Data Entry - Historical Data

DataEntry - Historical Data

Details of the client's shareholdings are entered into CCH SecTAX using the Securities option in the Funds window. Highlight the required fund in this case Own Securities and click Securities the following window appears:

|

Security: |

A picklist of securities currently set up in the client's fund. |

|

Close: |

Closes the security transactions window. |

|

Edit: |

Amends details of the transaction currently selected. |

|

New Trans: |

Adds a new transaction for the security currently displayed in security. |

|

New Security: |

Adds a new security into the client's holding. |

|

Delete: |

Deletes a transaction from the list. |

|

Reorder: |

This option allows you to re-order transactions that took place on the same date. By default, transactions are ordered in the same sequence in which they were entered and this sequence is used by the Capital Gains Tax routines to match transactions. The default sequence may be incorrect and this window allows you to rearrange the transactions. |

|

Edit Security: |

This option allows you to record client information relating to two distinct areas. The first is the nature of the clients claim to Business Asset Taper Relief, and the second verifies that your client is in receipt of gross rather than net payment of interest from Government Stocks. (See Chapter 7). |

|

Help: |

Accesses the on line help facilities. |

|

Sort by: |

Changes the order, in which securities are displayed – either by name order or by ISIN order. The default is name. |

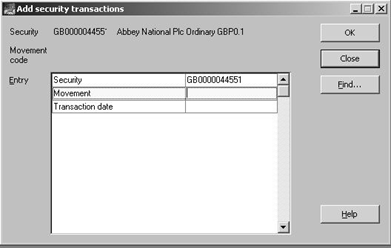

Click New Security, the following window appears:

The Add Security Transactions window has been designed to allow fast and easy entry of transactions. It does use some non-standard windows functionality. In particular, when entering transaction information you use the ENTER or RETURN key to move from field to field rather than the TAB key. This speeds up data entry as mainly the numeric keypad part of the keyboard is used.

Note: The entry fields displayed change depending on the type of transaction entered. This avoids the need to press RETURN to pass through fields that are not relevant.

|

Security: |

The ISIN number for the security is entered here. If the ISIN number is not known use either F2 or Find to locate the security and select in the security from the securities file. (See Chapter 10) |

|

Movement: |

The movement code to describe the transaction type is entered here. The code used determined the fields displayed for entry. If the movement code is not known use either F2 or Find to locate the transaction type and select in the movement code. (See Chapter 11) |

|

Transaction date: |

Enter the date of the transaction in the usual ddmmyy or dd/mm/yy formats. This date cannot be amended via the Add Security Transactions window once the entry has been made. If you need to change the transaction date, use the Edit Security Transaction window. |

|

OK: |

Confirms the entries made. |

|

Close: |

Closes the Add Security transactions window. |

|

Find: |

Used to locate a security or a movement code. |

|

Help: |

Accesses the online help facilities. |

Mr Roberts has an existing portfolio of securities. The historical data requires entering in order that the CGT position can be correctly determined. There are several ways in which details of the securities held can be entered.

Entering Full History

If you have full details of the security movements, all transactions from the initial purchase through subsequent sales, purchases and stock dividends are entered separately.

Enter the following transaction details into the Add Security Transactions window:

|

Security: |

Abbey National Ord 10p Shares |

|

Transaction Type: |

Purchase |

|

Date: |

12/12/1989 |

|

Quantity: |

1000 |

|

Cost / Proceeds: |

3,210.55 |

To locate the ISIN number press F2, the following window appears:

|

Select: |

Attaches the security to the client record. |

|

Close: |

Closes the securities window. |

|

Edit: |

Allows you to amend an entry in the Security database. |

|

New: |

Allows you to add an entry to the Security database. |

|

Delete: |

Allows you to delete an entry from the Security database. |

|

Find: |

Searches for the required security. |

|

Names: |

Runs a utility to automatically change security names where a name change has been effected. See Chapter 13. |

|

Help: |

Accesses the on line help facilities. |

Click Find the following window appears:

|

Search For: |

Enter the search criteria – are you looking for a name or ISIN number. |

|

Search By: |

Enter all or part of the entry you wish to search for.

Note: Wildcards (?, *) are not valid. This is determined by the Search For option. |

|

Text Search: |

Allows you to establish the number of securities that match your search criteria. |

Enter the name of the security in the Search by section and leave the search criteria by Name:

Click Find. The list of securities beginning with Abbey National is displayed. Scroll through the list to locate the correct security and highlight this on the list:

Click Select the following window appears:

The movement code is required to be entered. If you know the movement code enter this now, alternatively select F2 the following window appears:

Select the relevant movement type from the list in this case Purchase (PUR) and click select, the add security transactions window is updated:

Enter the remaining details, the completed window appears:

Press Enter, the transaction is written back to the client file and the window appears as follows:

The ISIN number is highlighted. Press Enter to continue entering transactions for Abbey National, or F2 to select in a different security.

Enter the remaining transactions for Abbey National:

|

Movement Type |

Date |

Nominal Quantity |

Cost / Proceeds |

|

Sale |

01/01/1990 |

500 |

1,501.26 |

|

Purchase |

12/12/1990 |

1,000 |

3,315.02 |

|

Purchase |

12/12/1992 |

1,000 |

3,655.02 |

|

Sale |

01/01/1993 |

500 |

2,601.02 |

|

Purchase |

12/12/1994 |

1,000 |

3,725.06 |

|

Purchase |

17/04/1997 |

2,000 |

11,175.00 |

|

Purchase |

16/02/1999 |

3,000 |

17,175.00 |

The Security Transactions Window appears as follows:

Click New Security; enter the following transactions for the following securities:

|

Shell Transport & Trading Co Plc Ord 25p Shares |

|||||

|

Movement Type |

Date |

Nominal Quantity |

Cost / Proceeds |

|

|

|

Purchase |

04/04/1988 |

10,000 |

43,535.35 |

|

|

|

Boots Co Plc Ord 25p Shares |

|||||

|

Movement Type |

Date |

Nominal Quantity |

Cost / Proceeds |

Ratio |

|

|

|

|

|

|

X |

Y |

|

Purchase |

12/12/1981 |

1,100 (1982 Value |

3,221.57 3,436.40) |

|

|

|

Sale |

01/04/1990 |

550 |

2,561.36 |

|

|

|

Purchase |

12/10/1991 |

1,100 |

4,755.12 |

|

|

|

Purchase |

12/02/1993 |

1,100 |

3,565.01 |

|

|

|

Sale |

01/08/1993 |

507 |

2,201.03 |

|

|

|

Purchase |

12/03/1994 |

1,110 |

3,900.04 |

|

|

|

Stock Dividend Stock |

03/02/1995 |

34 |

179.39 |

1 |

97 |

|

Stock Dividend Stock |

23/08/1995 |

75 |

394.59 |

1 |

45 |

|

Stock Dividend Stock |

02/02/1996 |

34 |

197.33 |

1 |

100 |

|

Stock Dividend Stock |

23/08/1996 |

74 |

447.49 |

1 |

47 |

|

Stock Dividend Stock |

07/02/1997 |

35 |

220.38 |

1 |

100 |

|

Purchase |

16/02/1997 |

3,240 |

12,035.10 |

|

|

|

Stock Dividend Stock |

22/08/1997 |

134 |

978.84 |

1.960784 |

100 |

Entering Pooled Values

When setting up a new client it is not necessary to write up every purchase and sale, only the ‘unmatched acquisitions’ (i.e. acquisitions unmatched by a subsequent disposal). For transactions prior to 17/3/98, it is only necessary to write up the value of the 1982 pool and the s104 pool (also called 1998 pool) using one transaction for each pool. If the pool values and subsequent unmatched disposals are available then only these transactions may be written up, greatly reducing the number of necessary entries.

1982 Pool

The 1982 Pool can be entered in two different ways. CCH SecTAX is a flexible product thereby allowing the user to either enter a pooled value inclusive of indexation where the base cost (original or March 1982 value) has already been established. If there is no indexation agreed balance we recommend that each transaction be entered separately as a normal purchase (using PUR); if the purchase date is prior to 31st March 1982, a prompt appears asking for the March 1982 value to be entered. SecTAX uses the appropriate cost or market value whichever value gives rise to the higher amount of indexation.

Single Pool Entry

To enter the entire 1982 pool as a single pooled transaction including indexation you may wish to amend the existing movement code as follows:

|

Movement Code |

CGT Rule |

Description |

Attributes |

|

P82 |

A7 Indexation from transaction date |

Pool as at 31/03/1982 |

CGT Over-ride Indexation accrued |

The A7 rule means that the transaction is indexed from the Transaction Date even where a CGT Override Date has been specified. This allows the indexed cost to be taken on. The transaction date is typically 05/04/1998 and the CGT Override date is 31/03/1982. The taper relief is calculated using the CGT Override date in the usual way; the extra year for taper relief is allowed.

Note: Do NOT enter details of the following transaction. We will be completing another example of pooled entries in the next exercise.

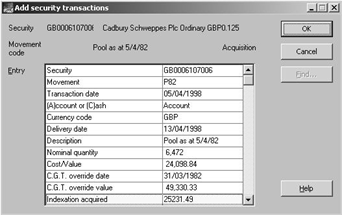

The P82 details would be entered as follows:

|

Cadbury Schweppes Plc Ord 12 ½ p Shares |

||||||

|

Code |

Date |

Quantity |

Cost / Proceeds |

CGT Override |

|

Indexation Acquired |

|

|

|

|

|

Date |

Value |

|

|

P82 |

05/04/1998 |

6,472 |

24,098.84 |

31/03/1982 |

49,330.33 |

25,231.49 |

The completed window appears as follows:

Click OK.

Individual Transactions

If the indexed pool has not been agreed, it is always best to enter each transaction separately, indexation is then calculated and the transactions matched. Taper Relief is also allocated where appropriate.

The transaction as entered above is made up of the following individual transactions:

|

Cadbury Schweppes Ord 12 ½ p Shares |

||||

|

Code |

Date |

Quantity |

Cost / Proceeds |

March 1982 Value |

|

PUR |

12/12/1978 |

1,000 |

3,162.62 |

3,723.55 |

|

PUR |

01/01/1979 |

470 |

1,519.80 |

1,750.07 |

|

PUR |

12/12/1980 |

2,000 |

3,399.02 |

7,447.11 |

|

PUR |

12/12/1981 |

1,000 |

3,455.02 |

3,723.55 |

|

PUR |

01/01/1982 |

500 |

1,845.50 |

1,861.78 |

|

PUR |

28/03/1982 |

1,502 |

5,564.91 |

5,592.78 |

The completed window for the first entry appears as follows:

Note:

1. The P82 transaction does not have a 1982 Market Value field. This is because with an A7 rule the 1982 value is ignored. This is why the CGT Override Value is filled in with the indexed cost of the higher of the original cost and the 1982 Market Value. However using the higher value is not always correct for CGT, e.g. if the securities are sold at a loss then the lower value is the correct CGT cost. This is a system limitation. Similarly if the original cost would give a gain and the 1982 value would give a loss then the shares should be disposed of as “no gain, no loss”; but with no 1982 value the system cannot make this comparison and the disposal would show a loss. In most cases 1982 acquisitions are sold at a large profit; in which case this would not cause a problem. However where a share has made little progress since 1982 and the problem does arise there are three ways around the problem:

- Enter the individual transactions instead of a pool transaction.

- Enter a single 1982 pool transaction using new movement code with an A1 rule and CGT override. This is unindexed and carries both the original cost and the 1982 Market Value. The transaction date is 05/04/1998 or whenever the pool was taken on, and the CGT Override Date is 31/03/1982. This method allows the system to switch automatically between the original cost and the 1982 Market Value as appropriate. It can be useful when unindexed data is available as at 1982. Where there were subsequent rights issues these need to be entered separately so that their indexation is correct. So although this method is more accurate, it requires more entries than the P82 entry when there were subsequent rights.

