Capital Allowances

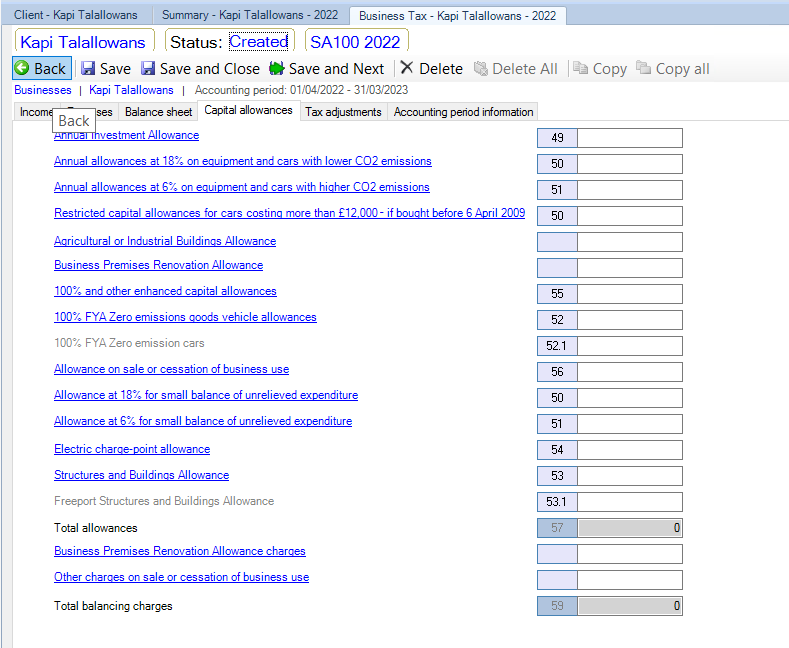

Capital allowances for businesses can be entered and claimed within under the Capital Allowances tab within the Accounting period within a business created from the Business Tax section of the Tax Return Data

Click on the hyperlink for the allowance to be claimed.

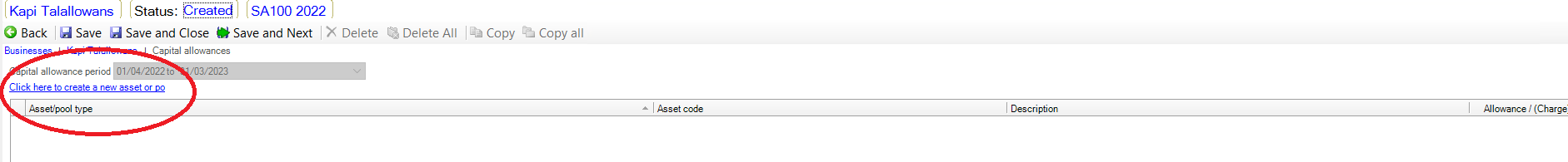

Create the new asset or pool by clicking on the hyperlink Click here to create a new asset or pool

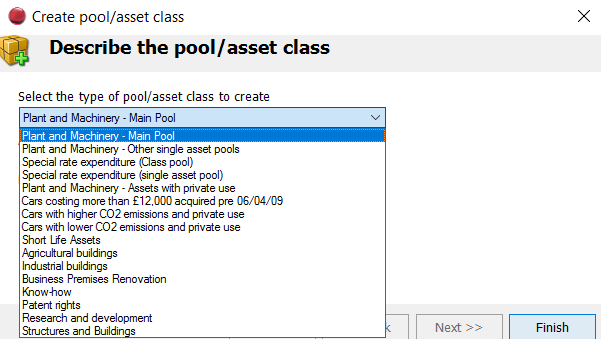

Select the type of pool / asset class to create from the drop down and enter a description.

Then click Finish

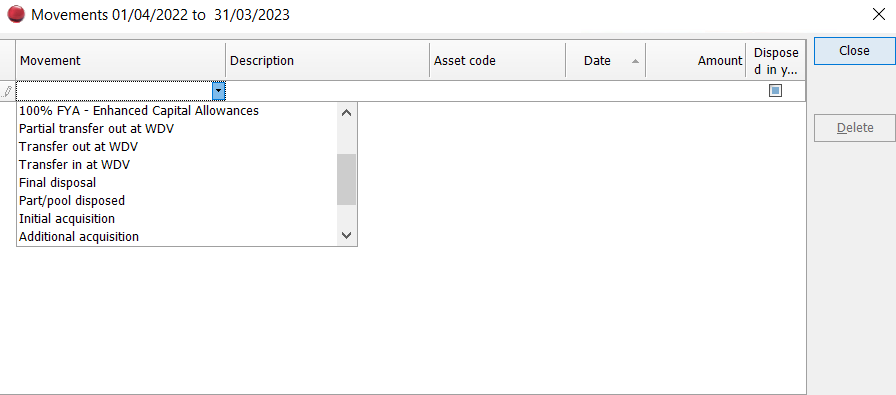

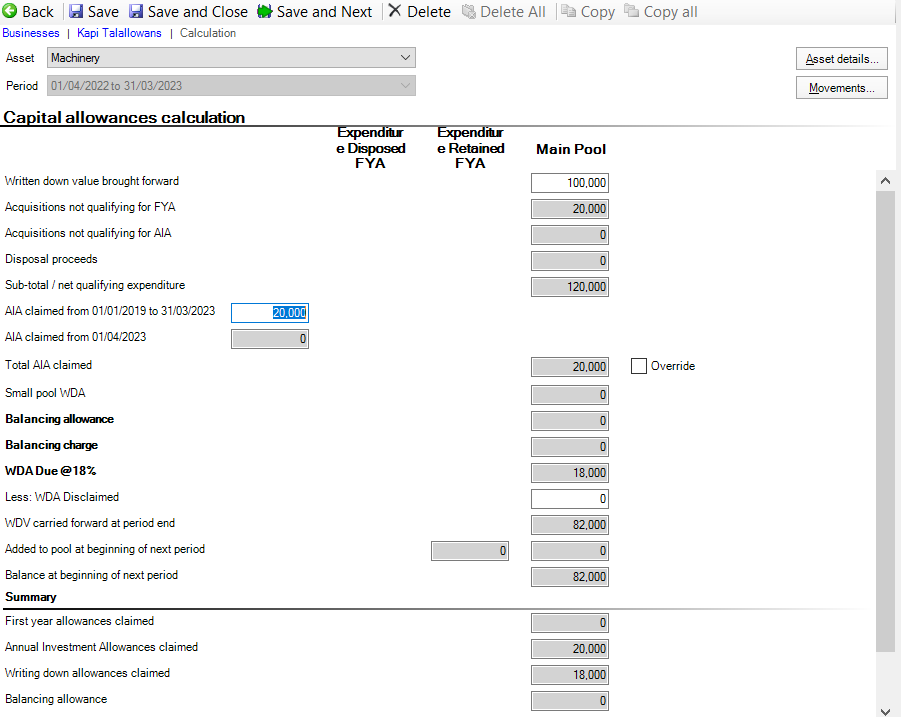

Enter any brought forward in the Written down value brought forward cell and analyse any additions or disposals etc. by clicking on Movements

Complete the Movements data entry window

To claim annual investment allowance (AIA), enter the amount claimed in the data entry cell

Capital Allowances

Capital Allowances for Freeport Structures and Buildings and Zero-emission cars have been updated, in addition the rate of Annual Investment Allowance remains at

£1 million after 31 March 2023.