LLP FRS 102 Master Pack User Guide

LLP FRS 102 Master Pack User Guide

The CCH Accounts Production FRS 102 LLP formats are a simple means of preparing accurate, statutorily compliant sets of FRS 102 LLP financial statements.

This user guide should be read in conjunction with the FRS 102 Limited master pack guide, which provides all the essential information common to limited companies and LLPs. This guide focuses on additional information relevant to LLPs alone.

LLP financial statements overview

These formats are devised to meet the requirements of:

- The Companies Act 2006

- Accounting standards

- FRS 102

- The LLP SORP 2018 (2021 from 1 Jan 2022, with early adoption available)

- The reduced disclosures for small entities available in section 1A

Users need to be familiar with the Statement of Recommended Practice – Accounting by Limited Liability Partnerships produced by the CCAB (Consultative Committee of Accounting Bodies). This 'LLP SORP' contains all the guidance required to understand how to produce accounts for a Limited Liability Partnership. (For example, it contains essential detail on Members' Participation Rights, which are the rights of member against the LLP that arise under the members’ LLP agreement in respect of profits, remunerations and amounts subscribed).

The LLP SORP 2021 is effective for accounting periods commencing on or after 1 January 2022. Early adoption is permitted for accounting periods beginning before 1 January 2022. The main changes affecting the financial statements in the 2021 version are:

- An accounting policy is required for the treatment of members' drawings and similar payments in the cash flow.

- Where there is an Energy and Carbon Report, the names of all LLP members must be provided.

Scope and restrictions

This master pack supports the following:

- Large and medium-sized entities

- The reduced disclosure requirements for small entities, including reduced filing

- The reduced disclosure requirements for qualifying subsidiaries

- Dormant accounts

- iXBRL tags for electronic submission to Companies House

Restrictions:

For reporting purposes, individual member balances are not required and therefore this pack does not support the postings of individual members’ loan balances. The amounts owed to/by individual members must be analysed outside the software and the total figures input as a single net figure into the appropriate nominal codes. Analysis between debit and credit totals is then achieved through an adjustment in the statutory database.

Client creation

Create client in CCH Central

- When setting up an FRS 102 LLP Client, in the Create Client Wizard Main Details tab, the Contact Type is LLP.

- In the Accounts tab, the options to choose are under Type, select LLP and under Entity please select LLP (FRS 102).

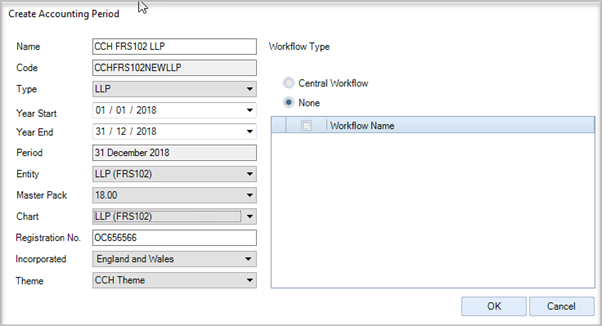

Create new LLP FRS 102 accounting period for an existing client

On the Accounts Production tab, click in the grid to create a new accounting period:

Type: select 'LLP'.

Entity: select 'LLP (FRS 102)'.

Set other fields as required and click 'OK'.

Double-click the accounting period row on the grid to load the accounts production screen.

General structure of the LLP master pack

This LLP master pack is largely based on the standard FRS 102 limited company pack, providing users with the same look and feel and familiarity. The structure of the chart of accounts, statutory database and formats are similar.

Nominal ledger

The nominal ledger structure for FRS 102 LLP is a 4 digit chart of accounts, with an optional 3 digit subcode length.

