Publishing documents to CCH Document Management

Publishing documents to CCH Document Management

The publishing of documents to the document management is the same whether publishing from outside of Online Filing and from within Online Filing following the creation of the IRMark.

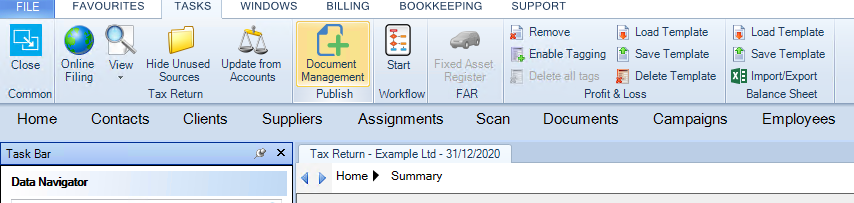

To publish documents to document management without the inclusion of the IRMark and associated online filing documents, open the period of account from the Tax Return tab within Central.

Click on the Document Management within the Publish section of the top Ribbon.

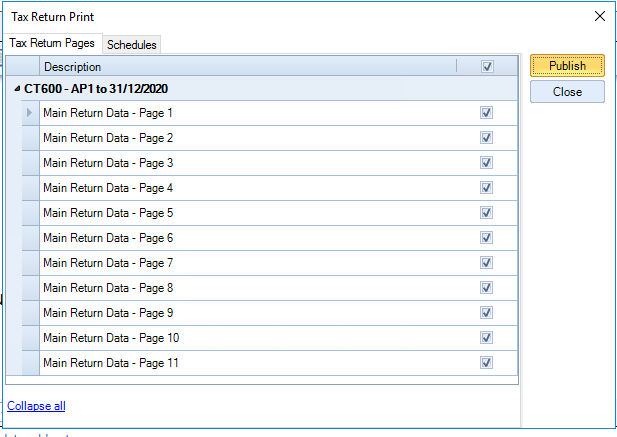

Select the Tax Return Pages and or computation Schedules to be published and click Publish.

A message will appear confirming that the documents have been successfully published.

To see the published documents select Document Centre tab in the client record.

Publishing documents from Online filing

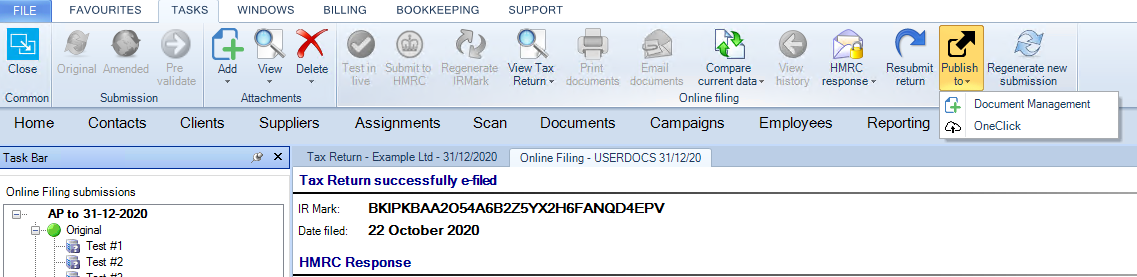

Documents can be published to the document management following generation of the online filing submission and creation of the IRMark. It is also possible to Publish those documents following a live submission to HMRC.

Select Online Filing from the top Ribbon.

To publish a submission's documents to Document Management, select Publish to in the Online Filing top ribbon and select Document Management.

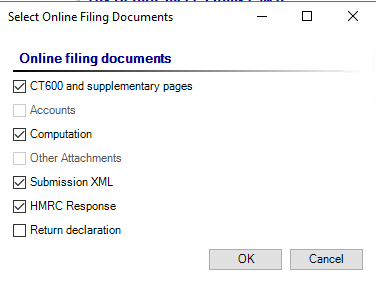

Select the documents to publish

- CT600 and supplementary pages

- Accounts (if attached)

- Computation

- Other PDF attachments

- Submission XML (XML file of Return)

- HMRC response

- Return Declaration

Click OK.

A message will appear confirming that the documents have been successfully published.

To see the published documents select Document Centre tab in the client record.