Schedule.

o Option for deduction for stock relief under Section 666 in Detailed Adjusted Profit Schedule.

o Option for deduction for an increase in the carbon tax under Section 664A in Detailed Adjusted Profit Schedule.

o Option for other deductions in Detailed Adjusted Profit Schedule.

o Option for other addbacks in Detailed Adjusted Profit Schedule.

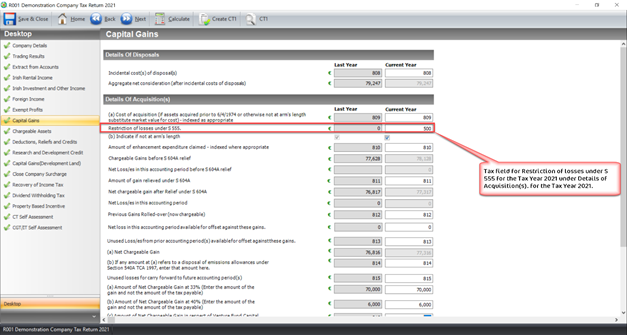

- Capital Gains

o Option to enter the amount of the restriction of losses under S 555 in Details of Acquisition(s).

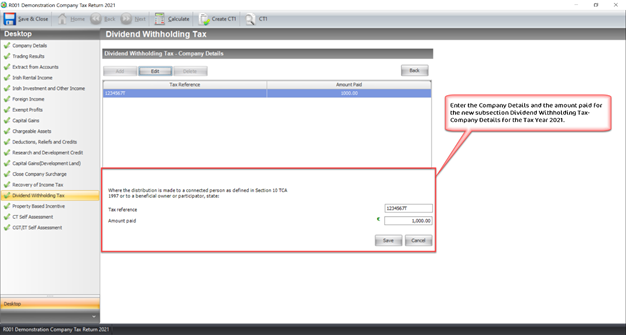

- Dividend Withholding Tax

o Subsection for Dividend Withholding Tax – Company

Minor changes in Tax Year 2021

Minor changes have been made to the following areas for the Tax Year 2021:

New Tax Fields for:

-

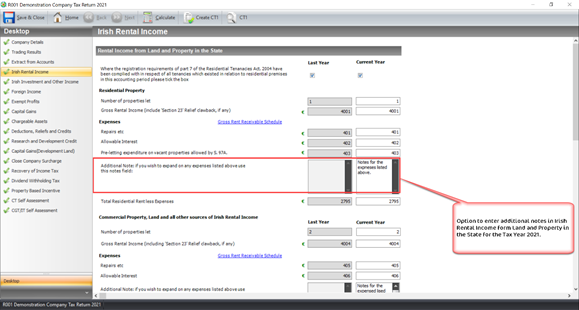

Irish Rental Income

o Option to enter additional notes in Rental Income from Land and Property in the State.

o Option to enter additional notes [Commercial Property etc.] in Rental income from land and Property in the State.

-

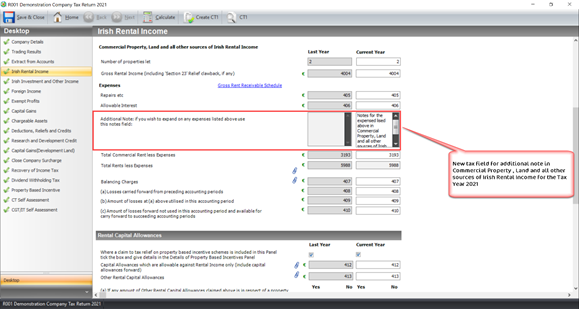

Irish Investment and Other Income

o Option to indicate the company refers to Real Estate Investment Trust [REIT]

o Option to enter the Tax Reference Number for Real Estate Investment Trust [REIT]

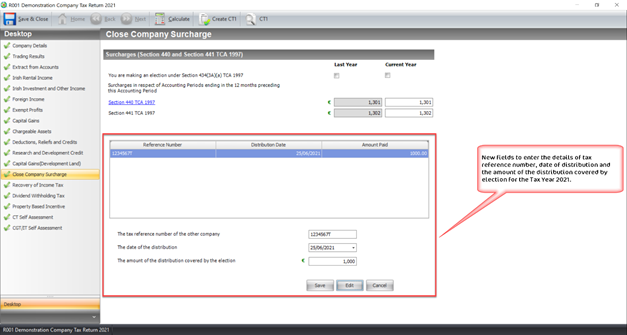

Close Company Surcharge

o Option to enter the Tax Reference Number of the other company under Surcharges (Section 440 and Section 441 TCA 1997)

o Option to enter the date of distribution under Surcharges (Section 440 and Section 441 TCA 1997)

o Option to enter the amount of distribution covered by-election under Surcharges (Section 440 and Section 441 TCA 1997)

CCH is committed to strong customer service and satisfaction. At all times you will be able to contact our company and our technical service teams. CCH will provide the highest level of customer service. We will provide telephone support as well as online remote access support and, where applicable, we will call out on-site to help resolve any support issue.

