Residential Property and Carried Interest

Residential Property and Carried Interest

To assist in the correct identification of assets chargeable under the NRCGT regulations HMRC introduced an asset type, Residential property (R). The NRCGT link introduced is only available (subject to residency status) if this asset type is selected.

When adding a disposal from Type select Residential property:

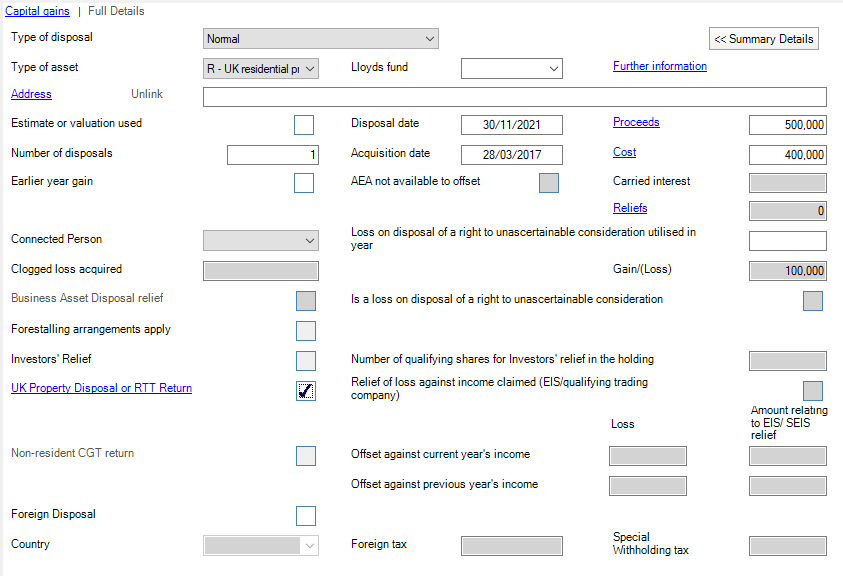

Enter the details as normal, and select Full details, the window appears:

Details of any Carried Interest is added to the box and is included in the values reported.

Real Time Transactions

When reporting Capital Gains, payment of the tax can either be:

-

Via a Real Time Transaction return, or

-

Annually as part of the SA process.

A box for UK Property Disposal or Real Time Transactions returns has been added to Capital Gains Tax. Add a transaction and select Full Details, the Full details window appears:

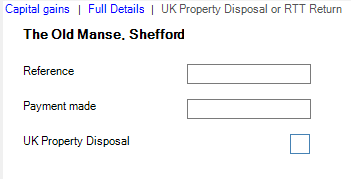

This box works in the same way as the Non Resident CGT box. Click UK Property Disposal or RTT Return, the window appears:

Enter the RTT reference and the payment made. The RTT reference is in the format RTTCGTnnnnn e.g. RTTCGT12345.

The payment made value appears as the SA302 as an adjustment to the Capital Gains Tax due: