CCH Personal Tax IE : 2024.2.1

Prerequisites

Installing CCH Personal Tax IE 2024.2.1

Prior to installing this update, you must ensure that you have 2023.2.1 currently installed on your system.

Installation of the update is straightforward; however, we recommend that you take a moment to review the Installation Guide (Update Guide)

Introduction

As per Revenue guidelines and due to the implementation of the Finance Act 2023 and amendment in the taxonomy, we have made changes in CCH Personal Tax Version 2024.2.1 for the Tax Year 2023. The major changes have been made to CCH Personal Tax to comply with Revenue.

Major changes in Tax Year 2023

Major changes include new tax fields and subsections to be filled in where applicable under

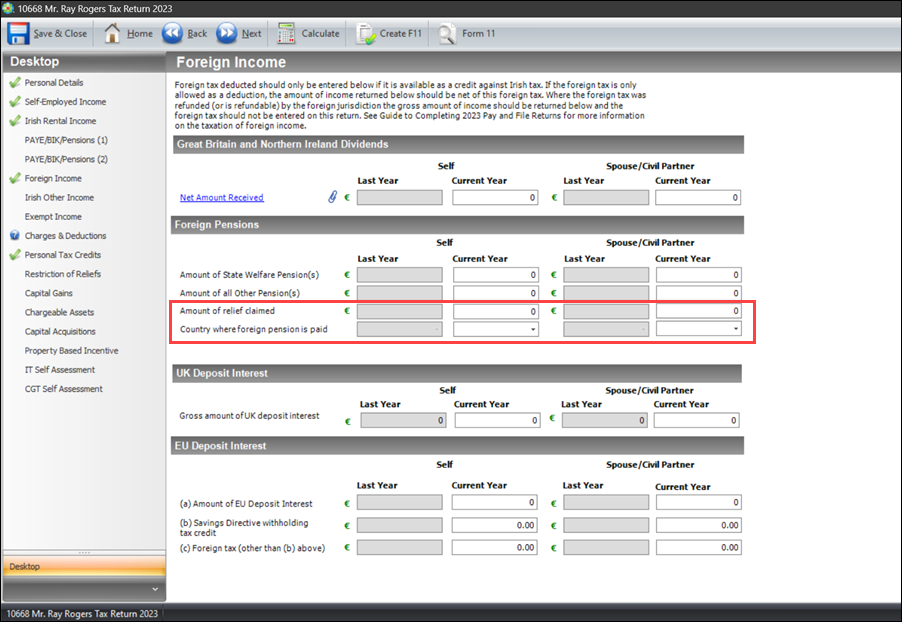

- Foreign Income

- Tax field under Foreign Pensions- Amount of relief claimed for Self in the Current Year

- Tax field for Foreign Pensions- Amount of relief claimed for Spouse/Civil Partner in the Current Year

- Tax field for Foreign Pensions- Country where foreign pension is paid for Self in the Current Year

- Tax field for Foreign Pensions- Country where foreign pension is paid for Spouse/Civil Partner in the Current Year

- Tax field for Lump Sums from Foreign Pension Arrangement (S.200A)- Name of Foreign Pension Arrangement for Self in the Current Year

- Tax field for Lump Sums from Foreign Pension Arrangement (S.200A)- Name of Foreign Pension Arrangement for Spouse/Civil Partner in the Current Year

- Tax field for Lump Sums from Foreign Pension Arrangement (S.200A)- Name and Address of administrator of the foreign pension arrangement for Self in the Current year

- Tax field for Lump Sums from Foreign Pension Arrangement (S.200A)- Name and Address of administrator of the foreign pension arrangement for Spouse/Civil Partner in the Current year

- Tax field for Lump Sums from Foreign Pension Arrangement (S.200A)- The date on which the Self became a member of the foreign pension in the Current year

- Tax field for Lump Sums from Foreign Pension Arrangement (S.200A)- The date on which the Spouse/Civil Partner became a member of the foreign pension in the Current year

- Tax field for Lump Sums from Foreign Pension Arrangement (S.200A)- Amount of lump-sum (s) paid in 2023 under the rules of S.200A for the Self in the Current year

