CCH Accounts Production 2022.2: Release Notes

Release Highlights

This release provides a compliance update for the Academies Accounts Direction 2021/22 and LLP SORP 2021. In addition there are a number of enhancements and other usability improvements.

- Academies Accounting Direction 2021/22

- LLP SORP 2021

- Updates to eight Master Packs are also provided.

User Guides are available in Help here and the earlier Release Notes can be found here.

Prerequisites

Installing CCH Accounts Production 2022.2

This release is installed using the Central Suite Installer. This ensures that all prerequisites are in place and that all the products for which you are licenced are installed in the correct sequence. Click here to learn about the Central Suite Installer (Prerequisites, Update Instructions etc).

Legislative & Compliance Updates

Packs updated

The following master packs have been updated for this release. These are discussed in more detail in the following sections.

- UK Academy – pack 14.00

- Limited (FRS 102) – pack 43.00

- Consolidated (FRS 102) – pack 35.00

- Limited Micro Entity (FRS 105) – pack 26.00

- Limited Liability Partnerships (FRS 102) – pack 30.00

- Limited IFRS – pack 35.00

- Consolidated (IFRS) – pack 10.00

- Charity (FRS 102) – pack 22.00

- Unincorporated – pack 18.00

Key changes that apply to multiple packs

Exception reports

For all master packs that include exception reports, these have been moved to start of the Full Accounts section and have been generally brought up to date. These reports are set to not print by default.

Packs affected are:

- FRS 102 Limited, IFRS Limited, FRS 102 LLP, FRS 105 Limited, Academies and Unincorporated.

Cash flow improvements

Cash flows have been changed as follows:

- The statutory database adjustments for grossing up investment and financing movements have been placed on separate grids, where information is provided about the balances before and after adjustments.

- Users can now reallocate dividends and interest received from investing activities to operating activities; interest paid from operating activities to financing activities; and dividends paid from financing activities to operating activities .

Packs affected are:

- FRS 102 Limited, FRS 102 Group, IFRS Limited, IFRS Group, FRS 102 LLP.

UK Academies Master Pack 14.00

Overview of changes

A user guide for Academies and other training materials are available in online Help.

Master Pack 14.00 applies to all Academy financial statements with accounting periods commencing on or after 1 September 2021, normally with periods ending 31 August 2022. It incorporates the changes introduced by the Academies Accounts Direction 2021 to 2022, in particular:

- The separate trading account for teaching schools has been made optional (this has been applied to both Fund 6 and Fund 7).

- The audit report has been updated for the August 2021 bulleting of illustrative audit reports.

- The staff costs note has a new table for severance pay, and now distinguishes between ordinary and special severance payments.

- Minor changes to wordings and disclosures throughout.

In addtion, the following improvements were made:

- There is now a dedicated VAT debtors code, 750.

- There is a new code for charging pension admin costs to the liabilities element, 97D55.

- Government soans are now split between DFE and non-DFE.

- Transfer codes have been added to the Intangibles area.

- Users now have the option of showing/hiding movements on fixed asset investments.

Format amendments

The following formats were amended:

- Exceprep - Exception report: VSTS 230458 - Moved Exception report to full accounts area; Updated to remove irrelevant items and to show headings only where there are items to check.

- Page1cvr - Front cover: VSTS 230458 - Company Registration No. changed to align with usage elsewhere as "Company registration number".

- Page4trr - Trustees' report: VSTS 230458 - Edited the carbon section to change the StatDB references to fuel and electricity so they output correctly.

- Page4gs - Governance statement: VSTS 230437 - Updates required by the 2022 AAD (added headings and new paras for Conflicts of interest and Meetings).

- Page5aud - Auditor's report: VSTS 230458 - Audit report amended in line with Aug 2021 illustrative examples.

- Page6sf1 - Statement of financial activities: VSTS 230437 - Updates required by the 2022 AAD (change note ref for funds 06/07 where separate trading accounts are not being shown). VSTS 230458 - Cell J40 style changed to Comparative Year No. Debit.