- If the shares are sold at a loss from the 1982 pool, make a retrospective adjustment of the CGT Override Value to set it to the correct CGT cost.

Most users either enter the individual transactions or a single indexed P82 transaction.

2. The CCT Wizard has certain limitations in dealing with 1982 transactions:

- When the cost is transferred to a new security it uses P82 entries which, as explained above, give an incorrect result if the security is sold at a loss and may give an incorrect result if the security is sold for “no gain, no loss”. Where a P82 is sold at a loss it is advisable to check the calculation and adjust the CGT Override value if necessary.

- If an old complex capital event (i.e. occurred before 05/04/1988) is processed the Wizard may give an incorrect answer even if the security is sold at a profit. This is because of the way the Wizard works. The Wizard processes a notional disposal on the date of the complex capital event. The whole holding is notionally sold for a large sum. The Wizard then processes the cost that was matched to that disposal. Before 05/04/1988 rebasing of cost did not exist (although the indexation was based on the higher of the cost and the 1982 value). So when the 1982 value was higher the cost transferred to the new holding in the P82 entry was always based on the original cost. If the security is sold after 05/04/1988 the system can only use the original cost figure as the 1982 market value figure is not available in the entry.

1998 Pool

Like the 1982 Pool, the 1998 Pool can be entered in two different ways. If there is no indexation agreed balance we recommend that each transaction be entered separately as a normal purchase. Where an indexation agreed balance is available, the pool can be entered using the P98 movement code. The P98 code rules and attributes are:

Note: The transaction date is 05/04/1998 but the CGT override is 16/03/1998.

It does not matter which method is used to enter the pooled values the same answer for CGT purposes is achieved.

As an example, we are going to enter details of the clients holding in Marshalls using both methods; firstly on an individual transaction basis into Fund 3, and secondly as an indexed pool into Fund 1. When the CGT reports are run later the same answer for CGT purposes is achieved.

From the list of Funds, highlight Fund 3 and click securities. Enter the following details:

|

Marshalls Ord 25p Shares |

|||||

|

Movement Type |

Date |

Nominal Quantity |

Cost / Proceeds |

Ratio |

|

|

|

|

|

|

X |

Y |

|

Purchase |

12/12/1988 |

1,000 |

3,162.62 |

|

|

|

Sale |

01/01/1990 |

500 |

1,519.80 |

|

|

|

Purchase |

12/12/1990 |

1,000 |

3,399.02 |

|

|

|

Purchase |

12/12/1992 |

1,000 |

3,455.02 |

|

|

|

Sale |

01/01/1993 |

500 |

2,001.02 |

|

|

|

Stock Dividend Stock |

28/11/1994 |

27 |

75.00 |

1 |

74 |

|

Purchase |

12/12/1994 |

1,000 |

3,725.06 |

|

|

|

Stock Dividend Stock |

03/07/1995 |

82 |

242.16 |

1 |

36 |

|

Stock Dividend Stock |

27/11/1995 |

40 |

124.36 |

1 |

77 |

|

Stock Dividend Stock |

01/07/1996 |

74 |

267.67 |

1 |

42 |

|

Stock Dividend Stock |

25/11/1996 |

35 |

136.98 |

1 |

92 |

|

Purchase |

16/02/1997 |

3,000 |

11,918.70 |

|

|

|

Stock Dividend Stock |

01/07/1997 |

138 |

563.22 |

1 |

45 |

|

Stock Dividend Stock |

21/11/1997 |

76 |

297.41 |

1 |

44 |

|

Sale |

31/03/1998 |

500 |

2,708.25 |

|

|

|

Purchase |

10/06/1999 |

570 |

3591.00 |

|

|

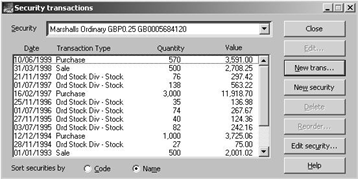

The summary window appears as follows:

After entering all the details, close out of Fund 3 and open Fund 1.

