CCH Corporation Tax IE: 2023.1.1

Prerequisites

Installing CCH Corporation Tax IE 2023.1.1

Prior to installing this update, you must ensure that you have 2022.1.2 currently installed on your system. Installation of the update is straightforward; however, we recommend that you take a moment to review the Installation Guide

Introduction

As per Revenue guidelines and due to the implementation of the Finance Act 2023 and amendment in the taxonomy, we have made changes to add and delete sections in CCH Corporation Tax Version 2023.1.1 for the Tax Year 2023. The major and minor changes have been made to Corporation Tax to comply with Revenue

Major changes in Tax Year 2023

Major changes have been made to the following areas for the Tax Year 2023:

- Company Details (Company Details)

o Tax radio button to choose- Is the company part of a multinational group?

o Tax field for - What is the jurisdiction of a tax residence of the group’s ultimate parent entity?

o Tax field for What is the name of the group’s ultimate parent entity?

- Trading Results

o Tax field for Amount spent on Farm Buildings

o Tax field for- Amount spent on slurry storage (section 658A(2)(a))

o Tax field for- Amount spent on slurry storage (section 658A(2)(b))

o Tax field for If any amount of Farm Buildings Allowance claimed above is in respect of farm buildings (section 658) enter the amount here

o Tax field for If any amount of Farm Buildings Allowance claimed above is in respect of slurry storage (section 658(2)(a)) enter the amount here

o Tax field for If any amount of Farm Buildings Allowance claimed above is in respect of slurry storage (section 658(2)(b)) enter the amount here

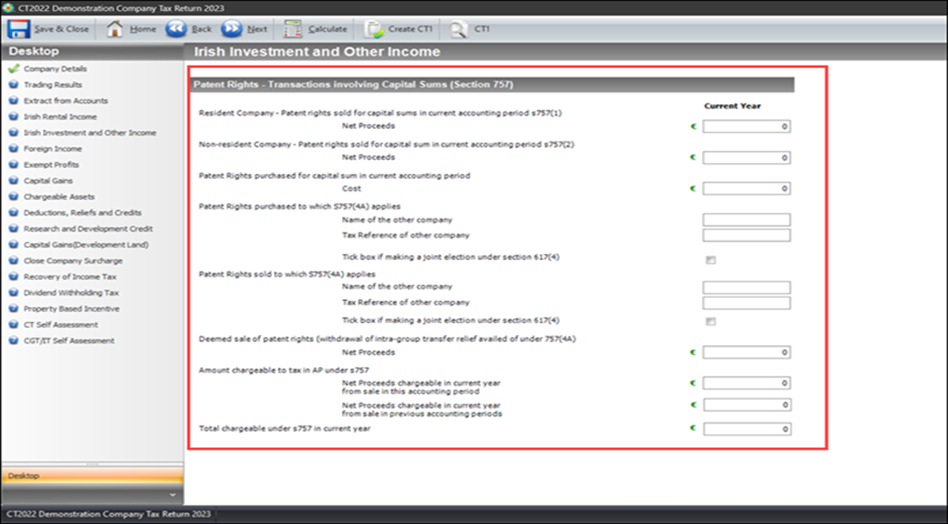

- Irish Investment and Other Income (Patent Rights- Transactions Involving Capital Sums (Section 757)

o Tax field for Resident Company Patent rights sold for capital sums in current accounting period s757(1)- Net Proceeds

o Tax field for Non-Resident Company Patent rights sold for capital sum in current accounting period s757(2)- Net Proceeds

o Tax field for Patent Rights purchased for a capital sum in the current accounting period- Cost

o Tax field for Patent Rights purchased to which S757(4A) applies- Name of the company

o Tax field for Patent Rights purchased to which S757(4A) applies- Tax reference of the company

o Tax field for Patent Rights purchased to which S757(4A) applies-Tick box if making a joint election under section 614(4)

o Tax field for Patent Rights sold to which S757(4A) applies- Name of the company

o Tax field for Patent Rights sold to which S757(4A) applies- Tax reference of the company

o Tax field for Patent Rights sold to which S757(4A) applies- Tick box if making a joint election under section 614(4)

o Tax field for Deemed sale of patent rights (withdrawal of intra-group transfer relief availed of under 757(4A)- Net Proceeds

o Tax field for Amount chargeable to tax in AP under s757- Net proceeds chargeable in the current year from sales in this accounting period

o Tax field for Amount chargeable to tax in AP under s757- Net proceeds chargeable in the current year from sales in previous accounting periods

Minor changes in Tax Year 2023

Minor changes have been made to the following areas for the Tax Year 2023:

- Company Details (Interest Limitation)

o Tax field for – If the accounting period commenced on or before 31 December 2021, please tick the box, No further details are required in this section

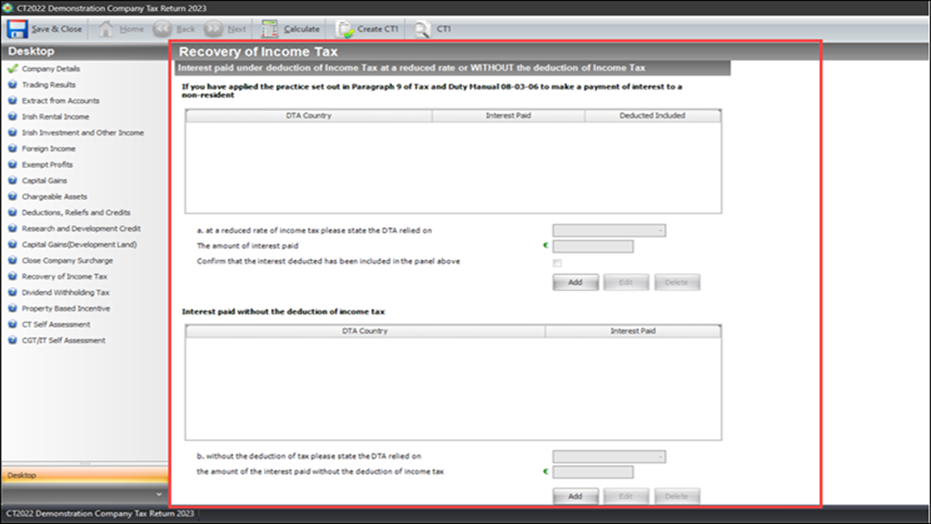

- Recovery of Income Tax

o Tax field for Recovery of Income Tax; if interest paid under deduction of Income Tax at a reduced rate or WITHOUT the deduction of Income Tax (If you have applied the practice set out in Paragraph 9 of Tax and Duty Manual 08-03-06 to make a payment of interest to a non-resident:

- Tax field for- a. At a reduced rate of income tax please state the DTA relied on

- Tax field for- The amount of interest paid

- Tax field for- Confirm that the interest deducted has been included in the panel above

o Tax field for Recovery of Income Tax; if Interest paid without the deduction of Income Tax:

- Tax field for- b. Without the deduction of tax please state the DTA relied on

- Tax field for- The amount of the interest paid without the deduction of Income Tax

- Company Details (Transfer Pricing)

o Tax field for- What is the jurisdiction of tax residence of the group’s ultimate parent entity has been removed

o Tax field for- What is the name of the group’s ultimate parent entity has been removed

IMPORTANT: Note it is very important that before running any database update you perform a database backup. CCH always advise that your practice takes regular backups to minimise any loss of data.

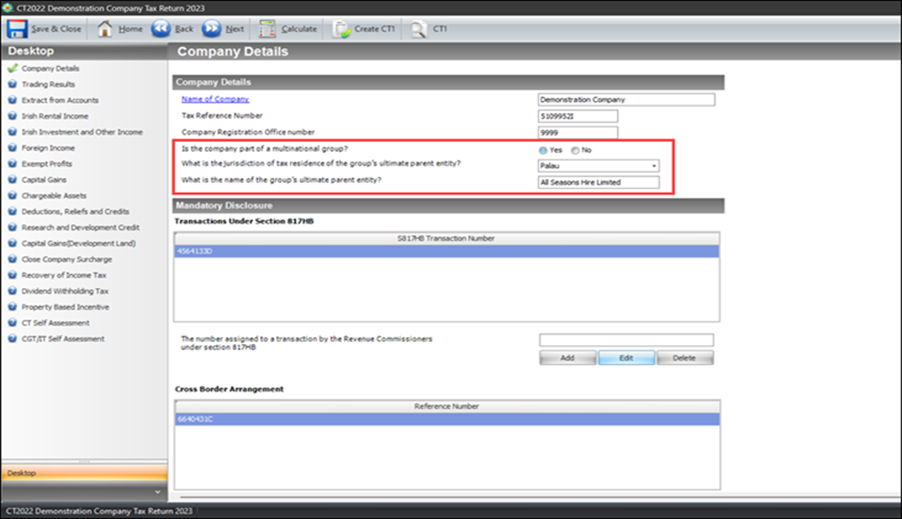

Company Details

Company Details

The Company Details section has new details added under the sub-section Company Details. The new version has three new fields added under the heading. In the new version, the user gets to confirm whether the company is part of a multinational group by selecting the Yes or No radio button as applicable. The user gets to choose from the drop-down menu the jurisdiction of tax residence of the group’s ultimate parent entity. The user can also name the group’s ultimate parent entity. The new fields added are listed below:

- Is the company part of a multinational group?

- What is the jurisdiction of tax residence of the group’s ultimate parent entity?

- What is the name of the group’s ultimate parent entity?

Figure 1: New section under Company Details

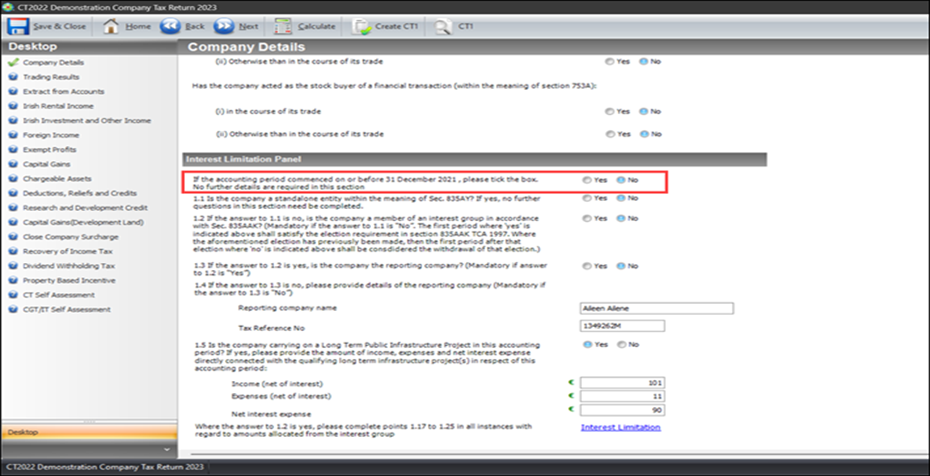

Interest Limitation

The Company Details section has new details added under the sub-section Interest Limitation. The new version has one new field added under the heading. The user has to confirm whether the accounting period commenced on or before 31 December 2021 by ticking either of the ‘Yes’ or ‘No’ checkbox. The new field added is listed below:

- If the accounting period commenced on or before 31 December 2021, please tick the box. No further details are required in this section.

Figure 2: New section under Interest Limitation

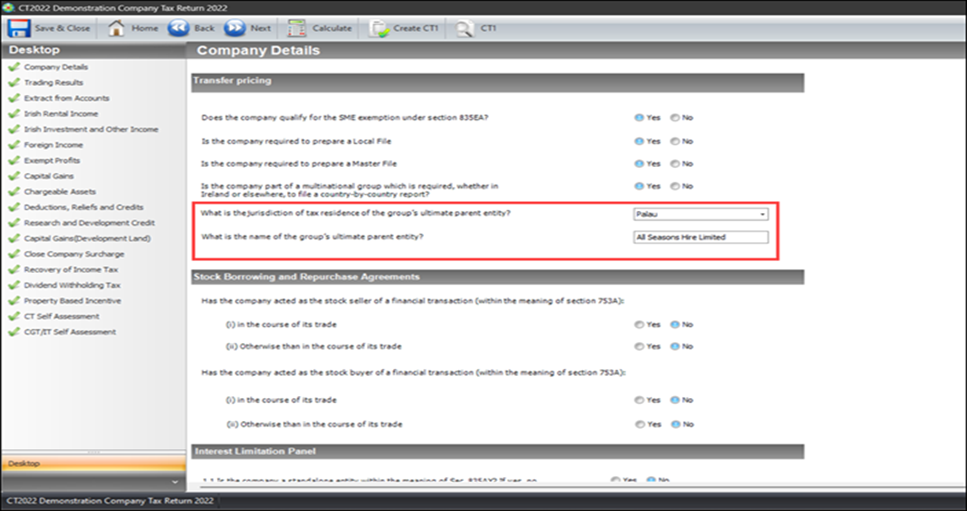

Transfer Pricing

The Company Details section has removed a detail added under the sub-section Transfer Pricing. The new version has one new field removed under the heading. The user does not have to choose the jurisdiction of tax residence of the group’s ultimate parent entity from the dropdown and also not enter the name of the group’s ultimate parent entity. The fields removed are listed below:

- What is the jurisdiction of tax residence of the group’s ultimate parent entity?

- What is the name of the group’s ultimate parent entity?

Figure 3: Section removed from Transfer Pricing

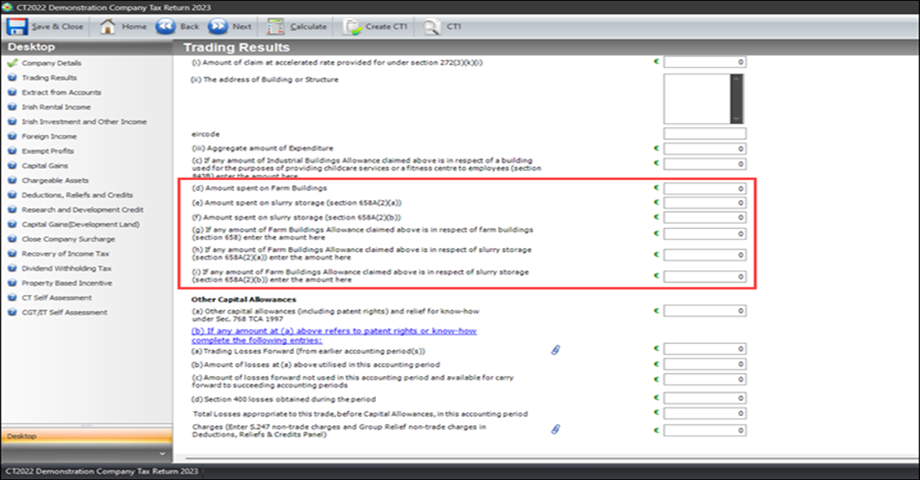

Trading Results

Trade Profits at 12.5%

The Trading Results section has new details added under the sub-section Trade Profits at 12.5%. The new version has six new fields added under the heading. The user can add the amount spent on Farm Buildings. They can add the amount spent on slurry storage (section 658A(2)(a)), amount spent on slurry storage (658A(2)(b)). The user can enter any amount of Farm Buildings Allowance claimed above in respect of farm buildings (section 658), enter any amount of Farm Buildings Allowance claimed above in respect of slurry storage (section 658A(2)(a)), enter the amount of Farm Buildings Allowance claimed above is in respect of slurry storage (section 658A(2)(b)). The new fields added are listed below:

- Amount spent on Farm Buildings

- Amount spent on slurry storage (section 658(2)(a))

- Amount spent on slurry storage (section 658(2)(b))

- If any amount of Farm Buildings Allowance claimed above is in respect of farm buildings (section 658) enter the amount here

- If any amount of Farm Buildings Allowance claimed above is in respect of slurry storage (section 658A(2)(a)) enter the amount here