This document outlines the changes made in CCH Corporation Tax Version 2021.2. Please take time to read the notes and apply the update.

The following program changes have been introduced to fulfil the requirement of the Revenue Department and requested from both user feedback and internal quality control reviews.

IMPORTANT: Note it is very important that before running any database update you perform a database backup. CCH always advise that your practice takes regular backups to minimise any loss of data.

Trading Results

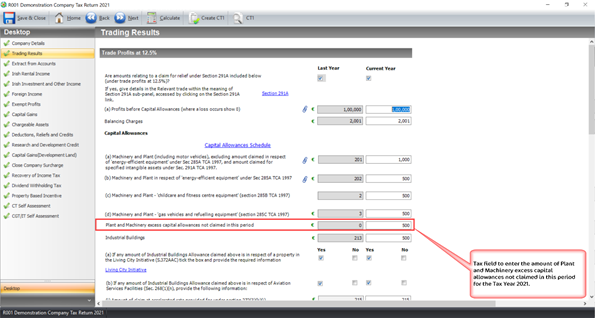

Option to enter Plant and Machinery excess capital allowance not claimed under Trade Profits at 12.5%

As per the Revenue guideline, Section 291A of TCA 1997 provides for capital allowances against trading income for the companies that incur expenditure on the provision of intangible assets for the trade. To comply with Revenue, we have added an option in the CCH Corporation Tax for the Tax Year 2021. The new option is as follows:

- Plant Machinery excess capital allowances not claimed in this period.

Figure 1: Tax field for Plant and Machinery excess capital allowances not claimed

Option to enter the amount under Section 400 during the period

As per the Revenue guideline, Section 400 of TCA 1997 provides that the right to capital allowances (and liability to balancing charges) and relief for losses forward are to be carried over from one company to another where a company ceases to carry on trade and thereafter another company carries it on, provided that there is substantial identity in the ownership of the trade before and after the change. Where the conditions of the section are fulfilled, the successor company in effect “steps into the shoes” of the predecessor company for capital allowances, balancing charges and losses forward.

To comply with the Revenue, we have added the following tax field in CCH Corporation Tax for the Tax Year 2021.

- Section 400 losses obtained during the period.

Figure 2: Tax field for Section 400 losses obtained during the period

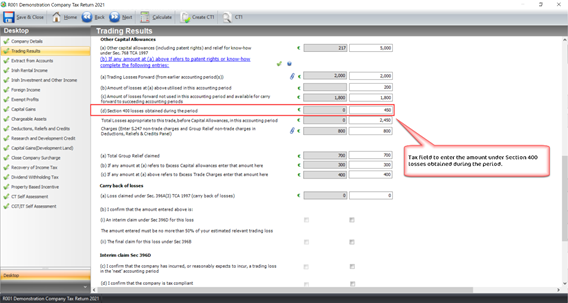

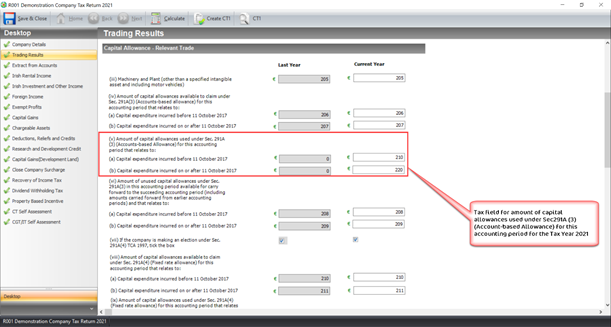

Option to enter the amount of capital allowance used under Sec. 291A(3)

As per the Revenue guideline, Sec. 291A of TCA 1997 refers provides the capital allowances against trading income for companies that incur capital expenditure on the provision of intangible assets for trade. Subject to Sec. 291A(3) of TCA 1997, where for any accounting period a wear and tear allowance is to be made under section 284 to a company that has incurred capital expenditure on the provision of a specified intangible asset for a trade carried on by that company, subsection (2) of section 284 shall apply.

To comply with the Revenue, we have added the following tax fields in CCH Corporation Tax for the Tax Year 2021.

