FRS 102 ROI S1A

CCH ROI 102 SECTION 1A LIMITED - ANNUAL REPORT AND FINANCIAL STATEMENTS - FOR THE YEAR ENDED 31 DECEMBER 2016

Company Information

|

Directors Company number |

Ms Example Director Mr Example Director Mr Example Director 2334456 2000 Oldsmar Boulevard Dublin Republic of Ireland Airport Drive Dublin Republic of Ireland |

DIRECTORS' REPORT FOR THE YEAR ENDED 31 DECEMBER 2016

The directors present their annual report and financial statements for the year ended 31 December 2016.

Principal activities: The principal activity of the company continued to be that of [XXXX]

Directors and secretary:The directors who held office during the year and up to the date of signature of the financial statements were as follows:

| Ms Example Director Mr Example Director |

Results and dividends: The results for the year are set out below.

Ordinary dividends were paid amounting to €140,000. The directors do not recommend payment of a further dividend.

No preference dividends were paid.

Directors' and secretary's interests: The directors' and secretary's interests in the shares of the company were as stated below:

Supplier payment policy: The directors acknowledge their responsibility for ensuring compliance, in all material respects, with the provisions of the European Communities (Late Payment in Commercial Transactions) Regulations 2012. Procedures have been implemented to identify the dates upon which invoices fall due for payment and to ensure that payments are made by such dates. Such procedures provide reasonable assurance against material noncompliance with the Regulations. The payment policy during the year under review was to comply with the requirements of the Regulations.

Accounting records

The company's directors are aware of their responsibilities, under sections 281 to 285 of the Companies Act 2014 as to whether in their opinion, the accounting records of the company are sufficient to permit the financial statements to be readily and properly audited and are discharging their responsibility by:

- employing qualified and/or experienced staff, and/or

- ensuring that sufficient company resources are available for the task, and/or

- liaising with the company's auditors/accountants /seeking external professional accounting advice.

- location of computer servers.

- arrangements to guard against falsification of the records.

*The accounting records are held at the company's 'business premises, . /registered office, 2000 Oldsmar Boulevard, Dublin, Republic of Ireland'.

Auditor: In accordance with Section 383(2) of the Companies Act 2014, the auditors, Insert Name, will continue in office.

Statement of disclosure to auditor

Each of the directors in office at the date of approval of this annual report confirms that:

- so far as the director is aware, there is no relevant audit information of which the company's auditor is unaware, and

- the director has taken all the steps that he / she ought to have taken as a director in order to make himself / herself aware of any relevant audit information and to establish that the company's auditor is aware of that information.

This confirmation is given and should be interpreted in accordance with the provisions of section 330 of the Companies Act 2014. The entity has availed of the small companies exemption contained in the Companies Act 2014 with regard to the requirements for exclusion of certain information in the Directors' report.

By order of the board

Mr Example Director

Secretary

22 June 2017

DIRECTORS' RESPONSIBILITIES STATEMENT FOR THE YEAR ENDED 31 DECEMBER 2016

The directors are responsible for preparing the Directors' Report and the financial statements in accordance with applicable Irish law and regulations.

Irish company law requires the directors to prepare financial statements for each financial year. Under that law, the directors have elected to prepare the financial statements in accordance with Companies Act 2014 and FRS 102 The Financial Reporting Standard applicable in the UK and Republic of Ireland (Generally accepted Accounting Practice in Ireland) issued by the Financial Reporting Council. Under company law, the directors must not approve the financial statements unless they are satisfied that they give a true and fair view of the assets, liabilities and financial position of the company as at the financial year end date and of the profit or loss of the company for that financial year and otherwise comply with the Companies Act 2014.

In preparing these financial statements, the directors are required to:

- select suitable accounting policies for the company financial statements and then apply them consistently;

- make judgements and estimates that are reasonable and prudent;

- state whether the financial statements have been prepared in accordance with applicable accounting standards, identify those standards, and note the effect and the reasons for any material departure from those standards; and

- prepare the financial statements on the going concern basis unless it is inappropriate to presume that the company will continue in business.