Differences from FRS 102 Limited

Limited company code ranges relating to the following will not be found in the LLP chart:

- Share based payments

- Directors' payments

- Deferred taxation

- Dividends

- Shares, related reserves and convertible loans

LLP ranges relating to the following will not be found in the company chart:

- Members' remuneration and other payments

- Members' capital

- Members' loans

Members' ranges

The following ranges relate to the balances and profit shares of members:

- Members' remuneration charged as an expense (Income statement)

- Codes 5000 to 5019 - Members’ remuneration paid under employment contract

- Codes 5020 to 5049 - Members’ remuneration paid under LLP agreement

- [Codes 5050 to 5099 not used or mapped to ranges: reserved for future use]

- Movements on members' reserves

- Codes 5110 to 5350 – Transfers between reserves and transactions directly affecting reserves (the latter appearing in Other comprehensive income)

- Members' interests (Balance sheet)

- Codes 9500 to 9539 - Members’ capital classified as debt

- Codes 9540 to 9589 - Members’ other debts – current accounts, including:

- 9550 Profit shares (double entry to 9747)

- 9551 Remuneration shares (double entry to 5000-5049)

- 9552 Interest earned (double entry to 5023)

- 9570-9589 Drawings

- Codes 9590 to 9639 - Members’ loans other amounts

- Codes 9640 to 9689 - Members’ capital classified as equity

Officers

The members of the LLP are entered in the officers screen, including identification as designated members.

Designated members

LLPs must have at least two "designated members", who perform certain duties in relation to the legal administration of an LLP, as specified in the incorporation document. These include such duties as:

- Signing the annual accounts

- Filing the annual accounts and annual returns at Companies House

- In the event of insolvency proceedings, providing a statement setting out the affairs of the business - assets, debts and liabilities.

For this reason, the user should tick the designated member box in the Officers screen to identify who are the designated members.

Note: Only designated members can sign the Members’ Report and Balance Sheet, and the software only permits those members you have identified as designated members.

Specific matters within the financial statements

Notes are included below only where the formats are significantly different from those found in standard limited financial statements.

Main pages

Information page (page2inf): This shows the designated members, limited liability partnership number plus other standard LLP information.

Members' report (page4mrs): There is no requirement to include a Members’ Report in the LLP SORP. Various disclosures that were mandatory here under the old SORP can be disclosed elsewhere in the financial statements if the user prefers. However, we have kept these disclosures in the Members' Report in the new pack.

There is an option to exclude the Members' Report from the financial statements (#lp10), but great care must be taken to tailor your financial statements and include the necessary detail elsewhere. In addition, there is an option (#cz68) to include the Members' Responsibilities Statement as part of the main Members' Report, but as this statement is a requirement of LLP SORP paragraph 25, take care that you do not then exclude the Members Report.

Note: Limited Liability Partnerships do not have a secretary.

Income statement (page6is)

Similar layout to a limited company except for the treatment of members’ remuneration charged as an expense, which includes retirement benefits payable for current members.

Statement of financial position (page7sofp):

The LLP SORP requires net assets attributable to members of the LLP to be shown on the face of the Balance Sheet. In addition, the SORP requires Total members’ interests and Amounts due from members in debtors (where applicable) disclosed as memorandum items on the face of the Balance Sheet.

Net assets or liabilities attributable to members is represented by Loans and other debts due to members and Members’ other interests. Loans and other debts due to members, eg profit allocations not covered by drawings, must be shown on the face of the Balance Sheet.

Amounts owing to and from members should not be offset, except where they are in respect of the same member.

Note: A LLP’s financial statements must be approved and signed by Designated Members

Reconciliation of members’ interests (page7romi)

This can be presented as a primary statement instead of a statement of changes in equity. By default this will be shown as a page rather than a note, but there is an option to include it as a note instead (#lp30).

Where the ROMI is shown as a the primary statement instead of a statement in changes in equity, comparative amounts are presented by way of a full table relating to the prior period, in a second sheet of the format.

The LLP SORP (para 60 and 60A) provides full advice on disclosures. The general guidance is that the notes to the financial statements (or primary statement 60A) should include a reconciliation of the movement in members' interests analysed between ‘Members’ other interests’ (which is regarded as equity) and ‘Loans and other debts due to members’.

Cash flow statement (page8cf)

Payments to members are by default shown as financing activities, but they can be allocated (fully or in part) to operating activities.

The analysis of changes in net debt follows the example provided in the LLP SORP and therefore has additional rows compared with those shown for a limited company.

Notes to the financial statements

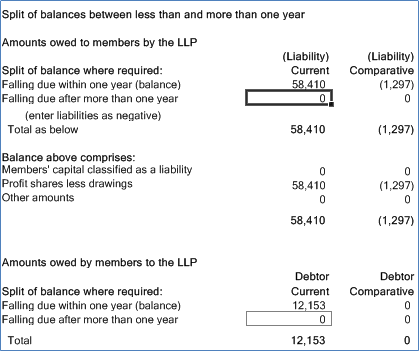

Loans and other debts due to members (note56)

The SORP requires the notes to the financial statements to explain where amounts in ‘Loans and other debts due to members’ (other than members’ capital classified as debt) would rank in relation to other creditors who are unsecured in the event of a winding up. The LLP Regulations require disclosure of the amount of loans and other debts due to members falling due after more than one year (#lp13).

Accounting policies - general: The members of the LLP must state in the notes to the accounts whether they are prepared in accordance with the Statement of Recommended Practice, together with FRS 102 “The Financial Reporting Standard applicable in the UK and Republic of Ireland” and the requirements of the Companies Act 2006.

Accounting policies – legal form and address: An entity shall disclose the legal form of the entity, its country of incorporation and registered office.

Accounting policies – members’ participation rights: The basis for the accounting required in the SORP is that the member’s agreement will give rights against the LLP. Such members’ rights against the LLP are referred to as participation rights.

There are 6 sections with optional titles within the accounting policies to provide detail of the participation rights in the LLP. Some of these paragraphs have default wordings, but users are required to choose and tailor the appropriate paragraphs. There are guidance notes in the software to assist the user.

- Introduction (with default paragraph – #cd999324)

- Profits (user has to select, one of two paragraphs or edit – #cd999326)

- Losses (user has to select, one of three paragraphs or edit – #cd999328)

- Unallocated profits and losses(with default paragraph – #cd999330)

- Other amounts(with default paragraph – #cd999332)

- Discounting of liabilities to members (user has to select, one of two paragraphs or edit – #cd999334)

- Cash flow - distributions and drawings (with default paragraph that user needs to edit - #lp36)

Members’ remuneration note (note82): This note discloses the remuneration paid under an employment contract and remuneration charged as an expense, together with other transactions in relation to members.

This note also has other static data that can be entered via the statutory database.

Disclosure of the share of profits to the member with the largest entitlement is only required where the profit before members’ remuneration is more than £200,000. You need to disclose the profit (including remuneration) that is attributable to the member with the largest entitlement to profit, in addition to any contributions paid by a subsidiary to a money purchase pension scheme on behalf of the highest paid member. The identity of the member need not be disclosed.

Taxation (note18): The profits of any LLP are not subject to corporation tax. Members are subject to income tax on their share of the profits or capital gains tax on their share of LLP assets. However, we have included a taxation note for more complex LLPs where there is a tax expense in corporate subsidiaries.

Debtors (note34): This note also discloses the amount of debts owing to the LLP by the members. Amounts owing to and from members should not be offset, except where they are in respect of the same member.

Post-retirement provision for and payments to former members

Former members may, upon retirement, be eligible to receive ongoing payments from the LLP. Where these relate to remunerative work carried out in the current period (eg where the former member provides consultancy services) these costs will be expensed as normal in the P&L and there is no need disclose them. Non-remunerative costs relating to former members are included in the P&L as part of the administrative expenses but will need to be dealt with separately in the cash flow. These costs and liabilities are dealt with through the following codes:

3165 Post-retirement expense re former members

3166 Post-retirement expense - movement in provision

9450-9487 Provision(s) set up for the liabilities to former members

8140 - Current liability for post retirement benefits due to former members (applies to short term payables)

9120 - Non-current liability for post retirement benefits due to former members (unlikely to be used since normally a provision is more appropriate)

- Where these costs relate to expenses in the current year not previously provided for upon retirement, they should be charged to code 3165, eg where the member retires part way through the year, or there is an unprovided-for expense for a previous member;

- Where a provision is first set up, or there is a movement on the provision (eg additional provision or release), the double entry is to 3166;

- Where a former member is paid, reducing the provision, the double entry to the bank payment is the provision utilised code (eg 9483).

