Making Tax Digital: Send to Tax Return - User Guide

Introduction

Send to Tax Return is a fundamental part of the CCH OneClick functionality linking CCH OneClick with our on-premise product CCH Personal Tax. Our 'Send to Tax Return' functionality consists of two major elements:

- Surfacing data previously entered in CCH Personal Tax in the CCH Personal Tax Info Panel in CCH OneClick

- Taking the information from HMRC’s Digital Tax Account (DTA), which surfaces data HMRC holds for a taxpayer, and posting the information back to CCH Personal Tax.

These deliver the following benefits to practices:

- Data already entered in a client’s tax return in CCH Personal Tax is surfaced within CCH OneClick and appears in the CCH Personal Tax Info Panel; information available within HMRC’s Digital Tax Account can be viewed in CCH OneClick concurrently and the user is able to identify any differences.

- Use of the HMRC APIs saves time and reduces the risk of transposition errors by taking the data from CCH OneClick and writing the information back to CCH Personal Tax.

Note: during our testing, we have identified that Chrome provides the best results when accessing the new online functionality. We recommend Chrome is set as your default browser.

Before you start – Important Notes

Versions

CCH Central must be running at least version 2018.2 to use this functionality. The 2019.2 version of CCH Central includes a change in th configuration for 'Send to Tax Return'. Please see below for details:

2.1 2019.2 onwards

- 'Send to Tax Return' no longer uses the user called CCH be default and does not require any special setup for users to access the functionality.

- 'Send to Tax Return' continues to use the CCH Personal Tax schema, usually called Tax Factory.

- From the 2019.2 version of CCH Central, the CCH Central Service Hub is used instead of the CCH Practice Portal Service. The CCH Central Service Hub must be installed and running.

2.2 2019.1 and earlier versions

CCH User

'Send to Tax Return' uses the CCH Personal Tax schema, usually called Tax Factory. This normally relies on the presence of a user called CCH. For all recent installations this is already configured and forms part of the Central database upon installation. Some older installations may not have this user and others may have removed the user. Ask your Administrator / Superuser to check for this employee and if it does not exist follow the instructions in the System Administrator section.

CCH Practice Portal Service

The CCH Practice Portal Service needs to be installed and running. To ensure the service is running check the services (or ask your administrator to do this):

Note: if the status is Started, clicking 'Restart' ensures that the service is stopped and started and up and running again.

Configuration and Authorisation with HMRC

Configuration Keys

There is a configuration key that controls the use of pre-population data available under HMRC’s Making Tax Digital project. By default this configuration key is switched off, i.e. the key value is set to 0.

Select File > Maintenance > User Defined > Configuration:

PT_DigitalTax_Enable - adding the Key Value 1 enables the View DTA option in the ribbon bar within a client’s Tax Return. API calls can be made, and a report appears of the client’s data held by HMRC. When this key is set to a value of 0, the option in the ribbon bar is visible but disabled for users.

HMRC Authorisation

- The authorisation to use the DTA information must be done in CCH Central because this currently relies on existing agent credentials and does not yet work with the new Agent Services Account.

- To allow your software to access HMRC’s pre-population data, existing agent credentials (i.e. those currently used for online filing and to access the HMRC Agent Portal) must be authorised. This provides an OAuth 2.0 token which is stored by CCH Central; this token is then used when subsequent API calls are made.

- Agent credentials may be stored in several locations within CCH Central and each of these locations has the ability to authorise credentials. Where the same credentials are entered in various locations, the credentials only need to be authorised once to apply in all locations they are used, provided the user ID and passwords match exactly.

- HMRC agent credentials must be entered correctly and saved in CCH Central to gain access to the APIs. CCH Central will automatically enter the credentials on the HMRC webpage; however HMRC may make changes to this page that results in this facility not working. If the user ID and passwords have to be manually entered, please ensure they match the credentials where the authorisation process was launched from.

- The ability to authorise agent credentials are subject to task permissions – refer to System Administrator below. It is set up in such a way to allow a single user, e.g. an IT administrator, to authorise multiple sets of credentials as well as cater for individuals authorising their own credentials.

