FRS 105 User Guide

FRS 105 Master Pack

Shared features

This FRS 105 master pack is largely based on the standard FRS 102 limited company pack, providing users with a continuation of the same approach, including compatible nominal ledger codings. Users should be familiar with that pack and refer to it for more details about features shared with that pack.

Note: MP 37 does not include changes relating to the 2024 Periodic Review, which applies for periods commencing on or after 1 January 2026. Early adoption will be available in later master packs.

Overview

FRS 105 “THE FINANCIAL REPORTING STANDARD APPLICABLE TO THE MICRO-ENTITIES REGIME” is a financial reporting standard for companies eligible to apply the Micro-entities Regime set out in UK Company Law, effective for periods beginning on or after 1 January 2016. It is based on FRS 102, but the Financial Reporting Council has adapted it significantly to satisfy the legal requirements and to reflect the simpler nature and smaller size of micro-entities.

Some of the most significant differences between FRS 105 and FRS 102 are:

- Micro-entities are only required to prepare a balance sheet and profit and loss account; they do not prepare the other primary statements required for larger companies.

- No assets can be measured at fair value or a revalued amount.

- No deferred tax or equity-settled share-based payments are recognised.

- All of the accounting policy choices set out in FRS 102 are removed.

- Micro-entities' accounts are only required to provide very limited disclosures and are presumed to give a true and fair view by doing so.

Eligibility criteria

Different criteria apply in the UK and the Republic of Ireland as set out below:

United Kingdom

FRS 105 may be applied by companies that satisfy at least two of the following three requirements in relation to a financial year:

- Turnover: Not more than £632,000 (pro-rated appropriately where a company’s year is shorter or longer than a calendar year)

- Balance sheet total (ie gross assets): Not more than £316,000

- Average number of employees: Not more than 10

A company must meet at least two of these limits in two consecutive years to qualify as a micro-entity and, once qualified, must exceed at least two of these limits for two consecutive years to cease to qualify.

Certain types of company, such as charitable companies and parent companies that are required or choose to prepare consolidated financial statements, are excluded from the micro-entity regime and therefore cannot apply FRS 105. A subsidiary of an FRS 102 Parent Company may not use FRS 105.

Republic of Ireland

A micro company must satisfy 2 out of 3 conditions:-

- Turnover: Not more than €700,000 (€900,000 from 1 July 2024, or 1 July 2023 by early adoption)

- Balance sheet total (ie gross assets): Not more than €350,000 (€450,000 from 1 July 2024, or 1 July 2023 by early adoption)

- Average number of employees : Not more than 10

A company must meet at least two of these limits in two consecutive years to qualify as a micro-entity and, once qualified, must exceed at least two of these limits for two consecutive years to cease to qualify.

Certain types of company, such as charitable companies and parent companies that are required or choose to prepare consolidated financial statements, are excluded from the micro-entity regime and therefore cannot apply FRS 105. A subsidiary of an FRS 102 Parent Company may not use FRS 105.

iXBRL Tagging

UK: The FRS 105 pack can be used for iXBRL tagging and once the accounts are loaded into CCH Review & Tag, you should not need to apply any additional manual tagging.

Republic of Ireland: Tagging in Ireland for FRS 105 is not supported.

Tax Link : This pack contains the link to share balances with CCH Corporation Tax, via the Tax Link screen.

Creating an FRS 105 accounting period

There are 4 ways to create an FRS 105 accounting period:

- Create a new client in CCH Central.

- Add an accounting period to an existing Client.

- Convert an existing UK GAAP period to FRS 105 during the year end process.

- Convert an existing FRS 102 period to FRS 105 during the year end process.

Create new client in CCH Central

When setting up an FRS 105 Client, in the Create Client Wizard Main Details tab, the Contact Type is Limited. In the Accounts tab, the options to choose are under Type, select Company and under Entity please select Limited (FRS 105).

Create FRS 105 accounting period for an existing client

Open the Client and select the Accounts Production tab, click in the grid to create a new accounting period:

Type: select "Company".

Entity: select "Limited (FRS 105)". Set other fields as required and click OK.

Double-click the accounting period row on the grid to load the accounts production screen.

Convert an existing UK GAAP or IE GAAP job to FRS 105

If you have an existing accounting period using the UK GAAP or IE GAAP limited company master pack, during the year end process you can convert this to use the FRS 105 master pack.

- In step 1 Select the option to “Adopt FRS 102/105/IFRS now”.

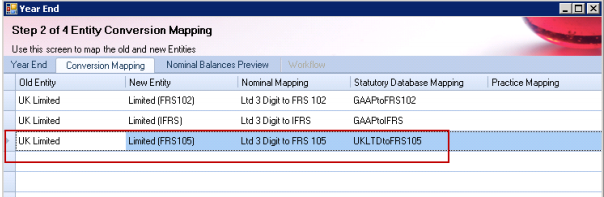

- In step 2 Select the row for FRS 105:

- In step 3 verify the nominal code mapping and make any adjustments necessary.

- Click Finish.

The new accounting period created will use FRS 105. You can convert any existing job to FRS 105, the job does not have to have “Micro-entity” selected already. You will need to ensure the job is eligible to apply FRS 105 (see criteria on page 2). You have the ability to convert from FRS 105 to FRS 102 and vice versa, for occasions when the company moves above/below the micro thresholds.

Transition adjustments on the first application of FRS 105

There may (rarely) be transitional changes when moving to FRS 105. The transition date will normally be the opening day of the prior year. The effects of the changes do not need to be disclosed in the financial statements or the notes and there is no reconciliation to the previous balances. The financial statements are produced as if the new accounting basis had always applied.

Where transition adjustments are required, the user should do this by entering ordinary journals as required in the current, comparative and pre-comparative periods to restate: the closing balances of the pre-comparative period;

- the opening balances of the comparative;

- the closing balances of the comparative;

- the opening balances of the current year.

Note: that there may be tax restatements arising from the changes, and the tax computations will need to be revisited.

Nominal ledger

The nominal ledger for FRS 105 is based on the 4 digit FRS 102 chart of accounts, modified to cater for the different requirements of FRS 105.

The nominal chart has the following key identifiers:

- Code ranges that group similar items together

- Descriptions that enable the user to understand the posting

- Category information which identifies where a posting will end up in the financial statements

The nominal chart is searchable both by browsing through codes and by entering text, and displays the 3 identifiers above, in data entry and information screens. Therefore, the entry of information is normally straightforward.

Statutory database

UK

The following information and options are shown:

- General information

- Professional accountancy body - Choosing the relevant body will give accountancy/audit report text customised to that body's specific requirements.

- Employees – This field is used as part of the size calculation and also for the required disclosure of average employees.

- Size and audit – The node is a guide to give an indication of the size of the entity for statutory purposes. This node is for information purposes only and will not affect any of the data settings or selections.

- Client preferences:

- Defective financial statements - This enables the user to submit revised financial statements. See the FRS 102 master pack guide for further information.

- Signature lines - Option to continue to show signature lines after the signing dates have been entered.

- Submitting these accounts via iXBRL – Additional information fields required for electronic filing at HMRC.

- Compliance terminology - Permits the user to override the default practice settings and use either Companies Act or IFRS terminology.

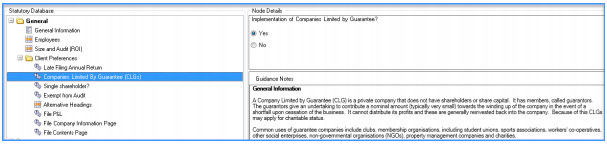

- Companies limited by guarantee (CLGs) – Option to tailor the client to become a CLG and use the appropriate terminology etc.

- Single shareholder – Option to tailor accounts and refer to member/shareholder where appropriate.

- Exempt from audit – Option to trigger an audit for the client if required.

- Directors' report options - Option to include a directors' report and (if so) whether to include it in the filing copy.

- Filing options:

- File profit and loss account (UK) - Option to include the profit & loss account in the filing copy (this will also cause the inclusion of the audit report, if existing)/

- File company information page – This allows users to specify if they wish to include the Company Information page in the filing copy.

- File contents page – Will include this page in the filing copy.

