Residence, Remittance Basis etc

Use the Non-Residence etc section to enter details relating to your clients resident status, which is used for tax purposes.

Description

The description of this section changes depending upon the tax year selected. For example, the name of this section changes to Residence, Remittance Basis etc in the 2009 tax year.

Note: Additional tabs appear on the Non-Residence etc tab depending upon the residence status that you select.

Changes to the Residence, remittance basis etc - Supplementary Page

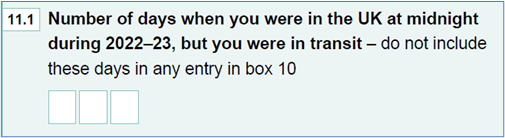

Box 11.1 Days spent in the UK at midnight but were in transit (254238)

HMRC has reinstated box 11.1 for the purpose of transit days:

The following changes have been made to CCH Personal Tax:

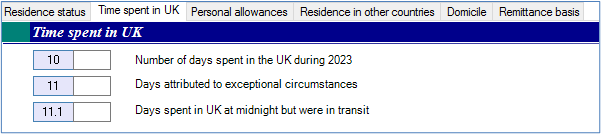

- Added a new column in the grid on the Time spent in UK tab of the Residence, Remittance Basis etc. data entry window, and populate this automatically where the Date of departure from the UK immediately follows the Date of arrival in the UK. This can be overidden by the user if the taxpayer was not in transit on the visit.

- Added a new field in the Summary section in the Time spent in UK tab of the Residence, Remittance Basis etc. data entry window, where the summary rather than detail information is entered:

- Updated the Time spent in the UK backing schedule for Days spent in Country at midnight but were in transit.

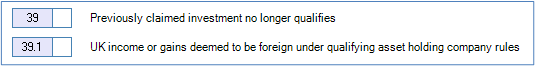

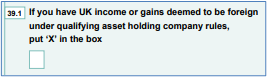

SA109 Box 39.1 UK income or gains deemed to be foreign under qualifying asset holding company rules (267639)

To accommodate this, we added a new check box on the Remittance basis tab of the Residence, Remittance Basis etc. data entry window: