Charity FRS 102 User Guide

Charity FRS 102 User Guide

Scope

The content of this master pack allows you to generate FRS 102 compliant Charity financial statements. It meets the requirements of:

- The Charity SORP for use with FRS 102

- UK Companies Act 2006 and the relevant Charities Acts for the UK regions, ie for charities registered in England & Wales, Scotland and (from MP 27) in Northern Ireland, together with cross-border registration for any two of the three

- ROI Companies Act 2014, as revised 2017

This Charity master pack is largely based on the standard FRS 102 Limited company pack providing users with the same look and feel and familiarity, and users should refer to the standard FRS 102 Limited user guide in conjunction with this specialist master pack guide.

Features not yet available

The following is not currently available:

- Exception report

- Lead schedules

- Formatted trial balance

- Support for receipts and payments accounts (though users can apply the pack for that purpose, making appropriate changes)

Setup

Create client in CCH Central

When setting up an FRS 102 Charity Client, in the Create Client Wizard Main Details tab, the Contact Type is Not for Profit.

In the Accounts tab, the options to choose are under Type, select Charity and under Entity please select Charity (FRS 102).

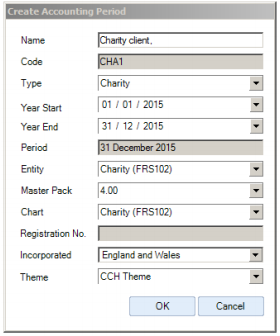

Create new Charity FRS 102 accounting period for an existing client

On the Accounts Production tab, click in the grid to create a new accounting period:

- Type: select "Charity".

- Entity: select "Charity (FRS 102)".

- Set other fields as required and click OK.

- Double-click the accounting period row on the grid to load the accounts production screen.

Accounting requirements for charities

Types of charity

A charity is a not-for-profit entity, the income of which is applied for charitable purposes. It is registered as a charity according to the statutory requirements of one or more jurisdictions and will be either:

- a charitable company, usually limited by guarantee; or

- a non-corporate trust or similar body established by a governing document.

This pack does not support ROI unincorporated charities.

Charitable companies

UK Charitable companies are required to follow the accounting requirements of the Companies Act 2006, whereas ROI Charitable companies are required to follow the accounting requirements of the Companies Act 2014 (as amended by the 2017 Act). In both cases, they must also follow the requirements of FRS 102 and the Charities SORP.

Small company exemptions

A major feature of the FRS 102 formats for trading companies is the availability of small company exemptions under Section 1A. This exemption is not available for charities and therefore the full requirements of FRS 102 and the Companies Acts will apply.

Charities can however take advantage of those exemptions which apply to small companies not applying section 1A (eg exemption from cash flow statements and certain directors' report disclosures); however, there are overlapping requirements from the Charities SORP, such as the requirement for a cash flow statement for charities that are "large" by the SORP's standards. Therefore, the user is required to designate "size" twice in the client pack: once according to the Companies Act, once according to the SORP.

As a result, there will be some situations where disclosure is not required by company law but has to be made to satisfy the SORP, and vice versa. Information about this is provided in the guidance linked to the relevant database items.

Unincorporated charities (note: supported for UK only)

UK unincorporated charities must follow the requirements of the Charities Act 2011. The disclosure requirements are driven almost entirely by the Charities SORP and FRS 102, with minor additions from the Charities Act itself.

Funds analyses

SORP 4.9 The columns of the SOFA must be used to distinguish restricted income funds, which may only be spent for a particular purpose of the charity, from unrestricted funds, which can be spent on any of its purposes, and endowment funds.

SORP 4.13 A charity may add additional columns to the SOFA to present material funds or activities on the face of the statement rather than in the notes. Any additional analysis of this type provided on the face of the SOFA must make clear the class of fund (unrestricted, restricted or endowment) in the column title. In providing additional information, a balance needs to be struck between the provision of additional information and the resulting complexity of the statement.

