CCH Accounts Production 2024.1: Release Notes

Release Highlights

This release provides a maintenance and compliance update for many entities. In addition there are a number of enhancements and other usability improvements:

- Allowing an LLP to be included in a group.

- Fixes for the Charity FRS 102 Master Pack which was heavily updated in 2023.3.

User Guides are available in Help here and the earlier Release Notes can be found here.

Prerequisites

Installing CCH Accounts Production 2024.1

This release is installed using the Central Suite Installer. This ensures that all prerequisites are in place and that all the products for which you are licensed are installed in the correct sequence. Click here to learn about the Central Suite Installer.

Note that if you are upgrading from an old release, before 2023.2, then the Accounts Production Database Upgrade is slow as it is loading new iXBRL tags. Loading the iXBRL tags was speeded up for the 2023.2 to 2023.3 upgrade. But earlier upgrades are still slow.

IMPORTANT - Traveling

Before performing this upgrade, ensure that all traveled out clients are traveled back in. This advice is the same for every release, but particularly important for this one.

CCH Accounts Production only supports New style Traveling with this release. Following this update, New style Traveling is automatically enabled. Behind the scenes this means that if several clients are traveled out then they are all traveled out in the same database instead of separate databases. But from a user's point of view, traveling out a client is performed in the same way as before.

Legislative & Compliance Updates

Packs updated

The following master packs have been updated for this release. These are discussed in more detail in the following sections.

- Limited (FRS 102) – pack 49.00

- Consolidated (FRS 102) – pack 41.00

- Limited Micro Entity (FRS 105) – pack 32.00

- Limited Liability Partnerships (FRS 102) – pack 36.00

- Limited Liability Partnerships (FRS 105) – pack 19.00

- Limited IFRS – pack 41.00

- Consolidated (IFRS) – pack 15.00

- Charity (FRS 102) – pack 25.00

- Unincorporated - pack 22.00

- Medical - pack 16.00

Key changes that apply to multiple packs

Include LLP subsidiaries in Group 102 pack: An extended exercise was carried out to enable Group (102) financial statements to include LLP subsidiaries. This involves substantial changes to the LLP chart and name ranges but also several changes to the Group pack and minor changes to other packs.

Limited (FRS 102) Master Pack 49.00

Format amendments

Exrep - Exception report: VSTS 219742 - Added row to indicate use of the refiling of accounts option

Page1cvr - Front cover: VSTS 317374 - Removed option for medium abbreviated accounts.

Page3con - Contents: VSTS 303100 - Suppressed ref to SOCI where small company reduced filing is applied.

Page4sr - Strategic report: VSTS 303100 - Added Sustainability information statement; Added additional paragraphs for the Business review.

Page4dir - Directors' report: VSTS 303100 - Added additional paragraph for principal activities; Simplified page suppression to remove ref to ROI medium exemption.

Page4dd - Directors' declaration: VSTS 317374 - Amended page setup to test for unaudited, ie #cd22<>2 instead of #cd22=0, and to suppress for abridged accounts.

Page5aud - Auditor's report 2020: VSTS 219742 - Provided additional unique formulae for tagging to distinguish between original and revised accounts. VSTS 303100 - Moved the continuation message to the bottom line of the page header; Updated wording for Special Report to agree with CRO and the 2020 compendium of audit reports.

Page6is - Profit and loss account: VSTS 317374 - Amended keep together.

Page7sofp - Balance sheet: VSTS 323351 - Removed refs to medium-sized filing exemptions; Removed line suppression for exemptions where the paragraph hasn't yet been chosen.

Notes 04, 07, 08, 09, 10 - Spare notes: VSTS 323351 - Amended page setup to include this note in ROI abridged accounts; Added Columnflex.

Note10 - Operating profit: VSTS 317374 - Suppress audit fees on full tab unless company is medium and not using full note. VSTS 323351 - Amended page setup to include this note in ROI abridged accounts

Note11 - Auditors' remuneration: VSTS 317374 - Suppress note entirely if company is small; always show if company is large

Note25 - Intangible assets: VSTS 308864 - Replaced descriptions "other changes" with "other movements"

Note28 - Fixed asset investments: VSTS 308864 - Amended keep together on all tabs.

Note34 - Debtors: VSTS 317374 - Amended ROISCE tab row suppression to provide subtotal lines correctly where there are deferred tax assets.

Note50 - Deferred taxation: VSTS 303100 - Amended column suppression to hide comparatives when 1st year applies.

Note53 - Retirement benefit schemes: VSTS 317374 - Replaced database-driven headings with standard text; Added text to OCI section to specify costs/(income).

Note74 - Related party transactions: VSTS 317374 - Extend the keep together on the FurtherDisclosure Tab to include full text where this is the only tab.

Note97 - Directors' interests: VSTS 317374 - Made inactive (n/a since ROI Co Act 2017)

Note76 - Controlling party: VSTS 317374 - Added new tagged items for largest and smallest groups.

Mgmtcvr1 - Management front cover: VSTS 303100 - Amended page setup to suppress note unless override is chosen in statutory database.

Mgmtbs - Detailed balance sheet: VSTS 303100 - Amended page setup to suppress note unless override is chosen in statutory database.

Mgmtdpl2 - Detailed income statement: VSTS 303100 - Amended row suppression on Profit/loss row so that the row prints where there are FV gains on investment property or exchange gains. VSTS 317374 - Removed duplicated Exceptional items from cell C54

Mgmtdpl2f2 - Format 2 detailed income statement: VSTS 303100 - Amended row suppression on Profit/loss row so that the row prints where there are FV gains on investment property or exchange gains.

Mgmt5yr - Five year summary: VSTS 303100 - Amended page setup to suppress note unless override is chosen in statutory database.

Mgmtvar4 , Mgmtvar5, Mgmtmthlypl6, Mgmtqtrly7, Mgmtmthlyvar8 Schedules of variances: VSTS 303100 - Amended page setup to suppress note unless override is chosen in statutory database.

Formattedtb - Formatted trial balance: VSTS 303100 - Added biological assets; Amended page setup to suppress note unless override is chosen in statutory database. database.

Paragraph amendments

Abridged audit report - basis of opinion: VSTS 303100 - Updated wording to agree with CRO and the 2020 compendium of audit reports.

Abridged audit report - introduction: VSTS 303100 - Updated wording to agree with CRO and the 2020 compendium of audit reports.

Abridged audit report - opinion: VSTS 303100 - Updated wording to agree with CRO and the 2020 compendium of audit reports.

Abridged audit report - other information: VSTS 303100 - Updated wording to agree with CRO and the 2020 compendium of audit reports.

Balance sheet - audit exemptions ROI: VSTS 323351 - Updated exemption text in line with latest CRO publication. MP18 Changes: - made explicit that the exemption is from audit

Other notes - largest and smallest groups: VSTS 317374 - Added new paragraph.

Name range amendments

Amended descriptions of name ranges to remove refs to "held to sale" or "other charges":

LLBHLD, LLBDHLD, LIHLD, LIDHLD, INVPHLD, INVPDHLD, INTC3HLD, INTC2HLD, INTC1HLD, INTA3DHLD, INTA2DHLD, INTA1DHLD, GITRFHLD, GCHLD, FLBHLD, FLBDHLD, FFHLD, FFDHLD, DEVCHLD, DEVAHLD, CSCHLD, CSAHLD, CEHLD, CEDHLD, AUCHLD, AUCDHLD, REACDIFOCI, PPE3HLD, PPE3DHLD, PPE2HLD, PPE2DHLD, PPE1HLD, PPE1DHLD, PMHLD, PMDHLD, PLCHLD, PLAHLD, NEGITRFHLD, NEGCHLD, MVHLD, MVDHLD, TOTINTIHLD, TOTINTHLD, TOTFAHLD, TOTFADHLD, TOINTHLDNGW

New ranges:

OCIPL OCI passing through profit and loss OCIASSJV+OCITAXRE+REACDIFOCI+REOTHTRFS

CASHX Cash and equivalents excl current 7810..788Z

Chart of accounts amendments

Renamed:

7880 Other cash (was Exchange differences)

Statutory database amendments

- The strategic report has new paragraphs for a sustainability report.

