Creating a New Client

How to create a new client in CCH Corporation Tax

Select File, New, Client from the Central menu (this opens the New Client Wizard).

Click on the Main Details tab

You must input 3 mandatory fields into the Main Details tab in order to create and save the client.

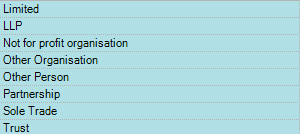

- Contact type - using the drop down list choose Limited/Other Organisation/Not for profit organisation.

- Code

- Main Name

Once this has been done, a new client will be created within Central with a 'Tax Returns' tab - from which you will be able to create and access the Corporation Tax Period of Account and relevant return(s).

The Company Registration Number (CRN) and Unique Taxpayer Reference (UTR) can be input at this stage, or later using the Main tab within the client.

Additional tabs present when creating a client (optional for data input):

- Address - this can be completed on creation of the client or at a later date.

- Notes - use this to add relevant notes to your client (not for Tax Return disclosure).

- Associated - select any clients or contacts here which your company client is associated with.

- Accounts - this tab will only be present if you have CCH Accounts Production installed.

Click on Finish and then open the Tax Returns tab.

The next stage is to create a new period of account.