CCH Corporation Tax IE: 2024.1.3

Prerequisites

Installing CCH Corporation Tax IE 2024.1.3

Prior to installing this update, you must ensure that you have 2024.1.2 currently installed on your system. Installation of the update is straightforward; however, we recommend that you take a moment to review the Installation Guide

Company Details- minor change

Interest limitation

The Company Details category has a new detail added under the sub-section Interest Limitation. In this sub-section, a table has been added in the hyperlink of the Interest Limitation Panel. You will be able to access the hyperlink from the Interest Limitation Panel sub-section of Company Detail’s Interest Limitation section. The table lets you add the Name of the company to which the payment was made, the Tax reference number of the recipient, and the amount of the payment. This table is however added under the condition 1.25 If the answer to 1.24 is yes, please provide the following details relating to the payment (Mandatory if the answer to 1.6 is “yes.” Otherwise optional. Once you click on Add, the details are put in the respective placeholders, and the same is reflected under the table. The table is represented in Figure 1. The new fields are listed below:

- Name of the company the payment was made to

- Tax reference number of the recipient

- Amount of the payment

Figure 1: New section under Interest Limitation Panel Hyperlink

The Company Details category has deleted a section under the Interest Limitation Panel. The above-mentioned addition has replaced this section. This removal has been added in the hyperlink of the Interest Limitation Panel. You will be able to access the hyperlink from the Interest Limitation Panel sub-section of Company Detail’s Interest Limitation section. The feature removed had a condition which was 1.25 If the answer to 1.24 is yes, please provide the following details relating to the payment (Mandatory if the answer to 1.6 is” yes.” Otherwise optional. If this condition is met, add the Name of the Company to the payment that was made, the Tax reference number on the receipt, and the payment amount. The removed section is displayed in Figure 2 and the fields removed are listed below:

- Name of the company the payment was made to

- The tax reference number on the receipt

- Amount of Payment

Figure 2: Deleted section under Interest Limitation Panel Hyperlink

Outbound Payments defensive measure- minor change

The Company Details category has a new section added for Outbound Payments Defensive Measure. These additions allow the user to enter the details of payment under the Reporting Requirements Chapter 5 Part 33 Outbound Payments Defensive Measure. Some placeholders allow the user to enter the details which when added are displayed in a table format. The user can enter the Date of the Payment, Payment Type, Gross Payment, Withheld Amount, Country, and Explanation, and provide details if any explanation is “other”. Once you click on Add, the details are put in the respective placeholders, and the same is reflected under the table. The table is represented in Figure 3. The new fields are listed below:

- Date of Payment

- Payment Type

- Gross Payment

- Withheld Amount

- Country

- Explanation

Provide details if any explanation is “other”

Figure 3: New section under Outbound Payment Defensive Measures

IMPORTANT: Note it is very important that before running any database update you perform a database backup. CCH always advise that your practice takes regular backups to minimise any loss of data.

Irish Rental Income- minor change

Non-resident landlord

The Non-Resident Landlord section under Irish Rental Income has added two new placeholders for this taxonomy. This will help you keep track of the gross value of the income and deductions for the current and last year. The information that you can enter is the Gross Value of the Rental Income subject to NLWT for the Accounting period ending in 2024 for the current year and the last year and the Gross Value of NLWT deductions for the Accounting period ending in 2024 for the current year and the last year. The same is displayed in Figure 4. The new fields are listed below:

- Gross Value of the Rental Income subject to NLWT for the Accounting period ending in 2024 for the current year and the last year

- Gross Value of NLWT deductions for the Accounting period ending in 2024 for the current year and the last year

Figure 4: New section under Non-Resident Landlord

Irish investment and other income- major change

Digital games tax credit u/s 481a(19)

The Irish Investment and Other Income category has a new section named Digital Games Tax Credit U/S 481A (19). These additions allow the user to enter the details of the game. The placeholders allow the user to enter the details which when added are displayed in a table format. The user can enter the Title of the game, Interim Cultural Certificate Number, Date of Issue of the Interim Certificate, Accounting period in which expenditure incurred begin date, Accounting period in which expenditure incurred end date, Eligible expenditure, Qualifying expenditure, Interim Digital Games Corporation Tax Credit claimed in previous years, Confirmation checkbox, and Interim Digital Games Corporation Tax Credit claimed. Once you click on Add, the details are put in the respective placeholders, and the same is reflected under the table. The table is represented in Figure 5. The new fields are listed below:

- Title of the game

- Interim Cultural Certificate Number

- Date of issue of the Interim Certificate

- The accounting period in which expenditure incurred begin date

- The accounting period in which expenditure incurred end date

- Eligible Expenditure

- Qualifying Expenditure

- Interim Digital Games Corporation Tax Credit claimed in previous years

- A checkbox to confirm that all expenditures in respect of which the claim is being made have been incurred since the commencement date of section 481A