- The strategic report has many more paragraphs for the business review.

- The P&L notes - audit fees has revised logic so that the longer note will not appear as an option for small entities.

- The management section has a new grid for the user to identify the schedules to print.

- The controlling party note has a new grid for users to enter the information.

Consolidated (FRS 102) Master Pack 41.00

Format amendments

Page4sr - Strategic report: VSTS 303100 - Added Sustainability information statement; Added additional paragraphs for the Business review.

Page4dir - Directors' report: VSTS 303100 - Added additional paragraph for principal activities.

Page7sofp - Company balance sheet: VSTS 301827 - Removed Deprecated iXBRL tag Cell B8

Page7gsoce - Group socie: VSTS 317374 - Replaced instances where APGROUP("SUM","{#bs99999}") was wrongly used instead of AP("{#bs99999}").

Note10 - Operating profit: VSTS 317374 - Suppress audit fees on full tab unless company is medium and not using full note.

Note11 - Auditors remuneration: VSTS 317374 - Suppress note entirely if company is small; always show if company is large.

Note25 - Intangible assets: VSTS 308864 - Replaced descriptions "other changes" with "other movements"

Note27 - Investment property: VSTS 317374 - Amended formula at the bottom of Hist tab to reference A7:A9 instead of A6:A8; applied columnflex to tabs.

Note28 - Fixed asset investments: VSTS 317374 - Corrected formulae containing “SUM,” or “1,” instead of "SUM" and "1".

Note80 - Joint ventures: VSTS 317374 -For page setup test, added = sign.

Note50 - Deferred taxation: VSTS 303100 - Amended column suppression to hide comparatives when 1st year applies.

Note53 - Retirement benefit schemes: VSTS 317374 - Replaced database-driven headings with standard text; added text to OCI section to specify costs/(income).

Note97 - Directors' interests: VSTS 317374 - Made inactive (n/a since ROI Co Act 2017)

Note76 - Controlling party: VSTS 317374 - Added new tagged items for largest and smallest groups.

Grpmgmtdpl2 - Group detailed income statement: VSTS 303100 - Amended row suppression on Profit/loss row so that the row prints where there are FV gains on investment property or exchange gains.

Audit trail 15 - Group audit trail - 15 subsidiaries: VSTS 303100 - Clarified bank figure adjustments. VSTS 380064 - For reserves movements, Replaced OCI with OCIPL; Show BSUS as single figure, with breakdown beneath.

Paragraph amendments

Balance sheet - medium-sized companies regime: VSTS 283209 - Repurposed as statement for medium-sized entities.

Director's report - small or medium company exemption statement: VSTS 283209 - Flexed exemption statement according to whether entity is small or medium-sized.

Name ranges

Amended descriptions of the name ranges:INVPDHLD, INVPHLD, LIDHLD, LIHLD, LLBDHLD, LLBHLD, MVDHLD, MVHLD, MVOTH, NEGCHLD, NEGCOTHR, NEGITRFHLD, PLAHLD, PLCHLD, PMDHLD, PMHLD, PMOTH, PPE1DHLD, PPE1HLD, PPE1OTH, PPE2DHLD, PPE2HLD, PPE2OTH, PPE3DHLD, PPE3HLD, PPE3OTH, TOINTHLDNGW, TOTFADHLD, TOTFAHLD, TOTFAOTH, TOTINTHLD, TOTINTIHLD, GCHLD, GCOTHR, GITRFHLD, INTA1DHLD, INTA2DHLD, INTA3DHLD, INTC1HLD, INTC2HLD, INTC3HLD, DEVAHLD, DEVCHLD, FFDHLD, FFHLD, FFOTH, FLBDHLD, FLBHLD, AUCDHLD, AUCHLD, CEDHLD, CEHLD, CSAHLD, CSCHLD, CSCOTHR

New ranges:

OCIPL OCI passing through profit and loss OCIASSJV+OCITAXRE+REACDIFOCI+REOTHTRFS

CASHX Cash and equivalents excl current 7810..788Z

CABCA Bank current accounts 7800..780Z

CABDA Bank Deposit accounts 7810..784Z

CABAIH Cash at Bank and in hand 7850..788Z

Statutory database amendments

- The strategic report has new paragraphs for a sustainability report.

- The strategic report has many more paragraphs for the business review.

- The P&L notes - audit fees has revised logic so that the longer note will not appear as an option for small entities.

- The management section has a new grid for the user to identify the schedules to print.

- The controlling party note has a new grid for users to enter the information.

Limited (FRS 105) Master Pack 32.00

Format amendments

Page2inf - Company information: VSTS 309724 - Added Line 17 to correct tagging of Accountant or Auditor

Page5aud2 - Auditor's report 2020: VSTS 303100 - Moved the page continuation message to the bottom line of the page header; Updated wording to agree with CRO and the 2020 compendium of audit reports.

Page7sofp - Balance sheet: VSTS 303100 - Replace refs to #cd44 (directors' report signing date) with #cd69 (balance sheet signing date). VSTS 302169 - Corrected the signing tab so that all references are to the signing of the financial statements instead of the directors' report.

Mgmtcvr1 - Management front cover: VSTS 303100 - Amended page setup to suppress note unless override is chosen in statutory database.

Mgmtbs - Detailed balance sheet: VSTS 303100 - Amended page setup to suppress note unless override is chosen in statutory database.

102dpl - Detailed income statement (frs 102): VSTS 303100 - Amended row suppression on Profit/loss row so that the row prints where there are FV gains on investment property or exchange gains.

102Mgmt5yr - Five year summary: VSTS 303100 - Amended page setup to suppress note unless override is chosen in statutory database.

Mgmtvar4 , Mgmtvar5, Mgmtvar6 Schedules of variances: VSTS 303100 - Amended page setup to suppress note unless override is chosen in statutory database.

Formattedtb - Formatted trial balance: VSTS 303100 - Added biological assets; Amended page setup to suppress note unless override is chosen in statutory database.

Schedules IASch, TASch, BASch, CASch, CrlySch, CrmySch, ProvliabSch, AccdefincSch: VSTS 303100 - Amended page setup to suppress note unless override is chosen in statutory database; Applied columnflex.

Formattedtb105 - Formatted trial balance: VSTS 303100 - Corrected PY formula for current liabilities total; Amended page setup to suppress note unless override is chosen in statutory database.

Formatted tb - Formatted trial balance (frs 102): VSTS 303100 - Amended page setup to suppress note unless override is chosen in statutory database; Extended fixed assets to include biological assets.

Paragraph amendments

Abridged audit report - basis of opinion: VSTS 303100 - Updated wording to agree with CRO and the 2020 compendium of audit reports.

Abridged audit report - introduction: VSTS 303100 - Updated wording to agree with CRO and the 2020 compendium of audit reports.

Abridged audit report - opinion: VSTS 303100 - Updated wording to agree with CRO and the 2020 compendium of audit reports.

Abridged audit report - other information: VSTS 303100 - Updated wording to agree with CRO and the 2020 compendium of audit reports.

Name range amendments

New range:

CASHX Cash and equivalents excl current 7810..788Z

Statutory database amendments

None.

Limited Liability Partnerships (FRS 102) Master Pack 36.00

Include LLP subsidiaries in Group 102 pack: An extended exercise was carried out to enable Group (102) financial statements to include LLP subsidiaries. This involves substantial changes to the LLP chart and name ranges. This includes:

- Creating new codes and names for fixed asset transfers.

- Removing or zeroing any name ranges in LLP that aren't used by the LLP pack and aren't relevant to the group.

- Making specific changes for items that are unique to LLP and need to be allocated to correct areas in the group.

- Identifying the items that need to be allocated by the user.

Note that certain reserves figures will be allocated directly to a new suspense name range, and will be reallocated using group journals. Full information will be provided in the updated Group pack.

Format amendments

Page4mem - Members' report: VSTS 303100 - Added Sustainability information statement; Added additional paragraphs for the Business review; Reorganised to show business review on separate tab.

Page6is - Profit and loss account: VSTS 380064 - Removed adjustments for benefits in kind #on21 and #on102.

Page6soci - Statement of comprehensive income: VSTS 380064 - Removed adjustments for benefits in kind #on21 and #on102.

Page7sofp - Balance sheet: VSTS 380064 - Mixed groups changes: Replaced BSUS with LLPBSUS.

Note10 - Operating profit: VSTS 317374 - Suppress audit fees on full tab unless llp is medium and not using full note.

Note11 - Auditor's remuneration: VSTS 317374 - Suppress note entirely if company is small; always show if company is large.

Note82 - Members' remuneration: VSTS 380064 - Removed adjustments for benefits in kind #on21 and #on102.

Note25 - Intangible assets: VSTS 380064 - Use excel functions instead of name ranges to provide totals.

Note26 - Tangible assets: VSTS 380064 - Mixed groups changes: Add transfers; Use excel functions instead of name ranges to provide totals.

Note27 - Investment property: VSTS 380064 - Mixed groups changes: Add transfer row.

Note43 - Creditors due within one year: VSTS 380064 - Mixed groups changes: Amend Other creditors to adjust for inclusion of Post retirement benefits o/s by default.

Note46 - Creditors due after one year: VSTS 380064 - Mixed groups changes: Amend Other creditors to adjust for inclusion of Post retirement benefits o/s by default.

Note108 - Other creditors due within one year: VSTS 380064 - Mixed groups changes: Amend Other creditors to adjust for inclusion of Post retirement benefits o/s by default; Remove DERIVC and DEFREVC from SCE tab.

Note109 - Other creditors due after one year: VSTS 380064 - Mixed groups changes: Amend Other creditors to adjust for inclusion of Post retirement benefits o/s by default ; Remove DERIVNC and DEFREVNC from SCE tab.

Note53 - Retirement benefit schemes: VSTS 317374 - Replaced database-driven headings with standard text; added text to OCI section to specify costs/(income).

Note76 - Controlling party: VSTS 317374 - Added new specific items for largest and smallest groups.

Mgmtcvr1 - Management front cover: VSTS 303100 - Amended page setup to suppress note unless override is chosen in statutory database.

Mgmtdpl2 - Detailed income statement: VSTS 303100 - Amended row suppression on Profit/loss row so that the row prints where there are FV gains on investment property or exchange gains.

Mgmtdpl2f2 - Format 2 detailed income statement: VSTS 303100 - Amended row suppression on Profit/loss row so that the row prints where there are FV gains on investment property or exchange gains.

Mgmtvar4 , Mgmtvar5, Mgmtmthlypl6, Mgmtqtrly7, Mgmtmthlyvar8 Schedules of variances: VSTS 303100 - Amended page setup to suppress note unless override is chosen in statutory database.

Formattedtb - Formatted trial balance: VSTS 303100 - Amended page setup to suppress note unless override is chosen in statutory database; reworked Total members' interests section. VSTS 380064 - Mixed groups changes: Replaced BSUS with LLPBSUS.

Taxlinksch - Tax link schedule: VSTS 303100 - Amended page setup to suppress note unless override is chosen in statutory database.

Paragraph amendments

Other notes - largest and smallest groups: VSTS 317374 - Added new paragraph.

Name range amendments

Amended ranges to separate out transfers (note: [....] signifies removal)

AUCDOTH Assets under construction other impairment movements [6428]+6431..643Z

AUCOTH Assets under construction other movements [6415]+6419..641Z

CEDOTH Computers and IT equipment other movements on depreciation [6368]+6371..637Z

CEOTH Computers and IT equipment other movements [6355]+6359..635Z

FFDOTH Fixtures & fittings other movements on depreciation [6338]+6341..634Z

FFOTH Fixtures & fittings other movements [6325]+6329..632Z

FLBDOTH Freehold land & buildings other movements on depreciation [6218]+6221..622Z

FLBOTH Freehold other changes [6205]+620A..620Z

INVPOTH Investment property other movements [6708]+6712..671Z

LIDOTH Leasehold improvements other movements on depreciation [6278]+6281..628Z

LIOTH Leasehold improvements other changes [6265]+626A..626Z

LLBDOTH Leasehold Land & buildings other movements on depreciation [6248]+6251..625Z

LLBOTH Leasehold other changes [6235]+623A..623Z

MVDOTH Motor vehicles other movements on depreciation [6398]+6401..640Z

MVOTH Motor vehicles other movements [6385]+6389..638Z

PMDOTH Plant & machinery other movements on depreciation [6308]+6311..631Z

PMOTH Plant & machinery other movements [6295]+6299..629Z

PPE1DOTH Other PPE1 other movements on depreciation [6458]+6461..646Z

PPE1OTH Other PPE1 other movements [6445]+6449..644Z

PPE2DOTH Other PPE2 other movements on depreciation [6488]+6491..649Z

PPE2OTH Other PPE2 other movements [6475]+6479..647Z

PPE3DOTH Other PPE3 other movements on depreciation [6518]+6521..652Z

PPE3OTH Other PPE3 other movements [6505]+6509..650Z

TOTFADOTH Total fixed asset other movements on depreciation [6218]+6221..622Z+[6248]+6251..625Z+[6278]+6281..628Z+[6308]+6311..631Z+[6338]+6341..634Z+[6368]+6371..637Z+[6398]+6401..640Z+[6428]+6431..643Z+[6458]+6461..646Z+[6488]+6491..649Z+[6518]+6521..652Z

TOTFAOTH Total fixed asset other movements [6205]+6208..620Z-6209+[6235]+6238..623Z-6239+[6265]+6268..626Z-6269+[6295]+6298..629Z+[6325]+6328..632Z+[6355]+6358..635Z+[6385]+6388..638Z+[6415]+6418..641Z+[6445]+6448..644Z+[6475]+6478..647Z+[6505]+6508..650Z

Added new ranges for compatibility with group pack:

FLBHLD Freehold land & buildings transfer 6205

FLBDHLD Freehold land & buildings depreciation eliminated on transfer 6218

LLBHLD Leasehold land & buildings transfer 6235

LLBDHLD Leasehold land & buildings depreciation eliminated on transfer 6248

LIHLD Leasehold improvements transfer 6265

LIDHLD Leasehold improvements depreciation eliminated on transfer 6278

PMHLD Plant & machinery transfer 6295

PMDHLD Plant & machinery depreciation eliminated on transfer 6308

FFHLD Fixtures & fittings transfer 6325

FFDHLD Fixtures & fittings depreciation eliminated on transfer 6338

CEHLD Computers and IT equipment transfer 6355

CEDHLD Computers and IT equipment depreciation eliminated on transfer 6368

MVHLD Motor vehicles transfer 6385

MVDHLD Motor vehicles depreciation eliminated on transfer 6398

AUCHLD Assets under construction transfer 6415

AUCDHLD Assets under construction impairment eliminated on transfer 6428

PPE1HLD Other PPE1 transfer 6445

PPE1DHLD Other PPE1 depreciation eliminated on transfer 6458

PPE2HLD Other PPE2 transfer 6475

PPE2DHLD Other PPE2 depreciation eliminated on transfer 6488

PPE3HLD Other PPE3 transfer 6505

PPE3DHLD Other PPE3 depreciation eliminated on transfer 6518

INVPHLD Investment property transfer 6708

TOTFAHLD Total fixed asset transfer 6205+6235+6265+6295+6325+6355+6385+6415+6445+6475+6505

