Movement Codes

Movement Codes

SecTAX uses Rules and Attributes to record how a transaction is to be treated for income and CGT purposes. Movement Codes, of up to three alphanumeric characters, link a Rule, specified Attributes (the Attributes available for selection depend upon the Rule) and a description. Movement Codes are the means used to specify how transactions are to be treated by the system.

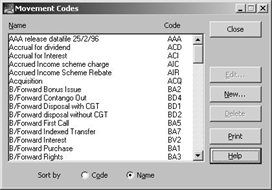

From Activities, Common/Shared Data select Movement Codes the following window appears:

The movement codes have been imported with remaining common files. The description attached to a Movement Code appears in the following reports:

- Investment Schedule

- CGT Report

- Income and Acquisition Schedules

- Assumed Dividend Schedule

- Ownership of individual securities

- Movement Code Report

- Autopost system

- Complex Capital Transaction Wizard (within Autopost)

The description, rule and attributes for most movement codes can be amended however the following Movement Codes are system defined and only the description can be amended, this is because the Autopost and Complex Capital Transactions Wizard routines use these codes:

|

Code |

Description |

CGT Rule |

|

BNI |

Bonus Issue |

A2 |

|

COU |

Payment for Rights |

A4 |

|

CRD |

Cost Reduction |

D6 |

|

CVI |

Conversion In (of SEDOL) |

A7 |

|

CVO |

Conversion Out (of SEDOL) |

D2 |

|

DIG |

Dividend - paid gross |

V9 |

|

DIV |

Dividend - paid net |

V1 |

|

EQU |

Equalisation payment |

A1 |

|

ESD |

ESD cash dividend |

V1 |

|

ESF |

ESF foregone dividend |

V8 |

|

ESB |

ESB new shares broker purchase |

A4 |

|

ESS |

ESS new shares option |

A3 |

|

FID |

Foreign Income Dividend |

V7 |

|

ING |

Interest - paid gross |

VA |

|

INT |

Interest - paid net |

V2 |

|

SDC |

Ord Stock Div - Cash |

V1 |

|

SDN |

Ord Stock Div - Notional Div |

V8 |

|

SDS |

Ord Stock Div - Stock |

A3 |

|

RTI |

Rights Issue |

A3 |

|

SRT |

Sale of Rights <5 % small disp |

A4 |

|

SR5 |

Sale of Rights > 5% (part dis) |

D3 |

|

TKC |

Take-over for cash |

D1 |

Click New the following window appears:

|

Code: |

The three character movement code is entered in this field. Each movement code must be unique and we recommend that the code used is easily identifiable (e.g. PUR for a purchase and SAL for a sale). |

|

Description: |

Up to 30 characters are available to record a description for this movement code. |

|

Rule: |

The appropriate CGT rule for this movement code is selected from the picklist. |

|

Attributes: |

Various flags can be used to differentiate between similar movement codes and to ensure that the correct CGT treatment is applied.

Note: Not all options will be available to you depending on the CGT rule selected above. |

CGT Rule Codes

The CGT Rule codes currently available within SecTAX are:

- A1 Normal Purchase

- A2 Bonus/Scrip

- A3 Rights Acquired

- A4 Sale of Rights < 5%

- A5 New Issue First Call

- A6 New Issue Subsequent Call

- A7 Index from Transaction Date

- A8 Interspousal Transfer

- D1 Normal Disposal with CGT

- D2 Disposal without CGT

- D3 Sale of Rights > 5% (Part disposal rule (A/A+B apportionment))

- D4 Contango Out (Special case for CGT)

- D6 Costs transferred out. Special CGT Cost Reduction rule (used to dilute costs occurring on a demerger or similar. Used mainly by the Complex Capital Transaction Wizard.

- V1 Normal dividend with tax credit

- V2 Interest paid net

- V5 Accrued Income Scheme Charge

- V6 Accrued Income Scheme Allowance

- V7 Foreign Income Dividend

- V8 Stock Dividend

- V9 Dividend paid gross

- VA Interest paid gross

Broadly speaking, the rule codes starting with A are for acquisitions; the D rule codes are for disposals and the V movement codes are for income.

Note: Cost write downs using often use a negative A rule code. For example, cash received as part of a sale of rights which is to be treated as a cost write down is handled using a negative A4 entry.

Rule A1

Rule A1 is used for normal acquisitions where the cost is incurred on the transaction date. Indexation is given from the transaction date, unless overridden by a CGT Override date.

Rule A2

Rule A2 is used for entering bonus issues etc. where there is a quantity but not a value. SecTAX demands a ratio in conjunction with the quantity. The quantity is rounded down to the nearest whole number where the Security's Unit of Quotation is Shares, as opposed to Fixed Interest or Units. The quantity is allocated to the earliest acquisitions first which can leave a small rounding difference on the latest acquisition quantity:

E.g. Acquisition 01/01/95 1000 shares 01/01/96 875 shares

01/10/97 600 shares

A bonus issue of 1 for 3, i.e. 825 shares for the 2475 shares held, is allocated as follows:

To 01/01/95 (1000 / 2475) * 825 = 333

To 01/01/96 (875 / 2475) * 825 = 291

To 01/10/97 balance of 825 = 201

For acquisitions between 06/04/65 and 05/04/98, the CGT Report simplifies the presentation by allocating back to the 82 pool (06/04/65 to 05/04/82) or the 85 pool (06/04/82 to 05/04/98) rather than back to the individual entries.

The ratio entered on an A2 entry is purely for documentation. The entry stores the quantity received and if an earlier dated purchase or sale is subsequently made then the quantity received will not be recalculated from the ratio. In this case, it is necessary to edit the subsequent bonus issues.

Rule A3

Rule A3 is used for entering rights issues where the cost is paid in one instalment. The allocation is done in a similar way as for bonus issues but is an allocation of quantity and cost.

Rule A4

Rule A4 is used for cost write downs where cash is received but there is no change in the holding, for example for a sale of rights where the proceeds are less than 5% of the value of the holding. The system allocates the cost back to the relevant acquisitions in a similar manner as for rights/bonus issues.

If an A4 entry is being used for a cost write up then it is positive. An A4 entry used for a cost write down should be negative.

Rules A5 and A6

These rules are used where new issues of shares are payable in instalments. Rule A5 relates to the first instalment and A6 to subsequent instalments. On entering a transaction with the rule A6 no quantity will be required. An A6 type transaction can only be used in conjunction with an A5 type. The effect is that if the period between the first call (A5) and subsequent calls (A6) is not greater than 12 months, on a subsequent disposal indexation is given with reference to the date of the first call. If the period exceeds 12 months indexation is given with reference to the date(s) of the relevant calls.

A5 and A6 transactions that are entered before 1982 must have 1982 values specified. Otherwise the A5 entry takes the whole 1982 value from the Security record. The same applies to pre-1965 entries. A simpler approach is usually to sum the total acquisition cost.

Rule A7

Rule A7 was originally used between 1982 and 1985 when indexation was only available from 12 months after the acquisition. The A7 rule allowed immediate indexation for certain inter-spousal transfers. This explains its title, "Index from Transaction Date". However it is now used for cost write ups (and downs) where it is not feasible to identify the original acquisition being adjusted from the transaction date. Until recently it was only used for rare transactions such as significant charges which are paid after the original transaction date, e.g. a late presented broker's bill. The CGT Override Date is used to identify the main transaction, but the indexation starts from the transaction date. (On other rule codes the indexation starts from the CGT Override Date, if present.)

However with the end of indexation on 05/04/98 it has acquired a new lease of life for taking on pool balances. (See S104 Pool Movement Code – Page 160).

Rule A8

This rule is used for inter spousal transfers, in particular for the acquisition of shares by the transferee. The A8 rule code is used for transfers after 05/04/1998 where the original acquisition was after 31/03/1982.