- Amount of capital allowance used under Sec. 291A (3) (Accounts-based Allowance) for this accounting period that relates to:

- Capital expenditure incurred before 11 October 2017

- Capital expenditure incurred on or after 11 October 2017

Figure 3: Option to enter the amount of capital allowance used under Sec. 291A(3)

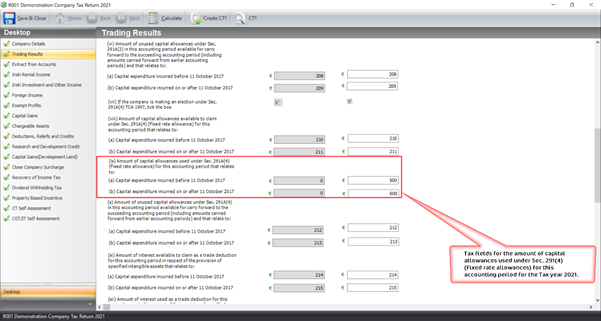

Option to enter the amount of capital allowance used under Sec. 291A(4)

As per the Revenue, guideline specified intangible assets are treated as machinery or plant for allowances provided so that the normal rules regarding wear and tear allowances, balancing allowances and balancing charges for the capital expenditure on machinery or plant also apply to capital expenditure on qualifying intangible assets, subject to the specific provision for Section 291A of TCA 1997. Allowances available under the section are based on the amount charged to a company’s Profit and Loss Account or Income Statement for the accounting period in respect of the amortisation or impairment of the specified intangible asset. However, the companies can opt instead for a fixed write-down period of 15 years at an annual rate of 7% of qualifying expenditure for 14 years and 2% in the final year.

Section 291A(4) refers to a company that may elect to claim relief over a fixed write-down period of 15 years at the rate of 7% per annum and 2% on the final year in respect of the capital expenditure incurred on the specified intangible asset.

To comply with the Revenue guidelines, we have added the following tax fields in the CCH Corporation Tax for the Tax Year 2021. The new fields are as follows:

- Amount of capital allowances used under Sec. 291A(4) (Fixed rate allowance) for this accounting period that relates to:

- Capital expenditure incurred before 11 October 2017

- Capital expenditure incurred on or after 11 October 2017

Figure 4: Option to enter the amount of capital allowance used under Sec. 291A(4)

Option to enter the amount of interest used as a trade deduction under capital allowance- relevant trade

To comply with the Revenue guideline we have added the following fields in the CCH Corporation Tax for the Tax Year 2021 under Capital Allowance- Relevant Trade subsection.

- Amount of interest used as a trade deduction for this accounting period in respect of the provision of specified intangible assets that relates to:

- Capital expenditure incurred before 11 October 2017

- Capital expenditure incurred on or after 11 October 2017

Figure 5: Option to enter the amount of interest used as a trade deduction

Extract from Accounts

Option to enter the staff cost in expenses and deduction

To comply with the Revenue guideline we have added a new tax field under Expenses and Deduction in CCH Corporation Tax for the Tax Year 2021. The new field is as follows:

- Staff costs

Figure 6: Tax field for the Staff cost under Expenses and Deductions.

Option to enter the amount of sub-contractors for RCT

To comply with the Revenue guidelines, we have added a new field to enter the amount of expenses and deduction for Sub-Contractors for the purpose of RCT under the Expenses and Deductions in CCH Corporation Tax for the Tax Year 2021. The new tax field is as follows:

- Sub-Contractors for the purpose of RCT

Figure 7: Tax field to enter expenses and deduction for sub-contractors for RCT

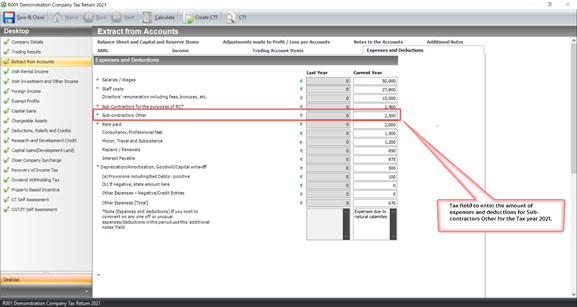

Option to enter the expenses and deduction for Sub-contractors Other

To comply with the Revenue guideline, we have added a new tax field to enter the amount of expenses and deduction for sub-contractors other in the CCH Corporation Tax for the Tax Year 2021. The new tax field is as follows:

- *Sub-contractors Other

Figure 8: Tax field to enter the amount of expenses and deduction for Sub-Contractors Other.

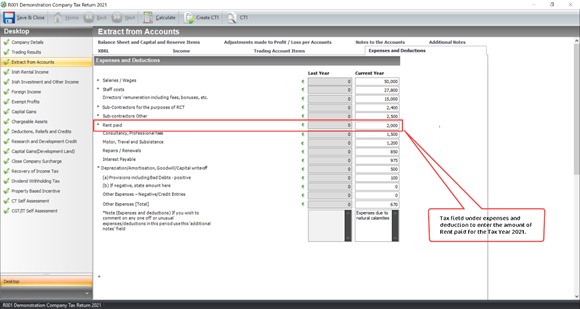

Option to enter the amount of rent paid under expenses and deduction

To comply with the Revenue guidelines, we have added a tax field to enter the Rent paid in Expenses and Deduction in CCH Corporation Tax for the Tax Year 2021. The new tax field is as follows:

- *Rent Paid

Figure 9: Tax field to enter the amount of Rent paid under expenses and deduction

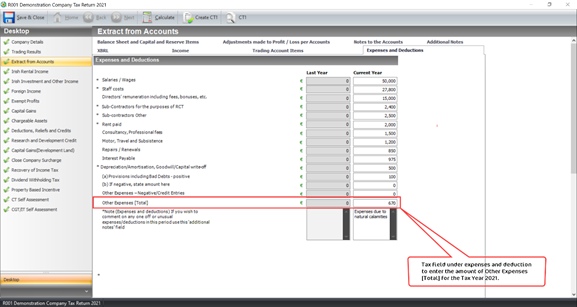

Option to enter amount of total other expenses in expenses and deductions

To comply with the Revenue guideline, we have added a new tax field to enter the total amount of other expenses under expenses and deductions in CCH Corporation Tax for the Tax Year 2021. The new tax field is as follows:

- Other Expenses [Total]

Figure 10: Tax field to enter the amount of Other Expenses [Total]

Option to enter additional notes to comment on any off or unusual expenses or deduction

As per the Revenue guideline, we have added a new field for the additional notes where you can comment on any one of or unusual expenses/deductions in CCH Corporation Tax for the Tax Year 2021. The new field is as follows:

- *Note (Expenses and deductions) if you wish to comment on any one off or unusual expenses/deductions in this period use this ‘additional notes’ field.

Figure 11: Field to enter additional notes for any one off or unusual expenses/ deduction.

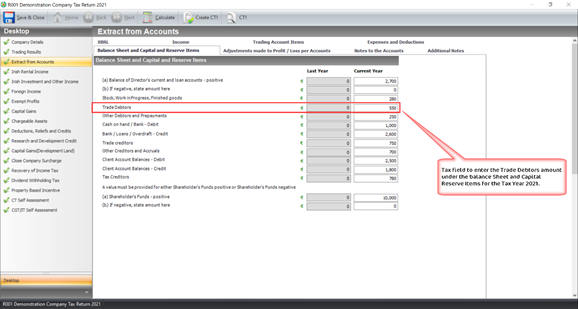

Option for Trade Debtors under Balance Sheet and Capital Reserve Items

To comply with the Revenue guideline, we have added a new tax field for Trade Debtors under the Balance Sheet and Capital Reserve Items in CCH Corporation Tax for the Tax Year 2021. The new tax field is as follows:

- Trade Debtors

Figure 12: Tax Field to enter the amount of Trade Debtors under Balance Sheet and Capital Reserve

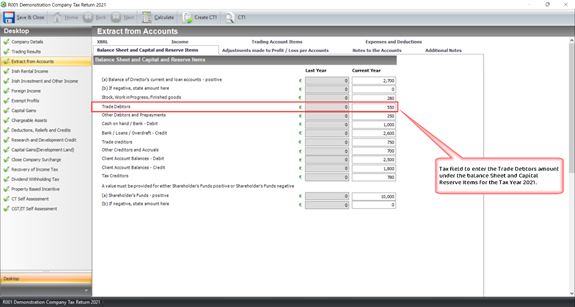

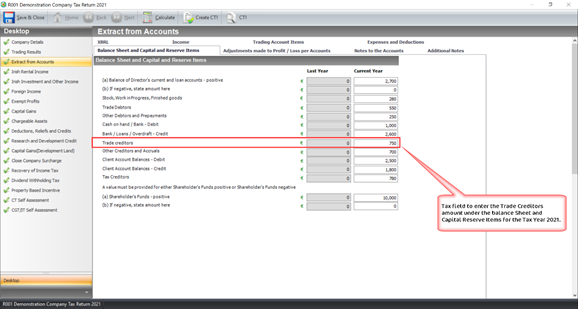

Option for Trade Creditors under Balance Sheet and Capital Reserve Items

To comply with the Revenue guideline, we have added a new tax field for Trade Creditors under the Balance Sheet and Capital Reserve Items in CCH Corporation Tax for the Tax Year 2021.

