Adjusting Profit and Loss items

Adding Tax categories

This feature allows for the adding of Tax categories which creates links to other areas in Corporation Tax for example disallowable adjustments.

To add tax categories to the /Profit & