Selecting the billing address and adding other details when billing

Details you can update

You also may need to add narrative text to a bill to explain bill amounts or adjustments. The Billing Explanation option on the Task Bar of the Bill Amounts window allows you to add internal notes within the practice. These do not appear on the client’s invoice. The text typed into this field appears in the Explanation field of the Draft Internal Bill Report displayed when the Reports button is clicked. As such, it is not a mandatory step in processing a bill but can be useful in clarifying details for the practice member who will review and authorise the invoice.

Other details you may want to add or change are:

-

Bill Date: The system defaults the system date as the invoice date. This can be changed by clicking on the Calendar button if required.

-

Invoice number: The system will automatically allocate an Invoice Number when the bill transaction is posted and will continue to increment the invoice number as this process is repeated. However, practices set up as a single entity will need to enter an invoice number on the very first bill generated by the system.

When a practice is set up as a multiple entity, the bill sequencing will be set up at configuration level and therefore employees will not need to complete an invoice number. -

Tax Type: This field allows you to override the overall tax status of the invoice. For example, whether an invoice is tax free or taxable at a particular (usually standard) rate.

Change the billing address and other details

-

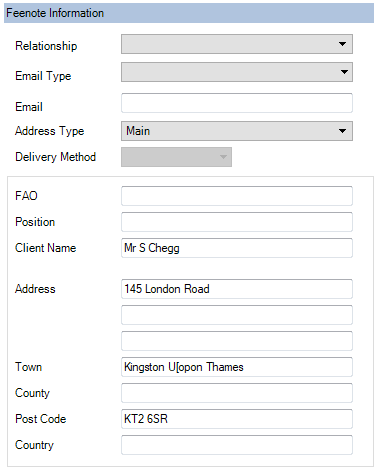

On the Billing Main page you can select the Address Type in the Feenote Information area or manually amend the address (this affects this bill only).

-

If associations have been added for the client, you can select one from the list on the right to have the bill addressed to that contact.

-

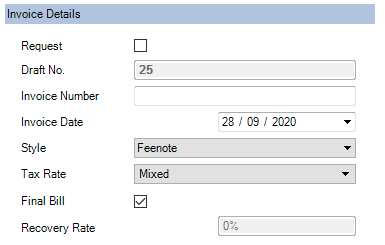

The invoice date will default to today's date. If you want to amend this, click in the Invoice Date field in the Invoice Details area and select the date from the calendar. Use the scroll arrows at the top to move between months.

-

If you do not want to accept the default invoice number (which will be allocated when an invoice is POSTED) you can overwrite it by typing a different number in the Invoice Number field. Your ability to do this will depend on your security level.

-

To amend the tax rate to be applied to the billed amount by clicking the Tax Type list and select the required rate.

NOTE

This field allows you to override the overall tax status of the invoice. For example, whether an invoice is tax free or taxable at a particular (usually standard) rate.

-

Continue on with Billing Stage Three by clicking the Bill Paragraphs button

on the Billing Main page, or click OK to save the draft bill and close the Billing Main page.

on the Billing Main page, or click OK to save the draft bill and close the Billing Main page.