- File accountants' report - Will include this page in the filing copy.

Accountants report: As per FRS 102.

Auditors report: This option has been added primarily for Republic of Ireland users, as under ROI legislation they are required to perform an audit for two years if they are late filing the company’s annual return. Although an audit on FRS 105 will be considered extremely rare for our UK users, there are some scenarios where either the members of the company request an audit or legislation requires this option.

Balance sheet

Within the balance sheet parent node, the following options are provided:

- Format 2 presentation - A choice to use Format 2 instead of Format 1.

- Keep balance sheet statements as one block - Allows users to keep the balance sheet statements and sign off as one block (If 'no', then the statements are permitted to start on one page and continue on the other).

- Prior period errors – This allows users to specify if prior period adjustments were made and if so it will trigger the message ‘as restated’ above the prior period figures.

The following information is shown in paragraphs, where appropriate:

- Company information paragraph

- Statement that company is dormant

- Audit exemption statement

- Directors’ responsibilities statement

- Members not requiring an audit statement

- Statement of preparation in accordance with requirements

Accounting policies: Not relevant to UK. For ROI, these policies are generally simpler versions of the FRS 102 policies.

Notes to the financial statements: The following information is required for the UK:

- Reporting period length (optional - would normally be used only where the period end has changed)

- Directors' benefits, loans, credits and guarantees

- Guarantees, contingencies and other financial commitments

- Average number of employees

- Off-balance sheet arrangements

- Auditors' ethical standards (ES-PASE)

- Other notes (optional - no others are required)

- Supplementary note for revised financial statements

The notes to the accounts are required to be included "at the foot of the balance sheet". For the UK, this is interpreted as appearing before the sign-off, apart from the "supplementary note" for revised financial statements.

Where the accounts contain an item of information additional to the micro entity minimum accounting items, regard must be had to any provision of an accounting standard which relates to that item. Usually, this would mean that the disclosure requirements of FRS 102 apply.

Republic of Ireland

The choices are as for the UK (see above) but with the following additions:

Client preferences

- Late filing of annual return – Prompt to remind users they need to perform an audit if late filing the annual return

Balance sheet

- Small companies abridged statement

Accounting policies - These are simplified compared with those in FRS 102.

Notes to the financial statements

- Departure from accounting principles

- Prior year adjustment

- Goodwill amortisation

- Impairment of financial assets, tangible, intangible fixed assets

- Holding of own shares/holding company shares

- Movement on profit and loss reserves

The Companies (Accounting) Act 2017 is more specific about the information required for guarantees and commitments, and this is therefore split out in the notes:

- Secured creditors

- Other charges on assets

- Guarantees and other financial commitments

- Retirement benefits commitments

- Amounts relating to group companies

- Capital commitments

Disclosure guidance notes related to the above are included in the statutory database, with extracts from the relevant regulations.

Financial statements options

Period dates

The requirements of FRS 105 are:

3.13 A micro-entity shall clearly identify each of the financial statements and the notes. In addition, a micro-entity shall display the following information prominently, and repeat it when necessary for an understanding of the information presented:

(b) the date of the end of the reporting period and the period covered by the financial statements

The requirements of FRS 105 with regard to dates and period will normally be met by the identification of the period end(s) in column headings, page headings and lines that reference the dates or period. Where the period end changes, the column headings will automatically add the day and month above the year. (See FRS 102 user guide for more information).

However, where this is not sufficiently clear (eg where this is a first period), there is a specific paragraph which can be chosen and amended to give the required information.

"Accounts" vs "Financial statements"

The default description used in this pack is "financial statements" and this has been used in the formats. However, the wording can be changed throughout by changing the default for "#aw3" in the system "Maintenance" menu, within "Word items".

Filing copy

The ‘filing copy’ for filing with the Registrar can be obtained in AP by selecting ‘Filing Copy’ within the Print Selection drop down on the Financial Statements screen:

By default, the following are excluded:

- The directors' report, if prepared.

- The profit and loss account. Where the profit and loss account has been excluded, the audit report is also excluded. Note that for micro-entities, when the audit report is excluded there is no requirement to refer to it within a note to the financial statements.

