Pre-population data

View Digital Tax Account data

As part of the Making Tax Digital program, HMRC are providing the ability to surface information they hold on an individual within tax software. This information is being surfaced to aid with Tax Return preparation.

To make use of this new function, setup is required to enable a new configuration key, authorise agent credentials, and set task permissions. These are detailed in the System Setup page.

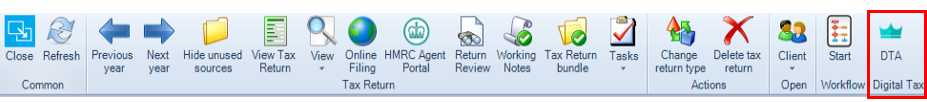

When accessing a client’s Tax Return, a new View DTA option has been added to a new ‘Digital Tax’ area in the ribbon bar.

By clicking on this button, a report is produced in a new tab containing any information HMRC may hold for a client.

This report has the same functionality to print, export to PDF, etc. as the backing schedules.

The initial pre-population data HMRC is making available via APIs is for National Insurance and Marriage Allowance claims, with these reported in sections. Employment, pensions and State Benefits (excluding State Pension) should be available in due course.

A list of data sources is shown when information for them has been requested from HMRC but no information is held by HMRC for the client.

HMRC have confirmed they are supporting data from the 2015/16 tax year onwards.

When using OneClick, clicking the DTA button will take you to the client's Digital tax Account.

Marriage Allowance claim

The Marriage Allowance claim data has two elements to it. The first is checking the client’s status for any existing Marriage Allowance claim (where one is made directly with HMRC rather than via the Tax Return).

The second element is checking details regarding the client’s spouse or partner. A spouse or civil partner must be entered in the Marriage tab within the client’s CCH Central record, with the following details for the spouse or partner complete to get a successful response from HMRC:

- First and last name

- National Insurance number

- Date of birth

Errors

Where information is being requested from HMRC, there is potential for errors to result where the data exchange does not complete. The reason for this can range from a UTR being invalid to the agent credentials not being authorised to access the data associated with a UTR.

In cases where this occurs, the report includes an error section detailing the data source the error relates to as well as the error status and a message to provide further detail.