In order to meet the requirements of the SORP, the formats provide:

- A split (usually by columns) between restricted, unrestricted funds, and (where applicable) endowments, and

- A separate column for a specified material fund where appropriate (this fund might have more than one element, which would be analysed elsewhere)

For comparatives, the SORP requirement is:

SORP 4.2 FRS 102 requires that comparative information must be provided for all amounts presented in the SOFA. This SORP requires that the comparative information provided for the total funds of a charity must be presented on the face of the SOFA. Comparative information provided for the separate classes of funds, if any, held by a charity may be presented either on the face of the SOFA or prominently in the notes to the accounts.

This requirement is met as follows:

- On the SOFA, there is a full breakdown by fund of the prior year figures, usually shown on the same page as the current year but with a user option to show it on a separate page;

- In notes tying into figures from the SOFA, a similar analysis by fund is provided. Where the notes layout does not follow the SOFA layout, an additional table is provided to match that shown on the SOFA.

Key information and choices

The General Information section has the following elements:

- Standard information such as name, period ends, country of incorporation, company registration number and currency;

- Further registration choices to cover England, Scotland and joint registration;

- Choice between corporate and non-corporate;

- Whether a corporate charity has share capital;

- Grids that show the user the calculated charity size and audit requirements, under both the SORP and other applicable legislation;

- User choices of size and audit;

- The accountancy body of the auditors/accountants.

The Charity Information section has the following elements:

- Choice of compliance terminology (either IFRS-style or Companies Act);

- Where available, the application of small companies exemption from preparing a cash flow statement;

- Charity registration number;

- Standard descriptions to apply throughout (eg whether to refer to the charity as "charity" or "trust" or other);

- A table for listing senior management for the Information page;

- For charities disclosing a separate material fund in addition to the required analysis, a description of that fund and identification of its type (ie restricted or unrestricted).

Disclosure and external reporting requirements

The disclosure and reporting requirements are affected by:

- Country of registration (and for the UK, the region as well)

- Whether the charity is a company

- Its size according to the SORP

- For companies, its size according to the country's Companies Act or associated legislation and the country's Charities Act or associated legislation

- For non-companies, its size according to the country's Charities Act or associated legislation

All these choices are made by the user under the General node and Charity information nodes. To assist in the choices related to size and external reporting, there are also grids that show the user the calculated sizes and minimum reporting requirement:

- One grid that uses the values included in the TB

- A second grid that permits the user to enter values - this is useful where the TB is incomplete or the user expects further material adjustments

An example of the first is shown below:

In the example given above:

- The charity is "Large" according to the SORP and will therefore have greater disclosure requirements driven by the SORP.

- The charity is a "Small company" according to the Companies Act and therefore will have reduced disclosure requirements.

- The charity does not require an audit under the Companies Act (unless required by the members) but it does require one under the Charities Act.

The user will use this grid to help inform their decisions about the size and method of external reporting. Those choices are made using the three inputs after the grids, ie

- Size of charity

- Size of company (which appears only where the company flag has been set to 'yes')

- Reporting requirement

The Reporting requirement input allows the user to choose between:

- Audit under the Companies Act

- Audit under the Charities Act

- Independent examination

- Accountants' report (ie full exemption)

Independent examination and Charities Act audit are not applicable for ROI companies in the current pack.

Charities Act audit vs Companies Act audit

Charitable companies which are above the Charities Act thresholds for an audit but below the limits for an audit under the Companies Act can choose between the two regimes for their audit. There are some technical differences between the requirements for audit under the Companies Act and under the Charities Act but these are not particularly significant. The differences that would likely be noticed by readers of the financial statements are:

- The requirements under which the audit is undertaken are described differently in the audit report.

- Where a Companies Act audit is not undertaken, a statement must be made on the balance sheet that the trustees have taken advantage of the relevant exemption from that audit, even though a Charities Act audit is being undertaken instead.