The directors are responsible for ensuring that the company keeps or causes to be kept adequate accounting records which correctly explain and record the transactions of the company, enable at any time the assets, liabilities, financial position and profit or loss of the company to be determined with reasonable accuracy, enable them to ensure that the financial statements and Directors' Report comply with the Companies Act 2014 and enable the financial statements to be audited. They are also responsible for safeguarding the assets of the company and hence for taking reasonable steps for the prevention and detection of fraud and other irregularities.

By order of the board

Mr Example Director

Secretary

22 June 2017

INDEPENDENT AUDITOR'S REPORT TO THE MEMBERS OF CCH ROI 102 SECTION 1A LIMITED

We have audited the financial statements of CCH ROI 102 SECTION 1A LIMITED for the year ended 31 December 2016 which comprise the Profit And Loss Account, the Balance Sheet and the related notes. The relevant financial reporting framework that has been applied in their preparation is the Companies Act 2014 and FRS 102 The Financial Reporting Standard applicable in the UK and Republic of Ireland issued by the Financial Reporting Council.

This report is made solely to the company’s members, as a body, in accordance with section 391 of the Companies Act 2014. Our audit work has been undertaken so that we might state to the company’s members those matters we are required to state to them in an auditor's report and for no other purpose. To the fullest extent permitted by law, we do not accept or assume responsibility to anyone other than the company and the company’s members as a body, for our audit work, for this report, or for the opinions we have formed.

Respective responsibilities of directors and auditor

As explained more fully in the Directors' Responsibilities Statement, the directors are responsible for the preparation of the financial statements and for being satisfied that they give a true and fair view and otherwise comply with the Companies Act 2014. Our responsibility is to audit and express an opinion on the financial statements in accordance with Irish law and International Standards on Auditing (UK and Ireland). Those standards require us to comply with the Auditing Practices Board's Ethical Standards for Auditors.

Scope of the audit of the financial statements

An audit involves obtaining evidence about the amounts and disclosures in the financial statements sufficient to give reasonable assurance that the financial statements are free from material misstatement, whether caused by fraud or error. This includes an assessment of: whether the accounting policies are appropriate to the company's circumstances and have been consistently applied and adequately disclosed; the reasonableness of significant accounting estimates made by the directors; and the overall presentation of the financial statements. In addition, we read all the financial and non-financial information in the annual report to identify material inconsistencies with the audited financial statements and to identify any information that is apparently materially incorrect based on, or materially inconsistent with, the knowledge acquired by us in the course of performing the audit. If we become aware of any apparent material misstatements or inconsistencies we consider the implications for our report.

Opinion on financial statements

In our opinion the financial statements:

- give a true and fair view of the state of the assets, liabilities and financial position of the company as at 31 December 2016 and of its profit for the year then ended; and

- have been properly prepared in accordance with FRS 102 The Financial Reporting Standard applicable in the UK and Republic of Ireland issued by the Financial Reporting Council and, in particular, the requirements of the Companies Act 2014.

Matters on which we are required to report by the Companies Act 2014

- We have obtained all the information and explanations which we consider necessary for the purposes of our audit.

- In our opinion the accounting records of the company were sufficient to permit the financial statements to be readily and properly audited.

- The financial statements are in agreement with the accounting records.

- In our opinion the information given in the Directors’ Report is consistent with the financial statements.

Matters on which we are required to report by exception

We have nothing to report in respect of our obligation under the Companies Act 2014 to report to you if, in our opinion, the disclosures of director's remuneration and transactions specified by sections 305 to 312 of the Act are not made.

| CCH (Statutory Auditor) for and on behalf of Example Accountancy Firm LLP Chartered Accountants Statutory Auditor |

28 June 2017 Airport Drive, Dublin, Republic of Ireland |

PROFIT AND LOSS ACCOUNT FOR THE YEAR ENDED 31 DECEMBER 2016

BALANCE SHEET AS AT 31 DECEMBER 2016

These financial statements have been prepared in accordance with the provisions applicable to companies subject to the small companies' regime and in accordance with Financial Reporting Statement 102 ‘The Financial Statement Reporting Standard applicable in the UK and Republic of Ireland’.

