Qualifying Investments

You can claim tax relief against your income for gifts of qualifying investments and/or shares sold for less than their market value to UK charities. You can claim relief for the following two types of investments:

Qualifying shares and securities

Real property

This relief is in addition to exemption from Capital Gains Tax on such gifts.

-

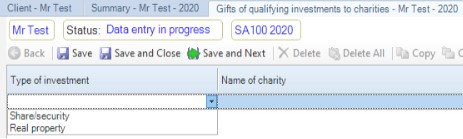

Open the Qualifying Investments to Charities section.

-

Select the share type from the Type of investment pull-down.

-

Additional investment detail fields appear above the Summary panel.

Note: you can only enter a value in Number of shares, when the investment type is Share/security.

-

Enter the charity name in Name of Charity.

-

In Value of Gift, enter the market value of the shares at the time you give or sell the shares to the charity.

-

(Optional) Complete the following:

- Description of investment

- Date of gift

- Number of shares, if securities

Note: you may include incidental costs of disposal, for example, brokers fees or stamp duty in Value of Gift. However, you must also minus the value of any benefits that you receive in connection with the gift or sale.

Click 'Save' and 'Close'.