- If any amount of Farm Buildings Allowance claimed above is in respect of slurry storage (section 658A(2)(b)) enter the amount here

Figure 4: New section added under Trade Profits at 12.5%

Irish Investment and Other Income

Patent Rights- Transactions involving Capital Sums (Section 757)

The Irish Investment and Other Income section has new details added under the sub-section Patent Rights. The new version has thirteen new fields added under the heading. The first addition lets the user to enter the net proceeds amount for resident company-patent rights sold for capital sums in current accounting period s757(1). The second addition lets the user to enter the net proceeds amount for non-resident company- patent rights sold for capital sum in current accounting period s757(2). The third addition allows the user to enter the cost of patent rights purchased for capital sum in current accounting period. The user can add the name of the other company, tax reference of the other company and tick a box if making a joint election under section 617(4) under Patent rights purchased to which S757(4A). The user can add the name of the other company, the tax reference of the other company, and tick a box if making a joint election under section 617(4) under Patent rights sold to which S757(4A). The user can enter the net proceeds of the deemed sale of patent rights. The user can also enter the net proceeds chargeable in the current year from sales in the accounting period and net proceeds chargeable in the current year from sales in the previous accounting period under the amount chargeable to tax in AP under s757. The user can also enter the total chargeable under s757 in the current year. The new fields added are listed below:

- Resident Company- Patent rights sold for capital sums in current accounting period s757(1) Net Proceeds

- Non-resident Company- Patent rights sold for capital sum in current accounting period s757(2) Net Proceeds

- Patent rights purchased for capital sum in current accounting period Cost

- Patent rights purchased to which S757(4A) applies: Name of the other company

- Patent rights purchased to which S757(4A) applies: Tax reference of other company

- Patent rights purchased to which S757(4A) applies: Tick box if making a joint election under section 617(4)

- Patent rights sold to which S757(4A) applies: Name of the other company

- Patent rights sold to which S757(4A) applies: Tax reference of other company

- Patent rights sold to which S757(4A) applies: Tick box if making a joint election under section 617(4)

- Deemed sale of patent rights (withdrawal of intra-group transfer relief availed of under 757(4A), Net Proceeds

- Amount chargeable to tax in AP under s757: Net Proceeds chargeable in current year from sale in this accounting period

- Amount chargeable to tax in AP under s757: Net Proceeds chargeable in current year from sale in previous accounting period

- Total chargeable under s757 in current year

Figure 5: New section added under Irish Investment and Other Income

Recovery of Income Tax

Interest paid under deduction of Income Tax at a reduced rate or without the deduction of Income Tax

The Recovery of Income Tax section has new details added under the sub-section Interest paid under deduction of income tax at a reduced rate or without the deduction of income tax. The new version has five new fields added under the heading. The first three additions are under the condition; if you have applied the practice set out in Paragraph 9 of Tax and Duty Manual 08-03-06 to make a payment of interest to a non-resident: a. at a reduced rate of income tax please state the DTA relied on, the amount of interest paid and confirm that the interest deducted has been included in the panel above. The next two additions are under the condition; Interest paid without the deduction of income tax: b. without the deduction of tax please state the DTA relied on, the amount of the interest paid without the deduction of income tax. The new fields added are listed below:

- If you have applied the practice set out in Paragraph 9 of Tax and Duty Manual 08-03-06 to make a payment of interest to a non-resident: a. at a reduced rate of income tax please state the DTA relied on

- if you have applied the practice set out in Paragraph 9 of Tax and Duty Manual 08-03-06 to make a payment of interest to a non-resident: The amount of interest paid

- if you have applied the practice set out in Paragraph 9 of Tax and Duty Manual 08-03-06 to make a payment of interest to a non-resident: Confirm that the interest deducted has been included on the panel above

- Interest paid without the deduction of income tax: b. without the deduction of tax please state the DTA relied on

- Interest paid without the deduction of income tax: the amount of the interest paid without the deduction of income tax

Figure 6: New section added under Recovery Income Tax