Given that the differences between audits under the two regimes are not particularly significant, it is common practice for charitable companies to be audited under the Companies Act requirements even though the requirement for that audit comes from the Charities Act.

Nominal ledger coding structure

The formats are consistent with the main FRS 102 formats as far as this is possible. Nominal ledger codes for balance sheet assets and liabilities, ie most of the codes from 6000 onwards, are substantially the same as those used in the main FRS 102 formats.

However, different codes must be used in order to:

- Provide analysis by fund type;

- Provide charity-specific groupings, eg costs of charitable activities, support costs and fundraising;

- Allow for transfers between funds.

Balance sheet items

Some codes have been added to the balance sheet sequence for charity specific assets:

- Heritage assets;

- Performance related investments and mixed motive investments.

In practice, these categories are seldom used but they are described in the SORP and may arise in some circumstances.

Codes between 9600 and 9990, which in other packs relate to conventional types of reserve, are replaced by an analysis of funds movements for each of the fund types.

SOFA coding - fund analysis

The Charities SORP requires analysis by funding type. This is achieved through the nominal ledger coding, which has four separate analyses for income and expenditure in the sequences:

- from 1000 for unrestricted funds,

- from 2000 for material funds,

- from 3000 for restricted funds and

- from 4000 for endowment funds.

The codes run in the same sequence (ie, each code within restricted funds would share the final three digits with the equivalent code in the unrestricted funds sequence) and the codes all run in the same order. Not all codes (or the consequent name ranges) are replicated for endowment funds, which have a lesser range of application.

SOFA coding - expenditure on charitable activities

The Charities SORP identifies the likely existence of multiple charitable activities. It requires income and expenditure relating to these multiple activities to be disclosed where this is material and relevant to the understanding of the financial statements.

The formats therefore provide subanalysis of direct costs between up to 7 charitable activities within each funding type apart from endowments. There is a consistent coding structure across the funds for each activity.

SOFA coding - income

A similar analysis by "activity" is available for charitable income, where required. However, it is rare for each activity (as identified above for expenditure) to be financed by separately identified income matching each activity and therefore users should consider whether it is most helpful to either:

- analyse by the purpose of the income, by using the same categories for income that were applied to expenditure (ie by activities), or

- analyse by the sources of income (eg government sources vs individuals), or

- not analyse by categories at all.

Note that income is already analysed on the nominal chart by type (eg grants and donations).

SOFA coding - collection and apportionment of support costs

See also Appendix 1: Support costs.

The Charities SORP requires a distinction between:

- Direct costs - which result directly from undertaking a charitable activity (eg grants made); and

- Support costs - which facilitate all charitable activities (eg general administrative costs).

The SORP further requires that where there are multiple material activities, the financial statements should show how the support costs are apportioned between the activities to provide total costs for each activity and fundraising.

From Master pack 24 onwards, the approach to recording and apportioning support costs has been simplified. The active codes for support and governance costs are:

Support codes - recording the costs

Wages 5100-5149

Depreciation 5150-5173

Leases 5177-5179

Support cost categories definable by user

1 5180 2 5181 3 5182 4 5183 5 5184

6 5185 7 5186 8 5187 9 5188 10 5189

Support code - apportioning those costs to activities etc

5195 Support recharge to activities etc

This single code should be used to recharge the total costs (ie 5100-5189) to the individual activities, fundraising and material other expenditure. Therefore the section 5100-5195 will cancel to zero. Where relevant (see below) this code can also recharge support costs to governance. Note however that this is normally an irrelevant complication.

Governance codes - recording the costs

Wages 5300-5329

Depreciation 5330-5373

Leases 5377-5379

Transferred from support 5380 (not strictly necessary)

Audit fees 5410-5412

Accountancy 5413

Legal and professional 5414

Governance categories definable by user

1 5430 2 5431 3 5432 4 5433 5 5434

Note:

- The SORP only requires a total for governance costs. Where the user decides not to disclose an analysis of governance, all governance costs apart from audit fees could be posted to a single code. However, it will often be helpful to analyse governance within the nominal ledger even where the financial statements will not show this analysis.

- From the 2019 SORP onwards, governance costs are an element of support costs rather than a separate category of costs. Therefore it would not normally be appropriate to apportion support costs to governance before then apportioning the total governance costs to activities etc. However, where users want to do this, they would journal between 5185 (out of support costs) into 5380 before then apportioning the governance total using 5450 as set out below.

Governance code - apportioning costs

5450 Governance recharge to activities etc

This single code should be used to recharge the total costs (ie 5300-5434) to the individual activities, fundraising and material other expenditure. Therefore the section 5300-5450 will cancel to zero.

Codes to recharge into

The various activities have single or double recharge codes for each fund element, eg:

1260 UF CA1 - Share of support costs for charitable activity 1, unrestricted fund

1280 UF CA1 - Share of governance costs [NO LONGER NEEDED - ALL CAN BE POSTED TO 1260]

The previous additional code 1280 for recharging governance costs separately has been left in place for the convenience of users who wish to accumulate and recharge governance separately.

Note that the individual elements of the support costs (eg wages, depreciation) are NOT individually recharged into separate codes; ie, support costs are apportioned into the activity as one figure for each activity/fund combination.

Support costs are similarly apportioned to fundraising, where appropriate, eg:

1182 UF Fundraising support costs for fundraising, unrestricted fund

1191 UF Trading support costs

1192 UF Trading governance costs [NO LONGER NEEDED - ALL CAN BE POSTED TO 1191]

Note that the distinction between trading and fundraising (arising from an earlier SORP) is no longer required; trading is regarded as a part of fundraising. However, the original categories (fundraising, trading, investment management) have been retained for analysis where desired.

Note also that there are codes for the support element of material costs disclosed on the SOFA (see below), eg:

1901 UF Material other expenditure - share of support for material costs figure, unrestricted fund

Flexibility within the formats

The Charities SORP, FRS 102 and (where relevant) the Companies Act dictate the required minimum disclosures but do not always specify the layout to be used for those disclosures. The example financial reports provided by the Charity Commission feature a range of layouts in a number of areas, and the Charities master pack formats therefore permit the user to apply most of those alernative layouts.

This flexibility is provided in a number of areas. For example:

Key descriptions

The basic terms used throughout the financial statements are defined through a grid in the Charity information section of the Statutory database:

Material funds

Postings can be made to a material fund which could be either restricted or unrestricted. This will then be shown as a separate fund in the SOFA, balance sheet and notes. The description of this fund is entered in the grid of charity designations, under the Charity information section of the Statutory database (see above).

Default descriptions on the SOFA

The SOFA line items are prescribed by the SORP and will not normally be changed. However, they can be overridden if required:

Analysis by activity

Postings of charitable expenditure can be analysed by activity, and this analysis is shown in the Charitable activities note. There is also an option to also show this analysis as rows on the face of the SOFA. The descriptions of these activities are entered in a grid in the SOFA section of the Statutory database:

Analysis by income grouping

Postings of charitable income can be analysed by type or activity, and this analysis is shown in the Charitable income. There is also an option to also show this analysis as rows on the face of the SOFA. The descriptions of these activities are entered in a grid in the SOFA section of the Statutory database, as shown above.

Analysis of fundraising costs

There is an option to show the breakdown of these costs on the face of the SOFA, using the categories in the nominal chart (fundraising, trading, investment management), with descriptions that can be overridden as shown in the "Default descriptions" section above.

Charitable income note

By default (from MP 24) this will be shown in the same layout as applied to other income, ie using the standard SOFA column headings for funds, with analysis in the rows grouped by the activity/group set up as described above. This can alternatively be shown under column headings related to the activity/group, with a separate summary by fund.