- The company information page.

- The contents page.

For all the above, there are option flags set up that permit the user to include them. Note that if the profit and loss account is included, the audit report (if applicable) will be included as well.

Profit and loss account

The profit and loss account format is set out within legislation and FRS 105. It follows a similar layout to the small companies profit and loss format 2, simplified by grouping amounts and omitting subtotals.

Balance sheet

There are two balance sheet formats set out within legislation and FRS 105 and users can choose between format 1 and format 2, both of which are simplified versions of the small companies formats. As previously stated, the notes to the accounts are required to be included at the foot of the Balance Sheet.

Other information

- In the management collection, there is a detailed profit and loss format, based on the micro entity layout. Most of the management pages can be set to print/not print within the management collection section of the statutory database.

- An exception report is included in the main collection.

- A set of lead schedule formats have been included in the lead schedule collection.

Appendix A – Farm FRS 105 Companies

Master Pack 5.00 and above includes support for Farm FRS 105 limited companies. Farm accounts can be produced using the additional features within the normal FRS105 Limited master pack. (Farms are no longer a separate entity like they were under old ukgaap). The Farm option is available by default within the FRS105 pack, if you wish to hide it (to prevent accidental usage for example), you may do so by setting the Configuration Key shown below to a value of 0;

AccountsShowLimitedFarmFRS105Entity

The focus of this release is to provide compliant FRS 105 farm statutory accounts. CCH Accounts Production does not yet have the functionality to produce detailed farm specific management accounts. This is something we are looking to support in a future release.

Limitations

The following items are not yet supported:

- Harvest accounts

- Quantities reporting

- The ability to convert from farm FRS 102 to farm FRS 105 and vice versa, for occasions when the company moves above/below the micro thresholds.

Create new farm client in CCH Central

When setting up a Farm FRS 105 Client, in the Create Client Wizard Main Details tab, the Contact Type is Limited, same as standard limited company. In the Accounts tab, the options to choose are under Type, select Company and under Entity please select Limited (FRS 105) and under Chart select Limited Farm (FRS 105).

Note: there is a pop up warning message circled in red below to remind users to choose the farm chart of accounts.

Create FRS 105 farm accounting period for an existing client

Open the Client and select the Accounts Production tab, click in the grid to create a new accounting period:

Type: select "Company". Entity: select "Limited (FRS 105)".

Chart: select "Limited Farm (FRS 105)" (Note: tooltip message appears to remind user to choose the farm chart).

Set other fields as required and click OK.

Double-click the accounting period row on the grid to load the accounts production screen.

Additional features for farm clients

Farm specific requirements have been incorporated within the existing FRS 105 standard limited pack to enable the production of compliant FRS 105 Limited Farm accounts. By selecting the farm chart of accounts on accounting period creation you are activating a hidden flag called #farm1, we use this flag in various places to trigger rows, formats or statutory database items to appearing if the Client is a farm.

Nominal ledger

The chart of accounts for Farms FRS 105 is completely new and does not resemble the old UK GAAP 3 or 4 digit Farm charts. It has been based on the existing limited FRS 105 Chart of Accounts but it has been substantially revised to incorporate the disclosures required for farming. Broadly speaking we have made use of sub-codes to enhance the chart to provide the detail required for recording farm specific transactions. The main changes have been applied to the following sections:

- Revenue (0010 to 0499)

- Cost of sales (0500 to 0999)

- Biological assets (FRS 105 6650 to 6669/FRS 102 6650 to 6679)

- Stocks/Inventories (7000 to 7099)

For example, Revenue has been divided into groupings with sub-coded further analysis:

- Revenue - sales of livestock (main code 0010)

- Revenue - sales of livestock (main code 0010)

- Livestock – Dairy (subcode – 01)

- Livestock – Beef (subcode – 02)

- Livestock – Sheep (subcode – 03)

- Etc

- Revenue - agricultural harvested produce (main code 0015)

- Milk (subcode – 01)

- Etc

- Revenue - arable (main code 0020)

- Wheat (subcode – 01)

- Etc

- Revenue – food crops (main code 0030)

- Potatoes

- Etc

- Revenue – feed crops (main code 0040)

- Hay

- Etc

To review the new Farm chart of accounts in more detail you may prefer to export to Excel. Once you have created a Farm FRS 105 accounting period, navigate to Chart of Accounts and click on the Export to Excel option.