- Page7bs - Balance sheet: VSTS 230458 - Company Registration No. changed to align with usage elsewhere as "Company registration number".

- Page8cf - Statement of cash flows: VSTS 230458 - Provided option of showing cash funds transferred in on conversion either within operating activities, investing activities or as a separate line.

- Note40 - Comparative information: VSTS 230437 - Updates required by the 2022 AAD (minor wordings).

- Note06 - Funding for educational operations: VSTS 230437 - Updates required by the 2022 AAD (revised heading). VSTS 230458 - Indented all of 'Other DfE/ESFA grants' items.

- Note08 - Expenditure: VSTS 230458 - Merged cells for detail of audit costs; Corrected formulae in cells I13 and I14.

- Note14 - Staff costs: VSTS 230437 - Updates required by the 2022 AAD (added table for severance payments; minor changes for special severance payments, higher paid staff and key personnel).

- Note17 - Transfers: VSTS 230458 - Added columnflex.

- Note16 - Taxation: VSTS 230458 - Added columnflex.

- Note18 - Exceptional item: VSTS 230458 - Removed extra row.

- Note19 - Intangible fixed assets: VSTS 230458 - Adjusted keep together; Added transfer rows.

- Note20 - Tangible fixed assets: VSTS 230458 - Added columnflex to attachment and updated the keep together & formatting.

- Note21 - Heritage assets: VSTS 230458 - Added columnflex.

- Note22 - Fixed asset investments: VSTS 230458 - Added columnflex to attachment and updated the keep together; triggered attachment by new flag.

- Note25 - Debtors: VSTS 230458 - Added dedicated vat debtors code.

- Note26 - Current asset investments: VSTS 230458 - Added columnflex.

- Note29 - Creditors falling due after more than one year: VSTS 230458 - Added column headings for finance lease section.

- Note30 - Provisions for liabilities and charges: VSTS 230458 - Added suppression to top row.

- Note31 - Deferred income: VSTS 230458 - Simplified keep together.

- Note32 - Funds: VSTS 230437 - Updates required by the 2022 AAD (change comparatives for new funds added last year). VSTS 230458 - Moved 'stop repeating subtitles' commands on main and comparative tabs onto rows that are never suppressed, so that they always take effect.; In MATCosts tab, amended formulae in D12 and H12 to include the G column figures.

- Note35 - Analysis of net assets between funds: VSTS 230437 - Updates required by the 2022 AAD (changed line descriptions to match AAD).

- Note36 - Pension and similar obligations: VSTS 230458 - Added new code for admin costs in pension schemes.

- Note39 - Cash flow: inflow from operating activities: VSTS 230437 - Updates required by the 2022 AAD (added notes cross references).

- Note42 - Cash flow: major non-cash transactions: VSTS 230458 - Added columnflex.

- Note60 - Cash flow - net debt analysis: VSTS 230458 - Applied formatting to some blank cells.

- Note43 - Contingent liabilities: VSTS 230458 - Added columnflex.

Paragraph amendments

The following paragraphs were amended or added:

Minor updates arising from AAD 2022

- Accounting policies - critical matters - detail

- Accounting policies - incoming resources - building programme

- Accounting policies - pensions - lgps

- Assurance report - respective responsibilities - accounting officer

- Governance statement - governance - reviews

- Governance statement - review of effectiveness - introduction

- Governance statement - risk and control framework - internal audit

- Governance statement - risk and control framework - internal audit role 2

- Governance statement - risk and control framework - internal audit role 3

- Notes - Bal sheet - pension - tps introduction

- Notes - Bal sheet - pension - tps valuation 3

- Notes - other - no related party transactions

- Regularity - confirm no irregularities

- Regularity - recognise irregularities

- Regularity - responsibilities of accounting officer

- SOFA notes - resources expended - ex gratia payments

- SOFA notes - staff costs - key management

- SOFA notes - staff costs - severance payments

- SOFA notes - staff costs - special severance payments

- Trustees report - connected and related

- Trustees report - financial review

- Trustees report - fundraising

- Trustees report - future plans

- Trustees report - introduction

- Trustees report - organisational structure

- Trustees report - remuneration of key management personnel

- Trustees report - reserves 1

- Trustees report - reserves 2 - funds review

- Trustees report - reserves 3 - funds in deficit

- Trustees report - reserves 4 - value of free reserves

Removed references to ICAEW guidance

- Audit report - irregularities assessment 1 -4

- Audit report - irregularities response action 1 -10

Other audit report changes

- Audit report - auditor's responsibilities - fraud introduction: VSTS 230458 - Audit report text amended in line with Aug 2021 illustrative examples: removed first two sentences.

- Audit report - auditors responsibilities for the audit: VSTS 230458 - Audit report text amended in line with Aug 2021 illustrative examples: Removed comma before 'but' in second sentence.

- Audit report - auditors responsibilities further description: VSTS 230458 - Audit report text amended in line with Aug 2021 illustrative examples: changed wording to "is available on".

- Audit report - matters on which we are required to report by exception: VSTS 230458 - Audit report text amended in line with Aug 2021 illustrative examples, and separate paras now combined.

- Audit report - nothing to report on matters - agreement with accounting records: VSTS 230458 - Audit report text amended to simplify presentation.

- Audit report - nothing to report on matters - books and records: VSTS 230458 - Audit report text amended to simplify presentation.

- Audit report - nothing to report on matters - disclosure of trustees remuneration: VSTS 230458 - Audit report text amended to simplify presentation.

- Audit report - nothing to report on matters - information and explanations: VSTS 230458 - Audit report text amended to simplify presentation.

- Audit report - opinion - introduction: VSTS 230458 - Audit report text amended in line with Aug 2021 illustrative examples: changed "the notes" to "notes" and removed "a summary of".

- Audit report - opinion - opinion introduction: VSTS 230458 - Amended stat db title for clarity.

- Audit report - opinion on consistency - disagreement: VSTS 230458 - Removed capitalisation of trustees' report.

- Audit report - opinion on consistency - disclaimer: VSTS 230458 - Removed capitalisation of trustees' report.

- Audit report - opinion on consistency - limitation in scope: VSTS 230458 - Removed capitalisation of trustees' report.

- Audit report - other information: VSTS 230458 - Audit report text amended in line with Aug 2021 illustrative examples (extensive changes).

- Audit report - responsibilities of trustees: VSTS 230458 - Audit report text amended in line with Aug 2021 illustrative examples: removed paragraph split.

New paragraphs

- Governance statement - governance - conflicts of interest

- Governance statement - governance - meetings

Nominal amendments

The following nominals were amended:

| Old description | Revised |

| 803 Government loans 804 Government loans - final 910 Government loans (amounts due in over 1 year) 911 Government loan - final acct 602 Goodwill: additions (non cash) 60C Dev costs: additions (non cash) 612 Software: additions (non cash) |

Government loans - DFE group Government loans - other Government loans > 1 year - DFE group Government loans > 1 year - other Goodwill: cost transfers Dev costs: cost transfers Software: cost transfers |

The following nominals were added:

750 VAT recoverable

97D55 Administration expenses

608 Goodwill: accum depreciation transferred

60H Dev costs: accum depreciation transferred

618 Software: accum depreciation transferred

Statutory database amendments

The following were added:

#ac1170 Governance statement Conflicts of interest

#ac1171 Governance statement Meetings

#ac1172 Other notes Hide fund 06 trading account

#ac1173 Other notes Hide fund 07 trading account

#ac1174 SOFA notes Severance para

#ac1175 SOFA notes Severance band 1

#ac1176 SOFA notes Severance band 2

#ac1177 SOFA notes Severance band 3

#ac1178 SOFA notes Severance band 4

#ac1179 SOFA notes Severance band 5

#ac1180 FAI Show details of FAI

#ac1181 Cash flow Disclosure of conversion cash

Limited (FRS 102) Master Pack 43.00

Format amendments

The following formats were amended:

- Exrep - Exception report: VSTS 230595 - Moved exception report to full accounts area and updated generally.