Separate material income or cost shown on the SOFA, eg governance

Where a user wishes to highlight a material group of income or costs on the SOFA, there are specific nominal codes set up to enable this. One example where this might be useful is where the user wants to highlight governance costs (as in the Charity Commission's example financial statements for Arts Theatre Trust). In this case, the governance and other support costs would be accumulated as normal but the apportionment of the governance share would be made to the nominal code for the separate material cost (see information under the Nominal ledger section).

Alternative presentation of support and governance

This can either be shown in summary, or analysed across activities in detail. The user also has the option to show governance only as a total, or to provide a separate analysis of it.

Balance sheet

The user can show analysis of creditors and provisions on the face of the balance sheet, or only totals.

Statutory database

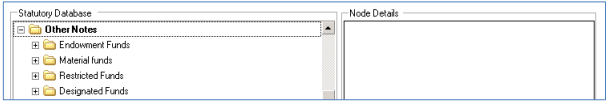

Fund analysis

The basic fund analysis is activated by making nominal ledger postings to the relevant accounts: Unrestricted funds 1000 to 1999, Material funds 2000 to 2999, Restricted funds 3000 to 3999 , and Endowment funds 4000 to 4999 (see above).

Additional fund analysis, where appropriate, is provided through the statutory database.

Restricted funds

Within the restricted funds node of the database, various options are presented (and similar options appear in the area for each type of fund):

a) An introduction to the note, with default text that should be tailored to the circumstances of the charity;

b) An analysis of fund movements;

c) Three free format text paragraphs.

Selecting the “Analysis of movements” grid opens the following input screen:

This database table allows the user to input a detailed fund analysis. Note the key features (from MP 24):

- The grid (and the corresponding note) picks up the total opening/closing balances and movements, as shown on the SOFA.

- Any pension fund or revaluation fund is excluded from the analysis and will be displayed separately.

- The unallocated balances for Opening, Income etc will by default be treated as the first fund in the list; therefore the user needs only to enter the name for this fund.

- When the user enters additional funds, any values will be deducted from that default first fund.

- Revaluation funds are posted to specific accounts in the nominal chart. There is a balance sheet option to show them separately on the balance sheet.

- If there are reserves for hedging included in restricted funds, they should be disclosed by using one of the analysis rows.

- On the format, the comparatives are shown on a separate table below the current figures. Therefore, the user does not need to match up the fund references to the previous year if new funds are inserted or the list is rearranged.

Material funds

Separate material funds, where they exist, can be analysed in the same way as restricted funds as set out above.

Endowment funds

Endowment funds are treated in the same way as restricted funds, except that the “Analysis of movements” tab, and the note itself, also allows a distinction between “Permanent” and “Expendable” endowments.

Unrestricted funds, including designated funds

This is treated in the same way as restricted funds, as set out above. The unallocated balance is described by default as General unrestricted funds and (from MP 24) is shown on the grid so that the total balance is reconciled.

Note that designated funds, by definition, are part of the charity’s unrestricted funds which the trustees have decided (for the present) to use for a specific purpose. There is no external restriction on such funds and they can be reassigned whenever the trustees wish.

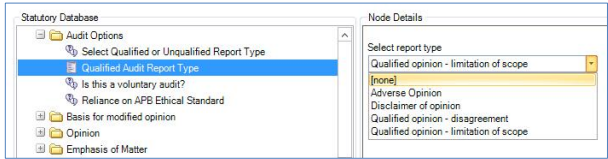

Qualified audit reports

For all charities there are two separate database fields which determine the presentation of a qualified report.

Here the “Select Qualified or Unqualified Report Type” node links into #cy155 which simply determines whether the report is or is not qualified (0 = unqualified, -1 = qualified). The qualified audit report type node links to #ar8 which determines what kind of qualification is given, there are four types:

1 = Adverse

2 = Disagreement

3 = Limitation of scope

4 = Disclaimer (the drop-down lists these options alphabetically).

