Reducing Payments on Account and Statements of Account

You can complete the form SA303 to reduce your client's payment on account.

About Reducing Payments on Account

Reduce Payment

- Select the client that you want to open the tax return for. The Client tab appears.

- Click the tax returns tab.

- Click the tax year to open the tax return. The Tax Return Summary tab appears.

- Click Tasks > SA303 under Tasks on the Ribbon Bar. The SA303 tab appears.

- This allows you to create a paper SA303 by clicking New.

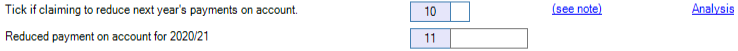

- Alternatively, click on Tax Payments/Repayments in the tax return data entry section. Click on the (see note) hyperlink and add a disclosure note.

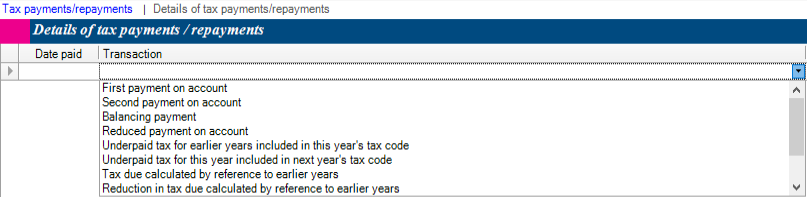

- Click on the Analysis hyperlink and add details of tax payments/repayments by using the drop down arrow under the Transaction column to specify the description.

- Click Save or Save and Close.

Note: The above steps do not apply to partnerships.

About Statements of Account

Overview

Create Statement

- Select the client. The Client tab appears.

- Click the tax returns tab.

- Click the relevant tax year to open the Tax Return. The Tax Return Summary tab appears.

- Click Tasks > Statements of account under Tasks on the Ribbon Bar. The Statements of account tax appears.

- Click the Create statement button and select the tax year that you want to create a statement for.

- The Payments box displays a summary of any tax due. Click the hyperlink to update the statement details in the grid.

- To add a payment, click the Payments tab.

- Complete the following:

- Date paid, Amount, Year and Reference.

- Enter any additional relevant information here.

- Click the Statement of Account tab. The Statement of Accounts grid displays the payment details added.

- Click Save and Close.

- A warning message appears if unallocated payments exist.

Note: the above steps do not apply to partnerships.