TOTFADHLD Total fixed asset depreciation eliminated on transfer 6218+6248+6278+6308+6338+6368+6398+6428+6488+6518+6458

EQUITYMOV Movement recorded in equity REOTH+RETRFSRES+RETRFSRR

REOTH Retained earnings - other movements 5140..520Z+5240..529Z+5360..599Z

LLPBSUS Balance sheet suspense LLP 9770..977Z+9990..999Z

OTHRESTOT Total other and own share reserves 9750..975Z

OCIPL OCI passing through profit and loss OCIASSJV+OCITAXRE+REACDIFOCI+REOTHTRFS

CASHX Cash and equivalents excl current 7810..788Z

BSUS Balance sheet suspense FOR GRP 9770..977Z+9990..999Z+9501..953Z+9541..958Z+9591..963Z+9641..968Z+9746..974Z

OTHRESERVE Other reserves - all 9745..9759

PENFORMDIR Pensions to former directors [3165..3169]

EXDIFFVH Exchange differences on FV hedged item 4371

HR Hedging reserve total 9760..976Z

Amended ranges for compatibility with group pack:

PROFIT Profit CYADJPYDIS+DIS1MOV+DIS2MOV+DIS3MOV+PLPIOTH+PROFITCO

RR Revaluation reserve 9720..9734

TOTEQUITY Total equity 0001..5999+9500..9999

MCAPCF Members' Capital EQ - c/f 9640..9689

MEMBERSREM Members' remuneration 5000..5049

MEMINT Members' Loans - interest 9552

MEMREM Members' Loans - remuneration 9551

MLNOTHRBCM Members' Other Amounts - retirement benefits current members 9609

OCITAXRE OCI Tax - profit and loss reserve 5220..522Z+5350..535Z

REOTHTRFS Currency translation differences (OCI) 5120..512Z

OCIASSJV Share of OCI of associates and JVs 5230..523Z

RE Retained earnings 0001..499Z

OCREDC Current other payables 8020..802Z+8040..804Z+8070..8081+8083..8084+8090+8093..809Z+[8110..813Z]+8110..814Z

OCREDNC Non-current other payables 9079..909Z+9102+9103+9107+9108+9110+9114+[9117..911Z]+9117..912Z

RECAPREDEM Redemption of capital - effect on retained earnings [5148]

RECAPREDUC Reduction in capital - effect on retained earnings [5147]

REBON Retained earnings bonus issue charged to retained earnings [5140]

EQDIVPBLC Equity dividends payable current [8096]

EQDIVPBLNC Equity dividends payable noncurrent [9120]

SBLIABC Share based payments current liability [8095]

REOSEXP Purchase of own shares - effect on retained earnings [5149..514Z]

EI3 All exceptional items 0499+2999+3989..399Z+4199+1999

Nominal chart amendments

Added new codes for compatibility with group pack:

5995 GROUP ONLY Minority interest in current profit

5996 GROUP ONLY Minority interest in other comprehensive income

6205 Freehold property transfer

6218 Freehold property depreciation eliminated on transfer

6235 Leasehold property transfer

6248 Leasehold property depreciation eliminated on transfer

6265 Leasehold improvements transfer

6278 Leasehold improvements depreciation eliminated on transfer

6295 Plant and machinery transfer

6308 Plant and machinery depreciation eliminated on transfer

6325 Fixtures and fittings transfer

6338 Fixtures and fittings depreciation eliminated on transfer

6355 IT equipment transfer

6368 IT equipment depreciation eliminated on transfer

6385 Motor vehicles transfer

6398 Motor vehicles depreciation eliminated on transfer

6415 Assets under construction transfer

6428 Assets under construction impairment eliminated on transfer

6445 Other PPE 1 transfer

6458 Other PPE 1 depreciation eliminated on transfer

6475 Other PPE 2 transfer

6488 Other PPE 2 depreciation eliminated on transfer

6505 Other PPE 3 transfer

6518 Other PPE 3 depreciation eliminated on transfer

6708 Investment property transfer

Statutory database amendments

- The members' report has many more paragraphs for the business review.

- The P&L notes - audit fees has revised logic so that the longer note will not appear as an option for small entities.

- The management section has a new grid for the user to identify the schedules to print.

- The controlling party note has a new grid for users to enter the information.

Limited Liability Partnerships (FRS 105) Master Pack 19.00

Format amendments

Page6is - Profit and loss account: VSTS 283209 - Show the turnover line even where there is no turnover.

Microdetailedpl - Detailed trading and profit and loss account: VSTS 283209 - Show the turnover line even where there is no turnover.

IFRS Master Pack 41.00

Key change to pack: The pack has been amended so that ROI abridged accounts (ie the reduced filing copy for ROI) can be produced.

Format amendments

Page1cvr - Front cover: VSTS 323351 - Amended page setup to include option for ROI abridged accounts; Added "unaudited" where an audit was not performed.

Page2inf - Company information: VSTS 309724 - Correction of Accountant/Auditor tagging

Page4sr - Strategic report: VSTS 303100 - Added Sustainability information statement; Added additional paragraphs for the Business review.

Page4dir - Directors' report: VSTS 303100 - Added additional paragraph for principal activities; Set formatting of Results paragraph as Body Text E instead of B. VSTS 323351 - Added for Declaration for ROI non-audited accounts; amended suppression settings for responsibility paragraph to not test for audit.

Page4drs - Directors' responsibilities statement: VSTS 323351 - Removed space at start of print suppression formula.

Page4dd - Directors' declaration: VSTS 323351 - Added for ROI non-audited accounts.

Page5aud2 - Auditor's report 2020: VSTS 323351 - Added tabs for audit report on ROI abridged accounts; Amended page setup to include for ROI filing copy.

Page6is - Income statement: VSTS 317374 - Merged descriptions across to column D where relevant.

Page6soci - Soci: VSTS 317374 - Merged descriptions across to column D where relevant.

Page7sofp - Sofp: VSTS 303100 - Amended tab FRS101 so that if there are no fixed assets or non-current liabilities, the net assets/liabilities row 49 will be shown (using the same formula as applies to row 48). VSTS 323351 - Included ROI abridged accounts statement; Enabled non-audit statements for IFRS; Moved all statements to shared tab.

Page7soce - Socie: VSTS 323351 - Amended page setup to include this in ROI abridged accounts.

Page8cf - Statement of cash flows: VSTS 317374 - Improved keep together. VSTS 323351 - Amended page setup to suppress for filing copy.

Note01 - Accounting policies: VSTS 317374 - Improved keep together.

Note10 - Operating profit: VSTS 317374 - Suppress audit fees on full tab unless company is medium and not using full note.

Note11 - Auditors' remuneration: VSTS 317374 - Suppress note entirely if company is small; always show if company is large.

Note05 - Revenue, Note06 - Exceptional items, Note10 - Operating profit, Note14 - Investment income, Note15 - Finance costs, Note16 - Other gains and losses, Note18 - Taxation, Note19 - Discontinued operations, Note23 - Impairments: VSTS 323351 - Amended page setup to include this note in ROI abridged accounts:

Note21 - Dividends: VSTS 317374 - Improved keep together.

Note25 - Intangible assets: VSTS 303100 - Suppressed revaluation paragraphs where #bn99914 is set to "no"; Made disclosure of CGU for acquired goodwill dependent on a new flag #bn9991784.

Note26 - Property, plant and equipment, Note78 - Subsidiaries, Note31 - Inventories, Note34 - Trade and other receivables, Note39 - Borrowings, Note57 - Revaluation reserve: VSTS 317374 - Improved keep together:

Note48 - Deferred taxation: VSTS 303100 - Rearranged to disclose liabilities and assets totals across the columns, showing both as positive; Created separate analysis sheet to use where there are assets only.

