Postponed VAT

Postponed VAT

What is postponed VAT?

New legislation has been introduced from the 1st January 2021 for all imports of goods, therefore if you’re a UK VAT registered company/person you will be responsible for the VAT on goods imported into the UK.

How does this affect my VAT submissions?

When accounting for postponed VAT on your VAT return you will need to pay and recover the import VAT on the same VAT return. In order to reflect this in Twinfield you will need to create a new VAT code.

Example:

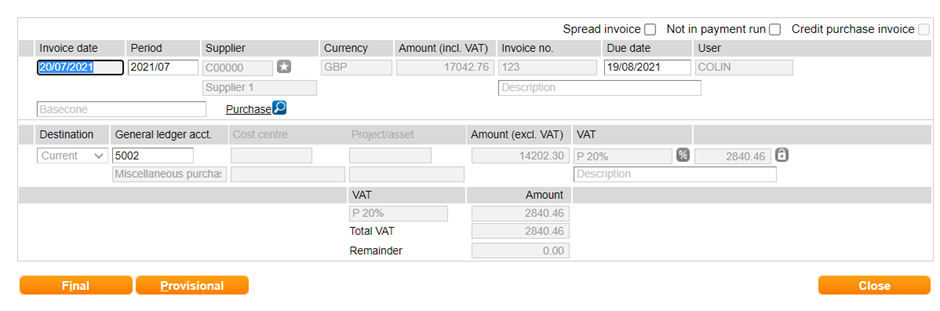

How is the purchase invoice received from the supplier?

- Is the amount due to the supplier £17042.76 (including VAT) or £14202.30 (excluding VAT)?

This example assumes that the gross amount is payable to the supplier and a postponed control account is used to record the VAT amount.

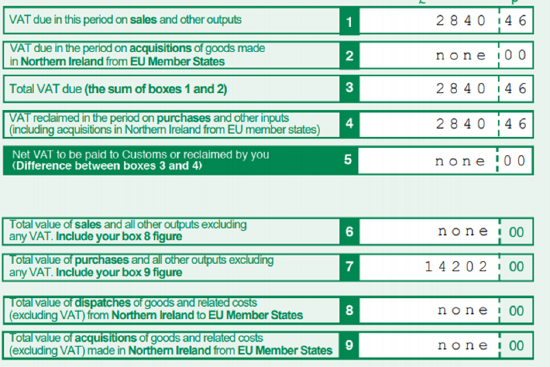

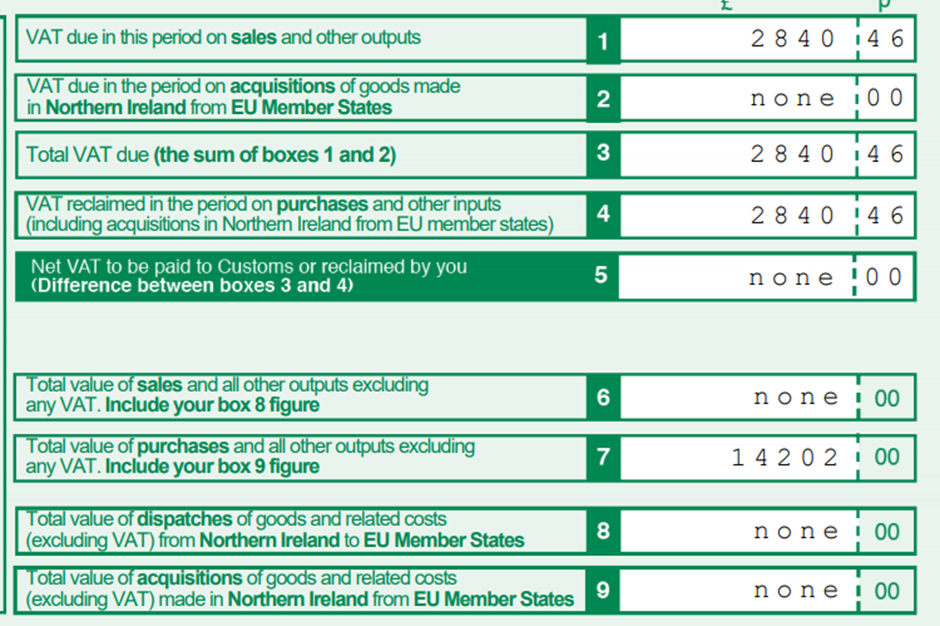

Example of VAT return after purchase invoice is posted above.

