old- CCH iFirm AML + Biometric KYC checks

Please note you must be running CCH Central version 2024.120 or later to use Biometric Testing

It is the expected behaviour that a client would fail the “Location” check if they are using a VPN, either through WI-FI or mobile data.

Getting started:

Please ensure you have familiarsed yoruself with the getting started guide to ensure that your account is set up correctly and you have the relevant permissions.

CCH iFirm AML + Biometric KYC checks:

CCH iFirm AML + Biometric KYC Checks verifies client identity by matching their ID (Passport or driving licence) with their face – this also includes other checks as well such as veryfying name, DOB & address against multiple data sources e.g. credit bureaus & Govt sources. It also runs checks for PEPS, Sanctions, Mortality & Adverse Media.

All AML checks start from CCH Central because that is where we get our data from. Select the client and then click Tasks and CCH iFirm AML

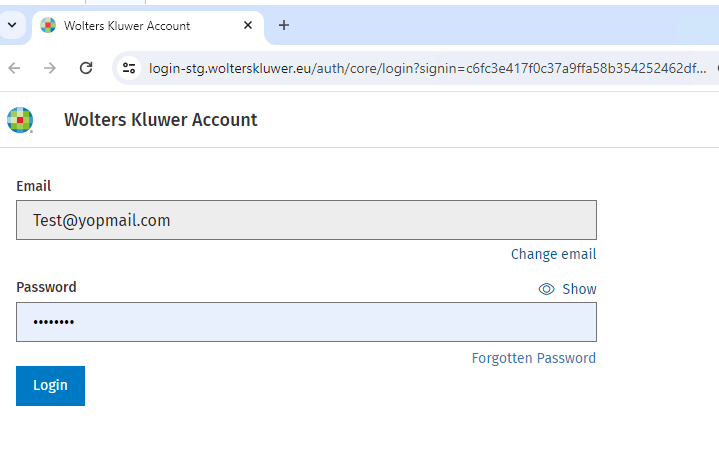

When clicking on CCH iFirm AML in CCH Central, it will launch iFirm and ask you to login with your email and password.

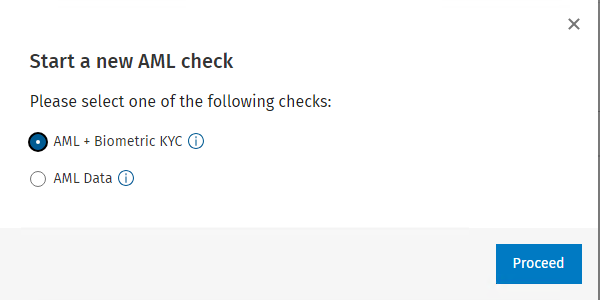

The following message should then display asking what type of test needs to be carried out. This list will be affected by what modules you have subscribed too.

Click Proceed

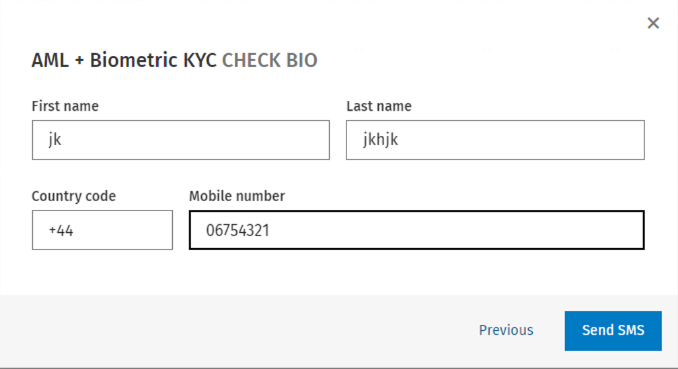

The following screen should then display. Check name and enter mobile number and click Send SMS

The client or contact will then get a text message that will ask them to do a number of things taking about 90 seconds that will verify the individual.

When the client or contact receives the text message they need to click on the website link

The following screen should display and then Click Verify Me

Click Continue to accept our terms and conditions

Client or contact then needs to enter address and postcode and it will then begin the Biometric verification

System is now going to ask for a photo of ID (e.g. driver license or passport)

The system will now use OCR to extract the data it has been given and start to run AML checks

Then check that your details are correct and amend if necessary

The system then asks for a selfie so it can measure up the face with the ID. It will ask the person to smile to confirm this is a live person rather than just a photo and create a very detailed dot matrix map of the face to check against the ID document.

The system will then produce a report that judges the results of the check. This can be viewed either in CCH iFirm AML or in the document centre for the client in CCH Central.

In order to view the PDF Report in the client Document Centre iFirm_AMLBioLicenceCheck configuration key must be set to "1" via File>Maintenance>User Defined>Configuration

An Example Biometrics report is shown below

The location check will only fail if we detect a VPN , or if the user has denied them accsess to their location in the phones settings. (see warning at top of this document)

The 'Liveness' test is where the client or contact was asked to smile to ensure a photograph or facial filters are not being used for any kind of impersonation.

Document Fraud Tests

During the document fraud assessment process, we perform the following checks in the background:

Image Composition: We ensure the document is live and captured on the spot. Our technology checks that the document and presented image of the document are not captured from a screen or a photocopy.

Photo Check: This is a check to see if the photo on the identity document is as expected, with checks to see if any suspicious overlay or modification is applied digitally or otherwise.

Document Integrity: We look for any damage to the document or modification and analyse the image to ensure it was captured raw through a mobile camera as stipulated.

Detail Check: We inspect the finer details that an identity document is composed of and examine the security features on the document to ensure that they align with the genuine versions of the document type

What about clients overseas?

If the client has a foreign document and a UK address then we can verify the client as expected, we can verify over 16,000 different documents from various countries.

If the client has a foreign address and a foreign document, we can only verify the document agasint the user to ensure they are the same person and the document is valid and untampered with. Due to the lack of reliable foreign data shared with 3rd parties we cannot verify name, address and DOB on foreign addresses. It is recommended here that you obtain a proof of address as well such as a utility bill or a bank/credit card statement.

The PEPS, Sanctions and adverse media of the checks are global.