Note53 - Retirement benefit schemes: VSTS 317374 - Replaced database-driven headings with standard text; added text to OCI section to specify costs/(income).

- Improved keep together.

Note97 - Directors' interests: VSTS 317374 - Made inactive (n/a since ROI Co Act 2017)

Note76 - Controlling party: VSTS 317374 - Added new tagged items for largest and smallest groups.

Mgmtcvr1 - Management front cover: VSTS 303100 - Amended page setup to suppress note unless override is chosen in statutory database.

Mgmtdpl2 - Detailed income statement: VSTS 303100 - Amended row suppression on Profit/loss row so that the row prints where there are FV gains on investment property or exchange gains.

Mgmtvar4 , Mgmtvar5, Mgmtmthlypl6, Mgmtqtrly7, Mgmtmthlyvar8 Schedules of variances: VSTS 303100 - Amended page setup to suppress note unless override is chosen in statutory database.

Formattedtb - Formatted trial balance: VSTS 303100 - Added biological assets; Amended page setup to suppress note unless override is chosen in statutory database. database.

Paragraph amendments

Added new paragraphs for ROI abridged accounts:

- Abridged audit report - basis of opinion 1

- Abridged audit report - basis of opinion 2

- Abridged audit report - certify

- Abridged audit report - opinion

- Abridged audit report - other information

- Balance sheet - abridged accounts statement - small

Balance sheet - audit exemptions ROI: VSTS 323351 - Updated exemption text in line with latest CRO publication.

Balance sheet - medium-sized companies regime: VSTS 323351 - Added paragraph

Other notes - largest and smallest groups: VSTS 317374 - Added new paragraph.

Name range amendments

New range:

CASHX Cash and equivalents excl current 7810..788Z

Chart of accounts amendments

Renamed:

7880 Other cash (was Exchange differences)

Statutory database amendments

- The strategic report has new paragraphs for a sustainability report.

- The strategic report has many more paragraphs for the business review.

- The auditors' report and balance sheet have additional paragraphs for the ROI abridged accounts option.

- The P&L notes - audit fees has revised logic so that the longer note will not appear as an option for small entities.

- The management section has a new grid for the user to identify the schedules to print.

- The controlling party note has a new grid for users to enter the information.

Consolidated IFRS Master Pack 15.00

Format amendments

Page4sr - Strategic report: VSTS 303100 - Added Sustainability information statement; Added additional paragraphs for the Business review.

Page4dir - Directors' report: VSTS 303100 - Added additional paragraph for principal activities; Set formatting of Results paragraph as Body Text E instead of B.

Note10 - Operating profit: VSTS 317374 - Suppress audit fees unless company is medium and not using full note.

Note11 - Auditor's remuneration: VSTS 317374 - Suppress note entirely if company is small; always show if company is large or option chosen to show full note.

Note25 - Intangible assets: VSTS 303100 - Suppressed revaluation paragraphs where #bn99914 is set to "no"; Made disclosure of CGU for acquired goodwill dependent on a new flag #bn9991784.

Note48 - Deferred taxation: VSTS 303100 - Rearranged to disclose liabilities and assets totals across the columns, showing both as positive; Created separate analysis sheet to use where there are assets only.

Note53 - Retirement benefit schemes: VSTS 317374 - Replaced database-driven headings with standard text; added text to OCI section to specify costs/(income).

Note76 - Controlling party: VSTS 317374 - Added new tagged items for largest and smallest groups.

Note25c - Intangible assets - co: VSTS 303100 - Suppressed revaluation paragraphs where #bn99914 is set to "no"; Made disclosure of CGU for acquired goodwill dependent on a new flag #bn9991784.

Note48c - Deferred taxation - co: VSTS 303100 - Rearranged to disclose liabilities and assets totals across the columns, showing both as positive; Created separate analysis sheet to use where there are assets only.

Note53c - Retirement benefit schemes - co: VSTS 317374 - Replaced database-driven headings with standard text; added text to OCI section to specify costs/(income).

Mgmtdpl2 - Group detailed income statement: MP 15.00 changes: VSTS 303100 - Amended row suppression on Profit/loss row so that the row prints where there are FV gains on investment property or exchange gains.

Audittrail15 - Group audit trail - 15 subsidiaries: MP 15.00 changes: VSTS 380064 - Show BSUS as single figure, with breakdown beneath.

Name range amendments

New range:

CASHX Cash and equivalents excl current 7810..788Z

Chart of accounts amendments

Renamed:

7880 Other cash (was Exchange differences)

Statutory database amendments

- The strategic report has new paragraphs for a sustainability report.

- The strategic report has many more paragraphs for the business review.

- The controlling party note has a new grid for users to enter the information.

Charities (FRS 102) Master Pack 25.00

Format amendments

Page2inf - Legal and administrative information: VSTS 317375 - Made headings bold for B11, B23, B25.

Page4trr - Trustees' report: VSTS 317375 - Merged remuneration property text across full page.

Page6sfa - Statement of financial activities: VSTS 303100 - Amended net income row to include the net gains on investments; inserted line above expenditure heading where there is only one type of income; amended row suppression on expenditure heading to show the line where there is any type of expenditure; Replaced refs to #cy220 with #ac997. VSTS 317375 - Changed SOFA comparatives tab cells E8, F8, G8 from #cd63 to #cd68; Set total income and expenditure lines to print even where there is only one source of either.

Page7sofp - Balance sheet: VSTS 303100 - Corrected format style for Creditors amount falling due within one year (row 33). VSTS 317375 - Changed trustees' designation to use #cy6; Amended row suppression for pensions to include the line where the asset is not recognised: Applied bold style to Net current assets text.

Page8cf - Statement of cash flows: VSTS 303100 - Improved descriptions on some rows.

Note111 - Donations and legacies: VSTS 303100 - Replaced refs to #cy220 with #ac997.

Note112 - Income from charitable activities: VSTS 303100 - Replaced refs to #cy220 with #ac997. VSTS 317375 - Added column suppression to the "Notes" tab; Amended Alt tab row suppression formula in A12.

Note113 - Income from trading activities: VSTS 303100 - Replaced refs to #cy220 with #ac997.

Note114 - Investment income: VSTS 303100 - Replaced refs to #cy220 with #ac997.

Note116 - Other income: VSTS 303100 - Replaced refs to #cy220 with #ac997.

Note117 - Fundraising costs: VSTS 303100 - Replaced refs to #cy220 with #ac997.

Note120 - Grants payable: VSTS 317375 - On current tab, changed comparative year to #cd67; Amended layout of comparative tab to follow other notes; Amended headings on notes tab to use new #ac references.

Note121 - Support and governance costs: VSTS 317375 - Moved warning message on SUM tab to start in column C.

Note10 - Net movement in funds: VSTS 317375 - Amended note suppression to force note if either a company or subject to an audit or independent examination; Added rows for non-audit fees.

Note11 - Auditor's remuneration: VSTS 317375 - Separate note now activated only for large companies.

Note136 - Employees: VSTS 317375 - Changed suppression formulae for key management information to refer to row 59.

Note122 - Other expenses: VSTS 317375 - Corrected text in cells C13 and C14; Replaced refs to #cy220 with #ac997.

Note123 - Gains and losses on investments: VSTS 303100 - Replaced refs to #cy220 with #ac997.

Note129 - Gains and losses on revaluations: VSTS 303100 - Replaced refs to #cy220 with #ac997.

Note131 - Other gains and losses: VSTS 303100 - Replaced refs to #cy220 with #ac997.

Note28 - Fixed asset investments: VSTS 317375 - Added missing currency text to cells G6, H6 and I6.