Note: if the incorrect agent credentials are entered during the authorisation process, a message stating the user is not authorised to view the DTA data is displayed when accessing the information for a client.

Tax System Parameters – Online Filing tab

Agent credentials can be entered at database or company/office/department/employee level within the Online Filing tab.

Credentials held in the employee record are used last. The Company / office / department credentials based on the client assignment in the Responsibility tab are used in preference to those held elsewhere.

- Select File > Maintenance > Tax Settings > Personal Tax > Tax System Parameters. Where credentials are used at database level, an option Authorise HMRC DTA, shows the current authorisation status and is from where the process is controlled.

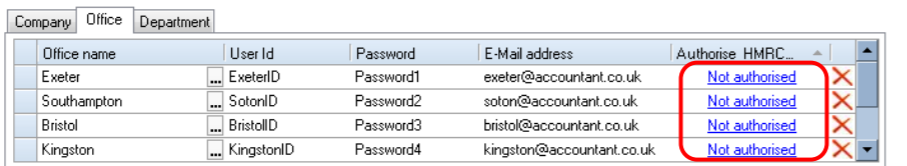

Where credentials are used at company/office/department level, a column Authorise HMRC DTA appears in the table. The current authorisation status appears and is from where the process is controlled.

- To authorise a set of agent credentials, click on the associated 'Not Authorised' hyperlink.

Tip! It is helpful to copy the user ID and password before authorising the credentials in case the auto-population does not work on the login page and details must be manually entered.

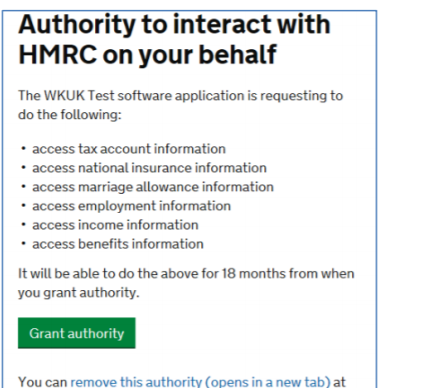

CCH Central displays a webpage owned by HMRC ‘Authority to interact with HMRC on your behalf’

3. Click on 'Continue'. The user ID and password should automatically populate. Where this does not happen, manually enter the details, ensuring they match the row the authorisation process was launched from. The HMRC page lists the information sources CCH Central will access.

4. Select 'Grant authority'

The webpage closes, and a success message appears. Click 'OK', the message disappears and the updated Authorise HMRC DTA status of the credentials is shown.

Note: HMRC have not enabled bulk authorisation; this is still under review with HMRC.

An employee can have their own agent credentials entered against their employee record in CCH Central. This is accessed under the Online filing details tab when viewing the employee details record.

Authorise HMRC DTA shows the current authorisation status and is from where the process is controlled. To authorise, click on the associated 'Not Authorised' hyperlink.

5. Follow steps 3 and 4 as above.

Status

There are three statuses associated with the HMRC DTA authorisation.

- Where the credentials have not been authorised and no OAuth 2.0 token exists in the CCH Central database, 'Not Authorised' appears.

- Where credentials have been successfully authorised and a valid OAuth 2.0 token exists in the CCH Central database, Authorised & Valid appears

- The OAuth 2.0 token will expire, e.g. when the authorisation period determined by HMRC has been exceeded. Where credentials have been authorised and an OAuth 2.0 token exists, but this token is expired, Authorised & Expired appears.

Note: Authorisation with HMRC should last for 18 months. The OAuth access token appears as expired after 4 hours of inactivity, resulting in the status turning to Authorised & Expired.

When the Authorised & Expired status is displayed, the system will automatically refresh the OAuth access token when a user next tries to access HMRC data without a user authorising CCH Central with HMRC again and update the status to Authorised & Valid. Users should not need to complete the authorisation flow with HMRC.

Where the same set of credentials are used in more than one place, for example against an office and against a specific employee, the credentials themselves only need be authorised once. The status automatically updates within CCH Central wherever the same credentials are used.

Clearing tokens

In cases where the OAuth 2.0 access token may need to be removed, the Authorise HMRC DTA menu box includes an option to Clear token.

Selecting this option and confirming the deletion of the token against the selected credentials will revert the status to Not Authorised.