If the transferor originally made multiple acquisitions then these acquisitions can be written up on the transferee using entries with an A8 rule. The transaction date is the transfer date; the CGT Override date is the original acquisition date. The system performs matching using the transaction date. If there were several original acquisitions then they will all have the same transaction date. In this case they are treated as a single acquisition and section 42 apportionment is performed. However for taper relief purposes the CGT Override date is used. If there were several original acquisitions then taper relief is calculated looking at each transaction’s original acquisition date using LIFO for post 05/04/98 entries.

No indexation is calculated on an A8 entry and, because the taper relief is based on the CGT Override Date, this rule code is described as “A8 No indexation, override taper date” in editing movement codes. (The use of the A8 rule is described in more detail at Page 86 – Inter spousal transfers).

Rule D1

Rule D1 is used for normal disposals at arms length where the proceeds are received on a single date, e.g. sales, disposals and redemption.

Rule D2

Rule D2 is used for disposals which are exempt from CGT, no matter what proceeds are entered. It is used for conversions of securities, paper for paper takeovers etc.

Rule D3

Rule D3 is used for partial disposals, i.e. where cash is received, the holding is unchanged, and a profit or loss arises. The main example is for sales of rights greater than 5% of the market value. It also applies to the cash element of a takeover and other reorganisations. On entering a D3 transaction the system requests the market value of the remaining holding. It automatically calculates the matched cost of sales using the formula,

|

(A x B) |

|

(B + C) |

Where:

|

A |

= |

Total acquisition cost |

|

B |

= |

Proceeds of Sale of Rights |

|

C |

= |

Total MV of remaining holding. |

Rule D4

This a very old rule relating to very specific circumstances for Contango's.

Rule D6

Rule D6 is used for transferring out part of the cost of a holding. This could be because a demerger has taken place and a proportion of the cost needs to be transferred to a different security. Similarly it may be because a proportion of a holding has been transferred to a beneficiary of a trust. Roughly speaking it is similar to an exempt D3 rule.

When a D6 entry is entered the following fields must be entered:

Transaction Amount The amount of cost that has been transferred out for accounting

purposes.

Market value remaining The market value of the cost that remains (i.e. number of shares x

FDD ) price.

When the CGT cost is reduced it is as though the cost had never been there. This is different from the effect of a negative A4 entry. A negative A4 entry reduces the cost of all previous unmatched acquisitions; it affects the indexation only from the date of the A4 entry. This treatment is correct for a sale of rights less than 5% (i.e. for negative “enhancement expenditure”), but it is not correct for the cost write down in a demerger. A D6 entry reduces both the cost and the associated indexation from all previous unmatched acquisitions. The CCT wizard deploys the D6 rule within demergers.

Rule V1

Rule V1 is used for entering dividends. If dividends have already been posted and are subsequently reclaimed by the market you may re-enter the dividend and the tax credit as negative values.

Rule V2

Rule V2 is similar to rule V1 but is intended for interest.

Rules V5 and V6

These rules are for entering amounts under the Accrued Income scheme. V5 is for posting charges (income); V6 is for allowances. V6 entries should be entered as negative. These entries can be selected for inclusion on the Income and Acquisition schedule.

Rules V7 and V8

These rules are used for foreign income dividends and stock dividends respectively. At the time of writing, the tax on these dividends is referred to as notional tax rather than a tax credit and cannot be reclaimed by a non-taxpayer.

Rules V9 and VA

These rarely used rules are for dividends and interest paid gross.

Attributes

The attribute flags can be used to differentiate between similar movement codes and to ensure that the correct CGT treatment is applied.

Note: Not all options will be available depending on the CGT rule selected above.

The available attributes are:

- Nil Quantity

- Update Accounts

- Held Over Gain

- CGT Over-ride

- Connected Person

- Indexation Accrued

Nil Quantity

This attribute allows, but does not require, an entry to have a zero quantity. The quantity, if present updates the holding for all A and D rule codes apart from A4 and D3.

Update Accounts

This is no longer used and can be ignored within CCH SecTAX.

