CCH Corporation Tax 2023.3 SP: Release Notes

Release Highlights

This release of Corporation Tax includes but is not restricted to:

- Associated Companies Changes

- Quality improvement - unable to remove tick from Box 329 when marginal relief is not due.

Prerequisites

Installing CCH Corporation Tax 2023.310 Service Pack

This release is installed using the Central Suite Installer. This ensures that all prerequisites are in place and that all the products for which you are licenced are installed in the correct sequence. Click here to learn about the Central Suite Installer.

Legislative & Compliance Updates

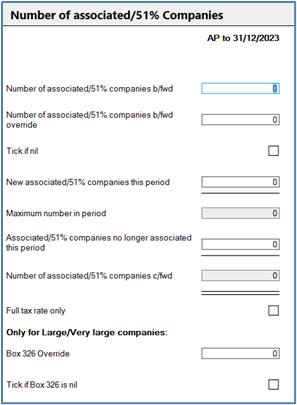

Associated Companies

For Accounting Periods starting on or after 1st April 2023, changes were introduced for completion of Box 326 on the CT600. Box 326 is to be used for reporting the number of Associated Companies and is only completed in the following conditions:

- Large or Very Large companies for the purposes of QIPs

- Companies claiming marginal relief.

- Companies using small profits rate.

Box 326 is to be completed with the maximum number for associated companies in the Accounting Period for those claiming Marginal Relief or the small profits rate.

Note: For large or very large companies, it is the number of associates at the beginning of period that is to be used when populating box 326

For periods straddling 31st March 2023, we have introduced Box 326 override for Large / very large companies; this is to be used where the number of associates brought forward differs from the number of 51% companies brought forward.

If the number of associated companies brought forward is 0 select the tick if nil checkbox.

Note: Where a company pays tax by instalments, the number of associates is calculated using the number of associates brought forward at the start of the Accounting period. For such companies do not populate the entries for new/leaving companies

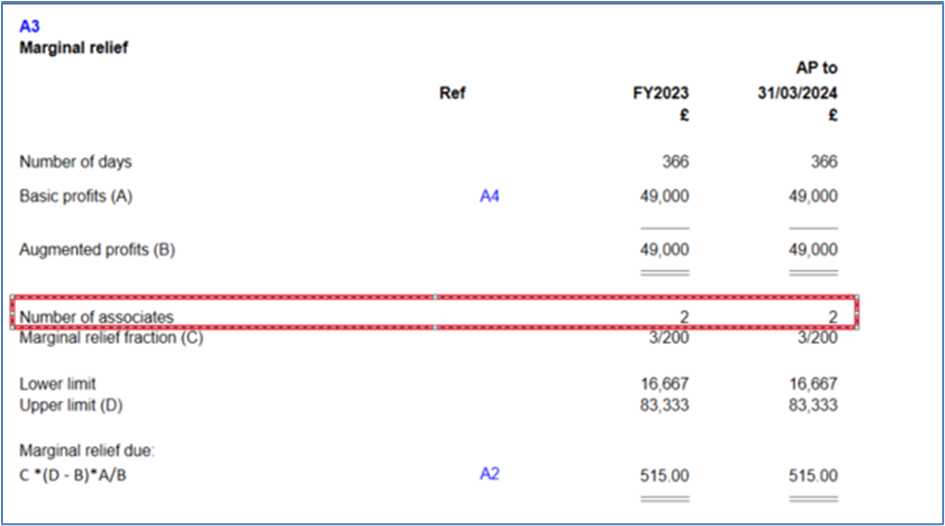

Computation Report

The marginal relief computation report has been updated accordingly:

100% FYA Fully Expensed Statement

100% Fully Expensed items introduced in the main 2023.300 release now appear in the Tax Account Summary section.

Quality Improvements

The following quality improvement has been addressed in this release:

ITS 67811 - Unable to remove tick from Box 329 when marginal relief is not due

When ticking the Full Tax Rate Only option in the Associates data entry screen, Box 329 on the CT600 remained ticked in error.