The financial statements were approved by the board of directors and authorised for issue on 22 June 2017 and are signed on its behalf by:

| Ms Example Director Director |

Mr Example Director Director |

NOTES TO THE FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 DECEMBER 2016

Accounting policies

Company information

CCH ROI 102 SECTION 1A LIMITED is a limited company domiciled and incorporated in Republic of Ireland. The registered office is 2000 Oldsmar Boulevard, Dublin, Republic of Ireland and it's company registration number is 2334456

Accounting convention: These financial statements have been prepared in accordance with FRS 105 'The Financial Reporting Standard applicable to the Micro-Entities Regime' and the requirements of the Companies Act 2014.

- The financial statements are prepared in euros, which is the functional currency of the company. Monetary amounts in these financial statements are rounded to the nearest €

- The financial statements have been prepared under the historical cost convention. The principal accounting policies adopted are set out below.

Turnover: Turnover is recognised at the fair value of the consideration received or receivable for goods and services provided in the normal course of business, and is shown net of VAT and other sales related taxes. The fair value of consideration takes into account trade discounts, settlement discounts and volume rebates.

When cash inflows are deferred and represent a financing arrangement, the fair value of the consideration is the present value of the future receipts. The difference between the fair value of the consideration and the nominal amount received is recognised as interest income.

Revenue from the sale of goods is recognised when the significant risks and rewards of ownership of the goods have passed to the buyer (usually on dispatch of the goods), the amount of revenue can be measured reliably, it is probable that the economic benefits associated with the transaction will flow to the entity and the costs incurred or to be incurred in respect of the transaction can be measured reliably.

Revenue from contracts for the provision of professional services is recognised by reference to the stage of completion when the stage of completion, costs incurred and costs to complete can be estimated reliably. The stage of completion is calculated by comparing costs incurred, mainly in relation to contractual

hourly staff rates and materials, as a proportion of total costs. Where the outcome cannot be estimated reliably, revenue is recognised only to the extent of the expenses recognised that are recoverable.

Research and development expenditure: Research expenditure is written off against profits in the year in which it is incurred. Identifiable development expenditure is capitalised to the extent that the technical, commercial and financial feasibility can be demonstrated.

Intangible fixed assets - goodwill: Goodwill represents the excess of the cost of acquisition of unincorporated businesses over the fair value of net assets acquired. It is initially recognised as an asset at cost and is subsequently measured at cost less accumulated amortisation and accumulated impairment losses. Goodwill is considered to have a finite useful life and is amortised on a systematic basis over its expected life, which is [XXXX].

For the purposes of impairment testing, goodwill is allocated to the cash-generating units expected to benefit from the acquisition. Cash-generating units to which goodwill has been allocated are tested for impairment at least annually, or more frequently when there is an indication that the unit may be impaired.

If the recoverable amount of the cash-generating unit is less than the carrying amount of the unit, the impairment loss is allocated first to reduce the carrying amount of any goodwill allocated to the unit and then to the other assets of the unit pro-rata on the basis of the carrying amount of each asset in the unit.

Intangible fixed assets other than goodwill: Intangible assets acquired separately from a business are recognised at cost and are subsequently measured at cost less accumulated amortisation and accumulated impairment losses. Intangible assets acquired on business combinations are recognised separately from goodwill at the acquisition date if the fair value can be measured reliably. Amortisation is recognised so as to write off the cost or valuation of assets less their residual values over their useful lives on the following bases:

| Software Patents & licences |

Tangible fixed assets: Tangible fixed assets are initially measured at cost and subsequently measured at cost net of depreciation and any impairment losses.Depreciation is recognised so as to write off the cost or valuation of assets less their residual values over their useful lives on the following bases:

| Freehold land and buildings Leasehold land and buildings Leasehold improvements |

The gain or loss arising on the disposal of an asset is determined as the difference between the sale proceeds and the carrying value of the asset, and is credited or charged to profit or loss.

Investment properties: Investment property, which is property held to earn rentals and/or for capital appreciation, is initially recognised at cost, which includes the purchase cost and any directly attributable expenditure. Subsequently it is measured at fair value at the reporting end date. The surplus or deficit on revaluation is recognised in the profit and loss account. Where fair value cannot be achieved without undue cost or effort, investment property is accounted for as tangible fixed assets.

Fixed asset investments: Interests in subsidiaries, associates and jointly controlled entities are initially measured at cost and subsequently measured at cost less any accumulated impairment losses. The investments are assessed for impairment at each reporting date and any impairment losses or reversals of impairment losses are recognised immediately in profit or loss.

A subsidiary is an entity controlled by the company. Control is the power to govern the financial and operating policies of the entity so as to obtain benefits from its activities. An associate is an entity, being neither a subsidiary nor a joint venture, in which the company holds a long term interest and where the company has significant influence. The company considers that it has significant influence where it has the power to participate in the financial and operating decisions of the associate.

Entities in which the company has a long term interest and shares control under a contractual arrangement are classified as jointly controlled entities.

Borrowing costs related to fixed assets: Borrowing costs directly attributable to the acquisition, construction or production of qualifying assets, which are assets that necessarily take a substantial period of time to get ready for their intended use or sale, are added to the cost of those assets, until such time as the assets are substantially ready for their intended use or sale. All other borrowing costs are recognised in profit or loss in the period in which they are incurred.

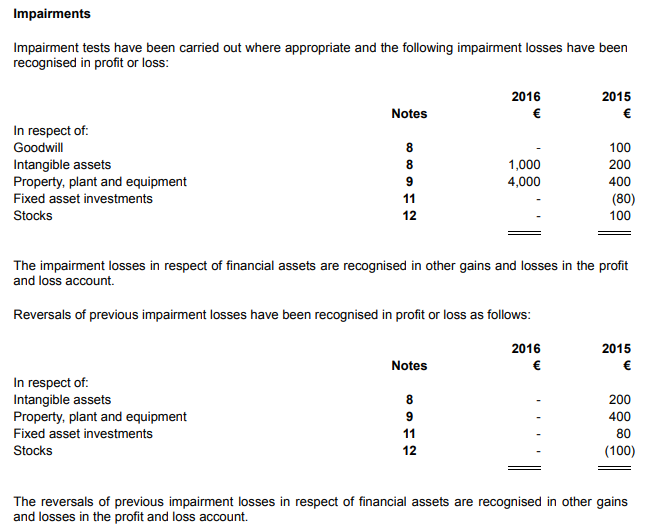

Impairment of fixed assets: At each reporting period end date, the company reviews the carrying amounts of its tangible and intangible assets to determine whether there is any indication that those assets have suffered an impairment loss. If any such indication exists, the recoverable amount of the asset is estimated in order to determine the extent of the impairment loss (if any). Where it is not possible to estimate the recoverable amount of an individual asset, the company estimates the recoverable amount of the cash-generating unit to which the asset belongs. Where a reasonable and consistent basis of allocation can be identified, assets are allocated to individual cash-generating units, or otherwise they are allocated to the smallest group of cash-generating units for which a reasonable and consistent allocation basis can be identified.

Recoverable amount is the higher of fair value less costs to sell and value in use. In assessing value in use, the estimated future cash flows are discounted to their present value using a pre-tax discount rate that reflects current market assessments of the time value of money and the risks specific to the asset for which the estimates of future cash flows have not been adjusted. If the recoverable amount of an asset (or cash-generating unit) is estimated to be less than its carrying amount, the carrying amount of the asset (or cash-generating unit) is reduced to its recoverable amount.

An impairment loss is recognised immediately in profit or loss, unless the relevant asset is carried at a revalued amount, in which case the impairment loss is treated as a revaluation decrease.

Recognised impairment losses are reversed if, and only if, the reasons for the impairment loss have ceased to apply. Where an impairment loss subsequently reverses, the carrying amount of the asset (or cash-generating unit) is increased to the revised estimate of its recoverable amount, but so that the increased carrying amount does not exceed the carrying amount that would have been determined had no impairment loss been recognised for the asset (or cash-generating unit) in prior years. A reversal of an impairment loss is recognised immediately in profit or loss, unless the relevant asset is carried at a revalued amount, in which case the reversal of the impairment loss is treated as a revaluation increase.

Stocks: Stocks are stated at the lower of cost and estimated selling price less costs to complete and sell. Cost comprises direct materials and, where applicable, direct labour costs and those overheads that have been incurred in bringing the stocks to their present location and condition. Stocks held for distribution at no or nominal consideration are measured at the lower of replacement cost and cost, adjusted where applicable for any loss of service potential. Cost is calculated using the weighted average method. At each reporting date, an assessment is made for impairment. Any excess of the carrying amount of stocks over its estimated selling price less costs to complete and sell is recognised as an impairment loss in profit or loss. Reversals of impairment losses are also recognised in profit or loss.