- Tax field for Lump Sums from Foreign Pension Arrangement (S.200A)- Amount of lump-sum (s) paid in 2023 under the rules of S.200A for the Spouse/Civil Partner in the Current year

- Tax field for Lump Sums from Foreign Pension Arrangement (S.200A)- Tax-free amount if any for 2023 for Self in the Current year

- Tax field for Lump Sums from Foreign Pension Arrangement (S.200A)- Tax-free amount if any for 2023 for Spouse/Civil Partner in the Current year

- Tax field for Lump Sums from Foreign Pension Arrangement (S.200A)- Amount of excess lump-sum(s) for 2023 for Self in the Current year

- Tax field for Lump Sums from Foreign Pension Arrangement (S.200A)- Amount of excess lump-sum(s) for 2023 for Spouse/Civil Partner in the Current year

- Tax field for Lump Sums from Foreign Pension Arrangement (S.200A)- The portion of the amount at (f) chargeable under Case III at the standard rate of income tax for Self in the Current year

- Tax field for Lump Sums from Foreign Pension Arrangement (S.200A)- The portion of the amount at (f) chargeable under Case III at the standard rate of income tax for Spouse/Civil Partner in the Current year

- Tax field for Lump Sums from Foreign Pension Arrangement (S.200A)- The portion of the amount at (f) chargeable under Case III at the higher rate of income tax and liable to USC for Self in the Current year

- Tax field for Lump Sums from Foreign Pension Arrangement (S.200A)- The portion of the amount at (f) chargeable under Case III at the higher rate of income tax and liable to USC for Spouse/Civil Partner in the Current year

- PAYE/BIK/Pensions (1)

- Tax field under Employment Details (Special Assignee Relief Programme (SARP))- Country where non-refundable foreign tax was withheld

- Tax field under Employment Details (Special Assignee Relief Programme (SARP))- Amount of federal tax only of non-refundable foreign tax was withheld

- PAYE/BIK/Pensions (2)

- Tax field under Employment- Name of Employer for Self in the Current Year

- Tax field under Employment- Name of Employer for Spouse/Civil Partner in the Current Year

- Tax field under Employment- Tax reference of Employer for Self in the Current Year

- Tax field under Employment- Tax reference of Employer for Spouse/Civil Partner in the Current Year

- Tax field under Employment- Address of Employer for Self in the Current Year

- Tax field under Employment- Address of Employer for Spouse/Civil Partner in the Current Year

- Irish Rental Income

- Tax field under Non-Resident Landlord- Gross Value of Rental Income subjected to NLWT for 2023

- Tax field under Non-Resident Landlord- Gross Value of NLWT deductions for 2023

- Tax field under Residential Property- Amount of additional ‘relevant interest’ claimed for the years 2019, 2020 and 2021 has been removed

- Tax screen under Residential Property Expenses- Section 97(2K) confirmation has been removed

- All radio buttons and tax fields for Claim for Additional Interest Relief under Section 297(2K) under the link of Section 97(2K) have been removed