Note: No chart design can be perfect for all possible farm businesses. In some cases you may find it more efficient to amend the default Farm chart descriptions to provide a better fit for your individual clients.

Nominal mappings

For those users converting existing accounting periods from UK GAAP “UK Limited Farm” to FRS105 farms, a nominal mapping has been provided. This minimises the need to re-key any Trial Balance data. A copy of this nominal mapping may be viewed from the Maintenance menu within CCH Accounts Production. Navigate to Maintenance > Accounts > Import/Export Definition then choose Nominal Mappings. Then perform the following steps:

1. Select - Entity Limited (FRS105)

2. Select - Chart – Limited Farm (FRS105)

3. Select - Edit System Mapping file (radio button at top of screen)

4. Mapping name – click in drop down menu and choose 3 digit/4 digit chart

5. Click on Export.

If needed, the default nominal mapping can be amended. You may wish to do this if it makes converting existing farm jobs more efficient.

Rounding account: As we have new farm chart of accounts and the main revenue accounts have been sub-coded, this could have an impact on the profit and loss account in terms of rounding. The default rounding account for our Farm chart has been changed to: 001001 – Revenue – sales of livestock - Livestock Dairy

Important note: We strongly recommend you change this rounding account to another more appropriate “Revenue” account, if the farm’s main business is not dairy farming. This is typically the nominal account where you post your main source of income, but you may decide to write off any differences on profit and loss rounding to say sundry expenses eg 3890.

To change the P&L Rounding Account:

1. select Chart of Accounts

2. select Rounding and Suspense

3. select P&L Rounding Account Change the nominal code by typing the account code or using the dropdown selection.

Warning: Take care NOT to change the P&L Close Off account, as this is the account where all the profit and loss nominal accounts close off to at year end. This should remain as 9900 Retained Profit for most users and should only be changed if you have a completely bespoke chart of accounts that you have created yourself.

Quantities

The master pack for farms does not support detailed management information. It is our intention to provide more comprehensive analysis in a future release and we will look to enhance the product with some statutory database grids to support recording of top level quantity/yield information.

It is possible to record quantity balances as part of the journal entry process in CCH Accounts Production. The quantity data can then be viewed in the trial balance screen, on reports and presented on the face of formats if required. However our standard formats do not contain the formula to present this information, the user would be required to edit the format and add the commands as shown below:

=APQTY("a,001001") This will display the current accounting period quantity balance for nominal code 001001 RevenueLivestock - Dairy.

=APQTY("[a,*TOTREV]")

This will display the current accounting period quantity balance for name range TOTREV.

=APQTYCODE("[*TOTREV],S,a,-1,0,ab")

This will display a list of all the current year quantity balances for nominal codes within name range TOTREV, which have activity in the current or comparative periods. By deleting the "S" parameter, individual sub code balances will be combined into their parent nominal code.

Quantity data is also available from a Saved Trial Balance, using the above commands but substituting the period reference “a” for the specific User Defined Reference (g to z) assigned to the Saved Trial Balance. For more detail on Support for “Quantity data” please see item 57234 in the 2014.1 release notes.

Options in the statutory database under Management Schedules

As FRS 105 has no statutory requirement for notes, there are no farm options within the statutory section of the pack. However, there are user choices for the management section.

- Users can choose to show the Enterprise version of the farm accounts, analysed by activity. If this option is not chosen, the user will see the standard management accounts, but with a breakdown of costs of sales between stock movements, purchases, direct costs and other cost of sales.

- Users can add or amend various descriptions used in the trading account.

Formats

The format collection is shared with the non-Farm FRS 105 Limited entities, with the addition in the management collection of Farm enterprise management accounts.