- Interim Digital Games Corporation Tax Credit claimed

Figure 5: New section under Irish Investment and Other Income

Digital games corporation tax credit under section 481a(20)

The Irish Investment and Other Income category has a new section named Digital Games Corporation Tax Credit Under Section 481A (20). These additions allow the user to enter the details of the game. The placeholders allow the user to enter the details which when added are displayed in a table format. The user can enter the Title of the game, Final Cultural Certificate Number, Date of Issue of the Final Certificate, Date of completion of the digital game, Eligible expenditure, Qualifying expenditure, Digital Games Corporation Tax Credit claimed in previous years, Confirmation checkbox, and Interim Digital Games Corporation Tax Credit claimed. Once you click on Add, the details are put in the respective placeholders, and the same is reflected under the table. The table is represented in Figure 6. The new fields are listed below:

- Title of the game

- Final Cultural Certificate Number

- Date of issue of the Final Certificate

- Date of completion of digital game

- Eligible Expenditure

- Qualifying Expenditure

- Digital Games Corporation Tax Credit claimed in previous years

- A checkbox to confirm that all expenditures in respect of which the claim is being made have been incurred since the commencement date of section 481A

- Interim Digital Games Corporation Tax Credit claimed

Figure 6: New section under Irish Investment and Other Income

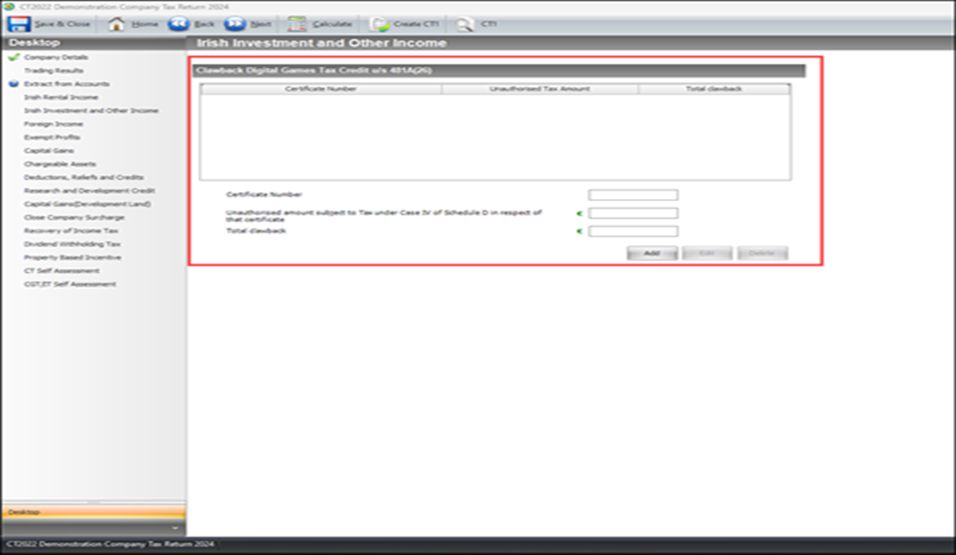

Clawback digital games tax credit u/s 481a (26)

Group ratio Section 835AAH TCA 1997 (See Figure 7)

The placeholders for this sub-section are listed below:

- 1.31 Is the interest group making an election to apply the group ratio in this accounting period? (If the answer is yes, please complete 1.32 and 1.33 below. Mandatory if the answer to 1.26 is ‘no’. Otherwise optional.

- 1.32 Group EBITDA (Mandatory if the answer to 1.31 is ‘yes’. Otherwise optional)

- 1.33 Group exceeding borrowing costs (Mandatory if the answer to 1.31 is ‘yes’. Otherwise optional)

Components of interest limitation calculation (See Figure 7)

The Irish Investment and Other Income category has a new section named Clawback Digital Games Tax Credit U/S 481A (26). These additions allow the user to enter the details of the certificate. The placeholders allow the user to enter the details which when added are displayed in a table format. The user can enter the Certificate Number, Unauthorized amount subject to Tax under Case IV of Schedule D in respect of that certificate, Total clawback. Once you click on Add, the details are put in the respective placeholders, and the same is reflected under the table. The table is represented in Figure 7. The new fields are listed below:

- Certificate Number

- Unauthorised amount subject to Tax under Case IV of Schedule D in respect of that certificate

- Total clawback

Figure 7: New section under Irish Investment and Other Income

Research and development credit - major change

The implementation for Research and Development Credit has been applied for this year’s taxonomy alongside last year's. All attributes under this section can be considered new going forward. To give a brief synopsis, Research and Development Credit is broadly categorised under four headings, namely - Research and Development Credit and Allowances, Unused Carry Forward, Subcontractors, and Grant assistance or other assistance received directly or indirectly to support R&D Activities. Apart from the broad categorisation of the four sections under the first heading. The sections are Section 766 TCA 1997, Section 766A TCA 1997, Section 766C TCA 1997, and Section 766D TCA 1997.

