IFRS Master Pack User Guide

CCH Accounts Production IFRS Limited

Overview

This master pack for CCH Accounts Production enables the generation of IFRS financial statements as adopted by the UK and the European Union.

The pack does not cater for the following:

- Listed companies (FTSE Market, PLUS Market, AIM Market)

- Banks

- Insurance companies and any adjustments arising from IFRS 17 Insurance Contracts

- IFRS 6 Exploration for and Evaluation of Mineral Resources

- IFRS 14 Regulatory Deferral Accounts

- IAS 26 Accounting and Reporting by Retirement Benefit Plans

- IAS 29 Financial Reporting in Hyperinflationary Economies

- IAS 34 Interim Financial Reporting

Relationship with FRS 102 master pack

The structure of the IFRS master pack is very similar to that of the FRS 102 master pack, and users should refer to FRS 102 Limited guide for basic information and shared content. Where there are important differences between the two packs, those differences are set out in the sections below.

FRS 101 Reduced disclosure framework

FRS 101 allows 'qualifying entities' (usually a subsidiary of a parent producing IFRS financial statements) to use the recognition and measurement requirements of IFRS in their individual financial statements without the need to give the entire suite of IFRS disclosures, subject to certain conditions. The IFRS master pack provides the option to produce FRS 101 financial statements and incorporates for this purpose:

- Additional nominal chart codes

- Alternative disclosures in the formats

- Additional statutory database items

- Amended or additional paragraphs

More information about this is provided in an appendix.

Small companies exemptions

There are no exemptions comparable to Section 1A, which applies only to FRS 102. However, small companies will still have the following exemptions available to them:

UK: Companies Act 2006 small companies exemptions will apply for companies subject to the small companies regime:

• The exemption from the requirement to prepare a strategic report - users can take the options to exclude the strategic report (#cd287)

• The exemption from the requirement to include the cash flow statement [Does not apply if reporting under IFRS]. Note however that this is already exempted for FRS 101. Where the exemption applies, users can take the option to include the cash flow statement (#cd999256).

• Certain directors' report disclosures.

• The option to file "filleted" financial statements (ie excluding the profit and loss account and related notes from the filed statements).

Where the company is set to "Small", a balance sheet statement will be triggered, stating that the financial statements are produced under the small companies regime

ROI: The only exemption is the ability to file abridged accounts.

Nominal ledger

The nominal ledger coding structure adopted in these formats has been designed to meet the requirements of both IFRS and FRS 102. Where codes relate to IFRS or FRS 102 alone, they are marked as such in both charts.

The nominal codes are 4-digit numerical. Although sub-codes have not been used within the master chart of accounts, users can create them if further analysis is required. Note that the use of sub-codes is may create problems for group accounts where the chart of a subsidiary does not match that of the other members of the group.

The nominal chart has the following key identifiers:

- Code ranges that group similar items together

- Descriptions that enable the user to understand the posting

- Category information which identifies where a posting will end up in the financial statements

The nominal chart is searchable both by browsing through codes and by entering text, and displays the 3 identifiers above, in data entry and information screens. Therefore, the entry of information is normally straightforward.

See the FRS 102 User guide for information concerning the overall structure of the nominal ledger.

Key differences for IFRS compared with FRS 102

The following IFRS codes are included in the shared FRS 102 chart but are not used for FRS 102:

- Additional codes for non-current assets

- Additional codes for contract costs and assets

- Additional codes for right of use assets (note however that the disclosure of right of use assets is mostly provided through database grid entries)

- Held for sale codes

The following FRS 102 codes are included in the shared chart but are not used for IFRS:

- Amounts written off or released for fixed asset investments

- Codes for negative goodwill

- Short term investments in group companies and own shares

Statutory database

This is broadly compatible with the database for FRS 102 and the user should review the information shown there.

Key differences for IFRS compared with FRS 102

- There is a section in IFRS for new and revised standards.

- There is a section in IFRS for the disclosure of revenue from contracts with customers in accordance with IFRS 15. A similar change to FRS 102 applies for accounting periods starting on or after 1 January 2026, with early adoption available.

- There is a section in IFRS for the disclosure of leased assets in accordance with IFRS 16. A similar change to FRS 102 applies for accounting periods starting on or after 1 January 2026, with early adoption available.

- The deferred taxation information is more detailed than that shown in FRS 102.

New and revised accounting standards

The adoption of new and revised standards requires additional and revised disclosures, in addition to any adjustments to prior year figures and opening balances. These disclosures are triggered as below.

Where early adoption is permitted, this is available to the user (eg see above).

