Pension Contributions

Step 1 of 4: Add Retirement Annuities Policies (RAP)

-

Open the Pension Contribution section.

-

Ensure that the RAP tab is selected.

-

Click

in Provider Name to link to a pension provider or manually enter the Provider Name.

in Provider Name to link to a pension provider or manually enter the Provider Name.

4. In Contract Number enter the policy number.

5. Enter the amount of qualifying contributions in Qualifying premiums.

6. (Optional) Enter the first payment date in First premium date.

7. (Optional) Enter the last payment date in Last premium date.

Note: Under Summary you can see information relating to all contributions made.

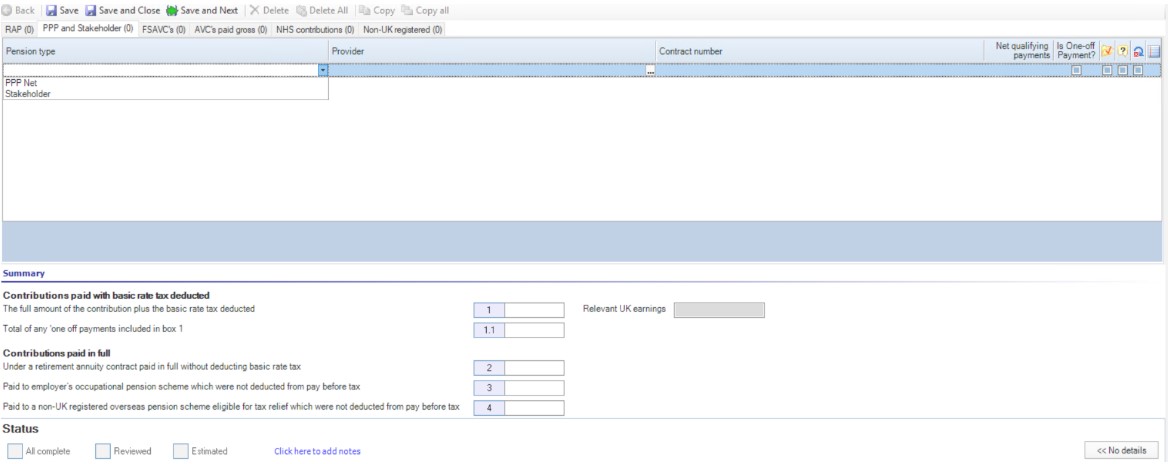

Step 2 of 4: Add Personal Pension Plans (PPP) and Stakeholder

-

Click the PPP and Stakeholder tab.

-

Select PPP or Stakeholder from the Pension Type drop-down.

-

Click

in Provider Name to link to a pension provider.

in Provider Name to link to a pension provider.

4. In Contract Number enter the policy number.

5. Enter the total of qualifying contributions excluding tax in Net qualifying payments.

6. Tick the box if this is a One-off payment.

Step 3 of 4 : Add Free Standing Additional Voluntary Contribution (FSAVC)

-

Click the FSAVC's tab.

-

Click

in Provider Name to link to a pension provider or you can manually enter the provider name.

in Provider Name to link to a pension provider or you can manually enter the provider name.

3. In Contract Number enter the policy number.

4. Enter the total amount paid excluding tax in Net qualifying payments.

5. Tick the box if this is a One-off payment.

Step 4 of 4: Add AVC's Paid Gross, NHS Contributions, and Non-UK Registered

-

Select one of the following tabs:

- AVC's paid gross

- NHS Contributions

- Non-UK registered

-

Click

in Provider Name to link to a pension provider or manually enter the provider name.

in Provider Name to link to a pension provider or manually enter the provider name.

3. (Optional - AVC's paid gross tab only) Enter the provider reference number in Contract number.

4. Enter the total amount paid before any deductions in Gross amount paid.

The amounts appear in Summary under Contributions paid in full.

5. When you have completed all the tabs, do one of the following:

- Click Save and Close.

- Click Save and Next to open the next tax section.