Cash at bank and in hand: Cash at bank and in hand are basic financial assets and include cash in hand, deposits held at call with banks, other short-term liquid investments with original maturities of three months or less, and bank overdrafts. Bank overdrafts are shown within borrowings in current liabilities.

Financial instruments: The company has elected to apply the provisions of Section 11 ‘Basic Financial Instruments’ and Section 12 ‘Other Financial Instruments Issues’ of FRS 102 to all of its financial instruments. Financial instruments are recognised in the company's balance sheet when the company becomes party to the contractual provisions of the instrument. Financial assets and liabilities are offset, with the net amounts presented in the financial statements, when there is a legally enforceable right to set off the recognised amounts and there is an intention to settle on a net basis or to realise the asset and settle the liability simultaneously.

- Basic financial assets: which include debtors and cash and bank balances, are initially measured at transaction price including transaction costs and are subsequently carried at amortised cost using the effective interest method unless the arrangement constitutes a financing transaction, where the transaction is measured at the present value of the future receipts discounted at a market rate of interest. Financial assets classified as receivable within one year are not amortised.

- Classification of financial liabilities: Financial liabilities and equity instruments are classified according to the substance of the contractual arrangements entered into. An equity instrument is any contract that evidences a residual interest in the assets of the company after deducting all of its liabilities.

- Basic financial liabilities: including creditors, bank loans, loans from fellow group companies and preference shares that are classified as debt, are initially recognised at transaction price unless the arrangement constitutes a financing transaction, where the debt instrument is measured at the present value of the future payments discounted at a market rate of interest. Financial liabilities classified as payable within one year are not amortised.

Debt instruments are subsequently carried at amortised cost, using the effective interest rate method. Trade creditors are obligations to pay for goods or services that have been acquired in the ordinary course of business from suppliers. Amounts payable are classified as current liabilities if payment is due within one year or less. If not, they are presented as non-current liabilities. Trade creditors are recognised initially at transaction price and subsequently measured at amortised cost using the effective interest method.

Compound instruments: The component parts of compound instruments issued by the company are classified separately as financial liabilities and equity in accordance with the substance of the contractual arrangement. At the date of issue, the fair value of the liability component is estimated using the prevailing market interest rate for a similar non-convertible instrument. This amount is recorded as a liability on an amortised cost basis using the effective interest method until extinguished upon conversion or at the instrument's maturity date. The equity component is determined by deducting the amount of the liability component from the fair value of the compound instrument as a whole. This is recognised and included in equity net of income tax effects and is not subsequently re-measured.

Equity instruments: Equity instruments issued by the company are recorded at the proceeds received, net of direct issue costs. Dividends payable on equity instruments are recognised as liabilities once they are no longer at the discretion of the company.

Taxation: The tax currently payable is based on taxable profit for the year. Taxable profit differs from net profit as reported in the profit and loss account because it excludes items of income or expense that are taxable or deductible in other years and it further excludes items that are never taxable or deductible. The company’s liability for current tax is calculated using tax rates that have been enacted or substantively enacted by the reporting end date.

Derivatives: are initially recognised at fair value at the date a derivative contract is entered into and are subsequently remeasured to fair value at each reporting end date. The resulting gain or loss is recognised in profit or loss immediately unless the derivative is designated and effective as a hedging instrument, in which event the timing of the recognition in profit or loss depends on the nature of the hedge relationship. A derivative with a positive fair value is recognised as a financial asset, whereas a derivative with a negative fair value is recognised as a financial liability

Taxation: The tax expense represents the sum of the tax currently payable and deferred tax.

- Current tax: The tax currently payable is based on taxable profit for the year. Taxable profit differs from net profit as reported in the profit and loss account because it excludes items of income or expense that are taxable or deductible in other years and it further excludes items that are never taxable or deductible. The company’s liability for current tax is calculated using tax rates that have been enacted or substantively enacted by the reporting end date.

