System Setup

Configuration Keys

A configuration key concerning the pre-population data available under HMRC’s Making Tax Digital project is available as follows:

Setting PT_DigitalTax_Enable to a Key Value of 1 enables the View DTA option in the ribbon bar within a client’s Tax Return, allowing the API calls to be made and producing the report of client’s data held by HMRC. When this key is set to a value of 0, the option in the ribbon bar is visible but disabled for users.

This is located under File > Maintenance > User Defined > Configuration and is set with a default Key Value of 0.

HMRC Authorisation

For the software to gain access to HMRC’s pre-population data, existing agent credentials, currently used for online filing and to access the HMRC Agent Portal, must be authorised. This provides an OAuth 2.0 token which is stored by CCH Central, which is then used when the API calls are subsequently made.

Agent credentials may be stored in a number of locations within CCH Central, which depends upon the current system set up. Each of these locations has the ability to authorise credentials.

HMRC agent credentials must be entered correctly and saved in CCH Central to enable access to the APIs. User ID and passwords cannot be entered manually into HMRC’s authorisation page.

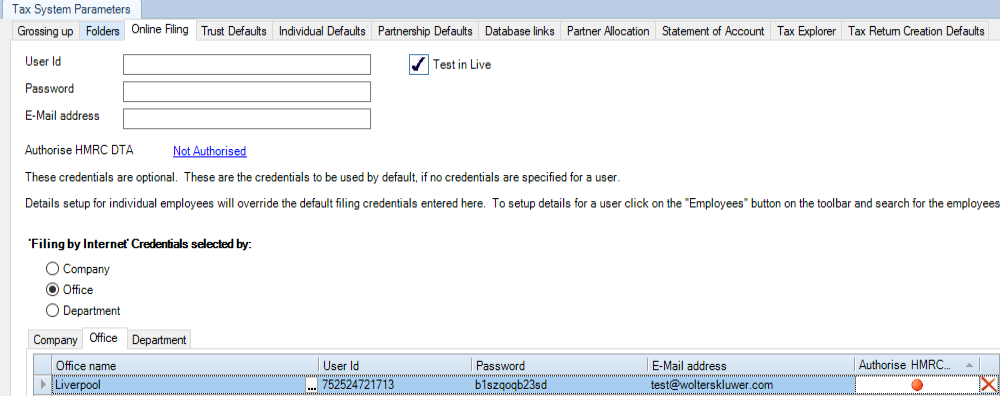

Tax System Parameters – Online Filing tab

Agent credentials can be entered at database or company/office/department level within the Online Filing tab.

This is accessed under File > Maintenance > Tax Settings > Personal Tax > Tax System Parameters.

Where credentials are used at database level, a new Authorise HMRC DTA row shows the current authorisation status and is where the process is controlled from.

Where credentials are used at company/office/department level, a new Authorise HMRC DTA column in the table shows the current authorisation status and is where the process is controlled from.

To authorise a set of agent credentials, click on the associated Not Authorised hyperlink. Select Authorise credentials in the menu box that appears.

A webpage entitled ‘Authority to interact with HMRC on your behalf’ opens, enter the correct credentials, HMRC will then telephone with an authorisation number, enter the number provided and answer a set of security questions from HMRC. Then select Grant authority.

The webpage will close and a success message is shown. Click OK to clear the message and see the updated Authorise HMRC DTA status of the credentials used for the authorisation process.

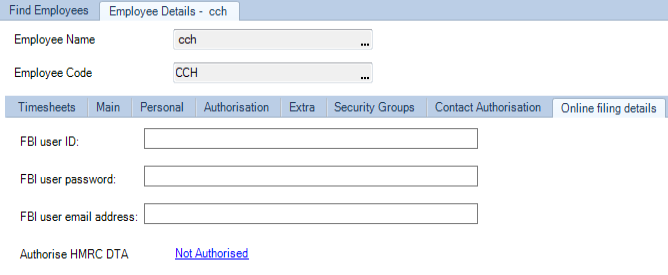

Employee Details – Online filing details tab

An employee can have agent credentials entered against their record in CCH Central. This is accessed under the Online filing details tab when viewing the employee details record.

A new Authorise HMRC DTA row shows the current authorisation status and is where the process is controlled from.

Click on the Not Authorised hyperlink and select Authorise credentials in the menu box that appears.

A webpage entitled ‘Authority to interact with HMRC on your behalf’ opens, enter the correct credentials, HMRC will then telephone with an authorisation number, enter the number provided and answer a set of security questions from HMRC. Then select Grant authority.

The webpage will close and a success message is shown. Click OK to clear the message and see the updated Authorise HMRC DTA status.

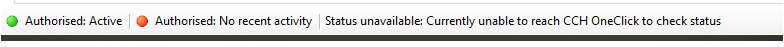

Status

Statuses associated with the HMRC DTA authorisation are listed along the bottom of the screen as follows:

Where the same set of credentials are used in more than one place, for example against an office and against a specific employee, the credentials themselves only need be authorised once. The status automatically updates within CCH Central wherever the same credentials are used.

Clearing tokens

In cases where the OAuth 2.0 access token may need to be removed, the Authorise HMRC DTA menu box includes an option to Clear token.

Selecting this option and confirming the deletion of the token against the selected credentials will revert the status to Not Authorised.

Task Permissions

A number of task permissions have been added to allow access to the various new Digital Tax features to be controlled.

These are accessed under File > Maintenance > Security > Task Permissions.

HMRC Authorisation

Separate permissions have been added for the ability to authorise credentials and the ability to clear a token to remove it from credentials that were authorised.

For credentials that are stored at database or company/office/department level, two new task permissions have been added under the Personal Tax product, listed within the Menus group:

- [Maintenance] [Tax settings] [Personal Tax] [Tax system parameters] [Authorise HMRC DTA] [Authorise credentials]

- [Maintenance] [Tax settings] [Personal Tax] [Tax system parameters] [Authorise HMRC DTA] [Clear token]

For credentials that are stored against an employee’s record, task permissions have been added under the Personal Tax product, listed within the Employee group:

- #Employee #Online filing details #Authorise HMRC DTA #Authorise credentials

- #Employee #Online filing details #Authorise HMRC DTA #Clear token

Where the Maintenance > Digital Tax > HMRC Authorisation option is used, the associated task permission to access this maintenance menu option is under the Central product, listed within the Maintenance group.

- [Maintenance] [Digital Tax] [HMRC Authorisation]

Digital Tax Account access

User access to HMRC’s pre-population data is controlled with a new task permission. Where a user has permission to access a client but not the new View DTA option, the icon will be enabled but the user will see a permission denied message.

This task permission is under the Personal Tax product, listed within the Menus group:

- [Task Bar] [Digital Tax Account access]