The structure looks like this:

- Unused Carry Forward

- Subcontractors

- Grant assistance or other assistance received directly or indirectly to support R&D Activities.

Research and development credits and allowances

The Research and Development Credits and Allowances heading mostly covers the four sections on the condition Is this R&D corporation tax credit claim being made following Section 766 TCA 1997. The checkboxes are available for both Last Year and Current Year. The first checkboxes for the last and current year are beside the field Section 766 TCA 1997 (Please note a claim cannot be made under this section in respect of R&D expenditure incurred in an accounting period that commences on or after 1 January 2023). There are checkboxes each for the last and current year under Section 766A TCA 1997, Section 766C TCA 1997, and Section 766D TCA 1997. The additions made are visible in Figure 8. The new checkboxes are listed below:

- The checkboxes for the last and current year besides Section 766 TCA 1997( Please note a claim cannot be made under this section in respect of R&D expenditure incurred in an accounting period that commences on or after 1 January 2023)

- A statement stating Please go into section 766A and click the calculate button to claim the total research and development credit due and the total research and development credit due in this accounting period following sections 766 and 766A

- The checkboxes for the last and current year beside Section 766 TCA 1997. Section 766A TCA 1997 (Please note a claim cannot be made under this section in respect of R&D expenditure incurred in an accounting period that commences on or after 1 January 2023)

- The checkboxes for the last and current year beside Section 766A TCA 1997

- The checkboxes for the last and current year beside Section 766C TCA 1997

- The checkboxes for the last and current year beside Section 766D TCA 1997

Figure 8: New section under Research and Development Credits and Allowances

Section 766 TCA 1997- major change

The Section 766A TCA 1997 section has a hyperlink, which opens up a window that allows you to enter the details for last year and current year as per the taxonomy. It has placeholders for amounts of unused credit claimed under different sections of 766 TCA 1997, it allows you to enter the Tax numbers of predecessor companies, and claim for payment of excess Research Development Tax credit following Section 766. It also presents a Back to R&D Credit button and you can click that to return to the Research and Development Credit Panel. All of these additions are for both current and last year. The additions can be viewed in Figure 9. The checkboxes are listed below:

- Amount of unused credit claimed under Sec. 766 TCA 1997 carried forward from a previous accounting period excluding unused credit carried forward from under Sec. 766(4B)(b)(ii)(I) and Sec. 766(4B)(iii)(I) TCA 1997

- Amount of unused credit carried forward under Sec. 766(4B)(b)(ii)(I) TCA 1997

- Amount of unused credit carried forward under Sec. 766(4B)(iii)(I) TCA 1997

- Amount of unused credit carried forward under Sec. 766(4C) TCA 1997

- Please enter the tax number of the predecessor Company 1

- Please enter the tax number of the predecessor Company 2

- Please enter the tax number of the predecessor Company 3

- Second Instalment- Amount of claim under Section 766(4B)(b)(ii)(II) TCA 1997

- Third Instalment- Amount of claim under Section 766(4B)(b)(iii)(II) TCA 1997

Figure 9: New section under Section 766 TCA 1997

Section 766a TCA 1997

The Section 766A TCA 1997 section has a hyperlink, which opens up a window that allows you to enter the details for last year and current year as per the taxonomy. It has placeholders for amounts of unused credit claimed under different sections of 766A TCA 1997, it allows you to tick the box to confirm the building and structure, which was the subject of a claim by the predecessor company, has been transferred to the successor company in accordance to Sec. 766A TCA 1997. It allows you to enter the Total Research and Development credit claimed, due, and clawed back. It also allows you to enter the claim for payment of excess Research Development Tax credit following Section 766A. All of these additions are for both current and last year. It also presents a Back to R&D Credit button and you can click that to return to the Research and Development Credit Panel. All of these additions are for both current and last year. The additions can be viewed in Figure 10. The checkboxes are listed below:

- Amount of unused credit claimed on the construction of the building under Sec. 766A TCA 1997 carried forward from a previous accounting period excluding unused credit carried forward under Sec. 766A(4B)(b)(ii)(I) TCA 1997 and Sec. 766A(4B)(b)(iii)(I) TCA 1997

- Amount of unused credit carried forward under Sec. 766A(4B)(b)(ii)(I) TCA 1997

- Amount of unused credit carried forward under Sec. 766A(4B)(b)(iii)(I) TCA 1997

- Amount of unused credit carried forward under Sec. 766A(3A)

- A checkbox to confirm that the building structure, which was the subject of the claim by the predecessor company, has been transferred to the successor company following Sec. 766A(3A)

- Total Research and Development credit claimed in this accounting period, following Section 766 and 766A

- Amount of Research and Development credit being clawed back

- Total Research and Development credit is now due in this accounting period, following sections 766 and 766A