- Deferred tax: Deferred tax liabilities are generally recognised for all timing differences and deferred tax assets are recognised to the extent that it is probable that they will be recovered against the reversal of deferred tax liabilities or other future taxable profits. Such assets and liabilities are not recognised if the timing difference arises from goodwill or from the initial recognition of other assets and liabilities in a transaction that affects neither the tax profit nor the accounting profit.

The carrying amount of deferred tax assets is reviewed at each reporting end date and reduced to the extent that it is no longer probable that sufficient taxable profits will be available to allow all or part of the asset to be recovered. Deferred tax is calculated at the tax rates that are expected to apply in the period when the liability is settled or the asset is realised. Deferred tax is charged or credited in the profit and loss account, except when it relates to items charged or credited directly to equity, in which case the deferred tax is also dealt with in equity. Deferred tax assets and liabilities are offset when the company has a legally enforceable right to offset current tax assets and liabilities and the deferred tax assets and liabilities relate to taxes levied by the same tax authority.

Provisions: are recognised when the company has a legal or constructive present obligation as a result of a past event, it is probable that the company will be required to settle that obligation and a reliable estimate can be made of the amount of the obligation. The amount recognised as a provision is the best estimate of the consideration required to settle the present obligation at the reporting end date, taking into account the risks and uncertainties surrounding the obligation. Where the effect of the time value of money is material, the amount expected to be required to settle the obligation is recognised at present value. When a provision is measured at present value, the unwinding of the discount is recognised as a finance cost in profit or loss in the period in which it arises.

Employee benefits: The costs of short-term employee benefits are recognised as a liability and an expense, unless those costs are required to be recognised as part of the cost of stock or fixed assets. The cost of any unused holiday entitlement is recognised in the period in which the employee’s services are received. Termination benefits are recognised immediately as an expense when the company is demonstrably committed to terminate the employment of an employee or to provide termination benefits.

Retirement benefits: Payments to defined contribution retirement benefit schemes are charged as an expense as they fall due.

Share-based payments: For cash-settled share-based payments, a liability is recognised for the goods and services acquired, measured initially at the fair value of the liability. At the balance sheet date until the liability is settled, and at the date of settlement, the fair value of the liability is re-measured, with any changes in fair value recognised in profit or loss for the year.

Equity-settled share-based payments are measured at fair value at the date of grant by reference to the fair value of the equity instruments granted using the [XXXXXXXXXX] model. The fair value determined at the grant date is expensed on a straight-line basis over the vesting period, based on the estimate of shares that will eventually vest. A corresponding adjustment is made to equity.

When the terms and conditions of equity-settled share-based payments at the time they were granted are subsequently modified, the fair value of the share-based payment under the original terms and conditions and under the modified terms and conditions are both determined at the date of the modification. Any excess of the modified fair value over the original fair value is recognised over the remaining vesting period in addition to the grant date fair value of the original share-based payment. The share-based payment expense is not adjusted if the modified fair value is less than the original fair value. Cancellations or settlements (including those resulting from employee redundancies) are treated as an acceleration of vesting and the amount that would have been recognised over the remaining vesting period is recognised immediately.

Leases: Leases are classified as finance leases whenever the terms of the lease transfer substantially all the risks and rewards of ownership to the lessees. All other leases are classified as operating leases. Assets held under finance leases are recognised as assets at the lower of the assets fair value at the date of inception and the present value of the minimum lease payments. The related liability is included in the balance sheet as a finance lease obligation. Lease payments are treated as consisting of capital and interest elements. The interest is charged to the profit and loss account so as to produce a constant periodic rate of interest on the remaining balance of the liability.

Rentals payable under operating leases, including any lease incentives received, are charged to income on a straight line basis over the term of the relevant lease except where another more systematic basis is more representative of the time pattern in which economic benefits from the lease asset are consumed. Rental income from operating leases is recognised on a straight line basis over the term of the relevant lease. Initial direct costs incurred in negotiating and arranging an operating lease are added to the carrying amount of the leased asset and recognised on a straight line basis over the lease term.

Government grants: Government grants are recognised at the fair value of the asset received or receivable when there is reasonable assurance that the grant conditions will be met and the grants will be received. A grant that specifies performance conditions is recognised in income when the performance conditions are met. Where a grant does not specify performance conditions it is recognised in income when the proceeds are received or receivable. A grant received before the recognition criteria are satisfied is recognised as a liability.

