Tax Return Disclosure Notes

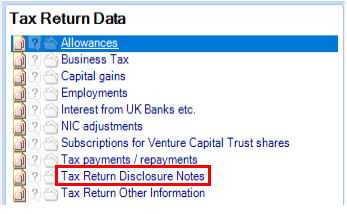

Access the Tax Return Disclosure Notes Window

Open a tax return. From Tax Return Data, select Tax Return Disclosure Notes:

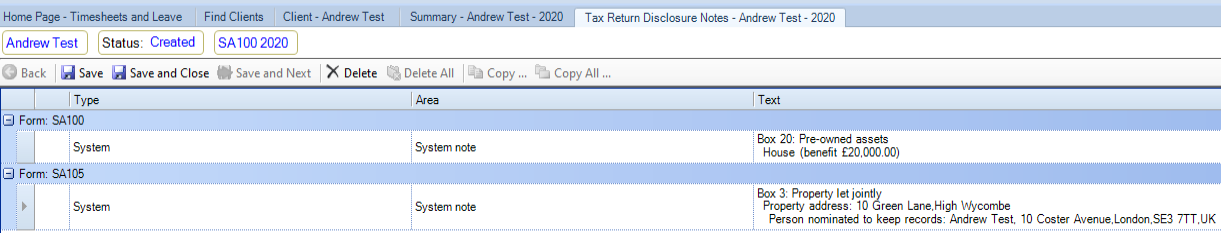

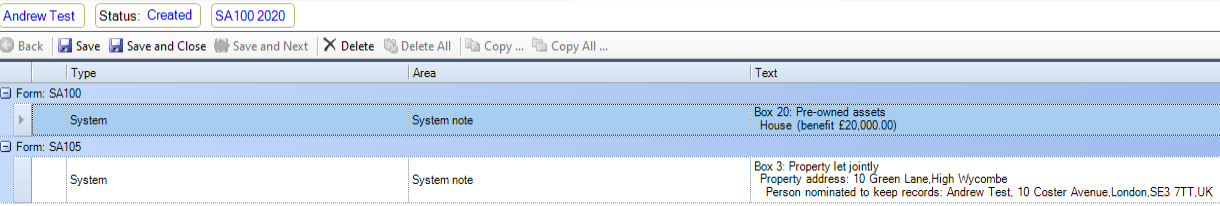

The Tax Return Disclosure Notes screen is displayed:

System notes are those that are hard-coded and the condition for that Disclosure Note to appear has been triggered.

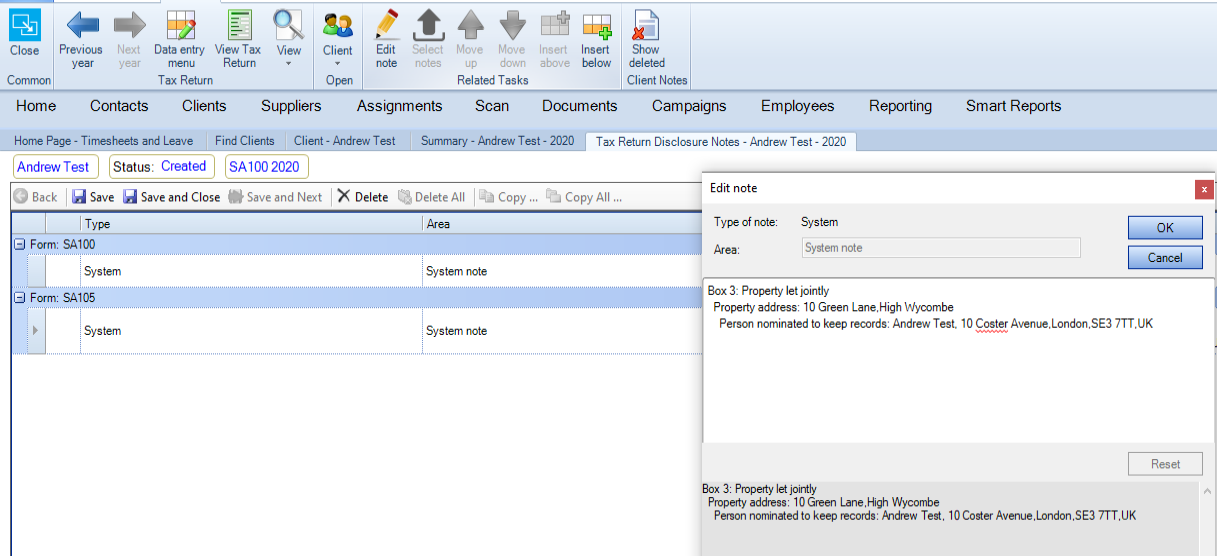

Editing Notes

System Notes

Highlight the note to be edited. Select Edit note from the Ribbon Bar. The Edit note window is displayed:

Add/edit the text. Select OK.

To restore the original text select Reset.

Deleting Notes

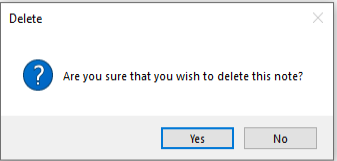

Highlight the note to be deleted. Select Delete from the ribbon above it:

A Delete window is displayed:

Where a notes is highlighted that is mandatory and not permitted to be deleted, the Delete button is disabled.

Show Deleted

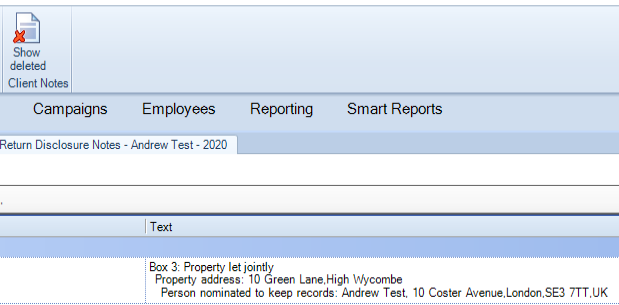

Select Show Deleted Client Notes from the Ribbon Bar to display notes which have been deleted (where permitted).

The deleted note will then be displayed and greyed out:

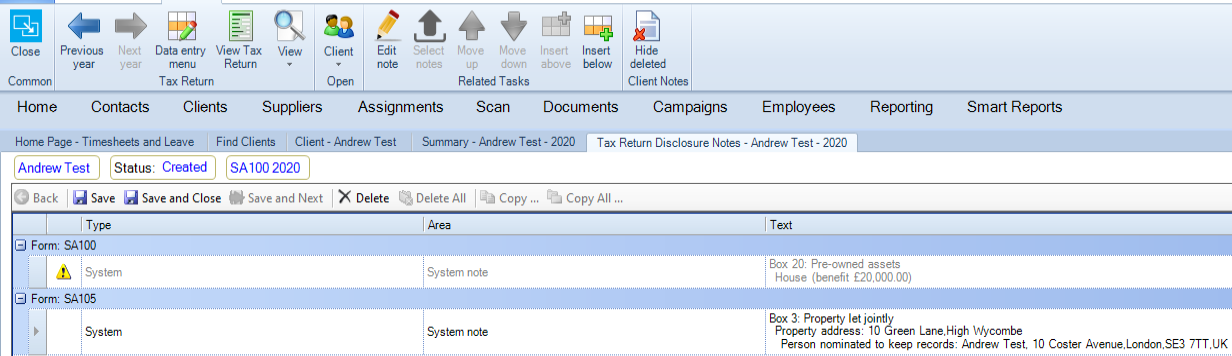

Displaying Disclosure Notes

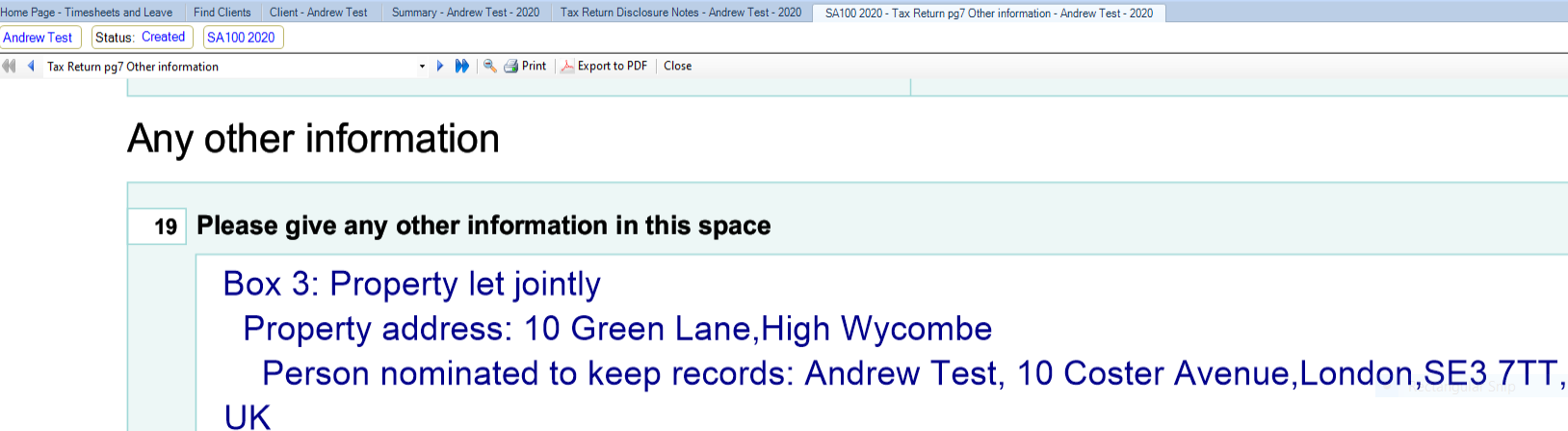

Disclosure notes are displayed in the other information box in the tax return:

Double click on the note to drill down to the Tax Return data entry screen associated with that note.