- Second Instalment- Amount of claim under Section 766A(4B)(b)(ii)(II) TCA 1997

- Third Instalment- Amount of claim under Section 766A(4B)(b)(iii)(II) TCA 1997

Figure 10: New section under Section 766A TCA 1997

Section 766c- TCA 1997

The Section 766C TCA 1997 section has a hyperlink, which opens up a window that allows you to enter the details for last year and current year as per the taxonomy. It has various placements introduced under the section For completion where a claim is being made under Section 766C. It is categorised into sections, namely Tax credit forward amounts relating to claims made in the prior period under section 766C TCA 1997, Tax credit forward amounts relating to claims made in the two preceding periods under Section 766C TCA 1997, Group Relief, Claim to 1st instalment under section 766C, Claim to 2nd instalment under section 766C, Claim to 3rd instalment under section 766C, Successor claim under section 766C (7A). It also presents a Back to R&D Credit button and you can click that to return to the Research and Development Credit Panel. All of these additions are for both current and last year. The additions can be viewed in Figures 11,12,13 and 14. The checkboxes are listed below:

- For completing where the claim is made under section 766C: Amount of the research and development corporation tax credit claimed under Sec. 766C in this accounting period at 25% (the tax credit should be in respect of all ++ n

- Amount of the Research and Development corporation tax credit claimed under section 766C TCA in this accounting period at 30% (the 30% rate only applies in respect of an accounting period commencing on or after 1 January 2024) (the tax credit should be in respect of all qualifying expenditure attributable to the company in this accounting period

- Where applicable did the company complete the pre-filling notifications to the Revenue

- Amount of the expenditure attributable to research and development activities incurred by the company during the accounting period concerned in respect of:

- Machinery or plant as preferred in Section 766(1A)(a)

- Emoluments of the employees carrying on qualifying research and development activities

- The sum of the remaining qualifying expenditure incurred by the company during the accounting period concerned

- Tax Credit forward amounts relating to claims made in the prior period under section 766C TCA 1997:

- R&D tax credit claimed (under section 766C) in prior accounting period

- Amount of the R&D tax credit which was claimed as a first instalment under 766C(6)(a)

- Balance of the R&D corporation tax credit in respect of an R&D corporation tax credit claim (under Section S766C) made in the prior period (i.e. the amount of R&D corporation tax credit less first instalment claimed at the previous period)

- Tax Credit forward amounts relating to claims made in the two preceding periods under section 766C TCA 1997:

- R&D tax credit claimed (under section 766C) in the two preceding periods

- Amount of the R&D tax credit which was claimed as a first instalment under 766C(6)(a)

- Amount of the R&D tax credit which was claimed as a second instalment under 766C(6)(b)

- Balance of the R&D corporation tax credit (under section 766C(6)(c)) in respect of an R&D corporation tax credit claim (under Section S766C) made in the two preceding accounting periods (i.e. the amount of R&D corporation tax credit less first instalment and second instalment claimed)

- Group Relief:

- Amount of qualifying group expenditure which has been surrendered to this company following section 766C(5). Please enter the amount of the qualifying expenditure claimed

- Enter the amount of the R&D corporation tax credit amount to which applies (excess credit claimed)

- Enter the tax reference numbers of the company(ies) who surrendered the excess amount to this company and the amount surrendered:

- TRN

- Amount

- TRN

- Amount

- And;

- Amount of qualifying group expenditure which has been surrendered to another member group company, following section 766C(5). Please enter the amount of the qualifying expenditure being surrendered

- Enter the amount of the R&D corporation tax credit amount to which applies (excess credit surrendered)

- Enter the tax reference numbers of the company(ies) to whom the credit was surrendered and the amount which has been transferred:

- TRN

- Amount

- TRN

- Amount

- Claim to 1st instalment under section 766C:

- First instalment, relating to a credit claimed in this accounting period, under section 766C(6)(a) TCA 1997. The first instalment is the greatest of (1) 25,000 or if lower, the amount of the credit claimed or (2)50% of the amount of the credit claimed

- First instalment, relating to a credit claimed in this accounting period, under section 766C(6)(a) TCA 1997. The first instalment is the greatest of (1) 50,000 or if lower, the amount of the credit claimed or (2)50% of the amount of the credit claimed. (The amount of 50,000 only applies in respect of an accounting period commencing on or after 1 January 2024)

- Provide the following details of the first instalment, or any portion of such amount:

- Indicate, by inserting x in the appropriate box, if is to be treated as an overpayment of tax, for section 960H, as set out in section 766C(7)(a) TCA 1997. If yes, please include the amount or any portion of such amount

- Amount

- The amount of the overpayment which is to be offset against the company’s corporation tax payable for the accounting period for preliminary tax purposes under Section 766C(13)

- Indicate, by inserting x in the appropriate box, if is to be paid to the company by the Revenue Commissioners, as set out in section 766C(7)(b) TCA 1997. If yes, please state the amount or any portion of such amount