Tax Returns

When using Send to Tax Return the tax return must be closed in CCH Personal Tax to ensure data integrity is retained. If the return is in use it is not possible to update CCH Personal Tax with the details from CCH OneClick. An error message is given advising that the return is in use and by whom.

Accessing the DTA Information

To ensure that you are able to access the API data for your client, you need to ensure that you are authorised to receive communications from HMRC regarding your client, i.e. a 64-8 (or the online equivalent) has been submitted to HMRC and actioned.

Tax Years

HMRC’s APIs provide data for 2015/16 onwards. Some data for 2015/16 and 2016/17 cannot be sent to CCH Personal Tax as this would have required changes to be made to CCH Personal Tax for those earlier years that in turn could have changed the data already submitted to HMRC. Where this is the case, we have included details in the following paragraphs.

Spouse – Marriage Allowance

- To ensure that the Marriage Allowance API to check a client’s spouse’s eligibility to receive an allowance transfer is called, a tax return must exist in CCH Personal Tax. The spouse information needs to be pulled from CCH Personal Tax from the Marriage tab in the client’s record.

- Additionally, the spouse’s record must contain the following details for the API to be called:

‒ First and last name

‒ National Insurance number

‒ Date of birth

• LIMITATION: CCH Personal Tax does not contain a setting defining the eligibility of the spouse to receive the Marriage Allowance, therefore these details cannot be sent to the tax return.

National Insurance

Not all years are fully supported in CCH Personal Tax as changes would have needed to be made to National Insurance in CCH Personal Tax for the prior years to support the Send to Tax Return functionality. The limitations are as follows:

- Class 1 NI Contributions – This is supported from 2016/17 onwards as the fields were merged in CCH Personal Tax into a single field Earnings liable to Class 1 NIC above PT and up to UEL; previously (2015/16 and earlier) the information was held in two separate fields.

- Class 2 NI Contributions – This is supported from 2017/18 onwards only. Previously it was necessary to check the override box; this box has been removed in 2017/18 allowing the details to be committed from CCH OneClick into CCH Personal Tax.

- Have maximum NI contributions been reached? – CCH Personal Tax does not record this information therefore these details cannot be sent to the tax return for any tax year.

Employment Please refer to KnowledgeBase Article 9431 for information of when PAYE data is available for clients.

Employment Benefits

The employment benefits in kind data provided by HMRC consolidates individual sections from the Form P11D into the categories as they are entered on a tax return, which does not match the fields within CCH Personal Tax.

Where Send to Tax Return is used for benefits, they will populate one of the relevant fields in CCH Personal Tax as HMRC’s APIs do not provide the exact make up of the benefits.

Pensions & Retirement Annuities

The pensions data provided by HMRC is a total of all pensions held by a client rather than a breakdown per pension provider. This can only be sent to the tax return where no individual pension providers are listed in CCH Personal Tax and the summary fields are enabled.

Please refer to KnowledgeBase Article 9431 for information of when PAYE data is available for clients.

Send to Tax Return

Send to Tax Return is the method used to write the data back into CCH Personal Tax. This can be thought of as pre-population of the data screens. After CCH OneClick has been configured and CCH Central is authorised with HMRC, you are in a position to start updating CCH Personal Tax with data from CCH OneClick. Within the client record in CCH Personal Tax ensure that the required tax return has been created:

Note: Please remember to close the client’s Tax Return when using Send to Tax Return; please see Section 3. Tax Returns above.

Open CCH OneClick. The easiest way to achieve this when wanting to access the DTA data from within CCH Central is open the client’s Tax Return and use the DTA button.

If accessed via the DTA button, step 5 (below) is the next page seen.

Alternatively, from the homepage in CCH Central, select CCH OneClick from the Ribbon Bar:

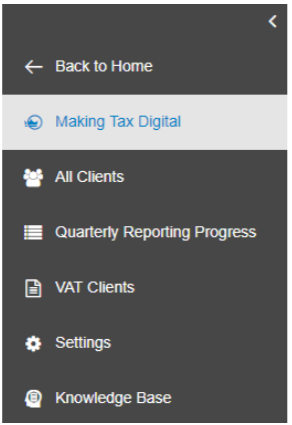

1. Login to CCH OneClick and click the Making Tax Digital tile on the dashboard.

The Making Tax Digital page opens. The icons on the left-hand side of the screen access different functions, a tool tip appears when hovering over the icon:

The menu is located on the left-hand side of the page. This can be expanded by selecting the right arrow.