Enter the following details in Fund 1:

|

Marshalls Ord 25p Shares |

||||||

|

Code |

Date |

Quantity |

Cost / Proceeds |

CGT Override |

|

Indexation Acquired |

|

|

|

|

|

Date |

Value |

|

|

P98 |

05/04/1998 |

6,472 |

24,098.84 |

16/03/1998 |

27,026.84 |

2,928.00 |

|

Sale |

12/12/1998 |

500 |

2,708.25 |

|

|

|

|

Purchase |

10/06/1999 |

570 |

3,591.00 |

|

|

|

The summary window appears as follows:

Notional Acquisitions

Sometimes the original purchase date and cost of a client's share holdings are not available. This is not a reason why details of the holding cannot be entered into SecTAX and used initially to calculate income going forward (and also accumulate stock dividends). Full acquisition details can be entered at a later date when these become available.

This type of entry is called a Notional Acquisition. The 2003 Tax Return (which was completed by another agent) showed a holding of 10,000 shares in Lloyds TSB. The shares have not been sold but the client can't remember when he bought them and how much they cost.

A new movement code NAQ requires setting up as follows:

Details of the shareholding are entered as follows:

Note:

|

Transaction Date |

The beginning of the previous tax year. As CCH SecTAX uses ex-div dates to calculate whether or not the client is entitled to the dividend this date ensures sufficient holding period. |

|

Cost / Value |

The value cannot be left blank enter 0.00 |

Transactions Listing

After entering all transactions it is good practice to check the details entered by running the transactions report. This lists all entries that you have just made for the current client.

From Client Work, select Transaction List the following window appears:

|

Funds: |

Allows you to select the fund details to be included in the report. |

|

Securities: |

Used to specify the securities to be included in the report. |

|

Conditions: |

Used to specify the period covered by the report and the transaction types to be included. |

|

Selections: |

Used to specify the transactions to be included in the report based on Country of Registration, Type of Security, Industrial Classification and Report Code. |

|

Sort Order: |

Allows the sort order of the items included in the report to be specified. |

|

Title: |

A different title for the report may be specified here if required. |

|

Report: |

Produces the report to screen. |

|

Close: |

Closes the dialogue box. |

|

Help: |

Accesses the online help facilities. |

Highlight Fund 1 click Securities, the following window appears:

Highlight all the securities to be included in the report. Standard windows technology is used to highlight all entries. Click Conditions the following window appears:

|

Period: |

Defaults to the current fiscal year. The default start and end dates can be overridden. |

|

Include Security Code: |

If the Security Code (ISIN) is to be included in the report then the box should be ticked. |

|

Report Errors: |

If you do not wish errors to be reported, the tick should be deleted from the box. |

|

Report Type: |

Select the transaction types to be included in the report. Transaction – Reports both income and gains CGT Transactions – Reports capital transactions only |

Note: To report on all transactions from the first entry delete the Period Start Date.

Click Selections, the following window appears:

This page specifies transactions to be included in the report based on Country of Registration, Type of Security, Industrial Classification and Report Code of each transaction. For each of the above you can select All, Blank or one of the codes set up in the common database. The options are as follows:

|

All: |

All transactions will be reported on including those where the field is blank. |

|

Blank: |

Only those transactions where this field is Blank (i.e. no entry has been made) are included. |

|

Specific: |

Only those transactions where this field matches that specified are included. |

Click Sort Order, the following window appears:

|

Sort Order: |

The Sorting Selections window displays the available sort parameters. The Sorting Order window displays any parameters already selected.

Note: Sorting is carried out in the order in which the parameters appear in the Sorting Order window. To add a sort parameter, highlight it in the Sorting Selections window then press the Add button. The sort parameter is added to the end of the Sorting Order list. To remove a sort parameter, highlight it in the Sorting Order window and press the Remove button. |

|

Page Throw on Change of Sort Code flag: |

Set this flag if you wish to have each sort parameter to start on a new page. |

Click Title, the following window appears:

This page allows you to specify a title for the report. Up to 80 characters may be used. Click Report.