Producers of farm enterprise accounts can apply their own analysis to sales and direct costs, and therefore can prepare a detailed profit and loss account which reflects that analysis, either in summary or analysed by enterprise (ie activity). An example of the latter follows:

Enterprise analysis

This analysis uses up to 10 enterprises defined in the nominal chart, as in the following example for purchases:

0600 Purchase of livestock

0605 Transfers between herd and livestock

0610 Purchases - Enterprise 1

0620 Purchases - Enterprise 2

0630 Purchases - Enterprise 3

0640 Purchases - Enterprise 4

0650 Purchases - Arable (excludes seeds and other inputs)

0660 Purchases - Enterprise 6

0670 Purchases - Enterprise 7

0680 Purchases - Enterprise 8

0690 Purchases - Enterprise 9

These codes are subcoded, eg for 0600:

060001 Purchase of livestock - dairy

060002 Purchase of livestock - beef

060003 Purchase of livestock - sheep

060004 Purchase of livestock - pigs

060005 Purchase of livestock - poultry

060099 Purchase of livestock – other

This arrangement permits users to analyse income and direct costs in a variety of ways:

- For many farms, there is a logical split between Livestock (0600-0609 codes), Arable (0650- 0659) and Other (0690-0699). The chart assumes this split and the relevant codes are prepopulated with common subcodes for those Enterprises.

- Some farms may wish to analyse costs and income further. For instance, Livestock might be split between Dairy and Sheep. In that case, 0600-0609 could be used for Dairy while 0610- 0619 is used for Sheep. The appropriate subcodes (01-99) would be set up under 0610 etc.

- Arable might be split into (say) Wheat and Barley, or split by harvest.

Important characteristics of the coding structure where applied to enterprise accounting

Descriptions: The management accounts pick up the code and subcode descriptions directly from the nominal chart. Therefore the user can customise the chart to match the characteristics of each Enterprise for each farm.

Income: The general structure follows the 9 Enterprises plus 'other farm income' and the chart has extensive coding already set up.

- 0010-0019 Livestock

- 0020-0049 Arable

- 0050-0059 Other income, included as Enterprise 9

- 0061-0069 Income for each of the other Enterprises (eg 0061 is for Enterprise 1 and users would add subcodes to 0061 to analyse that income)

- 0070-0109 Reserved for future use

- 0110-0449 Other farm income (shown after the Enterprise margins)

- 0450 Transfers to herd and flocks treated as livestock income

- 0451-0499 Reserved for future use

Costs:

- 0500-0599 Stocks

- 0600-0699 Purchases and transfers (mainly applying to livestock)

- 0700-0799 Direct costs

- 0800-0899 Wages allocated to Enterprises

- 0900-0989 Reserved for future use

- 0990-0999 Direct costs not allocated to specific Enterprises

Stocks 0500-0599: The appropriate treatment of inventories in the accounts depends on the characteristics of the specific Enterprise. Livestock inventory movements in some cases (but not all) would be regarded as an adjustment against purchases/cost of sales, whereas Arable inventories would normally be part of the 'output'. For the Enterprise accounts, there are three options based on postings as in the following example for livestock:

- 0500 Opening livestock (as separate adjustment)

- 0501 Opening livestock (adjusts sales)

- 0502 Opening livestock (adjusts purchases)

- 0503 DO NOT USE 0503-0504

- 0505 Closing livestock (as separate adjustment)

- 0506 Closing livestock (adjusts sales)

- 0507 Closing livestock (adjusts purchases)

- 0508 DO NOT USE 0508-0509

0500 & 0505 Stocks c/fwd and c/fwd are shown as a separate pair of rows after sales and before purchases.

0501 & 0506 will adjust sales in the enterprise accounts.

0502 & 0507 will adjust purchases.

Note: the stock codes can be sub-coded if desired.

Transfers 0605-0609: These do not distinguish between transfers in and out, but if the user wishes to show both (rather than just the net figure), the subcodes can be amended or extended to do this.

Note: 0450 is set aside specifically for any transfers to herd/flock that the user wishes to treat as income.

Direct costs 0700-0799: There are standard subcodes set up for Livestock and Arable, but users will normally amend and extend these to reflect the farm’s characteristics.

Wages 0800-0899: These are provided so that wages can be allocated from elsewhere in the chart to the Enterprises. These codes are not subcoded by default but the user can extend them with subcodes (eg to distinguish between wages and subcontract).

