Mapping Nominal Code information from CCH Trust Accounts

CCH Trust Accounts set up

CCH Trust Accounts passes investment entries into CCH Personal Tax. This includes investment income and disposals for Capital Gains Tax. However bank interest and property income are usually posted only to the nominal ledger and so are not imported into CCH Personal Tax. There is a facility in CCH Trust Accounts to transfer these nominal balances into CCH Personal Tax. It involves changes in both CCH Trust Accounts and CCH Personal Tax.

In CCH Trust Accounts nominal codes containing the balances to import can be specified in Edit Client Class.

- Go to Activities > Common/Shared Data > Client Classes > Trusts > Edit > PT mappings:

Account codes can be selected from the Master Chart by pressing the F2 key. The following operators can be used:

|

.. |

The sum of a range of accounts, e.g. 0021..0025 |

|

+ |

Add account values |

|

- |

Subtract them |

Subaccounts can be entered in the usual way, e.g. 0021/01

Where CCH Personal Tax requires a net e.g. Bank interest net. The CCH Trust Accounts balance is transferred into CCH Personal Tax as the net amount in CCH Personal Tax and the tax figure is calculated automatically as in manual Data Entry in CCH Personal Tax. However some users post the gross amount into Trust Accounts and post the tax to a separate expense account. Suppose bank interest paid net is posted as:

|

0026 |

Bank interest net |

100CR |

|

1002 |

Tax Payable Interest |

20DR |

|

7051 |

Bank |

80DR |

In this case posting account 0026 into CCH Personal Tax would give the wrong result. The nominal formula should be 0026+1002 so that the net figure is posted to CCH Personal Tax.

CCH Personal Tax- Tax Links tab

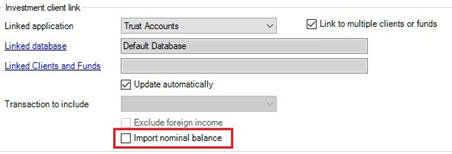

The Tax Links tab in CCH Central has a tick box called Import nominal balances. If ticked then the nominal balances are brought across from CCH Trust Accounts when the link is run.

Notes:

- The CCH Trust Accounts financial year does not need to correspond to the CCH Personal Tax, tax year. The link will run the Trial Balance for the appropriate period or display an error if this is not possible.

- The option to Import nominal balances is only available if Income is being imported and only functions for tax years 2011 on. Individual transactions are not imported, only the nominal balances. Imported balances are described as “Imported from Trust Accounts” in CCH Personal Tax. Income from Land and Property is rounded before being imported. Income is rounded down and expenses up.

- If you go back to CCH Trust Accounts and make changes then the next time you go back into the CCH Personal Tax, you are prompted to reimport the data.

- If multiple CCH Trust Accounts clients are linked to a single CCH Personal Tax client then the nominal balances are imported from all of them if Import nominal balances is ticked.