Note53 - Retirement benefit schemes: VSTS 317375 - Amended print suppression to take account of situation where assets and liabilities fully offset; Added Costs/income heading for OCI note; Corrected row suppression for OCI subtotal; Replaced text note of DC costs with numerical line; Replaced database-driven headings with standard text.

Note127 - Analysis of net assets between funds: VSTS 303100 - Replaced refs to #cy220 with #ac997.

Paragraph amendments

Other notes - largest and smallest groups: VSTS 317374 - Added new paragraph.

SOFA notes - key managment remuneration - introduction: VSTS 317375 - Minor changes to wording.

Chart of accounts amendments

1950 UF Defined benefit pension scheme OCI items Added 'benefit' to description

2950 MF Defined benefit pension scheme OCI items Added 'benefit' to description

3950 RF Defined benefit pension scheme OCI items Added 'benefit' to description

4950 EF Defined benefit pension scheme OCI items Added 'benefit' to description

5410 Audit or independent examination fees Added ref to independent examination

5411 Audit or IE fees for subsidiaries Added ref to independent examination

5412 Audit or IE fees for associated pension schemes Added ref to independent examination

5413 Accountancy Amended description

Statutory database amendments

- The P&L notes - audit fees has revised logic so that the information required by the SORP will now always be shown in the operating profit note, and the longer note will only appear for large corporate entities.

- The net movement of funds node (the charity equivalent of operating profit) has a new flag #cy873 to force the note to appear where it is not compulsory. #cy873 only appears for non-corporate charities not subject to audit or independent examination. All others will now show the note in all circumstances. In the very rare situation where a corporate charity has nothing to disclose in this note (eg for a dormant limited charity), the user will need to suppress the note by excluding it from printing in Financial Statements.

Unincorporated Pack 22.00

Format amendments

Note01 - Accounting policies: VSTS 303100 - Amended biological assets suppression formulae to use nbv of assets held at cost as well as at FV.

Note03 - Tangible assets: VSTS 303100 - Replaced totals with excel-type functions; Added cross-checks.

Note04 - Biological assets: VSTS 303100 - Amended page setup to show note for FV as well as cost versions; Removed ROI tab because PY not required now; Replaced totals with excel-type functions; Added cross-checks.

Mgmtcvr1 - Management front cover: VSTS 303100 - Amended page setup to suppress note unless override is chosen in statutory database.

Ptrtaxlinksch - Tax link schedule partnership: VSTS 303100 - Amended page setup to suppress note unless override is chosen in statutory database.

Sttaxlinksch - Tax link schedule sole trader: VSTS 303100 - Amended page setup to suppress note unless override is chosen in statutory database.

Mgmtvar4 , Mgmtvar5, Mgmtmthlypl6, Mgmtqtrly7, Mgmtmthlyvar8 Schedules of variances: VSTS 303100 - Amended page setup to suppress note unless override is chosen in statutory database.

5yearsummary - Five year summary: VSTS 303100 - Amended page setup to suppress note unless override is chosen in statutory database; Added year end day/month headings added for all years; Corrected column suppression..

Formattedtb - Formatted trial balance: VSTS 303100 - Amended page setup to suppress note unless override is chosen in statutory database; Centred headings above double columns; Added columnflex; Added biological assets.

Paragraph amendments

Balance sheet - approval statement: VSTS 303100 - Amended sign off paragraph to show '........' where there is no engagement letter date entered.

Statutory database amendments

- The management section has a new grid for the user to identify the schedules to print.

Medical Master Pack 16.00

Format amendments

Page6mie - Income and expenditure account: VSTS 303100 - Amended subtitles to exclude Fees and allowances line; Applied columnflex; Headings centred if period is not a year.

Page7mani - Allocation of net income: VSTS 303100 - Amended titles to include the period rows; Applied columnflex; Headings centred if period is not a year; Error message amended to test CY and PY individually, not as total.

Page7manip40 - Allocation of net income 40: VSTS 303100 - Amended titles to include the period rows; Applied columnflex; Headings centred if period is not a year; Error message amended to test CY and PY individually, not as total.

Page7bs - Balance sheet: VSTS 303100 - Amended titles to include the period row and blank row; Applied columnflex; Headings centred if period is not a year; Reduced column width for notes to 0.53; Replaced sign off text with new stat db paragraph.

Various notes: VSTS 303100 - Applied columnflex; Updated keep together:

noteM01, noteM02, noteM03, noteM04, noteM05, noteM06, noteM07, noteM08, noteM09, noteM10, noteM11, noteM12, noteM13, noteM14, noteM15, noteM16, noteM17, noteM18, noteM19, noteM20, noteM21, noteM22, noteM23, noteM24, noteM25, noteM26, noteM27, noteM28, noteM29, noteM30, noteM31, noteM32, noteM33, noteM34, noteM35, noteM36, noteM37, noteM38, noteM39, noteM40, noteM41, noteM42, noteM43, noteM44, noteM45, noteM46, noteM47, noteM48, noteM49, noteM50, noteM51, noteM52, noteM53, noteM54, noteM55, noteM56, noteM57, noteM58, noteM59, noteM60, noteM61, noteM82, noteM106, noteM83, noteM84, noteM85, noteM86, noteM104, notem104p40, noteM105, notem105p40

NoteM29 - Other nhs income gp 1: VSTS 303100 - Corrected deductions range.

NoteM102p40 - Current accounts 40: MP 16.00 changes: VSTS 303100 - No changes made.

NoteM103 - Detailed allocation of net income: VSTS 317374 - Amended formulae for totals in row 142 of linked sheets to refer to correct column of the main sheet; Amended formulae in A80 in linked sheets to suppress headings only where there are no profits allocated in PSR.

NoteM103p40 - Detailed allocation of net income 40: VSTS 317374 - Amended formulae for totals in row 142 of linked sheets to refer to correct column of the main sheet; Amended formulae in A80 in linked sheets to suppress headings only where there are no profits allocated in PSR.

Paragraph amendments

Balance sheet - approval statement: VSTS 303100 - New paragraph.

Notes - policies - accounting convention: VSTS 303100 - Replaced #aw3 or 'accounts' with #aw1.

Notes - policies - compliance with accounting standards: VSTS 303100 - Replaced #aw3 or 'accounts' with #aw1.

Chart of accounts amendments

Capital accounts generally:

9500-9690 Amended to remove the reference to b/fwd.

Name range amendments

New range:

PTREXP Expenses of partners 4950..495Z

Software Enhancements

Revised financial statements

The Limited FRS102 master pack now supports the issue of revised UK financial statements, where these replace defective financial statements as set out in SI 2008/373 The Companies (Revision of Defective Accounts and Reports) Regulations 2008

These revised statements include:

- A supplementary note, including corrections required together with the required directors' statement;

- Changes to the cover sheet, identifying these as revised financial statements;

- Changes to the audit report as set out in FRC - Auditors Reports on Revised Accounts and Reports Bulletin March 2020.

Automatic tagging of these revised financial statements has been included

The following format was added:

- Note118 - Revision Of Defective Financial Statements

Statutory Database changes

General - Client preferences: Added section for Defective financial statements, using new codes #cd999711 to #cd999722.

Please note that if refiling audited accounts the refiled accounts must contain the full audit statement and cannot use Note99 - Audit report information even if this was used in the original filing. This means that you cannot use the small companies filing exemptions and must file the P&L and Audit report.

Review & Tag changes

Review & Tag will now allow the refiling of previously submitted accounts

CCH Working Papers

Changes to make editing a template easier

There are several changes here:

- If you edited a template that was used in a pack, the template previewer in Working Papers Designer still showed the old version. You only saw the new version on exiting Central and re-entering. The Working Papers Designer now consistently shows the latest version of the selected template, even though the pack itself may actually contain an earlier version.

