FRS 102 Group Accounts User Guide

FRS 102 Group Accounts

The CCH Accounts Production FRS 102 Consolidation formats are a simple means of combining existing jobs into an accurate, statutory compliant set of FRS 102 financial statements.

This user guide should be read in conjunction with the FRS 102 Limited master pack guide, which provides all the essential information relevant to both single companies and groups. This group accounts guide focuses on additional information relevant to groups alone.

Prerequisites

We recommend that this module is used by experienced users of CCH Accounts Production who are involved with the finalisation of the group statutory accounts.

For the FRS 102 Consolidation option to be available it must be licensed, and a Configuration key needs to be entered in Central. Go to:

File > Maintenance > User Defined > Configuration, and enter:

Key Name = AccountsShowConsolidationFRS102Entity

Value = 1

Application

Group subsidiaries that can be consolidated automatically must have individual financial statements prepared as:

- FRS 102 limited companies or

- FRS 102 LLPs (see appendix concerning this)

In theory, a subsidiary acquired during the current accounting period might have a different period end and might already have its financial statements prepared under FRS 105. However, any company that has its financial statements consolidated within group accounts cannot qualify as a micro-entity and must therefore start preparing its financial statements under FRS 102. Where a company with existing micro-entity financial statements is acquired during the period, its results would normally be consolidated via consolidation journals. Alternatively, it could be set up on Accounts Production as a dummy FRS 102 company and consolidated that way.

The consolidation of charities and pension funds is not supported.

Theoretically, subsidiary accounts prepared under FRS 101 could be included in a FRS 102 group. However, the disclosures required and policies adopted are not aligned to those in FRS 102 and therefore FRS 101 subsidiaries are not supported in this master pack.

Overview

- Note: Master pack 46 now includes changes relating to the 2024 Periodic Review, which applies for periods commencing on or after 1 January 2026. Early adoption is permitted. See notes in the FRS 102 Limited guide about the application of the 2024 Periodic Review.

- These formats are a simple means of combining existing jobs into an accurate, statutory compliant set of FRS 102 group accounts.

- Small entity exemptions are available for groups, similar to the exemptions for limited companies.

- The consolidation entity does not need to be created before the individual entities.

- The year-end dates of the individual entities must all be the same.

- Individual entities must be on compatible master pack versions in order for them to be initially included in the consolidation group. Subsequent to that, the software will not force the user to update individual entities when the group entity is updated, but this should be done by users in order to ensure compatibility.

- The pack does not provide the additional disclosures required for listed companies and public interest entities.

- Trial balances are not imported. Instead, the figures are aggregated from the name ranges in the individual entities, together with the statutory database information.

- Group adjustments are made through the group journals.

- There is no provision for the automatic translation of entities denominated in a foreign currency.

- Partially owned subsidiaries, acquisitions part-way through the year and joint-ventures are not automatically accounted for and therefore consolidation adjustments will need to be made for these.

- A subsidiary may be a member of more than one group (multi group subsidiary).

- There is no limit to the number of subsidiaries.

Setting up the group

- File > New > Client.

- Complete the New Client Wizard mandatory fields, code and name, together with those required per your firm’s requirements.

- In the Accounts tab, choose the option to Create accounting data. Alternatively, if you do not take this step now, the accounting period(s) can be created later. The options will be the same.

Name and Code: These will feed through from Step 1 of the wizard

Type: Select Company from the drop-down list

Year Start: Enter

Year End and Period: This will auto populate once the year start has been entered; override for non-year periods.

Entity: Select Consolidation (FRS102) from the drop-down list

Master Pack: Allow this to default to the latest master pack

Chart: This will auto populate as Consolidation (FRS102) when the Entity is selected.

Registration Number: Enter. Note however that the parent company information will populate throughout from the parent entity information in the statutory database (#cd25 in the General information node).

Country of Incorp: Choose. Note however that the parent company information will populate throughout from the parent entity information in the statutory database (#cd2 in the General information node).

Theme: Will default to that set at the master level; you can change if necessary.

Click on Finish

Group structure

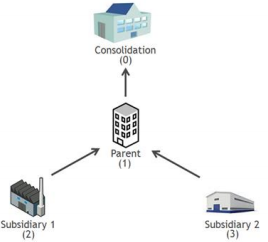

At least three entities will be created for a group, being the group entity, the parent entity and a subsidiary entity.

|

Key: 0 - Consolidation Entity |

1. From the Reference folder, click on the node Consolidation Group.

Note: if the Consolidation Group node is not present, then Consolidation (FRS 102) was not selected for the entity type. The client’s accounting period will need to be deleted and re-created.

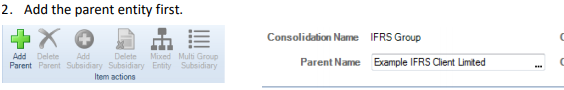

Adding the parent entity

Either click Add Parent on the ribbon or, to the right of Parent Name, click on the '…' ellipsis button (see above). A pop-up box will appear (see below). Within this, search for the parent entity, select and click OK.

Once the parent has been selected, the Chart Length, Year End and Parent MPV will be displayed in the area above the grid in which the subsidiaries will be selected and listed (see above).

Note: Entities will be filtered by the year-end date and will only show entities with a year-end which is the same as the consolidated entity’s year-end and which have a compatible master pack version (MPV). Mixed entities will be available for selection if Mixed Entity has been selected on the ribbon, likewise if Multi Group Subsidiary has been selected this option will be available.

Linking subsidiaries

3. Either click Add Subsidiary on the ribbon or, under the column header Subsidiaries, click on the ellipsis button, the pop-up box will reappear. Within this, search for the first subsidiary entity, select and click OK.

4. Repeat step (3) for each subsidiary.

5. Tick the check box if the subsidiary is wholly owned (see below) - if the tick is not accepted, click off the screen and back on again.

Explanation of other columns within the grid

Note: there is no field chooser option in this grid – all columns are displayed and cannot be hidden.

Wholly owned - The wholly owned tick box has no effect on the figures. It is there to suppress disclosure of subsidiaries and directors’ names in the Directors’ Report.

Chart length - To verify that the nominal code structure of all entities in the group is the same. Any nominal code that exists in one entity and not others need to be added across the whole group.

Year end - To verify that the year-ends of all members of the group are the same.

Entity type - Displays the type of Entity of each subsidiary, eg Limited (FRS102)

Consolidation figures

Note: The linked figures from the parent and subsidiary entities will not appear in the Trial Balance screen in the Consolidated entity. Only the effect of consolidation journal entries made within this group entity will appear in the trial balance screen.

Once the group structure has been determined within the group, a Group Audit Trail may be viewed, eg for the group, parent and individual subsidiary companies. See Management Collection below.

Financial statements

The options on the ribbon for these screens are the same as those for any entity and are permission sensitive.

Full collection

This provides the pages and notes for the Consolidated financial statements, and follows the order and content of the FRS 102 Limited Company formats.

The balance sheet, cash flow, statement of changes in equity and all balance sheet notes, together with most other non-P&L disclosures, are split into Group and Parent company sections. The income statement and its notes include only consolidated figures.

The accounting policies relate to the Group as a whole.

Management collection

The following reports are provided within this collection:

Group detailed income statement and schedules

This provides an income statement showing the consolidated posting to individual nominal accounts. There are optional separate schedules for cost of sales, distribution and admin costs, triggered by flag #mc1 in the statutory database. Where this option is not chosen, the income statement will show the detail instead of the totals for each.

Parent company income statement

This is the parent income statement in standard Companies Act presentation, with options to show according to Format 1 or 2.

Group audit trail

This report includes columns for the figures of the following:

- total group

- consolidation adjustments

- the parent entity

- up to fifteen subsidiary companies.

Note how the formulae call up the relevant figures:

- "0" or no numerical marker refers to group entries, ie journals and database adjustments.

- "1" refers to the parent.

- "2" refers to the first subsidiary, and so on for the others.

- "Sum" refers to the group total.

- "Sumex" refers to the group total before group adjustments.

The subsidiaries displayed may be increased by adding in more columns, copying the formula within the report and changing the unique subsidiary identifier number in the column(s) eg change '16' (which refers to subsidiary 15) to '17' (which will then refer to subsidiary 16).

The page may be exported to Excel, which will display the figures as values not formula, as for all pages/notes in CCH Accounts Production.

Note: Where nominal chart codes have been subcoded in the parent or subsidiaries, those subcodes must also be added to the group nominal chart; otherwise there will be errors in the presentation.

The layout of the Group Audit Trail is as shown below:

Exception report

The purpose of this report is to highlight tailoring questions within the Statutory Database for which the response given in the Consolidation does not match the response given in the Parent.

Only those items which do not match will be displayed. For information on the item, double click into the report to see the format of the report and areas being checked.

Addresses and associations

All addresses and associations are picked up from the parent entity:

- Addresses: registered office and business address.

- Associated relationships, eg:

'has auditor of', 'has bank/bs of (accts prod)', 'has solicitor of'

Officers

The officers are added to the Parent entity and will be displayed when viewing the Officer’s screen in the consolidated entity. This includes any dates of appointment and resignation. Where officers in the Parent have been updated but are not reflected in the Group, you can synchronise officers by choosing the option from the ribbon bar, as below.

Statutory database entries

Paragraph disclosures will generally be entered in the group entity, with some information being harvested from the parent instead.

Value inputs will generally adjust the total of parent plus subsidiaries, and where this is not the case (eg for Turnover analysis), the grid will make this clear.

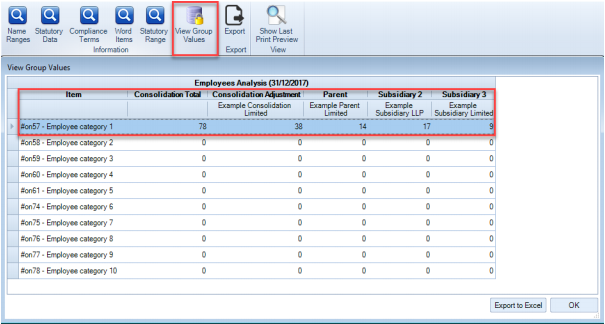

Where group figures are being used, these may be expanded to view the Group Values, by clicking the icon 'View Group Values' on the ribbon. This function is only relevant for statutory database grid items and will be greyed out for paragraph and flag (yes/no) nodes:

For example, this is an employee analysis grid extracted from the statutory database. The second screen shows the breakdown:

General tab

The following information is picked up from the group database:

- Company name (ie the name of the group)

- Trading name (ie the trading name of the group, if relevant).

- Period end information

- First year details

- Draft message

The following information is picked up from the parent entity database:

- Country of incorporation

- Registration number

- The Professional accountancy body may be changed at the client level, although this will usually feed from the master setting.

Rounding

If preparing the group financial statements to the nearest thousand or million, change the rounding unit within General Information of the group entity.

Subsidiaries may apply different rounding settings to that of the group, but those roundings are ignored at the group level. The Name Range balances are obtained from each subsidiary using the actual values, and then rounding is applied at the consolidation level.

Client preferences

These are set at the consolidation level.

Strategic report

Information is drawn from the consolidation database.

Directors’ report

Information is drawn from the consolidation database, except that officers' information comes from the parent.

Audit report

The Auditor's name and address is taken from the parent. All other information relating to the audit report is drawn from the consolidation database.

Accountants’ report

Information regarding the accountants’ report is drawn from the consolidation database.

Income statement

Presentation options are set in the consolidation database. Optional descriptions in grids are generally taken from the parent company.

Balance sheet

Presentation options are set in the consolidation database. Optional descriptions in grids are generally taken from the parent company.

Note the option to display the group and company pages together or separately.

Statement of changes in equity

The entry of amendable headings and the analysis of total "other movements" is carried out in the consolidation database since the group might analyse these items differently from the parent/subsidiaries, or combine them where they are individually immaterial.

Statement of cash flows

The cash flow works on a consolidated total basis, and therefore adds the amounts entered in the parent entity and all the subsidiary companies together, including all statutory database disclosure adjustments. Entries in the group database will be added to those already shown in the parent and subsidiaries.

Therefore, the first step is always to ensure that the individual cash flows for the parent and each subsidiary balance. Where those are correct, it is unlikely that the group figures will show a difference. Additional adjustments in the group cash flow should arise only in response to the effect of group journals.

Presentation options are set in the consolidation database.

The reallocation between operating activities, financing activities and investing activities is chosen at group level for investment income, interest paid and dividends paid.

Accounting policies

All group accounting policies are entered in the group database, including the basis of consolidation.

If there are any adjustments to the Intangible assets or Tangible assets headings when disclosing depreciation rates, these are made in the group entity (within the Intangible assets, Asset type headings and Tangible assets, Asset type headings sections of the Balance Sheet Notes tab).

Change in accounting policies

These are entered in the group entity database.