Heldover Gain

This attribute enables a Heldover or Deferred Gain to be recorded on an entry. Heldover gains relate to additions of shares and unit trust units. Deferred gains relate to additions of fixed interest securities.

Heldover Gains

Heldover gains can arise when an asset is transferred. Instead of the transferor paying CGT, the gain is calculated and heldover so that it becomes payable when the transferee sells the asset. When this final disposal occurs, the heldover gain is subtracted from the cost before the chargeable gain is calculated. So the heldover gain cannot exceed the cost of the asset being sold.

Deferred Gains

Deferred gains arise when a complex capital event gives rise to a qualifying corporate bond (QCB). The QCB itself is exempt from CGT. The gain on the parent security to date is calculated. A proportion of this gain is transferred to the QCB; however the CGT on the gain that is transferred is deferred until the QCB is sold.

Although a deferred gain can be entered manually on an addition of a fixed interest security, in practice they are usually entered automatically by running the CCT Wizard.

The deferred gain is the un-tapered gain. The taper relief available depends on the time the parent security was held, not on the time the QCB was held. So in addition to recording the deferred gain the system also requests the Taper Percentage. This is the percentage of the gain that is chargeable to CGT when the QCB is sold.

The parent security could be a normal asset, a business asset or an asset of mixed use. The deferred gain and taper percentage are therefore recorded for both personal and business use.

CGT Override

This is used on type "A" rule codes to allow a CGT Override Date and a CGT Override Value to be entered on an entry. This is of use when the date and amount for CGT purposes differ from the date and amount for accounting purposes. This used to happen on a transfer between spouses which were entered as follows:

Transaction date The date of the transfer Transaction value Market value at the date of transfer CGT override date Original acquisition date

CGT override value Original acquisition cost

Note: The above values are not the same for a S104 pool – see page 160

Connected Person

When:

- There is a transfer between connected persons

- Who both have holdings in the same security, and

- This transfer includes bonus or rights issues

A special movement code must be used with the Connected Person attribute set to ensure that the bonus continues to be attached to the same original acquisition. Care must be taken to correctly code the date fields of the transaction:

Transaction Date The date the new owner received the securities

CGT Override Date The date the old owner received the bonus

Delivery Date The date of the original transaction to which the bonus was attached

Indexation Accrued

This can be used to take on opening balances when a full investment history for a security is not available and all the transactions are known to belong to the same pool. It allows the field Indexation on Acquisition to be used on an entry. Usually (but not always) the entries would be:

Transaction value: The indexed cost of the security up to the date of the last chargeable event (e.g. a normal acquisition or disposal)

Transaction date: The date of the last chargeable event

Indexation Acquired: The amount of indexation included in the transaction value.

S104 Pool (1998 Pool)

With the cessation of indexation for personal disposals on 5 April 1998 the most important use of Indexation Accrued is for taking on the 1985 pool value at 05/04/1998. The problem is that if the 1985 pool came into existence before 17/03/1998 then an extra year’s taper relief is allowed. If a transaction dated is 05/04/1998 the extra year’s taper relief would not be given. On the other hand if we dated the transaction 16/03/1998 then the system would calculate one last month’s indexation on a subsequent disposal. A solution to this problem is to use a movement code with an A7 rule. The movement code window appears as follows:

When entering the transaction details these should be entered as follows:

|

Transaction value: |

Unindexed cost of the 1985 pool. |

|

Transaction date: |

05/04/1998, or whenever the pool value was taken on i.e. the date last indexed. (This should NEVER be later then 05/04/1998). |

|

Units: |

Units remaining in the pool |

|

CGT override date: |

16/03/1998 |

|

CGT override value: |

Indexed CGT cost of 1985 pool to 05/04/1998 (or date last indexed to). |

|

Indexation Acquired: |

The amount of indexation included in the CGT override value. |

The indexation on an A7 rule is calculated from the transaction date which is 05/04/1998. So no further indexation is calculated. Whereas the taper relief is based on the CGT override date which is 16/03/1998, allowing the extra year’s taper relief.