- If you edit a template that is used in a pack, you are now told what to do to get the latest version into your pack, as the pack will still be using the previous version. You need to open the Working Papers Designer, remove the template and Import it again.

- If you exit the Templates screen without checking in your template, you now receive a warning. This is a mistake that is easily made.

Bringing an edited template into an accounting period

Despite these changes, it still isn't obvious how to bring an edited template into an accounting period. You need to remove the existing paper from the accounting period and then run a Resync.

Probably it is more common to add the new version into a new practice masterpack. At Year End, you can upgrade to the new pack and see the new version. The order is important. If the new version of a template is added to the pack after the Year End has been performed then a Resync alone does not bring in the updated version. You will then need to follow the procedure in the last paragraph.

The reason for this behaviour is that the Resync can detect a template is missing from an accounting period and add it back in again. However if the version of a paper is different on an accounting period from the pack version then it does not update the accounting period version because overwriting the accounting period version may lose changes that the user has added deliberately.

Quality Improvements

CCH Accounts Production

ADO 309062 - Cannot run GDPR Generate PDF for Accounts Production

The user sees a red cross indicating that it has failed.

ADO 308738 - Several issues on Officers

Several issues have been encountered:

- There was an issue if the End Date of the Officer was deleted on the Associations screen.

- There was an issue on groups if an Officer had an End Date and was rolled forward and then an attempt was made to reactivate them with the original Start Date.

- Creating an Officer who served twice in a year could cause an error.

ADO 312002 - Remove use of configuration key AccountsShowLimitedFRS105Entity and AccountsShowIFRSEntity

All users should have access to the FRS105 entity, irrespective of configuration keys. Users should have IFRS based on licence.

ADO 312003 - Remove warning that "An issue has been discovered during the upgrade between Central, Accounts Production and the Financial Statement formats"

This message only affected a few practices. For historical reasons, it had been restricted to those practices with a Client Code starting with a "B". It is now completely removed.

ADO 302168 - ITS/65037 - FRS102 tags missing from Controlling party note76

The Statutory database Other notes>Controlling party has been reworked to facilitate the automatic tagging of the data within the note.

DO 315441 - Group accounts sometimes show incorrect balances when the user is not in the latest period

This issue was intermittent and only happened if you were not in the latest group accounting period. It might be fine one day and wrong the next. The balances shown excluded the parent and subsidiary balances.

ADO 320735 - If an AP() command and an APGROUP() command use the same formula then the AP() command can get the wrong value

The problem is that AP formula results are cached to avoid having to recalculate them. Unfortunately the APGROUP result was being cached as well. This meant that if the APGROUP command appeared before the AP command, the AP command could pick up the APGROUP's value. This error was rare as usually APGROUP and AP commands are used with different formulae. We have now given APGROUP commands their own cache which also makes group accounts about 30% faster.

ADO 323444 - Deleting an accounting period can reset the paragraphs in the previous year to their defaults

This happened if you a) changed a Statutory Database setting which has a default value, e.g. "Accountants' Report - Terms of Engagement", b) rolled forward to a new year on a later masterpack and c) then immediately deleted the new year. The old Statutory Database setting reverted to its default value.

CCH Review and Tag

ADO 309334 Replace the message that these accounts may contain the DPL

The warning message is now based on the inclusion of the bus_ReportIncludesDetailedProfitLossStatementTruefalse tag and its status. This is now automatically set to True if any DPL formats are included when generated from Accounts Production.

ADO 299885 - ITS/67805 - Incorrect message "Document missing mandatory tag 'Profit (Loss)' on small LLPs

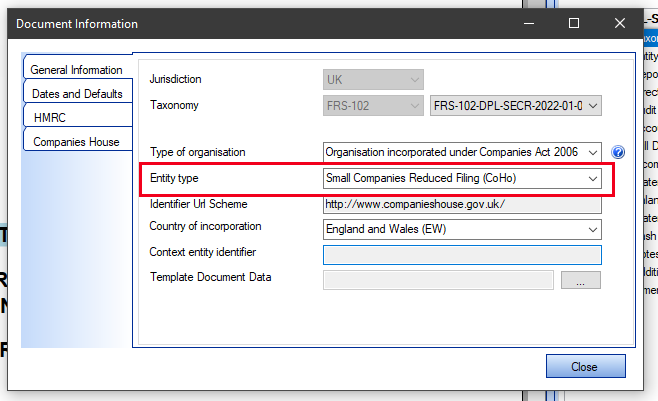

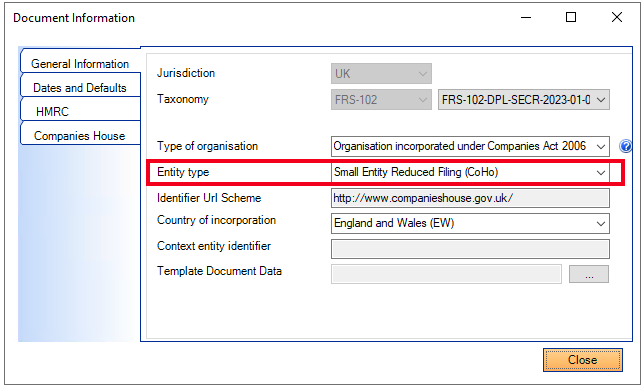

Small LLPs have the Print Selection set to "Small LLP Reduced Filing" in Accounts Production. In Review and Tag they should appear in the same way as small limited companies. Review and Tag was setting the Entity Type to "LLP (Full Accounts)" which gave rise to the error on the Companies House Errors tab. It now sets the Entity Type to "Small Entity Reduced filing (CoHo)". This setting is also used for small companies which used to appear as "Small Company Reduced filing (CoHo)".

ADO 290818 - Differences between previewed accounts in and the generated HTML in R&T

An HTML set of accounts in R&T does not appear the same as when previewed/printed in accounts production, this was due to a combination of bullet points and tagging. R&T generated HTML will now be the same as when previewed from accounts production.

ADO 297967 & 302169 - ITS 67780 (Accounts Production) Signatory on balance sheet format is blank and/or causes IXBRL error

Correction of multiple tags relating to signatory for LTD FRS105, Ltd FRS102, IFRS101 and Group FRS102

ADO 313785 - Streamlined Energy and Carbon Reporting (SECR)

We have now added the ability for Review & Tag to use the SECR mass and energy unit based tags, previously using these tags caused an error.

ADO 309724 - General tagging enhancements

Ltd FRS102/FRS105 - Company Information page - Company number

Ltd Group FRS102 - Cover Page - Company Number

Ltd FRS105 - modify the tags for Audit Report

Ltd FRS105 - Accountants report - add tag to accountants name

Ltd FRS105 - Information Page - Add line switching for Accounts/Auditor - tags

IFRS/IFRS 101 - tag auditor on Page5ud - Correct tag on Accountants report - Correct tags on information page

FRS102/FRS105 - Balance sheet tagged company number & Country of Incorporation

format IFRS/FRS101 - Balance sheet tagged company number & Country of Incorporation

ADO 295750 - Dimension hypercube

When locating (left click on tag) the tag it would take you to the DPL even if the tag was originally from a different parent node.

ADO 289112 - Extended view print

The extended view print function "tabloid" function will now work without cutting off tags when sending results to PDF.

ADO 299885 - Companies House - incorrect error warning

Error message "Document missing mandatory tag "Profit (loss)" was incorrectly showing under Company House errors for LLP FRS102.

We have also updated the Entity type description

now renamed to Small Entity Reduced Filing (CoHo)

ADO 317275 - ITS/67867 - Error The value 'IMP' is not a valid currency

Setting the Country of Incorporation to Isle of Man no longer causes "The value 'IMP' is not a valid currency in the ISO 4217 namespace." when submitting to HMRC or CoHo.