- Page5aud - Auditor's report 2020: VSTS 236229 - Amended statutory auditor field to show name (and therefore the iXBRL tag) separate from designation.

- Page7sofp - Balance sheet: VSTS 236229 - Replaced line suppression formula for share capital to always suppress for companies limited by guarantee.

- Page7soce - Statement of changes in equity: VSTS 236229 - Corrected cells L50 and L89 where "a," and "b," were reversed.

- Page8cf - Statement of cash flows: VSTS 235357 - Made changes to permit the reallocation of dividends and interest paid; Made descriptions for proceeds of/from etc consistent.

- Note99 - Audit report information: VSTS 236229 - Amended statutory auditor field to show name (and therefore the iXBRL tag) separate from designation.

- Mgmtdpl2 - Detailed trading and profit and loss account: VSTS 236229 - Added COS detail where the farm formats are used but not the farm trading accounts.

- Lscdtrs - Creditors within one year: VSTS 236229 - Amended print condition to include all current liabilities.

Paragraph amendments

The following paragraphs were amended:

- Audit Report - Matters on which we are required to report by exception: VSTS 230595 - Restored the paragraph split (Aug 2021 removed in illustrative accounts, but for small cos only and appears to be a mistake).

- Audit Report - Irregularities assessment and response paragraphs (several paragraphs): VSTS 230458 - Removed references to ICAEW guidance.

- Balance Sheet - Small Companies Regime s324 CA 2014: VSTS 230595 - Amended "Statement" to "Standard".

New paragraphs added

- General - Client preferences - Unqualified opinion: VSTS 230595 - Added plain text unqualified opinion for tagging.

Name range amendments

Added to farm formats:

CLIAB Current liabilities range 8000..899Z

Consolidated (FRS 102) Master Pack 35.00

Format amendments

The following formats were amended:

- Page8cf - Group Cash Flow Statement: VSTS 235357 - Made changes to permit the reallocation of dividends and interest paid; Made descriptions for proceeds of/from etc consistent.

- Page8pcf - Company Cash Flow Statement: VSTS 235357 - Made changes to permit the reallocation of dividends and interest paid; Made descriptions for proceeds of/from etc consistent.

Paragraph amendments

The following paragraphs were amended:

- Audit Report - Matters on which we are required to report by exception: VSTS 230595 - Restored the paragraph split (Aug 2021 removed in illustrative accounts, but for small cos only and appears to be a mistake).

Limited Micro Entity (FRS 105) Master Pack 26.00

Format amendments

The following formats were amended:

- Page7sofp - Balance Sheet: VSTS 230595 - Corrected the capitalisation of Company registration number on final tab and amended to show country of registration.

- Exrep - Exception Report: VSTS 230595 - Moved exception report to full accounts area and updated generally.

Paragraph amendments

The following paragraphs were amended:

- Audit Report - Matters on which we are required to report by exception: VSTS 230595 - Restored the paragraph split (Aug 2021 removed in illustrative accounts, but for small cos only and appears to be a mistake).

The following paragraphs were deleted:

- Notes - Directors' benefits: advances, credit and guarantees: No longer required.

Limited Liability Partnerships (FRS 102) Master Pack 30.00

Overview of changes

The LLP SORP 2021 is effective for accounting periods commencing on or after 1 January 2022. Early adoption is permitted for accounting periods beginning before 1 January 2022. The main changes affecting the financial statements in the 2021 version are:

- An accounting policy is required for the treatment of members' drawings and similar payments in the cash flow.

- Where there is an Energy and Carbon Report, the names of all LLP members must be provided.

Format amendments

The following formats were amended:

- Page4mem - Members' Report: VSTS 230646 - Updated for LLP SORP 2021, adding list of members for the carbon report.

- Page7romi - Reconciliation Of Members' Interest: VSTS 230646 - Updated for LLP SORP 2021 (Replace "Drawings" with "Drawings on account and distributions of profit".)