Unallocated direct costs 0990-0999: These subcoded items are provided in case users wish to distinguish between direct costs (or variable costs, or shared costs – the description can be amended) and other unallocated costs of sales. There is no need to use these codes unless this distinction is relevant, and any costs not transferred here from cost of sales will be shown in the trading account as a separate line after unallocated direct costs.

Cost of sales 1000-1999: These are treated in the accounts in the same way as non-farm cost of sales.

Appendix B – Audit reporting for FRS 105

Similar to FRS 102, in order to trigger the audit section, the user must select the appropriate option in the statutory database:

Note: An FRS 105 client will default to Accountants Report

Republic of Ireland users: If the country of registration is Republic or Ireland, Ireland or Eire a “Late Filing Annual Return” (#cd195) question is shown under Client Preferences.

If a company is late filing the annual return, it is required to perform an Audit for the next 2 years. If this question is answered 'yes' and the user does not choose the option to include an audit report, a warning will be shown in the Home page Errors and Exceptions summary:

Filing options

UK companies affected by audit: Under UK legislation, if the profit and loss account is not filed at Companies House, then an audit report does not need to be filed. If you select 'No' to the question "File P&L and Audit Report" (#micro2), then a note on the balance sheet regarding the audit information and opinion will be disclosed instead.

ROI companies: ROI users have an Abridged Audit Report, with separate fields in the Statutory Database similar to the FRS 102 ROI Abridged Audit Report.

Appendix C – Companies limited by guarantee (CLGs)

A Company Limited by Guarantee (CLG) is a private company that does not have shareholders or share capital. It has members, called guarantors. The guarantors give an undertaking to contribute a nominal amount (typically very small) towards the winding up of the company in the event of a shortfall upon cessation of business. It cannot distribute its profits and these are generally reinvested back into the company. Because of this CLGs may apply for charitable status. Common uses of guarantee companies include clubs, membership organisations, including student unions, sports associations, workers’ co-operatives, other social enterprises, nongovernmental organisations (NGOs), charities and property management companies.

Key points

The key differences between a Company Limited by Guarantee and a normal Limited Company are as follows:

- Most companies that are guaranteed do not trade for profit; therefore you refer to the Income and Expenditure Account rather than Profit and Loss Account. Terms such as surplus/deficit are used rather than profit or loss.

- No share capital will appear on the Balance Sheet or within the notes. Since the company has no shareholders, the reconciliation of movements in shareholders’ funds is not required.

- A Members' liability note is disclosed.

- CLG's are both applicable to the UK and Republic of Ireland.

- The application does not support CLG’s for Charities.

Statutory database

Implementing Companies Limited by Guarantee: To implement CLGs, within the statutory database access, there is an option to select whether the accounting period is a company limited by guarantee (CLG). To implement CLGs (Statutory Database Item #clg1), within the statutory database access; General > Client Preferences > Companies Limited by Guarantee (CLGs):

We have updated the Contents, Profit and Loss and Balance sheet formats to refer to CLG terminology i.e. ‘Income and Expenditure’ rather than Profit and loss and ‘Reserves’ rather than Capital and Reserves.

In addition we have edited various paragraphs to refer to Income and Expenditure, Companies Limited by Guarantee and used new statutory database items #profit and #loss to automatically refer to surplus and deficit rather than profit and loss.

Additional disclosures for Republic of Ireland

Republic of Ireland users have to produce notes to their FRS 105 accounts, so we have implemented some changes to support CLG, mostly wording changes to accounting policies. Conversion of existing CLG jobs in CCH Accounts Production (VAP) Sites in Ireland may already have CLG jobs set up in VAP. These may be converted into CCH Accounts Production in the normal way, but after converting you must remember to go into the Statutory Database and re-select the CLG option, as described above.

Note: CLG will be visible to all users for FRS 105. However for FSR 102 this option is separately licensed and if you wish to use it you should ensure your current license agreement permits you to use them. If you are unsure, or if you have not purchased these master packs, please contact your Account Manager prior to using them. If you create an accounting period using a master pack for which you are not licensed, a message similar to that shown below will be displayed: