About Losses

Losses in Detail

Note: The Losses sections deals with income tax losses. You should enter losses that relate to capital gains in the Capital Gains section.

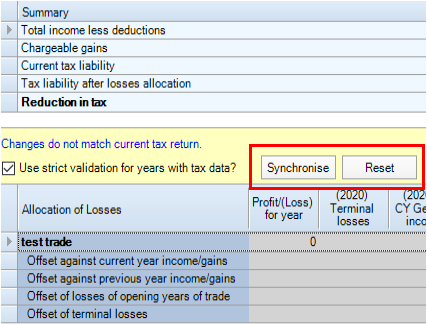

You can synchronise losses entered here with the tax return or reset the values if the allocation is not as required. This can also be used for "What if?" planning. For example, should the client use losses this year or carry forward to a future year against a higher tax rate?

Use the Synchronise button to update the tax return (computation figures) with the figures you have entered in the Losses section.

Losses Brought Forward (b/fwd)

If this is first return that you are undertaking for this client, then you may want to enter the losses they made from a previous tax return in the Losses Brought forward column.

Errors

An error occurs if you allocate an incorrect amount, for example, you allocate more than the incurred loss or the loss should be capped.

The cell or cells that contain the error appear in red and the message "There are errors in the allocation" appears next to the Reset button. You must correct all errors before you can synchronise losses with the tax return.

Note: Use the Reset button with care as it clears all figures and matches them with the amounts stored in the tax return.

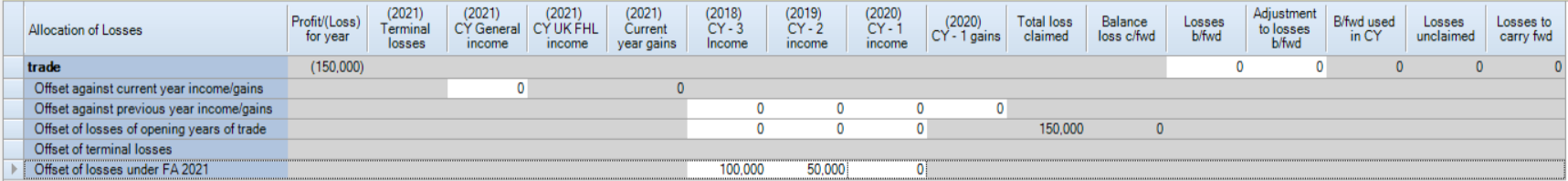

FA 2021 Temporary Trading Loss Carry Back

Section 18 and Schedule 2 bring in a temporary extension to existing carry back rules for trading losses from one year to three years; this is in force for 2021 and 2022. The relief, which has been introduced in response to the COVID-19 pandemic, has restrictions as to the trade or profession eligible to make a claim and to the type and amount of income that can be offset. There are also conditions that should be met before a claim is made.

Loss carry back entries can be made in respect of trades and professions including partnership share and Lloyd’s underwriting where the commencement date is not in the tax year, there is a loss and:

- Cash basis is not checked

- Non active trader is not checked

- Trading allowance is not checked

- Non active Partner is not checked

The relevant for for carry back is called Offset of losses under FA2021:

Only a few validations exist on the amounts that can be entered, users need to be aware of the total amount that can be claimed and the interaction with other reliefs.

The Total income less deductions element in the summary panel of the loss allocation screen reflects loss claims made for the year currently in progress, otherwise figures appear from the SA302 for tax without adjustment for losses.