Strictly, only “Disagreement” and “Limitation of scope” opinions should be referred to as “qualified” all four opinion types can be referred to as “modified”. Unlike the main FRS 102 formats, on the audit report page itself the lines for qualified and unqualified opinions are combined (ie there is not a separate sequence for each type), and a combination of coding within the standard paragraphs and line suppression on the format page itself gives the appropriate text in each situation.

The analysis given by #ar8 derives from a detailed analysis of the examples provided by the FRC. Although the contents of the qualification must reflect the specific circumstances of the charity (and the FRC stresses that firms should use their own wording where this better describes the situation), the overall structure for each type of report is largely consistent and can be used as a framework within which the more specific wording can be placed. The determination of the type of audit report should be the starting point for drafting the specific wording.

Incorporation of directors’ report and strategic report into the trustees' report

The SORP requires the preparation of a trustees’ report whereas the Companies Act requires the preparation of a directors’ report. For a charitable company, the trustees' report can meet the requirements for a directors’ report and the title of the trustees’ report includes the phrase “including directors’ report” for all charitable companies.

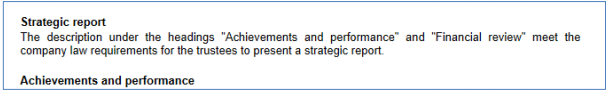

Charitable companies which are not "small" for Companies Act purposes are also required to prepare a strategic report (there is no equivalent requirement for unincorporated charities). Although the legislation suggests that the strategic report should always be a separate report from the directors’ report, the Charity Commissions have agreed with the FRC that a compliant trustees' report would also meet the requirements for a strategic report, so that a separate report need not be prepared. However, in order to meet the strict legal requirements, it is necessary to highlight within the trustees report those paragraphs which meet the requirements for a strategic report. This is controlled by the following database trigger:

This triggers additional disclosures within the trustees’ report. The main additional disclosure is to insert a new paragraph above the “Achievements and performance” section stating that this section together with the “Financial review” section meet the requirements for a strategic report:

In addition to this:

a) the title of the trustees’ report also refers to the inclusion of a strategic report; and

b) the signature section of the trustees’ report refers to the fact that the trustees are also approving the strategic report included within it.

Officers, advisers and delegated management

The Trustees of the Charity are entered as “Officers” in the same way as Directors are entered in the main FRS 102 formats.

For Charities that are "large" according to the SORP, there is an additional disclosure:

1.52. The report must state to whom the trustees’ delegate day-to-day management of the charity and from whom trustees are taking advice. In particular, the report must provide:

• the name of any chief executive officer or other senior management personnel to whom the charity trustees delegate day-to-day management of the charity on the date

the report was approved or who served in such a position in the reporting period in question; and

• the names and addresses of any other relevant organisations or persons providing banking services or professional advice to the charity, including its solicitors, auditor and investment advisers

Advisors are entered in the Associated tab of the client database, in the usual way.

Delegated management can be entered in two ways:

- From MP 24, there is a dedicated grid in the Charity information section of the database, which feeds through to the Information page (see screenshot).

- Alternatively, the user can provide the information in the "How decisions are made" paragraph under the Structure, governance and management section of the Trustees' report.

Specific matters within the financial statements relating to charities

Legal and administrative information page

This includes information required by the SORP and forms part of the financial statements.

Trustees' report

This is driven by a complicated mixture of disclosures required by Companies Act, Charities Act and Charities SORP, with differing requirements based on charity size and company size. The statutory database fields provide detailed guidance for each item. The user should be wary of suppressing any paragraphs that are required by the pack.

Report of Auditors, Independent examiners or Accountants

The report will necessarily be different from the standard report for a trading entity. The user should always compare it with guidance from their own institute.