- Amount

- Indicate, by inserting x in the appropriate box, if the excess amount or any part of that amount is to be surrendered to a key employee following section 766C(2) TCA 1997. If yes, please state the amount

- Amount

- Concerning the amount of credit surrendered, please enter details of each employee receiving the R&D corporation tax credit

- PPSN

- Amount

- Claim to 2nd instalment under section 766C:

- Second Instalment- Amount due under section 766C(6)(b) TCA 19977

- Provide the following details of the second instalment, or any portion of such amount:

- Indicate, by inserting x in the appropriate box, if is to be treated as an overpayment of tax, for section 960H, as set out in section 766C(7)(a) TCA 1997. If yes, please include the amount or any portion of such amount

- Amount

- Indicate, by inserting x in the appropriate box, if is to be paid to the company by the Revenue Commissioners, as set out in section 766C(7)(b) TCA 1997. If yes, please state the amount or any portion of such amount

- Amount

- Indicate, by inserting x in the appropriate box, if the excess amount or any part of that amount is to be surrendered to a key employee following section 766C(2) TCA 1997. If yes, please state the amount

- Amount

- Concerning the amount of credit surrendered, please enter details of each employee receiving the R&D corporation tax credit

- PPSN

- Amount

- Claim to 3rd instalment under section 766C:

- Third Instalment- Amount due under section 766C(6)(c) TCA 19977

- Provide the following details of the second instalment, or any portion of such amount:

- Indicate, by inserting x in the appropriate box, if is to be treated as an overpayment of tax, for section 960H, as set out in section 766C(7)(a) TCA 1997. If yes, please include the amount or any portion of such amount

- Amount

- Indicate, by inserting x in the appropriate box, if is to be paid to the company by the Revenue Commissioners, as set out in section 766C(7)(b) TCA 1997. If yes, please state the amount or any portion of such amount

- Amount

- Indicate, by inserting x in the appropriate box, if the excess amount or any part of that amount is to be surrendered to a key employee following section 766C(2) TCA 1997. If yes, please state the amount

- Amount

- Concerning the amount of credit surrendered, please enter the details of each employee receiving the R&D corporation tax credit.

- PPSN

- Amount

- Successor claim under Section 766C(7A):

- Amount of the Research and Development Corporation tax credit claimed by the predecessor company which is available to be claimed by the successor company under Sec.766C(7A) TCA 1997

- Please enter the tax number of the predecessor company:

- Company 1

- Company 2

- Company 3

- First Instalment

- Second Instalment

- Third Instalment

- Indicate, by inserting x in the appropriate box, if is to be treated as an overpayment of tax, for section 960H, as set out in section 766C(7)(a) TCA 1997. If yes, please include the amount or any portion of such amount

- Amount

- Indicate, by inserting x in the appropriate box, if is to be paid to the company by the Revenue Commissioners, as set out in section 766C(7)(b) TCA 1997. If yes, please state the amount or any portion of such amount

- Amount

Figure 11: New section under Section 766C TCA 1997

Figure 12: New section under Section 766C TCA 1997

Figure 13: New section under Section 766C TCA 1997

Figure 14: New section under Section 766C TCA 1997

Section 766d TCA 1997

The Section 766D TCA 1997 section has a hyperlink, which opens up a window that allows you to enter the details for last year and current year as per the taxonomy. It has various placements introduced under the section For completion where a claim is being made under Section 766D. It is categorised into sections, namely Tax credit forward amounts relating to claims made in the prior period under section 766D TCA 1997, Tax credit forward amounts relating to claims made in the two preceding periods under Section 766D TCA 1997, Group Relief, Claim to 1st instalment under section 766D, Claim to 2nd instalment under section 766D, Claim to 3rd instalment under section 766D, Successor claim under section 766D (3A). It also presents a Back to R&D Credit button and you can click that to return to the Research and Development Credit Panel. All of these additions are for both current and last year. The additions can be viewed in Figures 15,16,17 and 18. The checkboxes are listed below:

- For completion where the claim is made under section 766D:

- Amount of the research and development corporation tax credit claimed on the construction or refurbishment of a building under section 766D in this accounting period at 25%

- Amount of the Research and Development corporation tax credit claimed on the construction or refurbishment of a building under section 766D in this accounting period at 30% (the 30% rate only applies in respect of an accounting period commencing on or after 1 January 2024)

- Where applicable did the company complete the pre-filling notification to the Revenue

- Tax Credit forward amounts relating to claims made in the prior period under section 766D TCA 1997:

- R&D tax credit claimed (under section 766D) in prior accounting period

- Amount of the R&D tax credit which was claimed as a first instalment under 766D(5)(a)

- Balance of the R&D corporation tax credit in respect of an R&D corporation tax credit claim (under Section S766D) made in the prior period (i.e. the amount of R&D corporation tax credit less first instalment claimed in the prior period)