Judgements and key estimates

Entered in the group entity database.

Profit and loss account notes

The general rules are:

- Presentation choices and text paragraphs are generally picked up from the group database.

- Optional descriptions in grids are generally taken from the parent company.

- Numerical entries in grids will generally be required only for group consolidation adjustments.

The following group values are picked up from the group entity database alone:

- Turnover analysis - Revenue

- Taxation - Tax rate

- Audit fees - All adjustments

The following group values are picked up from the trial balance and database entries of the parent entity alone:

- Payments of dividends

- Directors' remuneration - but with a separate grid in the group to record payments to group directors made by subsidiaries.

Revenue

This is entered at the group level, rather than aggregating values from the parent and subsidiaries. This permits the parent and subsidiaries to split revenue according to their individual materialities, with the group analysing revenue (after eliminating inter-group balances) according to its own materiality.

Balance sheet notes

The general rules are:

- Parent company disclosures are picked up automatically from the parent database.

- Group paragraphs and presentation options are normally picked up from the group entity.

- For most numerical value disclosures, the company and subsidiary database adjustments are aggregated. Therefore, information only needs to be added in the group entity if there are consolidation adjustments in the area.

The following group values are picked up from the group entity database alone:

- Fixed asset investments - Carrying values differing from fair value

The following group values are picked up from the trial balance and database entries of the parent entity alone:

- Share capital information

For retirement benefits, the user has the following options:

This permits the user to specify whether (a) to show both a parent and group scheme; (b) to show only a group scheme; or (c) show only a parent scheme.

For share based payments, the user has a similar choice between parent/group/combined schemes.

Other notes

The general rules are the same as used for balance sheet notes.

The following values are picked up from the group entity database alone:

- Acquisition of subsidiary

- Disposal of subsidiary

- Transactions with directors

- Related party transactions

Entries specific to consolidated financial statements

Titles applied to group or company pages

From master pack 45 onwards, there are new terminology options available for the description of group and parent as applied to the main format pages such as the income statement.

- #Term34 refers to the group pages and for FRS 102 the default is "Group" for Companies Act terminology and "Consolidated" for IFRS terminology.

- #Term35 refers to the company pages and for FRS 102 the default is "Company" for Companies Act terminology and "Company" for IFRS terminology.

Users can amend the compliance terminology for their firm's preferences, eg to use "Parent company" instead of "Company".

Non-controlling interests

Nominal codes exist for postings which feed through to the P&L, balance sheet and statement of changes in equity:

Shares purchased from or disposed to non-controlling interests

5205 Purchase of shares in subsidiary from non-controlling interest (retained earnings element)

5206 Disposal of shares in subsidiary to non-controlling interest (retained earnings element)

Profits and dividends for non-controlling interests

5995 Minority interest in current profit - contra to 5997

5996 Minority interest in other comprehensive income - contra to 5997

5997 Minority interest contra against retained earnings

5998 Dividends paid to Minority interests - contra to 5999

5999 Minority dividends contra

Reserves balance

9770 Non-controlling interests balance brought forward

9771 Acquisition of controlling interests

9772 Disposal of controlling interests

9773 Other adjustments to non-controlling interests

9775 Purchase of shares in subsidiary from non-controlling interest

9776 Disposal of shares in subsidiary to non-controlling interest

Other entries

Directors' remuneration: There is a separate grid in the group to record payments to group directors made by subsidiaries.

Balance sheet presentation: The user can choose to show the group and company balance sheets on one page, instead of two separate pages.

Bank account offset: Bank figures can be offset against overdrafts where the group has right of offset.

VAT balances offset: Amounts receivable can be offset against amounts payable where the group has right of offset.

Retirement benefits: Where the parent company scheme is not also the group scheme, the user can enter and disclose information about the group scheme.

Share based payments: Where the parent company scheme is not also the group scheme, the user can enter and disclose information about the group scheme.

Other matters

Individual financial statements

The financial statements of the parent and all subsidiaries should be as complete as possible before trying to prepare the consolidated statements. All areas of the statutory database that will be disclosed in the group should be completed for each group member, which might require users to temporarily flag the size of an individual company as 'large' or 'medium' so as to activate all the disclosure areas, eg where the individual company is small but the group company is not.

Similarly, where the parent entity is taking advantage of the reduced disclosure framework option, the user will need to temporarily flag the parent as not taking this option so that the exempted disclosures are visible and can be completed for inclusion in the group.