SOFA

For companies, this also satisfies the requirement for an income and expenditure account.

SOFA notes

These are set up to normally permit current+comparative to fit onto one portrait page, with columns following the SOFA disclosure of funds.

Charitable expenditure and income

The charitable expenditure note uses the pre-defined charitable activities as its presentation analysis by column. Charitable income defaults to the normal setup for other SOFA notes but can also be displayed by activity or income group.

Support and governance

The user can show apportionment to the various activity in total, or by support cost group. Governance can be shown as a total, or analysed by cost group.

Fees for audit or independent examination

The Charities SORP requires charities (of any size) to disclose in the notes to the accounts the amounts payable to their auditor or independent examiner, analysed between fees payable for:

• statutory audit or independent examination;

• assurance services other than audit or independent examination;

• tax advisory services; and

• other financial services, for example consultancy, financial advice or accountancy services.

This will be shown by default within the Net movement in funds note (see below) except for incorporated charities that are large for Companies Act purposes, when the information will be shown in a more detailed separate note, in order to meet the expanded requirements for large companies.

Net movement in funds

This sets out the usual additional disclosures (eg depreciation split by leased/owned assets). The note will be included by default for:

- All limited companies (unless there are no items that require disclosure); and

- All charities subject to audit or independent examination.

Other entities may not require this note and the note will be excluded unless chosen for display by a flag in the statutory database.

Taxation

Users can choose whether to have a taxation note, by keeping or removing the simple standard paragraph.

Cash flow and notes

Charities that are "large" as defined by the SORP are required to have a cash flow including notes. Where there are no loans or obligations b/fwd or c/fwd, the analysis of changes in debt is replaced by a statement that there is no material debt.

Appendix 1: Support costs

The Charities SORP requires a distinction between:

- Direct costs - which result directly from undertaking a charitable activity (eg grants made); and

- Support costs - which facilitate all charitable activities (eg deneral administrative costs)

The SORP further requires where there are multiple material activities, the financial statements should show how those support costs are apportioned between the activities and fundraising to provide total costs for each activity:

8.13. This SORP requires that charities reporting on an activity basis must disclose:

• details of the accounting policy adopted for the apportionment of costs between activities and any estimation technique(s) used to calculate their apportionment;

• the total amount of support costs incurred in the reporting period;

• an analysis of material items or categories of expenditure included within support costs, with the total amount of governance costs incurred separately identified; and

• the amount of support costs apportioned to each of the charity’s significant activities as disclosed in the SOFA or in the notes to the accounts.

8.14. The information required for support costs and their apportionment may be provided in a tabular format.

NOTE: The SORP does not require either

(a) an analysis for each category of expenditure; or

(b) comparative information for the analysis.

Options available in the pack, from Master Pack 24 onwards:

- (Minimum disclosure) Provide an analysis of total support costs by category, followed by an allocation of the total costs to the charity's significant activities; or

- (Maximum disclosure) Provide a tabular analysis that splits support costs by category, and shows the allocation of each category to the charity's significant activities.

- Governance: show only as a total within the above, with an option to provide further analysis of that total.

Minimum (the default disclosure):

Maximum (where the user chooses to display this):

Governance (where the user chooses to display this):

Appendix 2: Posting Staff Costs, Depreciation and Governance Costs

Within the charity formats there are numerous places where staff costs and depreciation can appear. To simplify the description in this Appendix, the following conventions have been applied. Each expenditure can be charged against one of the four main fund types, in the description below:

F as the first digit of a code stands in for one of the following:

1 = Unrestricted funds

2 = Highlighted material funds

3 = Restricted funds

4 = Endowment funds

Nominal codes have not been set up for the majority of the headings in the endowment funds category since these will seldom will be required. However, if appropriate codes are set up by the user, the Name Ranges will analyse these amounts correctly. To allow for an analysis of these amounts between up to seven charitable activities:

A as the second digit of the code stands in for one of the following:

1 = Fundraising/trading

2 = Charitable activity 1

3 = Charitable activity 2

etc

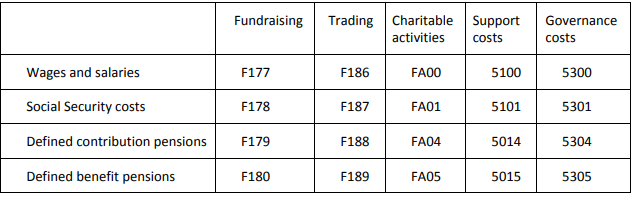

Staff costs

Direct posting method: It is possible to post a full analysis of staff costs directly within the codes relating to various activities in the SOFA. The analysis can be posted as:

For example, the direct costs for unrestricted funds wages relating to the first charitable activity would be posted to:

1200 UF CA1 - Wages and salaries

Where this method is used, the only subsequent adjustments that will be required relate to the apportionment of the total in support and governance costs. This process is set out in the Nominal chart section (see above) and also summarised below.

Indirect posting method: Many charities will have accumulated all (or part of) their staff costs in total and initially these might be posted into support costs (eg, all wages and salaries might be charged to 5100). However, some of these are not true support costs (ie, those costs that directly arise from charitable activities or fundraising etc). Where this is the case, the direct staff costs etc need to be transferred out of support costs into the direct costs codes. It is important to make this transfer by crediting the original code, eg 5100, NOT 5195 - ie, the transfer should reduce the support costs rather than be treated as an apportionment.

For instance, if support costs initially included all wages posted to 5100, then any wages which directly arose from charitable activity 1 unrestricted funds would be transferred out:

- Debit the wages code 1200

- Credit code 5100 to remove that element of wages from the support area entirely

The remaining wages would be left in 5100 and form part of the total support costs, which will need to be apportioned to the various activities as explained below.

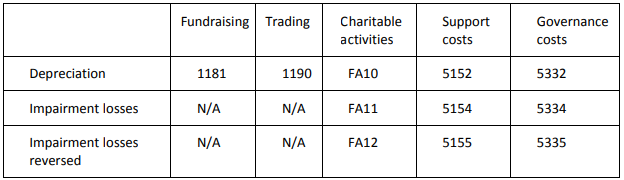

Depreciation and impairment

Direct posting method: Similar to staff costs, depreciation and impairment are analysed between the various activities within the SOFA using the codes.

The depreciation figures posted should include all depreciation and impairment amounts and any loss on disposal of tangible and intangible assets. Where this method is used, the only subsequent adjustments that will be required relate to the apportionment of the total in support and governance costs. This process is set out in the Nominal chart section and summarised below.

Indirect posting method: This works in the same way to the indirect posting method for staff costs, with the initial postings of all costs into the support or governance codes shown above (eg 5152). Any reallocation of costs directly arising from activities would be made by crediting the original posting (eg 5152) and debiting the individual activity codes. The balances remaining in support and governance would then be apportioned as set out below.

Apportionment of support and governance costs

As set out in the Nominal chart section, the balance of true support costs (including governance) are then apportioned as follows:

- Credit the apportionment codes 5195 (support) and 5450 (governance) with amounts equal to the net balances remaining in those sections, therefore reducing the overall balance in 5000-5499 to zero. Note that these two codes are used for all apportionment; there are not separate codes for wages, depreciation etc.

- Debit the "share of support" codes set up for each activity and fundraising, split by fund, eg 1260 UF CA1 - Share of support costs. Note that the governance share (using code 1280 in this instance) does not have to be shown separately at the activity level since this information is not required, and code 1260 can be used instead, if the user wishes.

It is not necessary to apportion support costs to governance before then apportioning the governance total. However, where users want to do this, they would journal between 5185 (out of support costs) into 5380 before then apportioning the governance total using 5450.