- Tax Credit forward amounts relating to claims made in the two preceding periods under section 766D TCA 1997:

- R&D tax credit claimed (under section 766D) in the two preceding periods

- Amount of the R&D tax credit which was claimed as a first instalment under 766D(5)(a)

- Amount of the R&D tax credit which was claimed as a second instalment under 766D(5)(b)

- Balance of the R&D corporation tax credit in respect of an R&D corporation tax credit claim (under Section S766D) made in the two preceding accounting periods (i.e. the amount of R&D corporation tax credit less first instalment and second instalment claimed)

- Claim to 1st instalment under section 766D:

- First instalment, relating to a credit claimed in this accounting period, under section 766D(5)(a) TCA 1997

- Provide details of the first instalment or any portion of such amount:

- Indicate, by inserting x in the appropriate box, if is to be treated as an overpayment of tax, for section 960H, as set out in section 766D(6)(a) TCA 1997 If yes, please include the amount or any portion of such amount

- Amount

- The amount of the overpayment which is to be offset against the company’s corporation tax payable for the accounting period for preliminary tax purposes Section 766D(12)

- Insert x in the appropriate box if the excess credit (as defined under section 766D(2)) which is to be treated as an overpayment (within the meaning of section 960H) has been allocated to this company from another group company (i.e. the excess credit is being claimed by this company)?

- Amount

- Enter the tax reference number of the company from which the excess credit has been surrendered

- TRN

- Insert x in the appropriate box if the excess credit (as defined under section 766D(2)) which is to be treated as an overpayment (within the meaning of section 960H) has been surrendered to another group company (i.e. the excess credit is surrendered to a group company)

- Amount

- Enter the tax reference number of the company from which the excess credit has been surrendered.

- TRN

- Indicate, by inserting x in the appropriate box, if is to be paid to the company by the Revenue Commissioners, as set out in section 766D(6)(b) TCA 1997. If yes, please state the amount or any portion of such amount

- Amount

- Claim to 2nd instalment under section 766D:

- Second instalment- Amount due under section 766D(5)(b) TCA 1997

- Insert x in the appropriate box if the second instalment made or any portion of such amount to be:

- Treated as an overpayment of tax, for section 960H, as set out in section 766D(6)(a) TCA 1997? If yes, please include the amount or any portion of such amount

- Amount

- Insert x in the appropriate box if the excess credit (as defined under section 766D(2)) which is to be treated as an overpayment (within the meaning of section 960H) has been allocated to this company from another group company (i.e. the excess credit is being claimed by this company)

- Amount

- Enter the tax reference number of the company from which the excess credit has been surrendered.

- TRN

- Insert x in the appropriate box if the excess credit (as defined under section 766D(2)) which is to be treated as an overpayment (within the meaning of section 960H) has been surrendered to another company to this company from another group company (i.e. the excess credit is surrendered to a group company)

- Amount

- Enter the tax reference number of the company to whom the excess credit has been surrendered.

- TRN

- Indicate, by inserting x in the appropriate box, if is to be paid to the company by the Revenue Commissioners, as set out in section 766D(6)(b) TCA 1997. If yes, please state the amount or any portion of such amount

- Amount

- Claim to 3rd Instalment under section 766D:

- Third instalment- Amount due under section 766D(5)(c) TCA 1997

- Provide the following details of the third instalment or any portion of such amount:

- Indicate, by inserting x in the appropriate box, if is to be treated as an overpayment of tax, for section 960H, as set out in section 766D(6)(a) TCA 1997. If yes, please include the amount or any portion of such amount

- Amount

- Insert x in the appropriate box if the excess credit (as defined under section 766D(2)) which is to be treated as an overpayment (within the meaning of section 960H) has been allocated to this company from another group company (i.e. the excess credit is being claimed by this company)

- Amount

- Enter the tax reference number of the company to whom the excess credit has been surrendered.

- TRN

- Insert x in the appropriate box if the excess credit (as defined under section 766D(2)) which is to be treated as an overpayment (within the meaning of section 960H) has been surrendered to another group (i.e. the excess credit is surrendered to a group company)

- Amount

- Enter the tax reference number of the company to whom the excess credit has been surrendered.

- TRN

- Indicate, by inserting x in the appropriate box, if is to be paid to the company by the Revenue Commissioners, as set out in section 766D(6)(b) TCA 1997. If yes, please state the amount or any portion of such amount

- Amount

- Successor claim under section 766D (3A):

- Amount of the Research and Development Corporation tax credit claimed by the predecessor company which is available to be claimed by the successor company under Sec.766D(3A) TCA 1997

- Please enter the tax number of the predecessor company:

- Company 1

- Company 2

- Company 3

- First Instalment

- Second Instalment

- Third Instalment

- Indicate, by inserting x in the appropriate box, if is to be treated as an overpayment of tax, for section 960H, as set out in section 766C(7)(a) TCA 1997. If yes, please include the amount or any portion of such amount

- Amount

- Indicate, by inserting x in the appropriate box, if is to be paid to the company by the Revenue Commissioners, as set out in section 766C(7)(b) TCA 1997. If yes, please state the amount or any portion of such amount

- Amount

Figure 15: New section under Section 766D TCA 1997

.

