Estate Income

Tax Rates and Income Types

The following table describes the tax rates and types of income that you can claim tax relief for.

|

Tax Rate |

Types of Income |

|

Non savings Income |

Rental income and profits from a trade. This does not include savings or dividend income. |

|

Savings Income |

Includes savings income such as interest received. |

|

Dividend Income |

Dividends from UK and foreign companies for 2017 |

|

Non-repayable basic rate |

Relates to gains realised on certain life insurance policies |

|

Income taxed at 22% |

Relates to any income taxed at 22% which the personal representative paid after 6 April 2008 |

|

Non-repayable lower rate |

Relates to tax years prior to 5 April 1999, and is only relevant if undistributed income is carried forward from 1998–99 or earlier years |

| Non-repayable dividend | Relates to dividends paid on UK shareholdings from 1999–2000 to 2015-2016. |

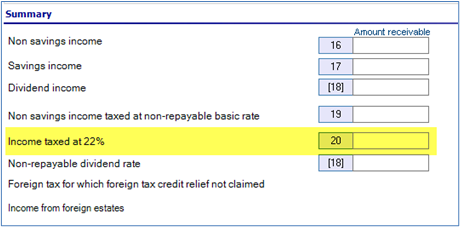

SA100 Estate Income and R185E (253195 & 253196 & 264077)

Following changes by HMRC for the year 2023 onwards, we have removed the row for Income taxed at 22%:

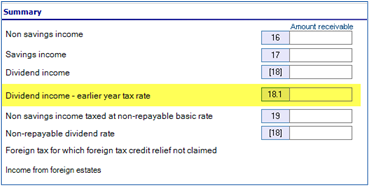

A new row Dividend Income – earlier year tax rate has been added:

The linking from the SA900 and R185E has also been updated to ensure that the correct values are mapped to the new box 18.1