- Page8cf - Statement Of Cash Flows:

- VSTS 230646 - Updated for LLP SORP 2021 (Added option to reallocate part or all of drawings to operating activities, using #lp37 and #lp38).

- VSTS 235357 - Made changes to permit the reallocation of dividends and interest paid and received between activities; Made descriptions for proceeds of/from etc consistent.

- Note01 - Accounting Policies: VSTS 230646 - Updated for LLP SORP 2021 (added policy for classification of drawings within the cash flow).

- Note55 - Reconciliation Of Members' Interests Note: VSTS 230646 - Updated for LLP SORP 2021 (Replace "Drawings" with "Drawings on account and distributions of profit".)

- Exrep - Exception Report: VSTS 230595 - Moved exception report to full accounts area and updated generally.

Paragraph amendments

The following paragraphs were amended:

- Accounting Policies - Basis of preparation: VSTS 230646 - Updated for LLP SORP 2021.

- Audit Report - Matters on which we are required to report by exception - Small company exemption: VSTS 230595 - Removed blank line before indented text.

New paragraphs added

- Accounting Policies - Members’ participation rights – Drawings: VSTS 230646 - Created for LLP SORP 2021.

- Members' Report - Carbon report - List of members: VSTS 230646 - Created for LLP SORP 2021.

- General - Client preferences - Unqualified opinion: VSTS 230595 - Added plain text unqualified opinion for tagging.

Statutory database amendments

The following were added:

#lp33 General - Client preferences: Early adopt LLP 2021

#lp34 Members' Report - Carbon report: List of members

#lp35 Accounting policies - Members' interests: Cash flow classification - heading

#lp36 Accounting policies - Members' interests: Cash flow classification of drawings

#lp37 Cash flow - Financing: Drawings allocated to operating costs

#lp38 Cash flow Financing: Option to allocate all drawings to operating costs

Limited (IFRS) Master Pack 35.00

Format amendments

The following formats were amended:

- Exrep - Exception report: VSTS 230595 - Moved exception report to full accounts area and updated generally.

- Page8cf - Statement of cash flows: VSTS 235357 - Made changes to permit the reallocation of dividends and interest paid; Made descriptions for proceeds of/from etc consistent.

- Note01 - Accounting policies: VSTS 230595 - Improved keep together on rows 297-301 share based payments

- Note85 - Cash generated from operations: VSTS 230595 - Added blank line after currency heading.

Paragraph amendments

The following paragraphs were amended:

- Audit Report - Matters on which we are required to report by exception (small and non-small): VSTS 230595 - Restored the paragraph split.

Name range amendments

Added:

CLIAB Current liabilities range 8000..899Z

Group (IFRS) Master Pack 10.00

Format amendments

The following formats were amended:

- Page8cf and Page 18cf - Statement of cash flows: VSTS 235357 - Made changes to permit the reallocation of dividends and interest paid; Made descriptions for proceeds of/from etc consistent.

- Note85 and Note 85c - Cash generated from operations: VSTS 230595 - Added blank line after currency heading.

Paragraph amendments

The following paragraphs were amended:

- Audit Report - Matters on which we are required to report by exception (small, non-small and ROI): VSTS 230595 - Restored the paragraph split.

Charities (FRS 102) Master Pack 22.00

Format amendments

The following formats were amended:

- Page1cvr - Front cover: VSTS 230595 - Amended Annual report description to exclude the irrelevant abridged/abbreviated option and show "unaudited" for both accountants report and independent examination.

- Page4trr - Trustees' report: VSTS 230595 - Suppressed supplier payment policy rows except for ROI companies.

- Page5aud2 - Auditor's report 2020: VSTS 230595 - Amend header to refer to Members for companies; Amend row suppression in A5 of "Signoff" tab

- Page8cf - Statement of cash flows: VSTS 235357 - Make descriptions for proceeds of/from etc consistent.

- Note121 - Support and governance costs: VSTS 236229 - Amended formulae in column suppression row I1-K1 to hide columns where there are no figures; amended formatting of PY headings to Col B.

- Note124 - Endowment funds: VSTS 236229 - Amended formulae in column suppression row E3-N3 to exclude row 19.

Paragraph amendments

The following paragraphs were amended:

- Audit report - Bannerman: Replaced "auditors'" with #aw10

- Audit report - nothing to report on matters - introduction: VSTS 230595 - Added paragraph split after opening para for companies. Text added in MP21 duplicates contents of #pd5049 and so has been removed,

- Audit report - opinion on true and fair: Added additional wording for Companies Act report

- Balance sheet - small companies regime: VSTS 230595 - Amended "Statement" to "Standard".

Name range amendments

Amended names:

PROFIT Profit for adjustments report

was CYADJPYDIS+DIS1MOV+DIS2MOV+DIS3MOV+PLPIOTH+PROFITCO

now DIS1MOV+DIS2MOV+DIS3MOV+TONIRAT

GROSSASSETS Gross assets for size purposes

was 6000..769Z+7700..789Z+7900..799Z+8160+9410..944Z

now 6000..679Z+Debits 6800..684Z+6850..769Z+Debits 7700..789Z+7900..799Z+Debits9410..944Z

New name:

ASSETS Gross assets excl pensions 6000..799Z

Statutory database amendments

Replaced plugin for size/report calculations with:

- Grids to show size calculation (automatic and manual).

- A simple drop-down choice of the report required.

Items added as a result:

#cy1062 Gross income

#cy1063 Gross assets

#cy1064 Calculated size last year

#cy1065 Qualifying size last year

#cy1066 No of employees

Unincorporated Master Pack 18.00

Format amendments

The following formats were amended:

- Exrep - Exception Report: VSTS 230595 - Moved exception report to full accounts area and updated generally.

- Page6is - Profit and loss account: VSTS 230595 - Centred dates etc over two columns where there is a change of year end or restatement.

- Page7sofp - Balance sheet: VSTS 230595 - Added stock note reference to FRS 102.

- Note11 - Creditors due after one year: VSTS 230595 - Changed description 'Bank loans and overdrafts' to 'Bank loans'.

Software Enhancements

CCH Accounts Production

VSTS 217422 - Saving accounts to PDF and Word and printing them

The method used to save the accounts to PDF and Word has changed. This was due to moving to a new version of a third-party component. However moving to the new version required rewriting this area and has resulted in several changes that are visible to users.

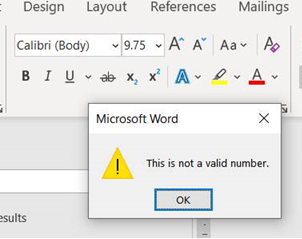

- To create a PDF, CCH Accounts Production first creates a Microsoft Word document internally before it is saved to PDF. This means that only features that are supported by Word can be supported in CCH Accounts Production. Word only accepts whole point sizes or half point sizes, e.g. 9pt or 9.5pt, but not 9.75pt. You can see this in Word if you try to change the font of some text to 9.75pt:

- Previously, CCH Accounts Production often used fonts that were not a whole or half point size. On upgrading to 2022.2, these fonts are rounded down to the nearest whole or half point size, e.g. 9.75pt text is rounded down to 9.5pt text.

- The new method creates PDF files much quicker than the old method and file sizes are smaller.

- The new method does not speed up generating Word documents or change their size, but it does fix some problems that occurred previously with saving accounts to Word.

- Because accounts are saved to PDF in the same way that they are printed, this change also affects accounts that are printed directly without being saved to PDF.

These changes affect all masterpack versions and the user does not need to take any action.

Note: You may not like the slightly smaller fonts that the system now uses. If so, you can use a larger size, but this is a significant amount of work. You create your own Theme in File > Maintenance > Accounts > Themes, use a different font size and tick 'Is Default' to use it for new clients. (The Theme for existing clients is changed through 'Job Themes').

However the CCH accounts pages are not designed for larger font sizes and some column headings may be wrapped. This can happen even within a single long word such as "exercisable". So moving to a larger font may require creating a practice pack and adjusting some column widths.

We doubt that many users will find it worthwhile to do this for the fractional change in font size.

Note: Although the new MS Word documents exactly replicate the accounts, they are hard to edit as every text item is held in its own textbox and this is positioned relatively to the top left of the page. If the text is edited and makes a textbox longer, it can bump into the next textbox below as the lower textbox will keep its position. However other edits, such as adding in extra pages, e.g. for an independent Auditor's Report, should not be a problem.

Note: If accounts are saved to Word and the whole document appears blank, this is probably because the setting to show textboxes has been switched off in Word. In Office 365, this is called Show drawings and textboxes on screen and can be found under File > Options > Advanced > Show document content. This problem should not occur often as the setting is On by default.

Note: As the new accounts are fractionally smaller than the old ones, there could be a slight difference between accounts that were produced before and how they appear now. So if accounts are out for signing, they could be slightly different by the time they are finalised.

Quality Improvements

CCH Accounts Production

ADO 230648 - When finalised, you should not be able to delete an accounting period

To delete a finalised accounting period, you now have to Unfinalise it first.

ADO 234653 - Year end sometimes fails with error - “Year End was unsuccessful”

The cause of the problem was that a close off account on a local nominal record occasionally became corrupted to include both the nominal code and the account description. We have not replicated this corruption, but we have prevented it causing an error at the Year End.

ADO 232906 - Statutory Database - Errors and Exceptions panel not fully shown

The Statutory Database shows an Errors and Exceptions panel. The bottom of this panel was truncated, hiding the tabs for Workflow and Working Papers.

CCH Working Papers

ADO 232913 - Full accounts will not save within Working Papers

The issue where the user was adding a full set of accounts using the From Financial Statements option and navigating away. The folder was not being retained and you got an error if you tried to add it again, this has been addressed.

ADO 233537 - ITS/59490 - Home Page - the Tool box to customise home page can take a long time to appear

This happened on sites that have WPM but no Corporation Tax.

ADO 236645 - Working Papers Designer - Adding a template that had been deleted in an earlier pack could corrupt the Papers Navigator

This could be seen in the Working Papers Designer where the schedule reference was something like [C._] instead of [C.3]. This meant the system could not determine the correct ordering for the template and could prevent adding further templates.

Notable Issues

CCH iXBRL Filing issues

Our current Notable issues list is available from Customer Communities on UserDocs.

CCH Accounts Production

207516 – Error 49 on upgrade

When logging into Central following a release, the error message “error code 49” is shown.

This indicates that the Central database and the Document Store database are no longer in sync.

Please contact CCH Support for assistance.

237416 - Transferring fixed assets from CCH Accounts Production to CCH Corporation Tax for IFRS

The link from CCH Accounts Production to CCH Corporation Tax for Tangible Fixed Assets does not work for IFRS clients.

The data must be entered manually in CCH Corporation Tax.

Unable to travel images

Any images stored in the Image Library will not be available in the travelled database. CCH will investigate providing this ability in a future release.

Unable to load accounting period if server data format is MM/DD/YY

An issue has been identified that prevents CCH Accounts Production from loading the Accounting Period if the date format in your environment is not dd/mm/yyyy. There is no solution to this at present, other than to amend your Date/Time settings in Windows.

206581 - FRS 102 – Countries that are incorporated in region 3

We have an issue with the Directors Report and Investment Property note not printing correctly. The majority of users are unaffected as accounting periods incorporated in England and Wales, Scotland and Northern Ireland are all set to region 1. Republic or Ireland and Eire are set to region 2. Other countries fall into region 3 and there may be a format issue caused by the print condition or row conditions incorrectly testing on either region 1 or region 2.

234971 – Text entered into paragraph is more than one page in length

We have an issue where text entered into a paragraph node in the statutory database does not print correctly if it is more than one A4 page in length. The bottom of the text ‘falls off’ the A4 page and is not continued on the following A4 page. The workaround is to split the text across two or more nodes, or if that is not possible, enter the text directly into the format cell and make the format local.