It is particularly important to make sure that the cash flow statement of each company balances correctly before trying to 'fix' the cash flow for the group, since any differences will be aggregated within the group.

Dividends

All or part of the subsidiary entity’s dividends will be payable to the holding entity and are therefore inter-group transactions. These must be adjusted against one another (ie cancelling income received vs dividends paid) using consolidation journals so that only external dividends are disclosed, being:

- parent dividends paid, plus

- any dividends paid by subsidiaries to minority interests

As an example, where the parent holds 70% of the equity shares and the subsidiary has paid a dividend of £100, £70 of this would be eliminated by a consolidation journal:

Dr 4200 Dividends receivable 70 (removes the full amount received by parent)

Cr 5001 Dividends paid 70 (removes part of the dividend paid by the subsidiary)

The remaining £30 is still included in the consolidated figure for dividends paid, which is correct. However, this then needs to be identified as a payment to the non-controlling interest which affects the value of that interest and therefore a further journal is needed:

Dr 5998 Dividends paid to minority 30

Cr 5999 Minority dividends contra 30

This journal will ensure that the non-controlling interest is adjusted for dividends paid, rather than adjusting the group’s interest.

Parameters used in formulae

This is best explained by examples for turnover:

| AP("[a,*TOTREV]") | The total of turnover codes for the consolidating adjustment shown in the Group TB, ie the sum of the Group journals for codes 0001..049Z. | Note that this is similar to the formula for an individual company using a non-group pack. |

| APGROUP("0","[a,*TOTREV]") | The same as above. | |

| APGROUP("1","[a,*TOTREV]") | The turnover value from the parent company. | |

| APGROUP("2","[a,*TOTREV]") | The turnover value from the first subsidiary in the current year list. | |

| APGROUP("SUM","[a,*TOTREV]") | The turnover value for the whole group. | |

| APGROUP("SUMEX","[a,*TOTREV]") | The turnover value for the parent plus all susidiaries only, ie excluding the group adjustments. |

Similar rules are applied for other types of value, eg

APGROUP("1","a,#on57")

APGROUPSTATRANGE("1","a","SSUBSD")

Multi group subsidiary

It is possible to add a subsidiary to more than one consolidation at the same time, eg where the group includes interim groups. The option is enabled for each entity, by selecting the “Multi group subsidiary” option on the ribbon:

The Task Permission is: #Client #Allow Consolidation Multiple group Subsidiaries

If the user is working within the subsidiary accounting period and clicks the consolidation group option, they will now be prompted to select which group is opened.

Note that this does not support the scenario where the subsidiary is partly owned by two or more unrelated groups, requiring the subsidiary’s balances to be apportioned to the various parent companies. In this rare circumstance, the user would need to create at least one dummy subsidiary, or else enter the subsidiary's balances through a consolidation journal.

Mixed entity groups

There are three ways to add subsidiaries that are a different entity type to that of the Parent.

- Set up a dummy FRS 102 limited company and bring in the relevant balances (usually by exporting the TB from the original entity to a spreadsheet, remapping any codes that will not fall into the correct ranges, then importing the amended TB into the dummy company), as well as entering the relevant statutory database information. This would be relevant for charities that are subsidiaries, where the nominal codes and name ranges are substantially different from the FRS 102 limited equivalents.

- Include the balances and statutory database information of the subsidiary by journals and database entries in the group itself. This is roughly equivalent to the first option, but it does not enable the user to review the separate accounts of the dummy company to ensure that all the information is correct (including whether the cash flow balances).

- For compatible entities (eg LLPs), the entity information can be included automatically once the relevant Task Permission has been activated. There will however be some adjustments at group level to deal with mismatches of codes, such as the need to consolidate LLP member balances which have no equivalent in a limited company.

The Mixed Entity Group mode must be enabled by adding a Configuration key to the Central database via Maintenance > User Defined > Configuration:

AccountsCanAddAnyEntityIntoGroup

Value = 1

This option must be enabled for each individual entity by selecting 'Mixed Entity' from the ribbon.

The Task Permission to restrict access to this option: #Client #Allow Consolidation Mixed Entity Subsidiaries

*Note: the consolidation will then rely on Name Ranges to obtain the balances from each subsidiary, to allow for potential differences in the charts of accounts.

