CCH Corporation Tax 2024.1: Release Notes

Release Highlights

This release of Corporation Tax forms part of our annual compliance release. The work includes but is not restricted to:

- New form CT600 and supplementary Form CT600M

- Changes to Capital Allowances

- Changes to repayments

- Updated RIM artefacts

In addition to the above items, we have also included a few ITS fixes, details of these and other changes are included in these release notes.

Prerequisites

Installing CCH Corporation Tax 2024.1

This release is installed using the Central Suite Installer. This ensures that all prerequisites are in place and that all the products for which you are licenced are installed in the correct sequence. Click here to learn about the Central Suite Installer.

IMPORTANT - Travelling

CCH Corporation Tax only supports New style travelling with this release.

Following this update New travelling is automatically enabled.

If you are using Old style Travelling please contact support who can provide details on the correct migration process to new travelling to your system Administrator.

Legislative & Compliance Updates

New Forms

The new form CT600 and Supplementary Form CT600M are included in this release. The new form CT600 is generated for all Accounting Periods ending after 31 March 2015.

RIM artefacts

We have implemented the latest RIM artefacts for the new Form CT600 and supplementary pages which go live in April 2024 for accounting periods starting after 31 March 2015.

100% Fully Expensed Capital Allowances

Previously 100% FYA Fully Expensed Capital Allowances and Balancing Charges were reported in boxes 688 and 689 for Trades and boxes 733 and 734 for Management Expenses. On upgrade to 2024.1 these are now reported in boxes 725 and 730 for Trades and boxes 750 and 755 for Management Expenses.

Where a tax return with entries 725, 730, 750 and 755 on the CT600 has been generated but not submitted, on upgrade a message appears in the Errors and Warnings panel.

50% and 100% Fully Expensed Capital Allowances

In the 2023 Autumn statement it was announced that these Capital Allowances would be made permanent.

100% First Year Capital Allowances

It is now possible to claim 100% First Year Capital Allowances for expenditure incurred after 31 March 2026.

50% FYA Capital Allowances

It is now possible to claim 50% First Year Capital Allowances for expenditure incurred after 31 March 2026.

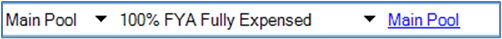

Fully expensed Capital Allowances - Linking from Fixed Assets

It is now possible to link fully expensed capital allowances in Fixed Assets.

Additions

Additions are included as an allowance type 100% FYA Fully Expensed

Disposals

Disposals are included within Pool type:

Click  to select the asset.

to select the asset.

Repayment Details

HMRC do not retain the company’s bank details after they have processed the company’s corporation tax returns. HMRC have requested bank details are shown on the form CT600.

We have added a warning in the Errors and exception panel where a corporation tax repayment is due prompting for the bank details to be entered. This will assist HMRC in making the repayment.

When bank details are entered Repayment to Bank is automatically ticked.

Note: If you choose to deselect the “Repayment to Bank” checkbox, the Bank Details do not appear on page 12 of the Form CT600.

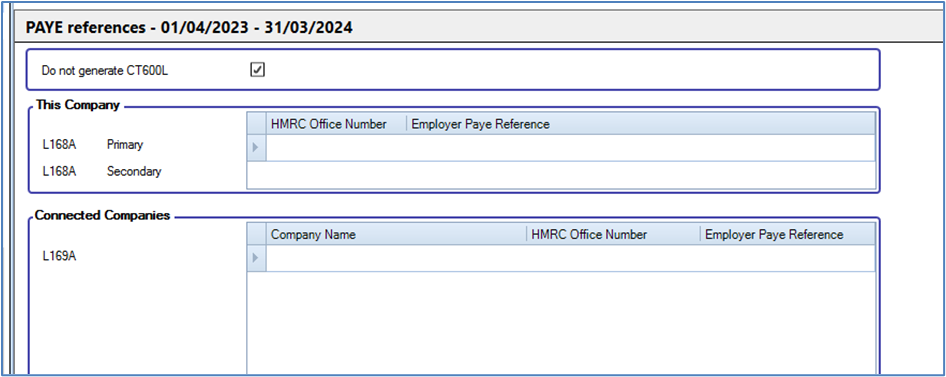

New checkbox to NOT generate CT600L

CCH Corporation Tax attaches the CT600L if any R&D expenditure is entered for Research and Development.

Following your feedback, we have added a new checkbox Do not generate CT600L to PAYE references within the CT600L section of the Data Navigator. Check the box to suppress the CT600L.

