CCH Personal Tax 2023.3: Release Notes

Release Highlights

This release of Personal Tax includes the following items:

- Addition of Green Savings Bonds to National Savings and Investments

- Obfuscation of HMRC credentials

- Textual changes to the Online filing credentials DTA screen

- Improvements to the performance of the Pension Savings Tax Charge

- Improvements to identify the credentials used when authorising the DTA

Prerequisites

Installing CCH Personal Tax 2023.3

This release is installed using the Central Suite Installer. This ensures that all prerequisites are in place and that all the products for which you are licenced are installed in the correct sequence. Click here to learn about the Central Suite Installer.

Software Enhancements

National Savings and Investments - Green Savings Bonds

We have added a new account type, Green savings bonds, to the drop list of account types within National Savings Interest for the year ended 5 April 2023. This has been added into all relevant return types. We have also ensured that these appear in the backing schedules.

Quality Improvements

The following items have been updated in this release.

ITS 57494 - Online fiIing credentials and the DTA screen description

We have reviewed the narrative displayed on the Online filing credentials tab name as well as the details displayed to make this clearer:

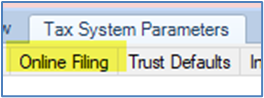

Tab Name

The tab name has now been updated:

Old:

New:

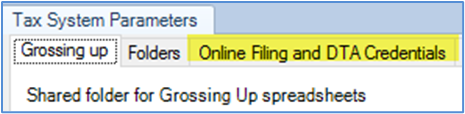

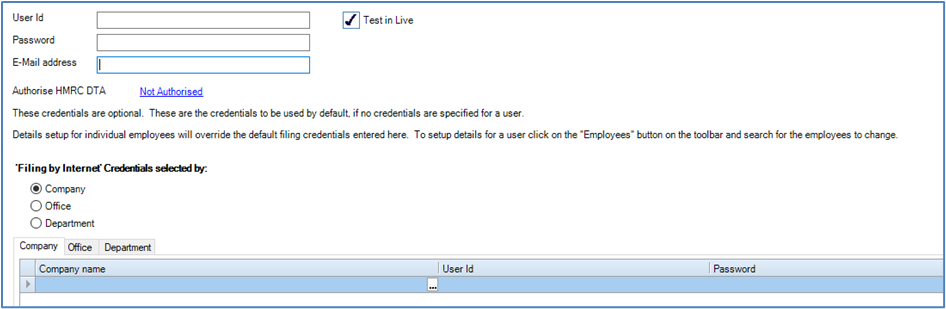

Details

The wording has been updated as follows:

Old:

New:

ITS 57723 - Online filing password security

We now encrypt online filing passwords stored in the database. Following on from the 2022.3 release access to the Online Filing details tab is now controlled by a task permission, this ensures that only users with specific permissions can see the Agent Credentials.:

This additional security enhancement prevents unauthorised viewing of the relevant passwords.

For further details please click here

ITS 62674 - Pensions Savings Tax Charge

We have previously identified an issue with the recalculation of the Pension Savings Tax Charge. Where details of income and the amount subject to pension savings tax charge had been entered the calculation was correct; however, if there was a change in the income then the re-calculation of the pension savings tax charge was not automatically calculated. The recalculation of the tax charge took place when the Pension savings tax charges data entry window was opened. When there is not more than one expat employment, we have changed how the tax on the excess is calculated so that the Pension savings tax charges window does not need to be opened to refresh the calculation. However, to ensure that the figures for Central Reporting are correct we recommend that you visit the Pension savings tax charges window and save the data.

ITS 66478 - Agent credentials used to authorise DTA

Users had advised that when attempting to reauthorise DTA credentials it was not possible to identify the credentials previously used. We are now automatically populating the credentials; this reduces the risk of using incorrect credentials.

Note: When the credentials appear in the HMRC Gateway window, the Sign In button is automatically selected.

ITS 66552 - Box 20 completed in error

Where a value on the data entry windows was ticked as being Estimated, Box 20 on Page 8 of the SA100 Tax Return (Provisional Figures) was being ticked in error. The box was ticked when viewing the Tax Return on screen and in the XML file for online filing; when looking at the Tax Return Other Information screen the tick was not visible..

Note: On update any returns with an IRMark generated are amended. You are prompted that data has changed, you can choose to submit the return as is or regenerate the IRMark and submit the amended return.

ITS 67707 - Business Asset Disposal Relief not carried forward

A user has reported that where Business Asset Disposal Relief (BADR) has been claimed on a disposal record, and upon roll forward no other disposals of any type are entered in the subsequent year, when the tax return is rolled forward to the third year, the BADR disappeared from the data entry window. Where any type of disposal is entered in the second year (with or without BADR) when the return is rolled forward, the BADR is retained.

ITS 67803 - Edited Disclosure Notes not appearing in the Tax Return Bundle.

When a new client specific disclosure note is added on the Tax Return Disclosure Notes window within a Tax Return, the data saved, and the user generates the Tax Return Bundle then the note appears in the bundle. If the note is subsequently edited (in the same session), the data saved into the database, and the bundle generated then the change to the note is not always reflected in the bundle.

Notable Issues: