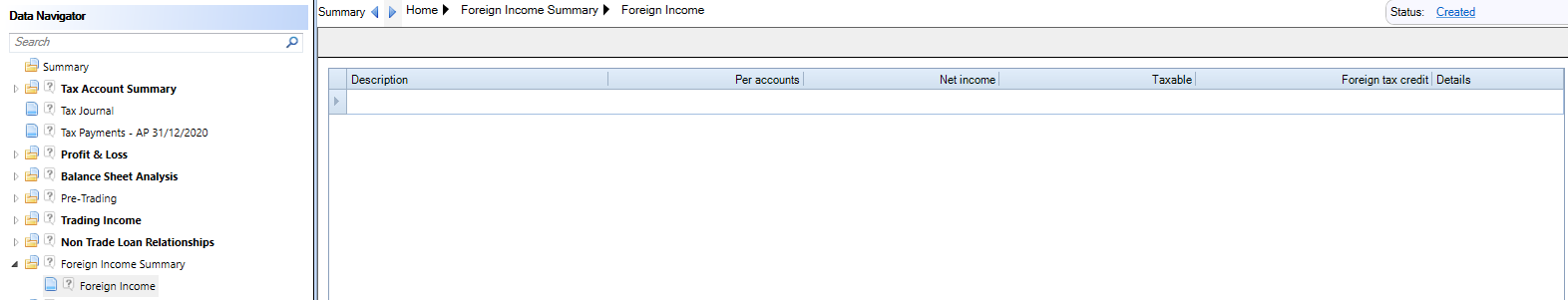

Foreign Income

Foreign Income is located within the Foreign Income Summary section of the Data Navigator.

To access the detailed analysis, enter a Description and a Details hyperlink will appear in the Details column to access the detailed analysis.

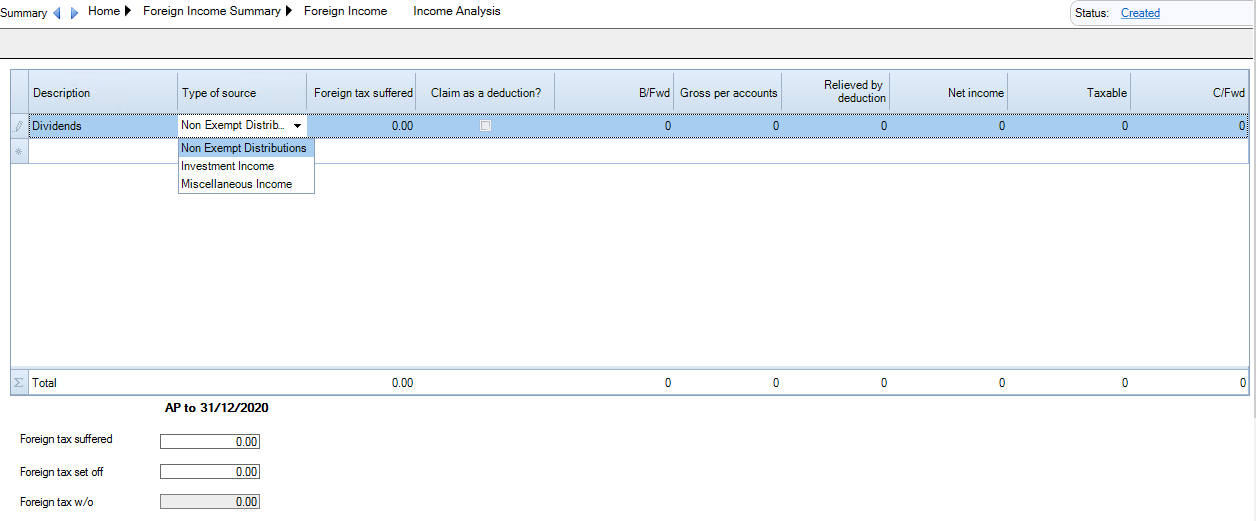

Description - enter a description for the source of foreign income

Type of source - select the Type of income received,either Non-exempt distribution, Investment income or Miscellaneous income

Foreign Tax suffered - enter an amount of foreign tax suffered on this source of income

Claim as a deduction - tick the box if the foreign tax suffered is to be claimed as a deduction against the income

B/fwd - enter an amount of income b/fwd from a previous period of account. This will be automatically populated when rolled forward from a previous period in CCH Corporation Tax.

Gross per accounts - enter an amount of gross income per the accounts

Relieved by deduction - this will be calculated by the system if you have selected to claim the foreign tax suffered by deduction.

Net income - Calculated by the system and is the result of Gross per accounts minus amount of foreign tax relieved by deduction minus C/fwd.

Taxable - enter an amount of foreign income deemed as taxable in the period.

C/fwd - enter an amount of income to be carried forward.

Once all rows of income have been completed, enter the total amount of Foreign tax Suffered and Foreign tax set off.

Related