Creative Industries

We have updated the Creative Industry Type selection:

The updated items are:

- Film Trade to Film Trade/AVEC

- Video Gaming to Video Gaming/VGEC

- Television to Television/AVEC

Quality Improvements

The following quality improvement has been addressed in this release:

ITS 67839 - Marginal Relief report does not display correctly

For marginal relief purposes we were not reporting the number of associates where there was only 1 associated company in the tax computation report. (The values reported on the CT600 were correct).

ITS 67840 - Associated no appearing as Bold in data navigator

We have fixed the display of the data navigator menu when the entry for Associates did not appear in a bold font when data was present in the Associates screen.

ITS 67860 - QIPs should be based in Associates brought forward

We have amended the QIPs calculation for Accounting Periods beginning after 31st March 2023 for Large and Very Large companies to use the number of associates brought forward rather than the maximum number in the Accounting Period.

ITS 67979 - CT600C not properly populated when there are more then 5 claimant companies

Previously the CT600C was not correctly populated when there were more than five brought forward claimant companies and online filing failed.

Items included in the 2023.310 Service Pack

The following items were included in the 2023.3 service pack release:

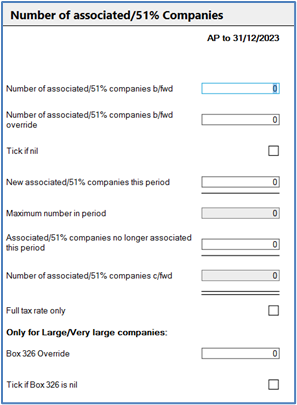

Associated Companies

For Accounting Periods starting on or after 1st April 2023, changes were introduced for completion of Box 326 on the CT600. Box 326 is to be used for reporting the number of Associated Companies and is only completed in the following conditions:

- Large or Very Large companies for the purposes of QIPs

- Companies claiming marginal relief.

- Companies claiming small profits rate.

Box 326 is to be completed with the maximum number for associated companies in the Accounting Period for those claiming Marginal Relief or the small profits rate.

Note: For large or very large companies, it is the number of associates at the beginning of period that is to be used when populating box 326

For Accounting Periods straddling 31st March 2023, we have introduced Box 326 override for Large / very large companies; this is to be used where the number of associates brought forward differs from the number of 51% companies brought forward.

If the number of associated companies brought forward is 0 select the tick if nil checkbox.

Note: Where a company pays tax by instalments, the number of associates is calculated using the number of associates brought forward at the start of the Accounting Period. For such companies do not populate the entries for new/leaving companies

Computation Report

The marginal relief computation report has been updated accordingly:

ITS 67811 - Unable to remove tick from box 329 when marginal relief is not due

When ticking the Full Tax Rate Only option in the Associates data entry screen, Box 329 on the CT600 remained ticked in error.

Notable Issues

ITS 67892 - CT600L generated when not applicable

If there is a payable tax credit and the CT600L is removed, the following errors arise on pre-validation:

SME Basic Relief

Box 875 must only be completed if Box 142 equals ‘yes’

Box 875 must not be greater than Box L180

SME RDEC

Box 880 must only be completed if Box 142 equals ‘yes’

Box 875 must equal Box L125

To remove the error - deselect the Do not generate CT600L checkbox (see above) and rerun the pre-validation.

ITS 67850 - R&D Tax credit for periods straddling change of rate

It has been brought to our attention that the calculation of maximum Research & Development Tax Credit within CCH Corporation Tax available for accounting periods spanning 1 April 2023 differs from HMRC’s published guidance.

As always, legislation is open to interpretation and there is no specific legislation confirming HMRC’s interpretation of the maximum tax credit available.

We are therefore providing the most beneficial calculation of available maximum tax credit; if you prefer to follow the HMRC guidance, we have catered for this, as only the amount claimed is noted on both the CT600 and computation.

If you believe that the most beneficial calculation used within the software is correct, you may also use this.

Considering the below example:

Pre April 2023 R&D enhanced expenditure = £150,000

Post March 2023 R&D Expenditure = £700,000

Total losses surrendered £500,000

The most beneficial tax credit is therefore :

£150,000 @ 14.5% = £21,750

£500,000- £150,000 = £350,000 @ 10% = £35,000

Total = £56,750

HMRC guidance states losses should be pro rata but there does not appear to be any legislation to confirm this method of calculation. We are calculating the maximum that could be claimed (unless the legislation is updated to follow HMRC guidance). As previously advised it is the amount entered as Tax credit claimed that is reported on both the CT600 and the tax computation, should you wish to follow HMRC guidance.

Both methods pass online filing validation and successfully file online. We provide the option for users to claim what they believe is correct.