The master pack automatically applies new and revised standards if either the implementation date has been passed (usually based on the period start date) or the user has chosen to early adopt the standard, where permitted.

The master pack permits the user to enter information about the effect of the new standards in a summarised table or a series of free format text paragraphs:

Users can also add text about voluntary changes in accounting policy:

Users can also add text about standards issued but not yet effective:

IFRS 15 Revenue from contracts with customers

Accounting policies

The application of IFRS 15 in 2018 (replacing IAS 11 Construction contracts and IAS 18 Revenue) changed the measurement basis and many of the disclosures involved. The policies section of the IFRS master pack sets out general policy information followed by specific accounting policies for key sources of revenue:

Income statement

The basic split of revenue by type/class is supported by the pack. To this is added:

- For FRS 101, the required split by geographical market.

- For IFRS, an optional split by geographical market or other (user-defined) parameter.

More complex tables or further analysis by text would be added by the user.

Balance sheet

Options and entries are as follows.

- The key disclosure option permits the user to show contract assets and liabilities on the face of the balance sheet.

- Contract balances can be analysed in the contracts note to show material elements.

- The note includes the required analysis of significant changes in balances.

- Construction contracts no longer require specific disclosure, but where these are material to the understanding of the financial statements, the IAS 11 disclosures can be shown.

Option to show on the face of the statement of financial position:

Option to treat all receivables as contract balances:

Alternatively, override to show contract balances when they are not equal to receivables:

Disclosure of other contract balances:

The significant changes in balances are entered in the following grid:

IFRS 16 Leases

Accounting policies

The application of IFRS 16 in 2019 changed the treatment of leases significantly, with many new disclosures. The accounting policies required are however fairly straightforward and the general application of IFRS 16 is provided in the IFRS master pack, for users to amend according to specific application:

Income statement

The disclosure of the cost of leases (ie, interest charged and costs of low-value or short-term leases) is initially governed by entries in the relevant nominal codes. This is then analysed as follows:

Additional information can be disclosed where relevant:

Balance sheet

Options and entries are as follows.

- The balance sheet disclosure (above) option permits the user to show ROU assets as a separate PPE total on the balance sheet.

- The notes disclosure option (below) permits the user to choose between the minimum disclosure and full movements, entered in grids.

The option chosen above will determine whether the user completes a full or partial grid of movements for disclosure.

Deferred tax

In the nominal ledger there are 3 areas that can be posted to:

- 9400-940Z Deferred tax liability balances not offset (one code for each jurisdiction)

- 9410-941Z Deferred tax asset balances not offset (one code for each jurisdiction)

- 9420-944Z Spare codes (currently treated as asset balances)

If balances can be offset, then they should be entered in the same range. For instance, if there is a liability for £300,000 and a separate asset of £100,000 which can be offset, they should be entered (say) as 9400 £300,000 Cr and 9401 £100,000 Dr.

If asset and liability balances cannot be offset and must be disclosed separately under IAS 12, they are entered in the separate asset and liability ranges (eg, in 9400 for the liability and 9410 for the asset).

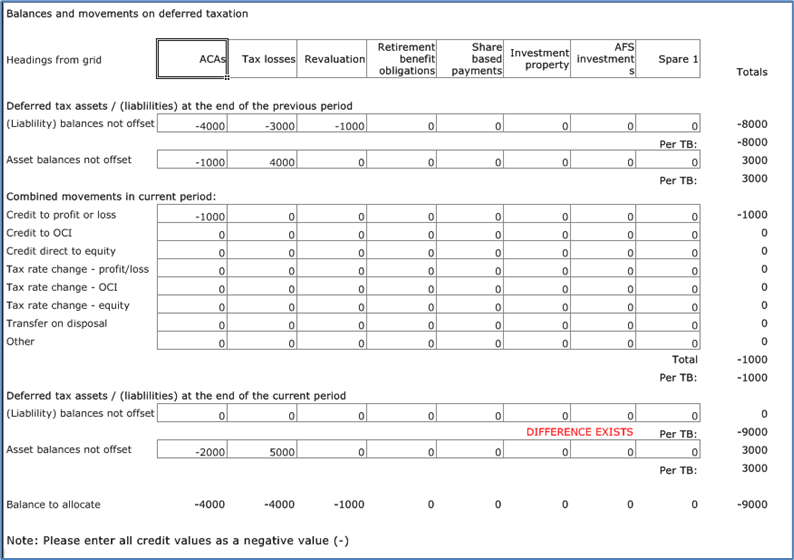

All analysis work is done within the Statutory Database: SOFP Notes>Deferred Tax:

- One grid (Deferred Tax Headings) permits the amendment of the standard category descriptions for the breakdown of the balances and movements (eg ACAs, Tax losses, Revaluations).