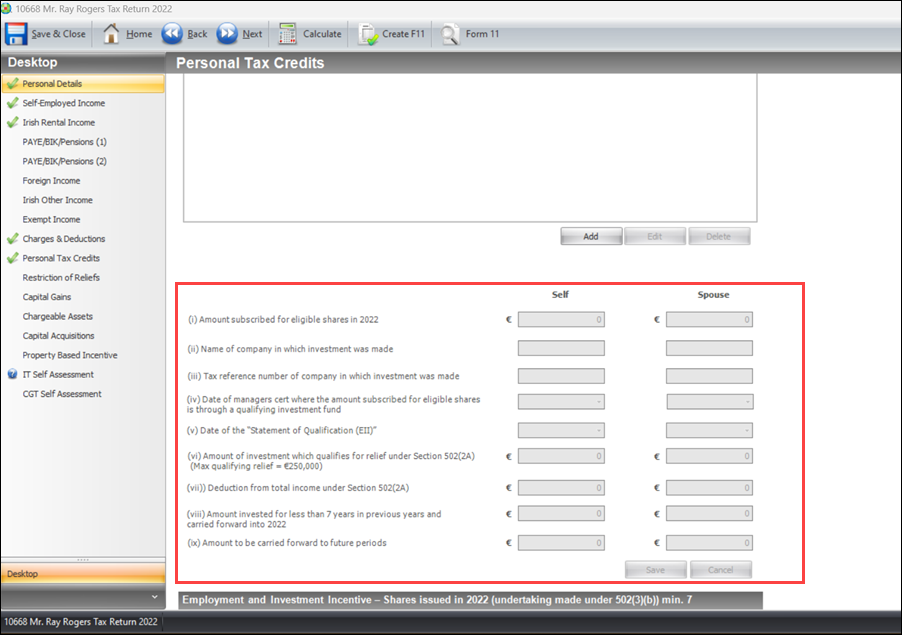

- Personal Tax Credits

- Tax field under Employment and Investment Incentive- Shares issued in 2022(undertaking made under 502(3)(b)) min. 7- The amount subscribed for eligible shares in 2022 for Self and Spouse has been removed

- Tax field under Employment and Investment Incentive- Shares issued in 2022(undertaking made under 502(3)(b)) min. 7- The name of the company in which investment was made for Self and Spouse has been removed

- Tax field under Employment and Investment Incentive- Shares issued in 2022(undertaking made under 502(3)(b)) min. 7- The tax reference number of the company in which the investment was made for Self and Spouse has been removed

- Tax field under Employment and Investment Incentive- Shares issued in 2022(undertaking made under 502(3)(b)) min. 7- The date of manager cert where the amount subscribed for eligible shares is through a qualifying investment fund for Self and Spouse has been removed

- Tax field under Employment and Investment Incentive- Shares issued in 2022(undertaking made under 502(3)(b)) min. 7- The date of the ‘Statement of Qualification (EII)’ for Self and Spouse has been removed

- Tax field under Employment and Investment Incentive- Shares issued in 2022(undertaking made under 502(3)(b)) min. 7- The amount of investment that qualifies for relief under Section 502(2A) (Max qualifying relief = £500,000) for Self and Spouse has been removed

- Tax field under Employment and Investment Incentive- Shares issued in 2022(undertaking made under 502(3)(b)) min. 7- Deduction from total income under Section 502(2A) for Self and Spouse has been removed

- Tax field under Employment and Investment Incentive- Shares issued in 2022(undertaking made under 502(3)(b)) min. 7- Amount invested for at least 7 years in previous years and carried forward into 2022 for Self and Spouse has been removed

- Tax field under Employment and Investment Incentive- Shares issued in 2022(undertaking made under 502(3)(b)) min. 7- The amount to be carried forward to future periods for Self and Spouse has been removed

- Radio box under Mortgage Interest Tax Credit-A residential property used as my sole or main residence for Self/Spouse, or,

- Radio box under Mortgage Interest Tax Credit -A residential property used as the sole or main residence of a former or separated spouse, or a former civil partner from whom I am living separately in circumstances where reconciliation is unlikely, or,

- Radio box under Mortgage Interest Tax Credit -A residential property used as the sole or main residence of a dependent relative, and is provided rent-free and without any other consideration to that dependent relative

- Tax field under Mortgage Interest Tax Credit -Local Property Tax (LPT) ID

- Radio box under Mortgage Interest Tax Credit -Check the box to confirm the claim in respect of a qualifying property in accordance with section 473(C ) of the Taxes Consolidation Act 1997 and is compliant with the provisions of LPT, the planning and development acts and such other requirements as set out in section 473 (C )

- Tax field under Mortgage Interest Tax Credit -Value of the qualifying loan on 31 December 2022 (Note: The value must be greater than €80,000 and less than €500,000

- Tax field under Mortgage Interest Tax Credit -The total amount of qualifying interest paid for the year 2023

- Tax field under Mortgage Interest Tax Credit -Amount of qualifying interest YOU paid for the year 2023

- Tax field under Mortgage Interest Tax Credit -Number of delays for which you paid interest on the qualifying loan in 2023

- Tax field under Mortgage Interest Tax Credit -Amount of qualifying interest 2nd mortgage payer paid for the year 2023