Foreign exchange: Transactions in currencies other than euros are recorded at the rates of exchange prevailing at the dates of the transactions. At each reporting end date, monetary assets and liabilities that are denominated in foreign currencies are retranslated at the rates prevailing on the reporting end date. Gains and losses arising on translation are included in the profit and loss account for the period.

Employees

The average monthly number of persons (including directors) employed by the company during the year was 26 (2015 - -).

Directors renumeration

Investment property comprises [XXX]. The fair value of the investment property has been arrived at on the basis of a valuation carried out at [XXX] by [XXX] Chartered Surveyors, who are not connected with the company. The valuation was made on an open market value basis by reference to market evidence of transaction prices for similar properties.

[Where the value of investments is determined other than by reference to market value, the particulars of the method adopted and reasons for adopting it should be disclosed.]

The long-term loans are secured by fixed charges over [XXX]

The net proceeds received from the issue of the convertible loan notes have been split between the financial liability element and an equity component, representing the fair value of the embedded option to convert the financial liability into equity. The liability component is measured at amortised cost, and the difference between the carrying amount of the liability at the date of issue and the amount reported in the Balance Sheet represents the effective interest rate less interest paid to that date. The effective rate of interest is XX%. The equity component of the convertible loan notes has been credited to the equity reserve.

Parent Company:

- The company is a wholly owned subsidiary of CCH Limited.

- The ultimate controlling party is unknown.

Approval of financial statements: The directors approved the financial statements on the 22 June 2017

--------------------------------------------------------------------------------------------------------------------------------------------------------------

We have examined:

(i) the abridged financial statements for the year ended 31 December 2017 on pages to 0 which the directors of CCH ROI 102 SECTION 1A LIMITED propose to annex to the annual return of the company; and

(ii) the financial statements to be laid before the Annual General Meeting, which form the basis for those abridged financial statements.

Respective responsibilities of directors and auditor

It is your responsibility to prepare abridged financial statements which comply with the Companies Act 2014. It is our responsibility to form an independent opinion that the directors are entitled under section 352 of the Companies Act 2014 to annex abridged financial statements to the annual return of the company and that those abridged financial statements have been properly prepared pursuant to 353 of that Act and to report our opinion to you.

This report is made solely to the company’s directors, as a body, in accordance with section 356 of the Companies Act 2014. Our work has been undertaken so that we might state to the company’s directors those matters we are required to state to them under section 356 of the Companies Act 2014 and for no other purpose. To the fullest extent permitted by law, we do not accept or assume responsibility to anyone other than the company and the company’s directors as a body, for our work, for this report, or for the opinions we have formed.

Basis for opinion

We have carried out the procedures we consider necessary to confirm, by reference to the financial statements, that the company is entitled to annex abridged financial statements to the annual return of the company and that the abridged financial statements are properly prepared. The scope of our work for the purpose of this report does not include examining or dealing with events after the date of our report on the full financial statements.

Opinion

In our opinion the directors are entitled under section 352 Companies Act 2014 to annex to the annual return of the company, abridged financial statements and those abridged financial statements have been properly prepared pursuant to the provisions of section 353 of the Act (exemptions available to small companies).

On ......................... we reported, as auditor of CCH ROI 102 SECTION 1A LIMITED, to the members on the company's financial statements for the year ended 31 December 2017 to be laid before its annual general meeting, and our report was as follows:

Opinion

We have audited the financial statements of CCH ROI 102 SECTION 1A LIMITED (the 'company') for the year ended 31 December 2017 which comprise and the related notes. The relevant financial reporting framework that has been applied in their preparation is the Companies Act 2014 and FRS 102 The Financial Reporting Standard applicable in the UK and Republic of Ireland. In our opinion the financial statements:

- give a true and fair view of the state of the company's affairs as at 31 December 2017 and of its profit for the year then ended;

- have been properly prepared in accordance with FRS 102 The Financial Reporting Standard applicable in the UK and Republic of Ireland; and

- have been prepared in accordance with the requirements of the Companies Act 2014.