- A second grid (Deferred Tax Movements) permits entry of:

- Movements during the year, analysed by category as above and the type of movement (eg Credit to profit and loss, Credit to OCI);

- Closing balances, with separate lines for liabilities and assets. The separate lines should only be used where the balances cannot be offset and must be disclosed separately under IAS 12.

This second grid has checks built in to show differences from the nominal and differences in each category total.

Appendix: FRS 101 Reduced disclosure framework

What is FRS 101 and who can use it?

FRS 101 allows 'qualifying entities' to use the recognition and measurement requirements of IFRS in their individual financial statements without the need to give the entire suite of IFRS disclosures, subject to certain conditions.

A qualifying entity is defined as:

'A member of a group where the parent of that group prepares publicly available consolidated financial statements which are intended to give a true and fair view (of the assets, liabilities, financial position and profit or loss) and that member in included in the consolidation'. [FRS 101 Glossary].

A charity cannot be a qualifying entity for the purposes of FRS 101.

Are there any other conditions that must be met in order to apply FRS 101?

A qualifying entity can take advantage of the disclosure exemptions in FRS 101 in its individual financial statements if it complies with all three of the requirements set out below:

a. Its shareholders have been notified in writing about, and do not object to, the use of the disclosure exemptions. Objections may be served on the entity, in accordance with reasonable specified timeframes and format requirements, by a shareholder that is the entity’s immediate parent, or by a shareholder or shareholders holding in aggregate 5% or more of the entity’s total allotted shares or more than half of the allotted shares in the entity that are not held by the immediate parent.

b. It otherwise applies IFRS as its financial reporting framework, but makes amendments to IFRS requirements where necessary in order to comply with the Companies Acts. These amendments are summarised below.

c. It discloses in the notes to its financial statements:

- a brief narrative summary of the disclosure exemptions adopted; and

- the name of the parent of the group in whose consolidated financial statements its financial statements are consolidated, and from where those financial statements may be obtained. [FRS 101 para 5].

What additional disclosures are required?

Financial statements produced applying FRS 101 are classed as Companies Act accounts rather than IAS accounts. They are therefore required to make additional disclosures required by the Companies Act.

What disclosure exemptions are available?

FRS 101 sets out disclosure exemptions from IFRS for the individual financial statements of subsidiaries (including intermediate parents) and ultimate parents that otherwise apply the requirements of IFRS and that meet the conditions for exemption.[FRS 101 para 5].

The exemptions are summarised below. Some of these require that equivalent disclosures are included in the publicly available consolidated financial statements of the group in which the entity is consolidated. The exemptions set out in FRS 101 paras 7 and 8 cover some of the disclosures required by the following standards:

- IFRS 2 – certain disclosures for share based payment arrangements in a subsidiary’s financial statements, using equity instruments of another group entity; and in an ultimate parent’s separate financial statements, using its own equity instruments.

- IFRS 3 – certain disclosures for acquisitions of unincorporated businesses.

- IFRS 5 – requirement to present cash flows relating to discontinued operations.

- IFRS 15 - (114 & 115) the requirement to disaggregate income; (118) the requirement to explain significant changes in balances; (119 a-c and 102-127) the requirement to disclose certain information about performance obligations and transaction pricing.

- IAS 1 – the requirement to present a balance sheet as at the beginning of the preceding period if there is a prior year adjustment.

- IAS 7 – a cash flow statement is not required.

- IAS 8 – for disclosures in respect of new standards and interpretations that have been issued but which are not yet effective.

- IAS 24 – for disclosure of key management personnel compensation, and for related party transactions entered into between two or more members of a group, provided that any subsidiary that is party to the transaction is wholly owned by such a member.

- IAS 36 – certain disclosures in respect of cash generating units.

FRS 101 also provides exemptions from the requirement to present comparatives in various roll-forward reconciliations, including movements in share capital (IAS 1), PP&E (IAS 16), intangible assets (IAS 38), investment property (IAS 40), and biological assets (IAS 41).

Qualifying entities that are not financial institutions, may also avail of exemption from some of the disclosure requirements of IFRS 7 Financial instruments, IFRS 13 Fair value (to the extent that they apply to financial instruments) and the capital risk management disclosures set out in paragraphs 134 to 136 of IAS 1.

Companies continue to be required to provide those disclosures set out in company law, relating to financial instruments held at fair value, including derivatives.