CCH Corporation Tax 2024.2: Release Notes

Release Highlights

This release of CCH Corporation Tax is specifically targeted to include the following:

- Research and Development Changes

- Investment Zones

- QIPs Reporting

In addition to the above items, we have also included a few ITS fixes. Details of these and other changes are included in these release notes.

Prerequisites

Installing CCH Corporation Tax 2024.2

This release is installed using the Central Suite Installer. This ensures that all prerequisites are in place and that all the products for which you are licenced are installed in the correct sequence. Click here to learn about the Central Suite Installer.

Note that when upgrading, the Corporation Tax Database Upgrade is, relatively, slow as it is loading new iXBRL tags. We will work to speed up this process before the compliance release for 2025.

Legislative & Compliance Updates

Research and Development Changes

For Accounting periods beginning after 31st March 2024, the Research and Development screen has the following Type of Expenditure options in the dropdown menu.

RDEC: Merged Scheme

Expenditure under 'RDEC: Merged Scheme' calculates a CY tax credit of 20% in the Tax Credits screen.

RDEC: Intensive (ERIS)

Expenditure under 'RDEC: Intensive (ERIS)' calculates an additional deduction of 86% and a maximum tax credit available of 14.5% of the loss surrendered in the Tax Credits screen and populates Box L170 on the CT600L with the tax credit claimed.

Subcontracted

Expenditure under 'Subcontracted' calculates a CY tax credit of 20% in the Tax Credits screen and populates box L185 on the CT600L

Subsidised and capped

Expenditure under 'Subsidised' and capped calculates a CY tax credit of 20% in the Tax Credits screen which populates Box L190 on the CT600L

Investment zones

Investment Zone asset detail data entry has been added to the Trade Capital Allowances area.

Plant and Machinery Allowances

To claim Plant and Machinery allowance in Investment zones on expenditure after 31st March 2024, click on the Asset Description column.

A tick box in the data entry screen has been added to claim this enhanced allowance.

This tick box should be manually checked for each asset as required.

The Investment Zone can be selected from the Freeport and/or Investment Zone Location dropdown

Complete the Business operation address and Postcode fields.

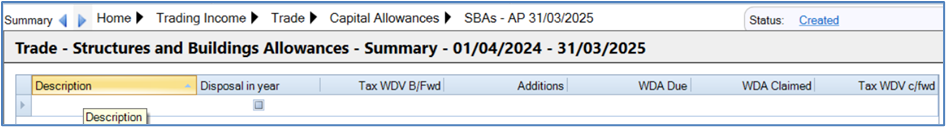

Structures and Buildings Allowances

To claim Structures and Buildings allowance in Investment zones on expenditure after 31st March 2024, click in the Asset Description box.

A tick box in the data entry screen has been added to claim this enhanced allowance.

The Investment Zone can be selected from the Freeport and/or Investment Zone Location dropdown.

Complete the Business operation address and Postcode fields.

Linking from the Fixed Asset Screens - Additions

Plant and Machinery additions in Investment zones are included as an allowance type:

Linking from the Fixed Asset screen – Disposals

We have included Investment Zones within Pool type:

To select the asset disposed of, click the ellipsis. A dropdown menu of the assets in Investment Zones appears.

Select the asset to link to the disposal:

QIPs Reporting

In Central Reporting we have updated the CCH Corporation Tax – Tax due & filing date report to capture all companies where the current accounting period’s data has not been entered into CCH Corporation Tax but would have a QIP due on the basis that they were large in the preceding Accounting Period.

Please note the report only shows periods of account where the previous period of account has been created in CCH Central.

Quality Improvements

ITS 67744 - Research and Development tax credit

For a period straddling 31st March 2023, if surrendering a loss for R&D SME Basic on expenditure before 1st April 2023, entered as Total Expenditure Only, the maximum tax credit available is now calculated correctly at 14.5%.

Items included in the 2024.120 Service Pack

Legislative & Compliance Updates

New Computation Taxonomy

The 2024 Corporation Tax Computation Taxonomy is included in this release. As in previous years, this goes live on the HMRC gateway shortly after this release but before the 2024.2 release. This new taxonomy will be used for all new corporation tax returns generated on or after 31st May 2024. Existing returns generated before this date are unaffected.

Configuration Key

We have added a configuration key CT_Use2024Taxonomy to ensure that all submissions created on or after 31 May 2024 use the new Computation Taxonomy. Existing submissions created before this date using the 2023 computation taxonomy continue to be accepted by the Government Gateway; there is no need to regenerate the IR mark.