2. The expanded menu displays the description of each section within Making Tax Digital.

3. Select All clients, the client list appears

4. Click the required client. If there is a long list of clients to choose from use the Search option towards to top right of the window or on a specific column to refine your search criteria

5. Within the client record, select Digital Tax Account

A list of available years appears. These are the years supported by the HMRC Making Tax Digital initiative. (See Tax Returns - Tax Years).

6. Select the year, the Tax Year window appears

The Tax Year window consists of two sections:

- Tax Year – This is pre-populated with the information supplied by the various HMRC APIs.

- CCH Personal Tax Info Panel – this is populated with the information already held in CCH Personal Tax.

The first time this is accessed for a client, a status box shows that data is being retrieved from CCH Personal Tax. Once retrieved and the page refreshed, info panel is displayed.

Note: the CCH Personal Tax Info Panel can be refreshed to by using the Retrieve latest Tax Return button for users of CCH Central version 2019.2, and by refreshing the page for users of earlier versions of CCH Central.

HMRC Pre-Population Data

The details appearing in this panel are provided by the HMRC APIs.

Note: Please refer to KnowledgeBase Article 9431 for CCH Personal Tax: When will the Digital Tax Accounts (DTA) data be available for information regarding when HMRC make data available.

Where data is not yet available, or the client does not have a source, the section will show “HMRC Response: No data is currently held by HMRC for this source.”

The APIs currently available are:

| API | Includes |

| Employment | Employer name |

| PAYE reference | |

| Pay from this employment | |

| Tax deducted from this employment | |

| Employment Benefits | Description of benefit |

| Value of benefit | |

| Marriage Allowance | Existing status |

| Is taxpayer deceased? |

| Marriage Allowance – Spouse’s Eligibility to Receive Allowance | Eligibility |

| National Insurance Contributions | Total earnings liable to Class 1 NIC above PT and up to UEL |

| Class 2 NIC total due | |

| Have maximum NI contributions been reached? | |

| Pensions & Retirement Annuities | Total pay from all pensions & retirement annuities (excluding State Pension) |

| Total Tax deducted from all pensions & retirement annuities | |

| State Benefits | Incapacity Benefits payments received |

| Total tax deducted from Incapacity Benefits | |

| Jobseeker’s Allowance payments received | |

| Tax Refunds | Tax Refunds Tax refunded or set off by HMRC or Jobcentre Plus |

To reiterate some of these APIs have limitations when applied to CCH Personal Tax. These are as follows:

Marriage Allowance & spouse’s eligibility

- To ensure that the Marriage Allowance API to check a client’s spouse’s eligibility to receive an allowance transfer is called, a tax return must exist in CCH Personal Tax. The spouse information needs to be pulled from CCH Personal Tax from the Marriage tab in the client’s record. Additionally, the spouse’s record must contain the following details for the API to be called:

‒ First and last name

‒ National Insurance number

‒ Date of birth - •CCH Personal Tax does not contain a setting defining the eligibility of the spouse to receive the Marriage Allowance, therefore these details cannot be sent to the tax return.

- Is Taxpayer deceased? – CCH Personal Tax does not contain a setting within the Marriage Allowance window to record if the client is deceased, and therefore these details cannot be sent to the tax return.

National Insurance

Not all years are fully supported in CCH Personal Tax as changes would have needed to be made to National Insurance in CCH Personal Tax for the prior years to support the Send to Tax Return functionality. The limitations are as follows:

- Class 1 NI Contributions – This is supported from 2016/17 onwards as the fields were merged in CCH Personal Tax into a single field Earnings liable to Class 1 NIC above PT and up to UEL; previously (2015/16 and earlier) the information was held in two separate fields.

- Class 2 NI Contributions – This is supported from 2017/18 onwards only. Previously it was necessary to check the override box; this box has been removed in 2017/18 allowing the details to be committed from CCH OneClick into CCH Personal Tax.

