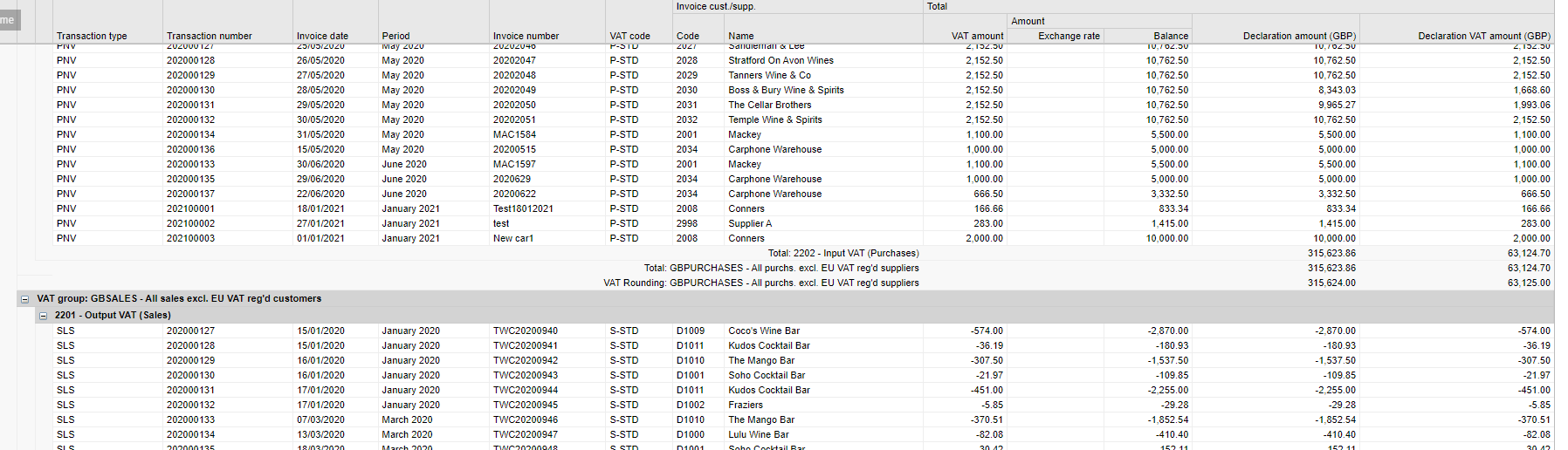

The VAT return can be produced monthly, quarterly or yearly; the creation and sending of VAT returns consists of the following steps:

- Run VAT Analysis Report.

- Captures both provisional and final transactions

- Create the VAT return.

- Review VAT analysis report.

- Finalise the VAT return.

- Click on the Reports icon

- Select the ‘Reports’ tile

- Click ‘View category’.

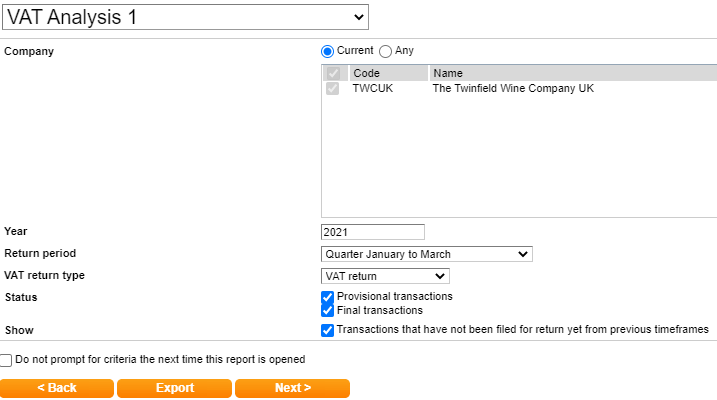

- Select report i.e., ‘VAT Analysis 1'.

The following criteria can also be selected

- Year

- Return period

- VAT return type

- Status

- Show

Please note: Tick the status 'Show' - this will ensure any late transactions posted into a previous VAT timeframe has been included onto the report.

Once your criteria is select click 'Next' to display the report.