Basis for opinion

We conducted our audit in accordance with International Standards on Auditing (Ireland) (ISAs (Ireland)) and applicable law. Our responsibilities under those standards are further described in the Auditor's responsibilities for the audit of the financial statements section of our report. We are independent of the company in accordance with the ethical requirements that are relevant to our audit of financial statements in Ireland, including the Ethical Standard issued by the Irish Auditing and Accounting Supervisory Authority (IAASA), and we have fulfilled our other ethical responsibilities in accordance with these requirements.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion.

Conclusions relating to going concern

We have nothing to report in respect of the following matters in relation to which the ISAs (Ireland) require us to report to you where:

- the directors' use of the going concern basis of accounting in the preparation of the financial statements is not appropriate; or

- the directors have not disclosed in the financial statements any identified material uncertainties that may cast significant doubt about the company’s ability to continue to adopt the going concern basis of accounting for a period of at least twelve months from the date when the financial statements are authorised for issue.

Other information

The directors are responsible for the other information. The other information comprises the information included in the annual report, other than the financial statements and our auditor’s report thereon. Our opinion on the financial statements does not cover the other information and, except to the extent otherwise explicitly stated in our report, we do not express any form of assurance conclusion thereon.

In connection with our audit of the financial statements, our responsibility is to read the other information and, in doing so, consider whether the other information is materially inconsistent with the financial statements or our knowledge obtained in the audit or otherwise appears to be materially misstated. If we identify such material inconsistencies or apparent material misstatements, we are required to determine whether there is a material misstatement in the financial statements or a material misstatement of the other information. If, based on the work we have performed, we conclude that there is a material misstatement of this other information, we are required to report that fact.

We have nothing to report in this regard.

Opinions on other matters prescribed by the Companies Act 2014

Based solely on the work undertaken in the course of the audit, we report that in our opinion:

- the information given in the Directors' Report is consistent with the financial statements; and

- the Directors' Report has been prepared in accordance with applicable legal requirements.

We have obtained all the information and explanations which we consider necessary for the purposes of our audit. In our opinion the accounting records of the company were sufficient to permit the financial statements to be readily and properly audited, and the financial statements are in agreement with the accounting records.

Matters on which we are required to report by exception

Based on the knowledge and understanding of the company and its environment obtained in the course of the audit, we have not identified any material misstatements in the directors' report. We have nothing to report in respect of our obligation under the Companies Act 2014 to report to you if, in our opinion, the disclosures of director's remuneration and transactions specified by sections 305 to 312 of the Act are not made.

Responsibilities of directors for the financial statements

As explained more fully in the Directors' Responsibilities Statement, the directors are responsible for the preparation of the financial statements and for being satisfied that they give a true and fair view, and for such internal control as the directors determine is necessary to enable the preparation of financial statements that are free from material misstatement, whether due to fraud or error.

In preparing the financial statements, the directors are responsible for assessing the company’s ability to continue as a going concern, disclosing, as applicable, matters related to going concern and using the going concern basis of accounting unless the directors either intend to liquidate the company or to cease operations, or have no realistic alternative but to do so.

Auditor's responsibilities for the audit of the financial statements

Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with ISAs (Ireland) will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of these financial statements.

A further description of our responsibilities for the audit of the financial statements is located on the IAASA’s website at: http://www.iaasa.ie/Publications/Auditing-standards/International-Standards-on-Auditing-for-use-inIre/International-Standards-on-Auditing-(Ireland)/ISA-700-(Ireland). This description forms part of our auditor’s report.

The purpose of our audit work and to whom we owe our responsibilities

This report is made solely to the company’s members, as a body, in accordance with section 391 of the Companies Act 2014. Our audit work has been undertaken so that we might state to the company’s members those matters we are required to state to them in an auditor's report and for no other purpose. To the fullest extent permitted by law, we do not accept or assume responsibility to anyone other than the company and the company’s members as a body, for our audit work, for this report, or for the opinions we have formed.

for and on behalf of Example Accountancy Firm LLP .........................

| Chartered Accountants Statutory Auditor |

Airport Drive Dublin Republic of Ireland |

We, the undersigned, hereby certify that:

the foregoing is a true copy of the Special Report of the Auditor.

the attached Profit and loss account, Balance sheet and the related Abridged Notes are a correct abridged copy of those laid before the annual general meeting of the company.

On behalf of the board

| Ms Example Director Director Example Director Secretary |

Date: ......................... Date: ......................... |