- Have maximum NI contributions been reached? – CCH Personal Tax does not record this information therefore these details cannot be committed.

Employment Benefits in Kind

The employment benefits in kind data provided by HMRC consolidates individual sections from the Form P11D into the categories as they are entered on a tax return, which does not match the fields within CCH Personal Tax.

Where Send to Tax Return is used for benefits they will populate one of the relevant fields in CCH Personal Tax, as HMRC’s APIs do not provide the exact make up of the benefits.

Pensions & Retirement Annuities

The pensions data provided by HMRC is a total of all pensions held by a client rather than a breakdown per pension provider. This can only be sent to the tax return where no individual pension providers are listed, and the summary fields are enabled in the pensions received data entry source in CCH Personal Tax.

Send to Tax Return

Before clicking Send to Tax Return, data needs to be selected. The methods described below applies to all pre-population sections.

7. There are three ways of selecting the pre-population data.

‒ Use all sections in tax return – this option selects all data in all sections in the tax year.

- Use all in tax return – this option selects all data for the relevant section only.

- Select the desired data at individual row level - Click anywhere on the row of the item to be selected.

The selection expands. Tick the Use in tax return check box:

8. Click Close, the option is retained, and the section closes retaining the tick:

9. When the desired data is selected, click Send to Tax Return to send the data to CCH Personal Tax. The status box shows that the selected data is being sent to CCH Personal Tax.

Note: all items to be sent to CCH Personal Tax must show the check box ticked. A single or multiple entry may be selected before clicking Send to Tax Return to CCH Personal Tax.

After the data has been sent, the Use in tax return selections resets to being deselected.

When the data has been successfully sent a message appears.

If an error has been encountered, a message is displayed with information to explain the error.

CCH Personal Tax Data Info Panel

The CCH Personal Tax Info Panel is populated using our Tax Factory database schema and displays the information already entered in CCH Personal Tax.

Where the return has been created but no details entered, the side panel appears as follows:

Where data is already present in a tax return, the CCH Personal Tax Info Panel displays the details present in CCH Personal Tax.

After Send to Tax Return has been completed for selected data, the CCH Personal Tax Info Panel is updated to reflect the changes as they are made in CCH Personal Tax:

System Administrator

CCH User This section regarding CCH User applies to 2019.1 or earlier versions of CCH Central only. As indicated in CCH User Send to Tax Return uses the Tax Factory. If you do not have a CCH user it is possible to configure things to use an existing valid employee.

1. Open the Practice Portal Service configuration file (usually located with the deploy folder, as an example C:\Program Files (x86)\CCH PracticePortalService)

2. Open the file and from the <appsettings> change the value of the ProxyUser:

Note: the value to be used is the U/name not the code as indicated in the employee record:

Task Permissions Several task permissions have been added to allow access to the various new Digital Tax features to be controlled. Select File > Maintenance > Security > Task Permissions.

HMRC Authorisation

Separate permissions have been added for the ability to authorise credentials and clear a token where required. Where credentials are stored at database or company/office/department level, two new task permissions have been added under the Personal Tax product, listed within the Menus group:

- [Maintenance] [Tax settings] [Personal Tax] [Tax system parameters] [Authorise HMRC DTA] [Authorise credentials]

- [Maintenance] [Tax settings] [Personal Tax] [Tax system parameters] [Authorise HMRC DTA] [Clear token]

Where credentials are stored against an employee’s record, task permissions have been added under the Personal Tax product, listed within the Employee group:

- #Employee #Online filing details #Authorise HMRC DTA #Authorise credentials

- #Employee #Online filing details #Authorise HMRC DTA #Clear token

Where the Maintenance > Digital Tax > HMRC Authorisation option is used, the associated task permission is under the Central product, listed within the Maintenance group.

- [Maintenance] [Digital Tax] [HMRC Authorisation] Digital Tax Account access User access to HMRC’s pre-population data is controlled with a new task permission. Where a user has permission to access a client but not the View DTA option, the icon is enabled but the user receives a permission denied message. This task permission is under the Personal Tax product, listed within the Menus group:

- [Task Bar] [Digital Tax Account access]