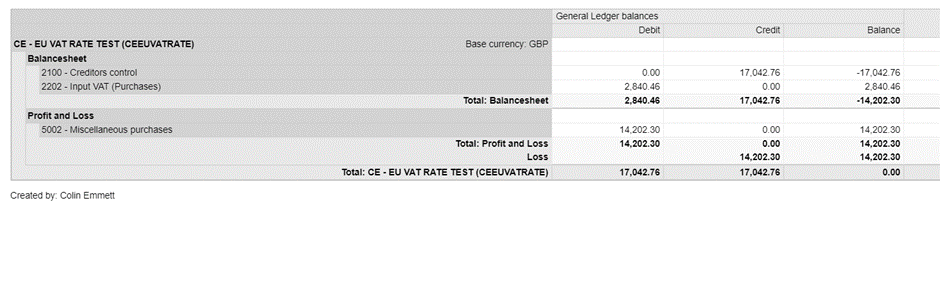

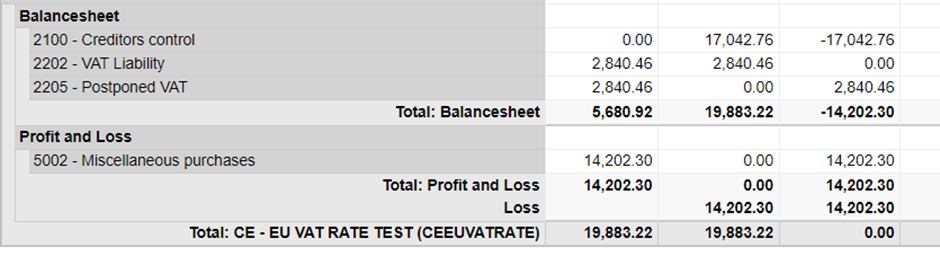

TB after the above purchase invoice is posted.

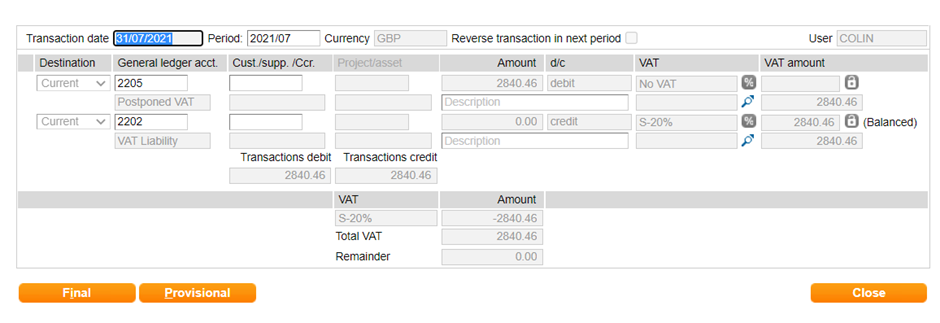

Adjusting entry via journal at VAT period end

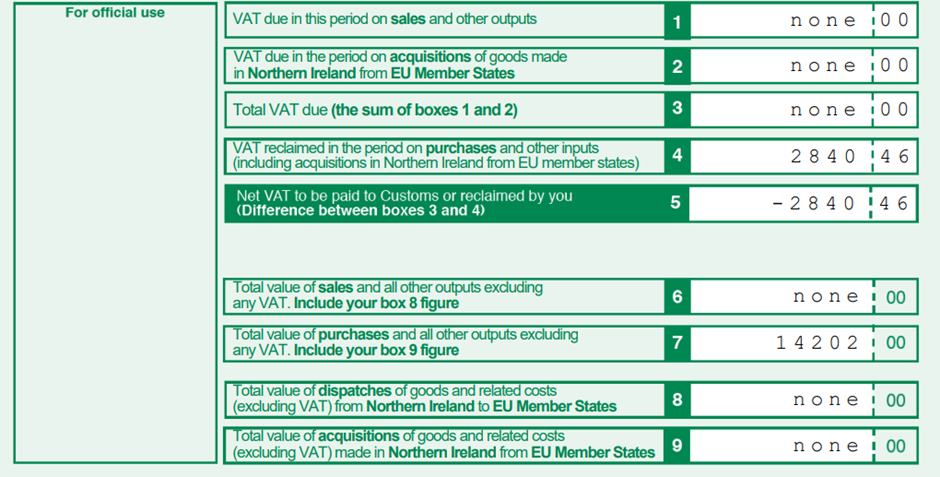

Impact on VAT return after above journal is posted

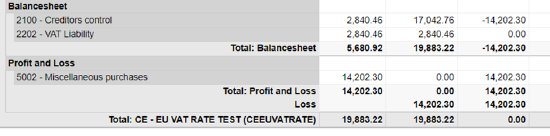

Impact on TB after journal

Alternative - If the gross amount is not being paid to the supplier then the debit balance in Postpone VAT can be journaled to the creditors control (using the suppliers code) to clear the amount outstanding on the invoice or the above journal can be amended to use the creditors control with the suppliers account rather than a postpone VAT code.

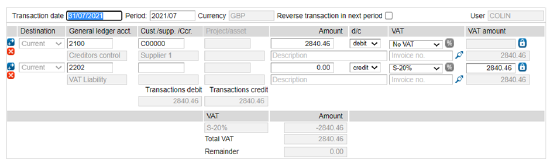

Example Journal using creditors control

Impact on TB with this example

Impact on VAT return with this example