The new tax field is as follows:

- Trade creditors

Figure 13: Tax Field to enter the amount of Trade Creditors under Balance Sheet and Capital

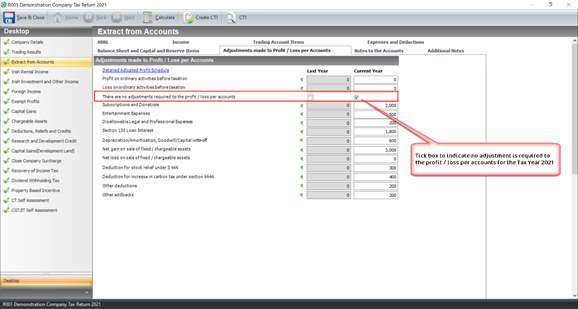

Option to indicate no adjustment required to the profit/loss per accounts

To comply with the Revenue guideline, we have added an option to indicate that there is no adjustment required to the profit/ loss per accounts in CCH Corporation Tax for the Tax Year 2020. The new option is as follows:

- There is no adjustment required to the profit/loss per accounts [Tick box].

Figure 14: Tick box to indicate no adjustment is required to the profit/ loss per accounts.

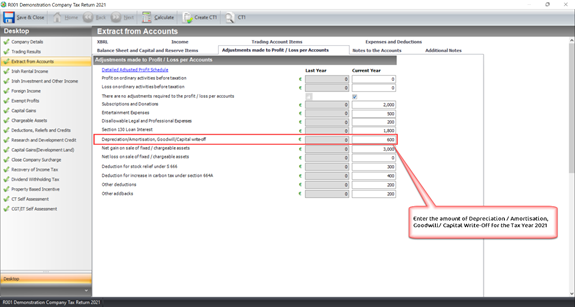

Option for Depreciation/ Amortisation and Goodwill /Capital Write-Off

Under the new tax regime and the Revenue guideline, we have added a new tax field for the depreciation/ amortisation and goodwill/ capital write-off in Adjustment made to Profit/Loss per Accounts in CCH Corporation Tax for the Tax Year 2021. The new tax field under Adjustment made to Profit/Loss per Accounts as follows:

- Depreciation/Amortisation, Goodwill/Capital write-off

Figure 15: Tax field for Depreciation/ Amortisation, Goodwill/Capital write-off

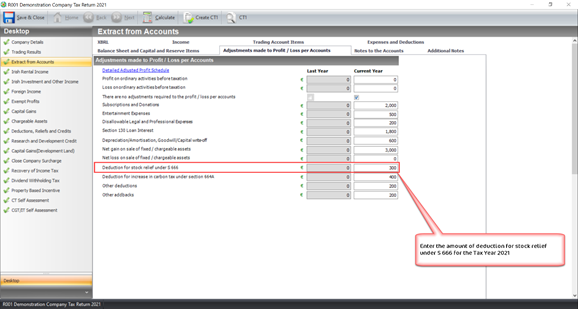

Option to enter deduction for stock relief under Section 666

As per the Revenue guideline, Section 666 of TCA 1997 makes provision for a tax deduction for the increase in the stock value which is also known as Stock Relief. Stock Relief is available to any person carrying on the trade of farming, the profits for which are chargeable to tax. The person may be an individual or a company carrying on the trade either solely or in partnership.

To comply with the Revenue guidelines, we have added a tax field for the deduction for stock relief in CCH Corporation Tax for the Tax Year 2021. The new tax field is as follows:

- Deduction for stock relief under S 666

Figure 16: Tax field to enter the amount of deduction for stock relief under S 666

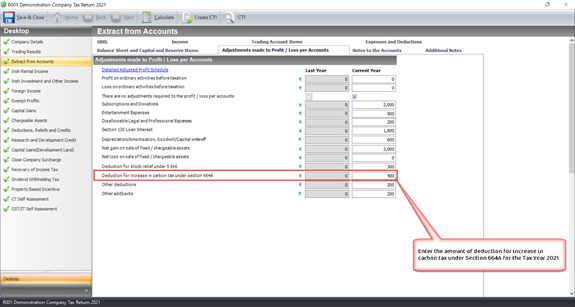

Option for deduction for an increase in Carbon Tax under Section 664A

As per the Revenue guideline, Section 664A of TCA 1997 refers to the relief for the expenditure incurred concerning the carbon tax on farm diesel. To comply with the Revenue, we have added a tax field in the CCH Corporation Tax for the Tax Year 2021 under adjustment made to Profit/Loss per accounts. The new tax field is as follows:

- Deduction for increase in carbon tax under section 664A

Figure 17: Tax field for deduction for the increase in Carbon Tax under Section 664A

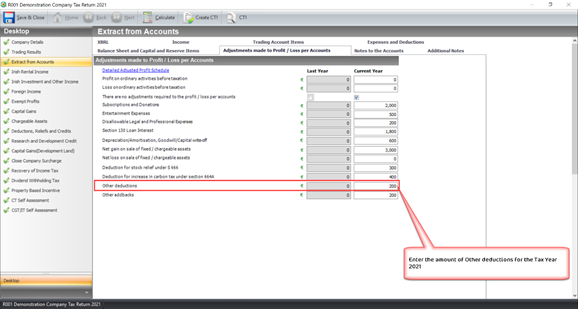

Option for Other Deduction in Adjustment made to Profit/Loss per Accounts

To comply with the Revenue guideline, we have added a new tax field for other deductions under adjustment made to profit/loss per account in the CCH Corporation Tax for the Tax year 2021. The new tax field is as follows:

- Other deduction

Figure 18: Tax field for Other Deduction in Adjustment made to Profit/ Loss per Accounts

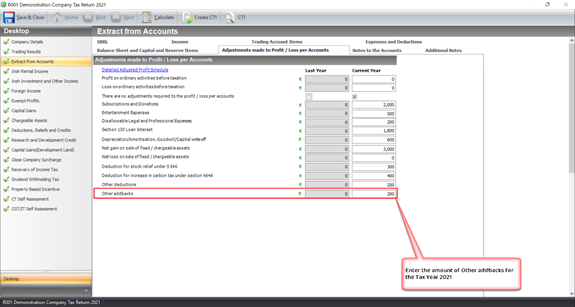

Option to enter the amount of Other addbacks

To comply with the Revenue guidelines, we have added a new tax field to enter the amount of other addbacks under the Adjustment made to Profit / Loss per Accounts in the CCH Corporation Tax for the Tax Year 2021. The new tax field is as follows:

- Other addbacks

Figure 19: Tax field for Other addbacks under Adjustments made to Profit/Loss per Accounts

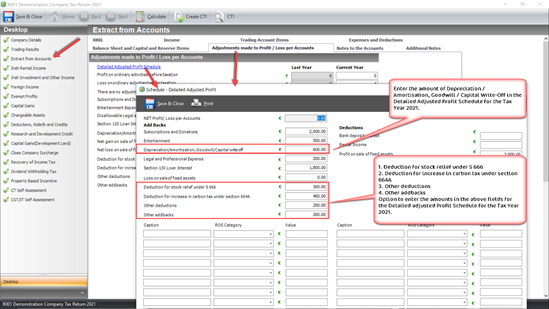

Option to enter the amounts in Detailed Adjusted Profit Schedule

As per the new guideline by Revenue, we have added the following tax fields in the Detailed Adjusted Profit Schedule, under Adjustment made to Profit /Loss per Accounts in the CCH Corporation Tax for the Tax Year 2021. To add the details click on the Detailed Adjusted Profit Schedule hyperlink. The new tax fields under the schedule are as follows:

- Depreciation/ Amortisation, Goodwill / Capital write-off

- Deduction for stock relief under S 666

- Deduction for increase in carbon tax under section 664A

- Other deductions

- Other addbacks

Figure 20: Option to enter the details in Detailed Adjusted Profit Schedule

Irish Rental Income

Option to enter additional notes in Rental Income from Land and Property in the State

As per the Revenue guideline, we have added a field to enter notes in the Rental Income from Land and Property in the State subsection in CCH Corporation Tax for the Tax Year 2021. The new field is as follows.

- Additional Note: if you wish to expand on any expenses listed above use this notes field:

Figure 21: Additional Note field in Rental Income from Land and Property in the State

Option for additional note for expenses in Commercial Property, Land and all other sources

To comply with the Revenue guideline we have added a tax field for entering the additional notes for expenses in commercial property, land and all other sources of Irish Rental Income in CCH Corporation Tax for the Tax Year 2021. The new tax field is as follows:

- Additional Note: if you wish to expand on any expenses listed above this notes field:

Figure 22: Additional Notes for expenses in Commercial Property, Land, and all other sources.

Irish Investment and Other Income

Option to enter the tax reference number for Real Estate Investment Trust (REIT)

As per the new tax regime and Revenue guidelines, REIT refers to the companies whose income is derived from the rental of the commercial or residential property. Real Estate Investment Trust (REIT) are not chargeable to either corporation tax in respect of income from their property rental business or chargeable gains accruing on the disposal of asset of their property rental business. Note that, a Real Estate Investment Trust (REIT) may a single company or a group of companies.