.

Figure 16: New section under Section 766D TCA 1997

Figure 17: New section under Section 766D TCA 1997

Figure 18: New section under Section 766D TCA 1997

Unused Carry forward- major change

The Unused Carry Forward heading under the Research and Development Credit section shows the taxonomy details for this and last year. It has placeholders that allow you to enter the amount of carry forward of R&D tax credit under Section 766, the amount of carry forward of R&D tax credit under Section 766A, and the total amount of unused prior year credits under Section 766B. All placeholders are for both last year and the current year. The additions are visible in Figure 19. The new fields added are listed below:

- Amount of carry forward of R&D tax credit under Section 766 available for use in succeeding accounting periods against corporation tax

- Amount of carry forward of R&D tax credit under Section 766A available for use in succeeding accounting periods against corporation tax

- Total amount of unused prior year credits carried forward to future years following application of Section 766B

Figure 19: New section under Unused Carry Forward

Subcontractors- major change

The Subcontractors heading under the Research and Development Credit section shows the taxonomy details for this and last year. It has placeholders that allow you to enter the Research and Development expenditure under Section 766 and to indicate using a tick box if you have notified the “other persons” but they may not claim tax credits. All placeholders are for both last year and the current year. The additions are visible in Figure 20. The new fields added are listed below:

- Research and Development expenditure on subcontracted expenditure to universities (Section 766(1)(b)(vii))

- Research and Development expenditure on subcontracted expenditure to other persons (Section 766(1)(b)(viii))

- Please indicate by ticking the appropriate box if you have notified the “other persons” that they may not claim the tax credit for such sub-contracted expenditure

Figure 20: New section under Subcontractors

Grant assistance or other assistance received directly or indirectly to support R&D activities- major change

The Grant Assistance Or Other Assistance Received Directly Or Indirectly To Support R&D Activities heading under the Research and Development Credit section shows the taxonomy details for this and last year. It has placeholders for the Amount of grant, Source of grant, EI R&D grants, IDA R&D grants, Higher education institute grants, and many more. All placeholders are for both last year and the current year. The additions are visible in Figure 21. The new fields added are listed below:

- Amount of grant or similar amount received specifically to support R&D Activities

- Source of grant or similar amount

- EI R&D grants

- IDA R&D grants

- LEO R&D grants

- Higher education institute grants

- Other Irish public R&D grants (including public research centres)

- Irish private non-profit institute R&D grants (e.g. privately owned research centres, philanthropic transfers)

- European Union R&D grants

- Other public R&D grants (including foreign public universities and public research centres)

- Other private non-profit institute R&D grants (e.g. privately owned research centres, philanthropic transfers)

- Others (please specify in box)

- Specify

- Allowance claimed for capital expenditure on scientific research (section 765 TCA 1997)

Figure 21: New section under Grant Assistance Or Other Assistance Received Directly Or Indirectly To Support R&D Activities

Recovery of Income Tax- major change

Interest paid to partnerships and tax-transparent entities without the deduction of income tax

The Interest Paid To Partnerships And Tax Transparent Entities Without The Deduction Of Income Tax section under the Recovery of Income Tax category has a few additions. If you have applied the practice set out in Paragraph 5.3 of Tax and Duty Manual 08-03-06 to make a payment of interest to a partnership of a tax-transparent entity then you can enter the gross amount of the interest payment and the territory. You can then click on Add to make them appear on the table. The additions are visible in Figure 22. The new fields added are listed below:

- The gross amount of the interest payment was

- Territory

Figure 22: New section under Interest Paid To Partnerships And Tax Transparent Entities Without The Deduction Of Income Tax

CT Self assessment- major change

Self assessment made under chapter 4 of part 41A TCA 1997

The Self-Assessment made under Chapter 4 of Part 41A TCA 1977 section under the CT Self-Assessment category has two new additions in the taxonomy. You can now enter the Research and Development Credit for the current and last year and the Research and Development Cash Refund for the current and last year for the taxonomy. The additions are visible in Figure 23. The new fields added are listed below:

- Research and Development Credit

- Research and Development Cash Refund

Figure 23: New section under Self-Assessment made under Chapter 4 of Part 41A TCA 1977 section

Trading results- Removal

Expected trade profits

Trade losses removal

The Trade Losses heading under the Expected Trade Profits section for the Trading Results category has got some placeholders removed. A few clauses for Carry back of losses have been removed that confirmed whether an amount entered was an interim claim under Sec 396D and whether an amount entered was no more than 50% of the final claim for this loss. You could confirm whether a company incurs or expects to incur a trading loss. You can also confirm whether the company was a tax complaint. The deletions are visible in Figure 24. The fields removed are listed below:

- (b) I confirm that the amount entered above is:

- (i) An interim claim under Sec 396D for this loss

- The amount entered must be no more than 50% of your estimated non-relevant trading loss:

- (ii) The final claim for this loss under Sec 396B

- Interim claim Sec 396D:

- (c) I confirm that the company has incurred, or reasonably expects to incur, a trading loss in the ‘next ‘ accounting period

- (d) I confirm that the company is tax-compliant. The company is tax compliant if its tax affairs are up to date and no returns or payments are outstanding

Figure 24: Section removed under Trade Losses

Trade profits removal

The Trade Profits at 12.25% heading under the Trade Profits section removed placements from the hyperlink. The placements used to let you tick whether an amount entered was an interim claim under Sec 396D, or whether the final claim for this loss was under Sec 396B. It also lets you confirm whether a company incurred or expected to incur a trading loss and whether they are tax compliant. The deletions are visible in Figure 25. The fields removed are listed below:

- (b) I confirm that the amount entered above is:

- (i) An interim claim under Sec 396D for this loss

- The amount entered must be no more than 50% of your estimated non-relevant trading loss:

- (ii) The final claim for this loss under Sec 396B

- Interim claim Sec 396D:

- (c) I confirm that the company has incurred, or reasonably expects to incur, a trading loss in the ‘next ‘ accounting period

- (d) I confirm that the company is tax-compliant. The company is tax compliant if its tax affairs are up to date and no returns or payments are outstanding

Figure 25: Section removed under Trade Profits

Profits from qualifying assets

Profits from qualifying assets under chapter 5 of part 29 TCA 1997 details- removal

The Profits from qualifying assets under Chapter 5 of Part 29 TCA 1997 details heading under Profits from Qualifying Assets section removed placements from the hyperlink. The placements used to let you tick whether an amount entered was an interim claim under Sec 396D, or whether the final claim for this loss was under Sec 396B. It also lets you confirm whether a company incurred or expected to incur a trading loss and whether they are tax compliant. The deletions are visible in Figure 26. The fields removed are listed below:

- (b) I confirm that the amount entered above is:

- (i) An interim claim under Sec 396D for this loss

- The amount entered must be no more than 50% of your estimated relevant trading loss:

- (ii) The final claim for this loss under Sec 396B

- Interim claim Sec 396D:

- (c) I confirm that the company has incurred, or reasonably expects to incur, a trading loss in the ‘next ‘ accounting period

- (d) I confirm that the company is tax-compliant. The company is tax compliant if its tax affairs are up to date and no returns or payments are outstanding

Figure 26: Section removed under Profits from Qualifying Assets

Deductions, reliefs and credits- removal

Relief on value basis

Relief on value basis- (Note: enter amounts of gross loss/charge/group relief to be offset- removal

The Relief on Value Basis (Note: Enter amounts of gross Loss/Charge/Group Relief to be offset) heading under the Relief on Value Basis section removed placements from the hyperlink. The placements used to let you tick whether an amount entered was an interim claim under Sec 396D, or whether the final claim for this loss was under Sec 396B. It also lets you confirm whether a company incurred or expected to incur a trading loss and whether they are tax compliant. You could also enter the amount of excess loss, charges and group relief in respect of Qualifying Assets as restricted under Sec.769K(2)(a) and 769K(2)(b) for the last and current year. The deletions are visible in Figure 27. The fields removed are listed below:

- (b) I confirm that the amount entered above is:

- (i) An interim claim under Sec 396D for this loss

- The amount entered must be no more than 50% of your estimated relevant trading loss:

- (ii) The final claim for this loss under Sec 396B

- Interim claim Sec 396D:

- (c) I confirm that the company has incurred, or reasonably expects to incur, a trading loss in the ‘next ‘ accounting period

- (d) I confirm that the company is tax-compliant. The company is tax compliant if its tax affairs are up to date and no returns or payments are outstanding

- Enter below the amount of excess loss, charges and group relief in respect of Qualifying Assets as restricted under Sec.769K(2)(a) and 769K(2)(b):

- (a) Trading Loss from a Qualifying Asset

- (b) If any amount (a) refers to Excess Capital Allowances, enter the amount

- And;

- Trading Charges in respect of Qualifying Assets

- Trading Group Relief in respect of Qualifying Assets

- Carry back Losses for Qualifying Assets:

- (i) An interim claim under Sec 396D for this loss

- The amount entered must be no more than 50% of your estimated relevant trading loss:

- (ii) The final claim for this loss under Sec 396B

- Interim claim Sec 396D:

- (c) I confirm that the company has incurred, or reasonably expects to incur, a trading loss in the ‘next ‘ accounting period

- (d) I confirm that the company is tax-compliant. The company is tax compliant if its tax affairs are up to date and no returns or payments are outstanding

Figure 27: Section removed under Relief on Value Basis