ADO 321465 - ITS/67948 - ROI accounts - Report does not contain an explicit currency declaration error

When generating accounts from Accounts Production the tag bus_PrincipalCurrencyUsedInBusinessReport is automatically added to OtherData with a dimension of Euro when the country of incorporation is set to Ireland.

CCH Working Papers

ADO 300965 - If a PDF file cannot be viewed in the WP viewer, use the system default viewer instead

Some PDF files cannot be viewed by the Working Papers PDF viewer. In some cases, Central freezes . This is not necessarily either the fault of the PDF or the Working Papers viewer as PDF files can contain a huge (and changing) variety of internal file formats and we are not aware of a viewer that supports all of them.

To prevent the application freezing, Working Papers now tries to open the PDF file for up to 15 seconds, but if the time expires, then it switches to the default PDF viewer which at CCH is Adobe Acrobat Reader. This allows you to view the paper but you cannot sign it off or add notes in the same way as you can in Working Papers. So the next step is usually to print the PDF to a PDF Capture Tool:

- Use the Print option of your PDF viewer. In the list of printers you might see a PDF Capture Tool. At CCH we use Microsoft Print to PDF. If there isn't one, ask your IT staff.

- Select that as your "printer" and print the PDF. Your PDF viewer will try to print the PDF and convert it to a language the printer understands, but the PDF Capture Tool will interpret that language and convert it back to a new PDF file which you can save to disk. The format of the new PDF file will be different internally from the original format.

- Now remove the old PDF which had a problem from the accounting period and add in the newly saved PDF.

You should find that you can view it within Working Papers in the usual way.

CCH Fixed Asset Register

ADO 329848 - Incorrect fixed asset register codes generated in some cases

For Asset Classes ending in a numeral, e.g. OP1 - Other PPE1, the generated asset codes got longer and longer, e.g. OP100001, OP1100002, OP11100003 ... This fix will not affect the next asset code generated for OP1 as that has already been calculated. But it will fix asset codes generated after that.

Notable Issues

CCH iXBRL Review & Tag - Known Issues

| Date Raised | ITS | Description | Workaround ( If applicable) | Scheduled/Resolved |

|---|---|---|---|---|

| 24/03/2021 | 62820 | Companies House credentials are reset after a CSI upgrade. We have had a small number of reports that the Companies House online filing credentials are being removed/reset after an upgrade using the CSI installer. |

Re-enter the credentials using the reviewandtagsettings.exe located in the Deploy folder. | TBC |

| 08/01/2021 | 61714 | IFRS accounts produced in Accounts Production errors on Information Page. Certain address and 3rd party information cells on the Info page on the IFRS format have updated to create duplicate tags. This will show as duplicate fact value errors when exported to CCH iXBRL Review & Tag. |

In CCH iXBRL Review & Tag double-click on the duplicate fact value error within the Exceptions tab. This will take you to the tagged area that has the error. Left-click on the tagged area and amend the dimension to the correct value. |

TBC |

| 24/12/2020 | 61704 | Companies House submission database showing Client Code as NA The submission database was updated in 2020.3 to include the client code from CCH Central to enable users to report on filings by client code. This code is obtained by matching the company name within the CCH iXBRL Review & Tag file to the database within CCH Central. If, however your client's name in CCH Central does not match the Company name reported within the accounts, the entry will be logged as NA. |

Ensure that you client name in CCH Central and the Company name reported in the accounts match. | TBC |

| 15/12/2021 | 61694 | Micro Entities set to Full accounts when using reduced filing option. When accounts produced in CCH Accounts Production for FRS105 Micro entities the option to use reduced filing sets the accounts type in CCH iXBRL Review & Tag as (Full Accounts). This is due to there being no legal form of accounts recognised as filleted so the option defaults to Full. |

If you are producing reduced filing accounts for Micro entities to file at Companies House. Leave the entity type as Micro Entities (Full Accounts). Do not change to Small Companies Reduced filing. | TBC |

| 25/08/2020 | 59571 | FRS102 Sec1 A small Companies - Full Accounts filing throws an error “Document missing mandatory tag Statement on quality and completeness of information provided to auditors" is reported when Customers try to file an FRS102 Sec1A Full accounts to Companies House. The majority of the FRS102 Sec1A Small Companies file Small company reduced filing version, there is nothing to prevent filing of a full accounts to CCH. The entity type is set to full in error and this causes the error. | The error can be ignored, and accounts filed. To prevent the error, change the entity type in document information to Small Companies Reduced filing. If after making this change, another exception on Applicable Legislation appears, you need to add this tag in other data and select Small Companies Regime. | TBC |

| 01/12/2017 | TBC | FRS 105 Audited – reduced filing Companies House Submissions in CCH iXBRL Review & Tag We do not currently support iXBRL filing for audited 105 accounts. The concept of audited 105 is still in its infancy; please paper file until we receive more guidance on this issue. |

For Information only | |

| 01/10/2020 | 60609 | Charity FRS 102 -Filing exception on Directors responsibilities note from balance sheet for charitable companies The paragraph on directors’ responsibilities on the balance sheet is not switching the word items #wd18 and #wd3 for charitable companies where a single director is marked as the balance sheet signatory. It is not switching to the singular term 'acknowledge' and 'his/her ' from 'acknowledges' and 'their'. This causes a fatal 9999 error in CCH IXBRL Review & Tag when filing to Companies House. |

This is an issue in CCH Accounts Production but CCH iXBRL Review & Tag users need to be aware. Workaround -Update/edit the tag in review and tag to the correct wording and submit. When editing it is good practice to edit the content, copy to a note pad and then copy back and apply the tag. |

For Information only |

| TBC | FRS 102 Limited - Statement of Changes in Equity (Page7SOCE) A minor tagging issue affecting 1st year only financial statements. This results in a a tagging error for FRS102 that includes as SOCE |

This is an issue in CCH Accounts Production but CCH iXBRL Review and Tag users need to be aware. Open the format, click Draft and Show iXBRL Tags on the ribbon bar. Then on Row 47 right-click and use the Suppress Tag option on the numeric cells. Alternatively, you can delete the Prior Year tags in CCH iXBRL Review and Tag. |

For information only |

CCH Working Papers

Our current Notable issues list is available from Customer Communities on UserDocs.

CCH Accounts Production

ITS/67726 – Management Collection - showing cost of sales and selling costs on separate schedules

This release contains a new option to show the cost of sales and selling costs on separate schedules. The option only applies to the Format 1 Profit and Loss account, but it also appears for the Format 2 Profit and Loss account. If selected for Format 2, it has no effect.

237416 - Transferring fixed assets from CCH Accounts Production to CCH Corporation Tax for IFRS

The link from CCH Accounts Production to CCH Corporation Tax for Tangible Fixed Assets does not work for IFRS clients.

The data must be entered manually in CCH Corporation Tax.

Unable to travel images

Any images stored in the Image Library will not be available in the travelled database.

Unable to load accounting period if server data format is MM/DD/YY

An issue has been identified that prevents CCH Accounts Production from loading the Accounting Period if the date format in your environment is not dd/mm/yyyy. There is no solution to this at present, other than to amend your Date/Time settings in Windows.

206581 - FRS 102 – Countries that are incorporated in region 3

We have an issue with the Directors Report and Investment Property note not printing correctly. The majority of users are unaffected as accounting periods incorporated in England and Wales, Scotland and Northern Ireland are all set to region 1. Republic or Ireland and Eire are set to region 2. Other countries fall into region 3 and there may be a format issue caused by the print condition or row conditions incorrectly testing on either region 1 or region 2.

234971 – Text entered into paragraph is more than one page in length

We have an issue where text entered into a paragraph node in the statutory database does not print correctly if it is more than one A4 page in length. The bottom of the text ‘falls off’ the A4 page and is not continued on the following A4 page. The workaround is to split the text across two or more nodes, or if that is not possible, enter the text directly into the format cell and make the format local.