- Tax field under Mortgage Interest Tax Credit -Number of days for which 2nd mortgage payer paid interest on the qualifying loan in 2023

- Tax field under Mortgage Interest Tax Credit -Amount of qualifying interest 3rd mortgage payer paid for the year 2023

- Tax field under Mortgage Interest Tax Credit -Number of days for which 3rd mortgage payer paid interest on the qualifying loan in 2023

- Tax field under Mortgage Interest Tax Credit -The total amount of qualifying interest paid for the year 2022

- Tax field under Mortgage Interest Tax Credit -Amount of qualifying interest YOU paid for the year 2022

- Tax field under Mortgage Interest Tax Credit -Number of delays for which you paid interest on the qualifying loan in 2022

- Tax field under Mortgage Interest Tax Credit -Amount of qualifying interest 2nd mortgage payer paid for the year 2022

- Tax field under Mortgage Interest Tax Credit -Number of days for which 2nd mortgage payer paid interest on the qualifying loan in 2022

- Tax field under Mortgage Interest Tax Credit -Amount of qualifying interest 3rd mortgage payer paid for the year 2022

- Tax field under Mortgage Interest Tax Credit -Number of days for which 3rd mortgage payer paid interest on the qualifying loan in 2022

Please note it is very important that before running any database update you perform a database backup. CCH always advise that your practice takes regular backups in order to minimise any loss of data.

Additions

Foreign Income

Foreign Pensions

The Self-Employed Income section has new details added under Farm Partnership Details. The changes have been added under the Add Details hyperlink. The filer needs to click on the Add Details hyperlink under the Farm Partnership Details to fill in the details. The process of navigation can be identified below. The user of the same needs to click on the highlighted section of Figure 1 to reach Figure 2. After clicking Add Details, the filer can add the required details for different Reliefs such as Relief for qualifying farmer under Sr.667B used in 2021, Relief for qualifying farmer under Sr.667B used in prior years, etc. The new changes made reflect the requirement for the Relief for Partner in the Registered Farm Partnership. The two Tax Fields added are listed below:

- Relief for a partner in Registered Farm Partnerships under Sr. 667C used in 2020

- Relief for a partner in Registered Farm Partnerships under Sr. 667C used in 2019

Lump sums from foreign pensions arrangement (S.200A)

The Foreign Income tab has new details added under the Lump Sums from Foreign Pension Arrangement (S.200A) section. The new field lets the user enter the current year amount for relief claimed and if any that was claimed the year before. The tax field has been added for both the user and their spouse. The new addition is highlighted in Figure 2. The Tax Fields added are listed below:

- Name of Foreign pension arrangement for Self in the current year

- Name of Foreign pension arrangement for Spouse/Civil Partner in the current year

- Name and Address of administrator of the foreign pension arrangement for Self in the current year

- Name and Address of administrator of the foreign pension arrangement for Spouse/Civil Partner in the current year

- The date on which the Self became a member of the foreign pension in the current year

- The date on which the Spouse/Civil Partner became a member of the foreign pension in the current year

- Amount of lump-sum (s) paid in 2023 under the rules of S.200A for the Self in the current year

- Amount of lump-sum (s) paid in 2023 under the rules of S.200A for the Spouse/Civil Partner in the current year

- Tax-free amount if any for 2023 for Self

- Tax-free amount if any for 2023 for Spouse/Civil Partner

- Amount of excess lump-sum(s) for 2023 for Self

- Amount of excess lump-sum(s) for 2023 for Spouse/Civil Partner

- The portion of the amount at (f) chargeable under Case III at the standard rate of income tax for Self in the current year

- The portion of the amount at (f) chargeable under Case III at the standard rate of income tax for Spouse/Civil Partner in the current year

- The portion of the amount at (f) chargeable under Case III at the higher rate of income tax and liable to USC for Self in the current year

- The portion of the amount at (f) chargeable under Case III at the higher rate of income tax and liable to USC for Spouse/Civil Partner in the current year

Figure 2: New Tax fields under Foreign Income

PAYE/BIK/PENSIONS (1)

Employment Details (Special Assignee Relief Programme (SARP))

The PAYE/BIK/Pensions (1) tab has new details added under the Employment Details (Special Assignee Relief Programme (SARP)) section. The new field lets the user enter the amount of federal tax only of non-refundable foreign tax that was withheld. It also lets the user select from a drop-drown country where non-refundable foreign tax was withheld. The new addition is highlighted in Figure 3. The Tax Fields added are listed below:

- Country where non-refundable foreign tax was withheld

- Amount of federal tax only of non-refundable foreign tax was withheld

Figure 3: New Tax fields under PAYE/BIK/Pensions (1)

PAYE/BIK/PENSIONS (2)

Employment

The PAYE/BIK/Pensions (2) tab has new details added under the Employment section. The new fields let the user enter the name of the employer, tax reference of the employer and address of the employer. The tax field has been added for both the user and their spouse The new addition is highlighted in Figure 4. The Tax Fields added are listed below:

- Name of Employer for Self in the current year

- Name of Employer for Spouse/Civil Partner in the current year

- Tax reference of Employer for Self in the current year

- Tax reference of Employer for Spouse/Civil Partner in the current year

- Address of Employer for Self in the current year

- Address of Employer for Spouse/Civil Partner in the current year

Figure 4: New Tax Fields under PAYE/BIK/Pensions (2)

Irish Rental Income

Non-resident Landlord

The Irish Rental Income tab has new details added under the Non-Resident Landlord section. The new field lets the user enter the gross value of rental income subjected to NLWT for 2023 and also lets the user enter the gross value of NLWT deductions for 2023. The new addition is highlighted in Figure 5 The Tax Fields added are listed below:

- Gross value of Rental Income subjected to NLWT for 2023

- Gross value of NLWT deductions for 2023

Figure 5: New Tax Fields under Irish Rental Income

Personal Tax Credits

Mortgage Interest Tax Credit

The Personal Tax Credits tab has new details added under the Mortgage Interest Tax Credit section. The new field lets the user enter the details of the Qualifying Property, Qualifying Loan, Qualifying interest paid on qualifying loan for this and previous year. The new addition is highlighted in Figure 10 The Tax Fields added are listed below:

Qualifying Property

- A residential property used as my sole or main residence for Self/Spouse, or,

- A residential property used as the sole or main residence of a former or separated spouse, or a former civil partner from whom I am living separately in circumstances where reconciliation is unlikely, or,

- A residential property used as the sole or main residence of a dependent relative, and is provided rent-free and without any other consideration to that dependent relative

- Local Property Tax (LPT) ID

- Check the box to confirm the claim in respect of a qualifying property in accordance with section 473(C ) of the Taxes Consolidation Act 1997 and is compliant with the provisions of LPT, the planning and development acts and such other requirements as set out in section 473 (C )

Qualifying Loan

- Value of the qualifying loan on 31 December 2022 (Note: The value must be greater than €80,000 and less than €500,000

Qualifying interest paid on qualifying loan 2023

- The total amount of qualifying interest paid for the year 2023

- Amount of qualifying interest YOU paid for the year 2023

- Number of delays for which you paid interest on the qualifying loan in 2023

- Amount of qualifying interest 2nd mortgage payer paid for the year 2023

- Number of days for which 2nd mortgage payer paid interest on the qualifying loan in 2023

- Amount of qualifying interest 3rd mortgage payer paid for the year 2023

- Number of days for which 3rd mortgage payer paid interest on the qualifying loan in 2023

Qualifying interest paid on qualifying loan 2022

- The total amount of qualifying interest paid for the year 2022

- Amount of qualifying interest YOU paid for the year 2022

- Number of delays for which you paid interest on the qualifying loan in 2022

- Amount of qualifying interest 2nd mortgage payer paid for the year 2022

- Number of days for which 2nd mortgage payer paid interest on the qualifying loan in 2022

- Amount of qualifying interest 3rd mortgage payer paid for the year 2022

- Number of days for which 3rd mortgage payer paid interest on the qualifying loan in 2022

Figure 10: New Tax Fields under Personal Tax Credits

Deletions

Irish Rental Income

Residential Property

The Irish Rental Income tab has details removed from the Residential Property section. One field has been removed. The tax fields have been removed for both the user and their spouse. The removal is highlighted in Figure 6. The Tax Fields removed are listed below:

- Amount of additional ‘relevant interest’ claimed for the years 2019, 2020 and 2021 for the Self in the current year

- Amount of additional ‘relevant interest’ claimed for the years 2019, 2020 and 2021 for the Spouse/Civil Partner in the current year

Figure 7: Link removed under Irish Rental Income

Figure 8: Tax fields removed under Irish Rental Income

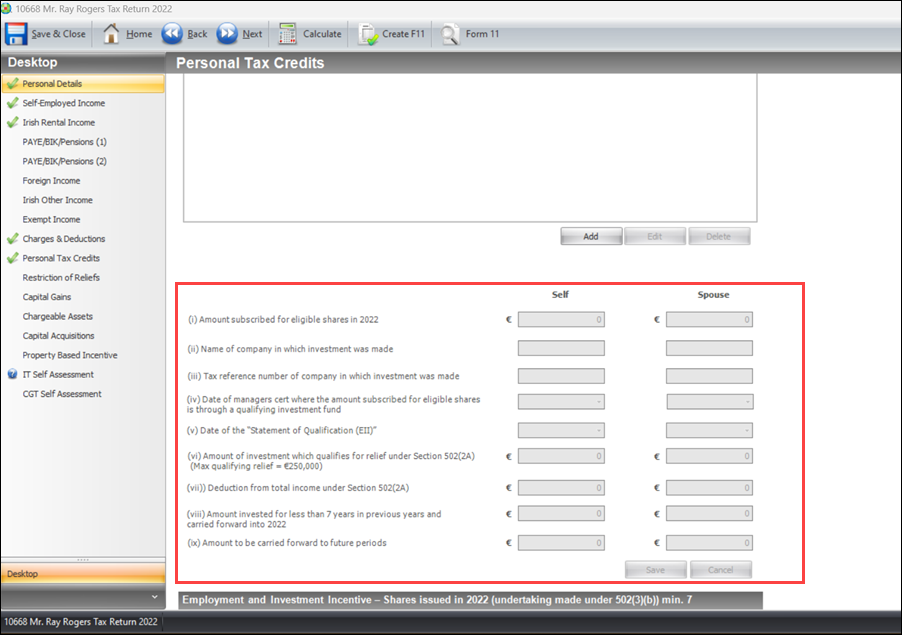

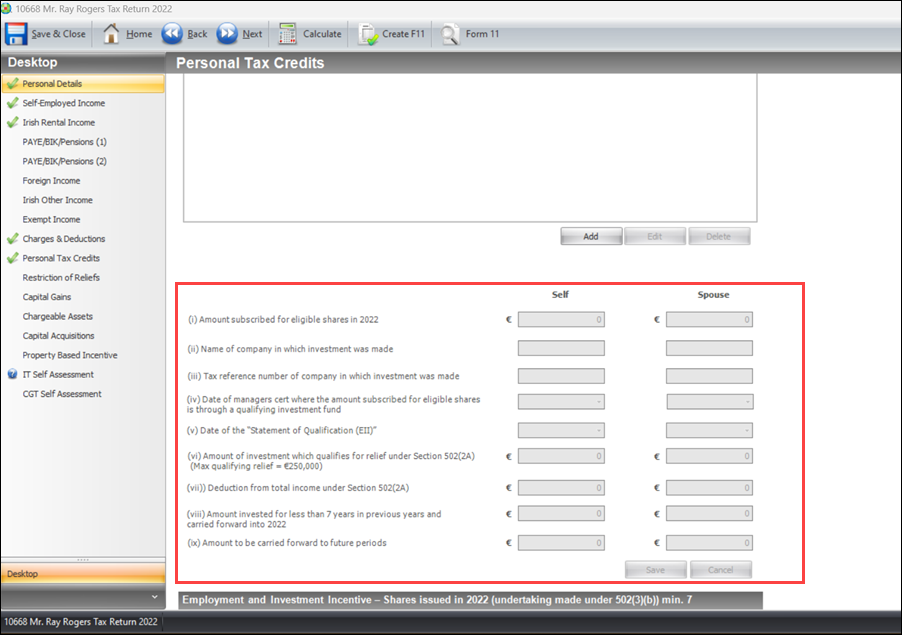

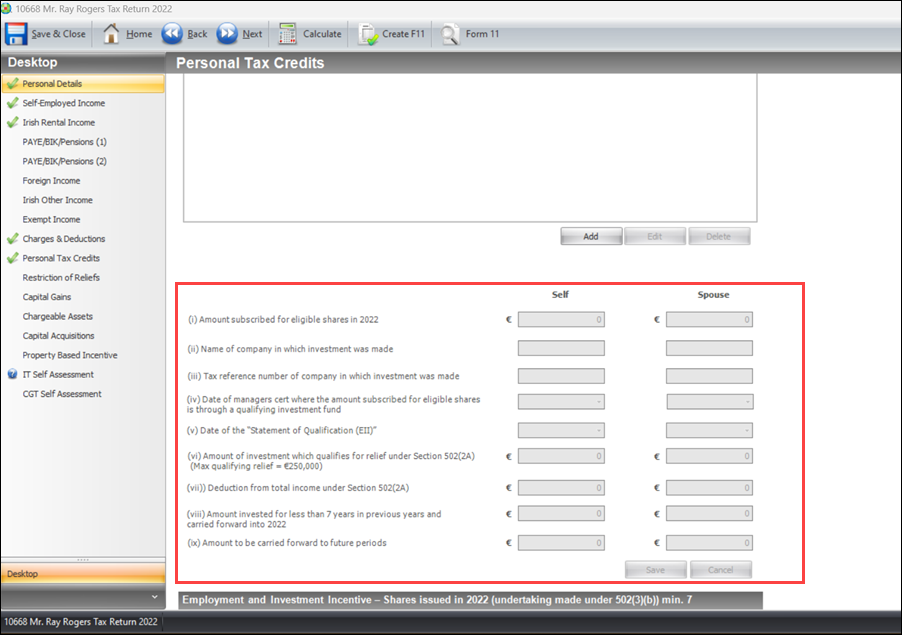

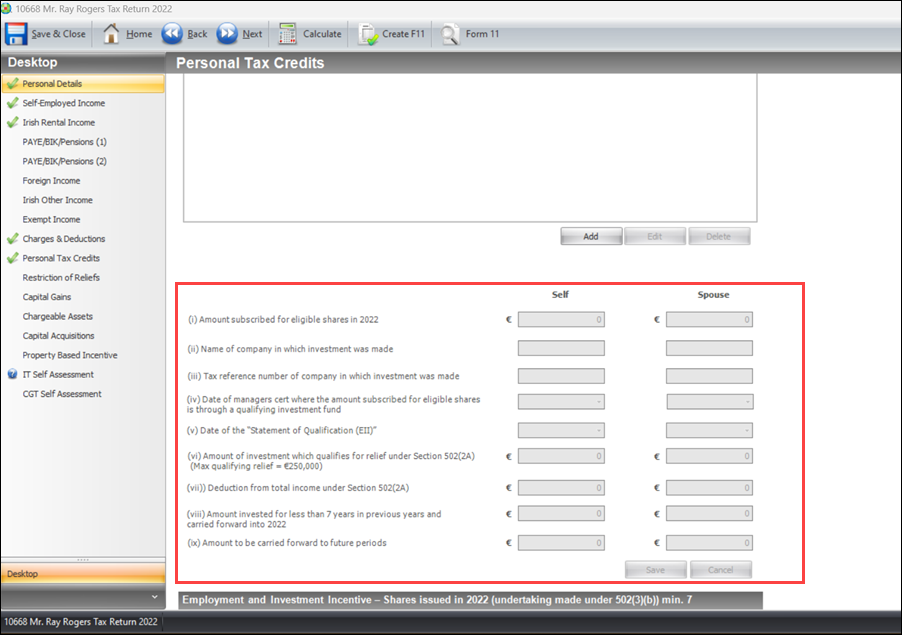

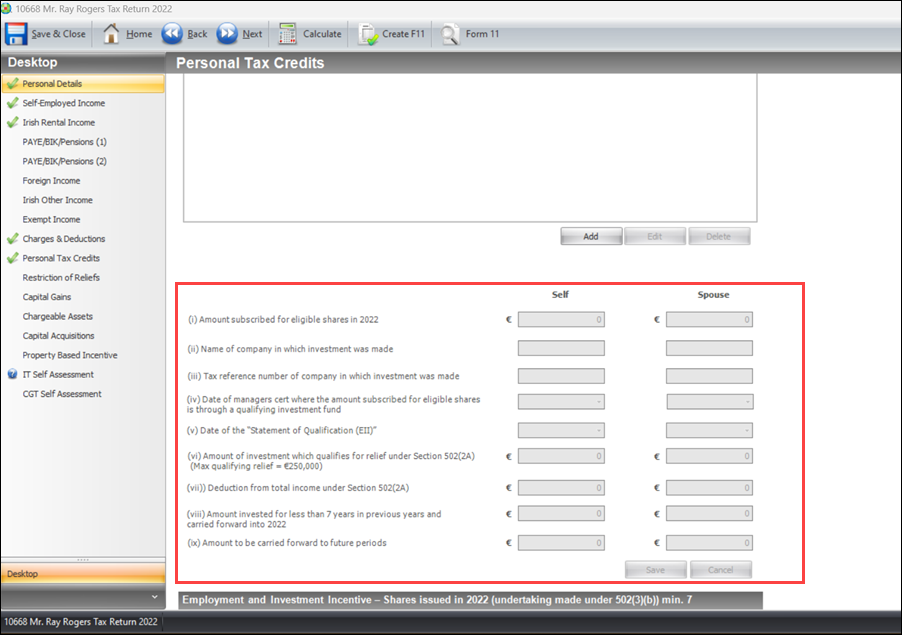

Personal Tax Credits

Employment and Investment Incentive

The Personal Tax Credits tab has details removed from the Employment and Investment Incentive section. Nine fields have been removed. The tax fields have been removed for both the user and their spouse. The removal is highlighted in Figure 9. The Tax Fields removed are listed below:

- The amount subscribed for eligible shares in 2022 for Self

- The amount subscribed for eligible shares in 2022 for Spouse

- The name of the company in which investment was made for Self

