Default Terminology in CCH Accounts Production

Default terminology for entities within CCH Accounts Production

To view navigate to: File > Maintenance > Accounts > Compliance Terminology

|

The shipped default is "Companies Act" for the following entities: |

The shipped default is "IFRS" for the following entities: |

|

|

|

Compliance Terminology is not applicable to the following entities:

|

Changing the default terminology at the Master level

To change the default for an entity first navigate to: File > Maintenance > Accounts > Compliance Terminology

Select the Entity and Master Pack, the master pack does not need to be in a draft state.

Use the radio button to change the Terminology setting: options are Companies Act, IFRS and Companies Act except for primary header.

Changing the default terminology at the Client level

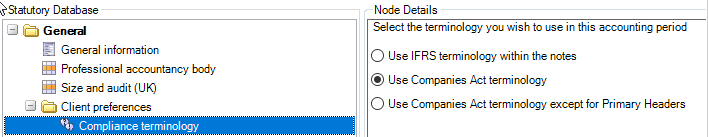

This will be done within a client's statutory database and will only affect that client. To do this go to the General Folder > Client Preferences and Compliance Terminology.

Select the terminology to be used for the client. This will remain in force until changed at the client level in future, if required. A master change will not override this choice.