To comply with the Revenue guidelines, we have added an option to add the tax reference number of the companies which refers to REIT under the Distribution received from companies resident in the State subsection in the CCH Corporation Tax for the Tax Year 2021. The new fields are as follows:

- (c) If, in respect of either of the above distribution at (a) or (b) the paying and receiving companies are connected within the meaning of Section 10 or are group members, state the tax reference number of the paying company:

- Tax Reference Number

- It Refers to REIT [Tick box]

After entering the above details, click on [Save].

NOTE: CCH Corporation Tax allows the entry of a maximum of 10 companies in this section.

Figure 23: Option to indicate the company refers to REIT and enter th

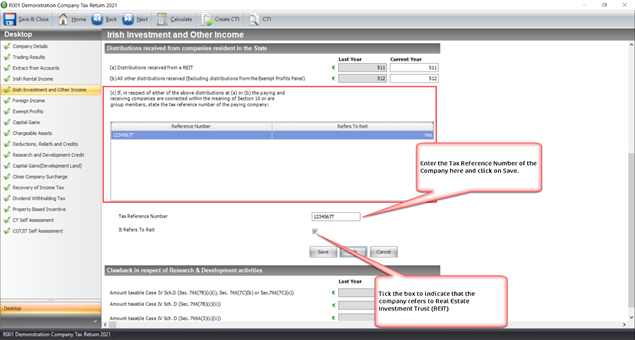

Capital Gains

Option to enter the restriction of losses under Sec. 555

As per the Revenue guideline, Section 555 of TCA 1997 provides the special treatment for the expenditure which, although indirectly allowable for Corporation Tax or Income Tax in the form of capital allowances or renewals allowances, is nevertheless capital outlay. Notwithstanding Section 554, such capital outlay is an allowable deduction for the Capital Gains Tax (CGT) purposes.

However, where a loss accrues on the disposal, the amount of the loss allowable is restricted to the extent that it has been covered by the amount of the capital allowances or renewal allowance granted for Corporation Tax or Income Tax purpose.

To comply with the Revenue guideline, we have added a tax field to enter the amount of restriction of losses under S 555 under the Details of Acquisition(s) subsection in the CCH Corporation Tax for the Tax Year 2021. The new tax field is as follows:

- Restriction of losses under S 555.

Figure 24: Tax field to enter the amount for restriction of losses under S555.

Close Company Surcharge

Option to enter the details of the tax reference number with distribution date and amount paid

The close company surcharge of 18 months distribution period, will on applied to the Revenue, be extended by a further 9 months. This extension is available in response due to COVID-19 circumstances affecting the company. It will be applied for accounting periods ending from 30th of September 2018 onwards, for which distribution to avoid the surcharge would be due by 31st of March 2020 onwards. As per the Revenue guideline, Section 440 of TCA 1997 provides for an additional charge of the Corporation Tax, referred to as a “Surcharge” on close companies at the rate of 20% of the excess of the aggregate of the distributable investment income and the distributable estate income over the distribution made for an accounting period.

Section 441 of TCA 1997 provides for a 15% surcharge on certain undistributed income of close service companies. The surcharge applied to the income of the close companies that are not distributed within 18 months from the end of the accounting period in which the income arose. In recognition of the COVID-19 circumstances which may require many of the companies to retain cash to support their business, the Revenue will extend the 18 months for distributions by a further 9 months.

To comply with the Revenue guideline, we have added the following fields in the CCH Corporation Tax for the Tax Year 2021.

- The tax reference number of the other company

- The date of the distribution

- The amount of the distribution covered by an election

After entering all the above details, click on [Save].

NOTE: CCH Corporation Tax allows the entry of a maximum of 10 companies in this section.

Figure 25: Enter the details of the tax reference number, distribution date and amount paid

Dividend Withholding Tax

Subsection for the Company details for Dividend Withholding Tax

Dividends paid and other distributions (“relevant distributions”) made by Irish-resident companies are generally liable to a dividend withholding tax (DWT) at a rate of income tax of 25%. This rate applies from the 1st of January 2020.

As per the Revenue guideline and new tax regime, we have added a subsection for the company details for Dividend Withholding Tax in CCH Corporation Tax for the Tax Year 2021. The new tax fields are as follows:

- Where the distribution is made to a connected person as defined in Section 10 TCA 1997 or to a beneficial owner or participator, state:

- Tax reference

- Amount paid

Enter the above details and click on [Save].

NOTE: CCH Corporation Tax allows the entry of a maximum of 10 companies in this section.