- The name of the company in which investment was made for the Spouse

- The tax reference number of the company in which the investment was made for Self

- The tax reference number of the company in which the investment was made for Spouse

- The date of manager cert where the amount subscribed for eligible shares is through a qualifying investment fund for Self

- The date of manager cert where the amount subscribed for eligible shares is through a qualifying investment fund for the Spouse

- The date of the ‘Statement of Qualification (EII)’ for Self

- The date of the ‘Statement of Qualification (EII)’ for the Spouse

- The amount of investment that qualifies for relief under Section 502(2A) (Max qualifying relief = £500,000) for Self

- The amount of investment that qualifies for relief under Section 502(2A) (Max qualifying relief = £500,000) for Spouse

- Deduction from total income under Section 502(2A) for Self

- Deduction from total income under Section 502(2A) for Spouse

- Amount invested for at least 7 years in previous years and carried forward into 2022 for Self

- Amount invested for at least 7 years in previous years and carried forward into 2022 for Spouse

- The amount to be carried forward to future periods for Self

- The amount to be carried forward to future periods for Spouse

Figure 9: Tax fields removed under Personal Tax Credits

Updates to the Tax Credit panel to reflect increased values

- Personal tax credit The maximum value of this credit has been increased from €1,700 to €1,775. The married credit was increased from €3,400 to €3,550

- Employee tax credit The maximum value of this credit has been increased from €1,700 to €1,775

- Earned Income tax credit The maximum value of this credit has been increased from €1,700 to €1,775

- Widowed Person Tax Credit The maximum value of this credit has been increased from €2,240 to €2,315. Note the customer’s information in the Personal Details panel must reflect the status of ‘widowed’ or ‘deceased civil partner’ for the option to claim the widowed person tax credit to be presented on the return

- Home Carer’s Tax Credit The maximum value of this credit has been increased from €1,600 to €1,700