Research & Development Allowances

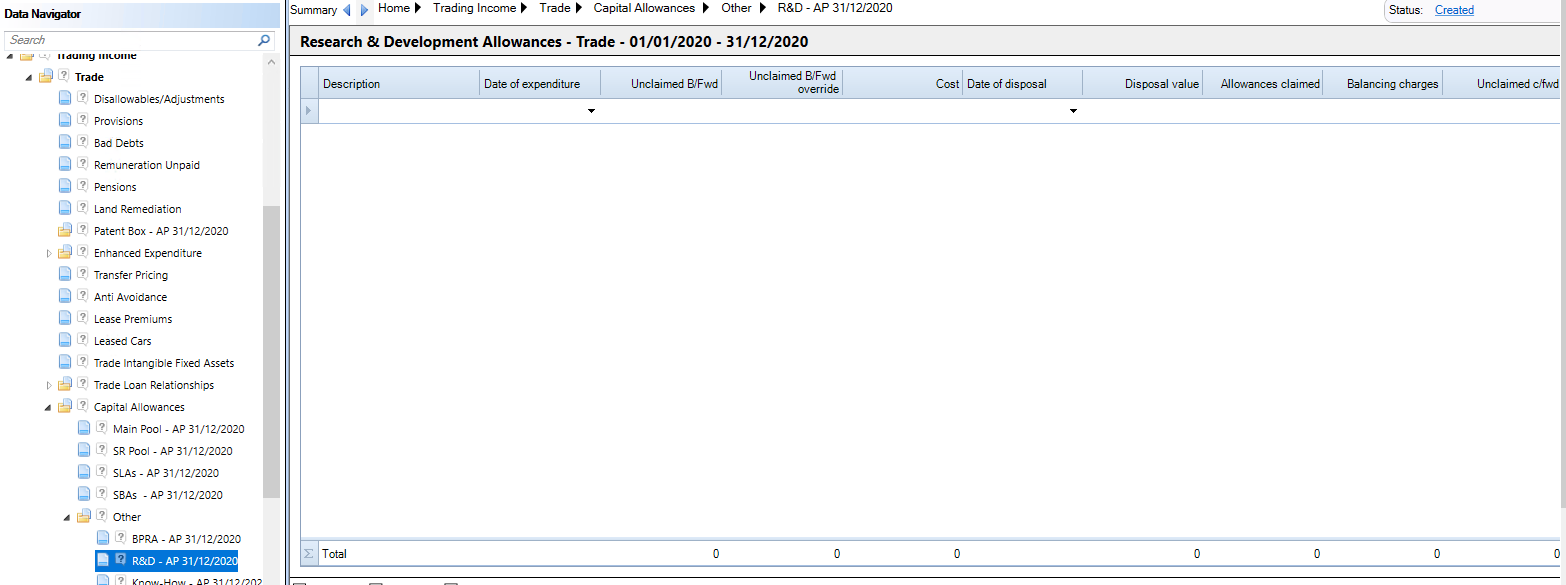

The R&D allowances input screen is located under Trading Income > Trade Name > Capital allowances > Other > R&D in the Data Navigator.

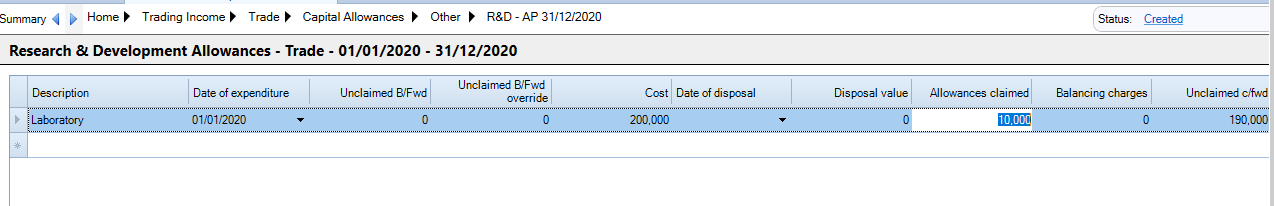

The Description must be unique.

The Date of expenditure can be entered manually or selected from the Date picker.

Allowances claimed is for the claim for current year allowances.

Balancing charges arise when the Disposal Value exceeds the capital allowances not claimed.

The balancing charge is capped at the allowances given and any capital profit is taxed in the normal manner and is calculated when the disposal date and proceeds are shown.

The tax on the capital profit should be manually entered.

The Allowances claimed in prior years can be calculated from the Cost less Unclaimed Bfwd.

Notes

it is not possible to claim a balancing allowance on the disposal of a Research and Development Asset