For example, if trying to obtain the balance of Turnover for the Consolidated (name range TOTREV), each subsidiary will be polled for its balance of TOTREV, regardless of how that name range was defined for each subsidiary.

However, this does require that the name range exists in each subsidiary.

Adjustments for LLP subsidiary

Where the subsidiary of an FRS 102 (Limited) Group is an LLP, the following matters need to be considered:

Items which do not normally need any adjustments

Items in GRP but not LLP

· Share based payments

· Directors’ balances, remuneration, pensions and compensation

· Dividends payable

· Deferred tax

· Corporation tax

· Some cash flow hedging reclassifications

· Other investment 6990 and 7660

· Share capital postings, Equity reserve, Share premium reserve, Capital redemption reserve, Own shares reserve

· Held for sale balances

· Redeemable preference shares

Items appearing in both GRP and LLP in a compatible manner

Most P&L items (those that don't totally align, eg former members' pensions, are correctly allocated by the revised LLP name ranges)

Actuarial gains 5210..5229

Revaluation reserve 9720..9734

Other reserves 1, 2, 3 9745..974Z, 9750..9754, 9755..975Z

Hedging reserve 9760-976Z

Items in LLP which will need to be reallocated by the user

These will need to be allocated by journals in the group, based on the specific circumstances of the LLP.

Members' remuneration

5000 - 5049 Members' remuneration (This will have double entry into 9551, 9552 and 9609.)

- These codes are included as part of the name range REOTH (Other equity).

Members’ capital and loans

LLP has separate ranges for the various types of members' balances:

Members capital - classified as debt 9500..9539

Members' loans 9540..9589

Members' other amounts 9590..9639

Members' capital - equity 9640..969Z

- These codes are included as part of the name range REOTH (Other equity) or REBFWD (Other equity b/fwd).

Therefore, the LLP reserves, as brought into the group, are:

REBFWD (Reserves brought forward) = 9500+9540+9590+9640

RE (Total reserves) = 0001..599Z+REBFWD

REOTH (Other movements on reserves)

= 5140..520Z transfers & other movements

+ 5240..529Z unused codes

+ 5351..599Z unused codes & suspense

+ 5001..5099 members' remuneration

+ 9501..953Z+9541..958Z+9591..963Z+9641..968Z movements on the various members’ balances (noted above)

Items not covered by Accounts Production

Acquisitions during the year

When an entity is acquired during the year, only the values after the date of acquisition should form part of the consolidated accounts. This is not done automatically by the software and the full year's figures will be consolidated.

The figures required can be achieved by using a consolidation journal to remove the pre-acquisition balances.

In addition, you must adjust the assets of the Subsidiary entity to reflect their fair value as at the date of Acquisition (eg, the cost of plant and machinery at the date of acquisition would be shown as Additions through business combination, and additions after this would be shown as ordinary additions). This can be entered as a consolidating adjustment.

Non-coterminous financial years

The directors of a parent entity must ensure, except where there are good reasons to the contrary, that the financial years of the parent and subsidiary undertakings coincide.

The Group master pack will not permit the inclusion of a subsidiary that does not have the same year end as the parent. However, this can be achieved by adjusting the subsidiary's period end dates to agree to the parent's. Once the group financial statements have been prepared, the subsidiary's year end date can be amended for the purposes of printing its own financial statements.

The user will also need to consider whether the changes taking place between the parent's and subsidiary's period ends would materially affect the view given by the consolidated accounts. If so, they will need to be adjusted for in the preparation of the consolidated accounts. This can be carried out by consolidation journals.

Alternatively, the user can duplicate the subsidiary client, creating one with a period end that matches the parent.

To duplicate the client:

- Export the full client.

- Import the client with a different code.

- Change the period ends.

- Use this as the Subsidiary that is added to the list in the group structure.

- Either make the adjustments required within the client, or as a consolidation adjustment.

Joint ventures

In group accounts, an investor that is a parent must use the equity method to account for jointly controlled entities. (FRS 102, section 15). There are nominal codes set up for JVs and areas in the statutory database for data input.

Foreign currency translation

Each asset, liability, revenue or cost arising from a transaction denominated in a foreign currency, should be translated into the local currency at the exchange rate in operation on the date on which the transaction occurred. This will be done outside of CCH Accounts Production.

There exists a Currency translation reserve for recording and disclosing of gains and losses which are not taken directly to profit or loss.