For purposes of the cash flow, the user also makes an entry in the Stat db Non-Cash/Operating grid #cf999115: amounts paid that reduce the provision outstanding. This, together with the entries above, will show in the Cash generated note the P&L charge added back as part of the adjustments to profit to give cash generated. The total paid to former members is then shown in the cash flow statements, being the charge excluding provisions movement plus any payments to reduce the provision.

Division of profits

The LLP SORP distinguishes between:

- Members’ remuneration charged as an expense

- Post-retirement payments to former members

- Unallocated profit – available for 'discretionary division'

'Members’ remuneration charged as an expense' is a broad term and includes any allocation of profit which is automatically divided under the terms of the LLP membership agreement or any employment contracts relating to the members. It will include the crediting or charging of interest on members' balances.

(See the LLP SORP definitions in paragraph 9 Allocated profit, 10 Automatic division of profits, 20 Members’ remuneration, 21 Members’ remuneration charged as an expense, 24 Unallocated profit).

The discretionary division of profit applies only to profits that are not already allocated according to legal agreements. Therefore, if the LLP agreements include a specific allocation of all profits after salaries etc (eg the % to be earned by each member), there will be no unallocated discretionary profits and all profit shares should be entered as 'Remuneration' (see below).

How the master pack deals with profits

- All profits 0000-4999 will automatically be allocated initially to 'Other reserves'.

- The legally agreed allocation of these profits should be entered as debit entries in ranges 5000-5049 (which will then be included in the movements on 'Other reserves'), with double entries to the reserves affected by the allocation.

- Discretionary allocation of the unallocated current profits should be entered as a double entry between codes in Other reserves and Members Current Account (see below)

- Any remaining unallocated profits will remain within 'Other reserves'.

- Allocation of prior year unallocated profits and or other amounts held within 'Other reserves' can be also made (see below).

Double entries for the profit allocations are as follows:

Remuneration charged as an expense - interest

| Dr Cr |

5023 9552 |

Interest paid under LLP agreement Members Current Account - interest credited (note – all interest earned is charged here, whatever members' balances it accrues on). |

Remuneration charged as an expense - other

| Dr Dr Dr Dr Cr Cr |

5000-5019 5020-5022 5024-5039 5040 9551 9609 |

Remuneration including pensions paid under employment contracts Remuneration paid under LLP agreement Pensions and other costs (credits) arising under LLP agreement Automatic division of profits under LLP agreement Members Current Account – remuneration Members Loans Other - post retirement payments current members |

Discretionary allocation of remaining unallocated profits

| Dr Cr |

9747 9550 |

Other reserve - profits/losses current year Members Current Account - division of profits/losses. |

Note: that if not all the profits are allocated, they remain within Other reserves for future reallocation

Further allocation of profits from Other reserves (usually for prior year profits)

| Dr Dr Cr Cr |

9748 9510 9555 9650 |

Other reserve - other division of profits movement Members Capital Classified as Debt - division of profits/losses Members Current Account - allocation of previous year profits Members Capital - division of profits/losses |

Reporting for Small LLPs - differences from limited companies

- Selecting Small LLP Exemptions will by default exclude also the Reconciliation of Members’ Interests from the members' financial statements. There is an option within the Small LLP Exemptions folder to allow the user to override this.

- Where the the Reconciliation of Members’ Interests in included in the members' financial statements, the user will have the option of excluding it from the filing copy.

- The Loans and other debts due to members’ note will only output the paragraph detailing how loans and other debts due to members rank against other unsecured creditors.