Figure 26: New subsection for Dividend Withholding Tax- Company Details

Tax fields removed from the Tax Year 2021

The following field has been removed from the CCH Corporation Tax for the Tax Year 2021.

We have removed the following Tax Field from Trading Result Section.

- Trading Results

- Profits from Qualifying Assets under Chapter 5 of part 29 TCA 1997 Details

o Amount of capital allowances claimed under Sec. 291A (3) for this accounting period (Account-based allowance).

o Amount of capital allowances claimed for this accounting period for which an election has been made under Sec. 291A (4) TCA 1997 (Fixed rate allowance)

o If the company is making an election under Sec. 291A(4) TCA 1997, tick the box.

o Amount of interest claimed as a trade deduction for this accounting period in respect of the provision of specified intangible assets

o Amount of interest claimed as a charge on income under Sec. 247(4B) TCA 1997 for this accounting period in respect of the provision of specified intangible assets

o If a joint election is being made under Sec. 615(4)(a) TCA 1997in respect of a specified intangible assets, tick the box and indicate

o Whether the company is transferring or acquiring the asset (Transferring)

o Whether the company is transferring or acquiring the asset (Acquiring)

o The tax reference number of the other company

o The name of the other company

- Excepted Trade Profits (Section 21A TCA 1997) at 25%

o Where the profits at above rate in whole or in part to a relevant trade within the meaning of Sec. 291A.

- Capital Allowance- Excepted Trade

o Amount of capital allowances claimed under Sec. 291A(3) TCA 1997 in respect to the capital expenditure incurred before 11 October 2017 (Accounts-based allowance).

o Amount of capital allowances claimed under Sec. 291A(3) TCA 1997 in respect to the capital expenditure incurred on or after 11 October 2017 (Accounts-based allowance).

o Amount of capital allowances claimed under S291A(3), not used in this period carrying forward to succeeding accounting period (including amount carried forward from the earlier accounting periods).

o If an amount of capital allowances for carry forward at the line (iii) refers to capital expenditure incurred on or after 11 October 2017, enter the amount here.

o If the company is making an election under Sec. 294A(4) TCA 1997, tick the box.

o Amount of capital allowances claimed for this accounting year for which an election has been made under Section 291 (A) TCA 1997, in respect to the capital expenditure incurred before 11 October (Fixed Rate allowance)

o Amount of capital allowances claimed for this accounting year for which an election has been made under Section 291 (A) TCA 1997, in respect to the capital expenditure incurred on and after 11 October (Fixed Rate allowance)

o Amount of capital allowances claimed under S 291A (4)TCA 1997, not used in this accounting period for carry forward to the succeeding accounting period (including amounts carried forward from earlier accounting periods).

o If an amount of capital allowances carry forward at line (vii) refers to a capital expenditure incurred on and after 11 October 2017, enter the amount here.

o Amount of interest claimed as a trade deduction for this accounting period in respect of the provision of the intangible assets relating to capital expenditure incurred before 11 October 2017

o Amount of interest claimed as a trade deduction for this accounting period in respect of the provision of the intangible assets relating to capital expenditure incurred on and after 11 October 2017

o Amount of unused interest claimed as trade deduction in respect of the provision of specified intangible assets relating to capital expenditure incurred before 11 October 2017

o Amount of unused interest claimed as trade deduction in respect of the provision of specified intangible assets relating to capital expenditure incurred on or after 11 October 2017

o Amount of unused interest claimed as a trade deduction in respect of the provision of specified intangible assets available for carry forward to the succeeding accounting period (including amounts carried forward from earlier accounting periods) and that relates to capital expenditure incurred before 11 October 2017

o Amount of unused interest claimed as a trade deduction in respect of the provision of specified intangible assets available for carry forward to the succeeding accounting period (including amounts carried forward from earlier accounting periods) and that relates to capital expenditure incurred on or after 11 October 2017

o Amount of interest claimed as a charge on income as restricted under Sec. 247(4B) TCA 1997 for this accounting period in respect of the provision of specified intangible assets

o If a joint election is made under Sec. 615(4)(a) TCA 1997 in respect of a specified intangible asset, tick the box.

o Whether the company is transferring or acquiring the asset

o The tax reference number of the other company

o The name of the other company

o If a joint election is being made under Sec. 617(4) TCA 1997 in respect of a specified asset, tick the box and indicate

o Whether the company is transferring or acquiring the asset

o The tax reference number of the company

o The name of the other company

- Tax fields removed from Extract from Accounts

o Expenses and Deduction

o *Sub-Contractors

- Adjustment made to Profit / Loss per Accounts

o Light, Heat and Phone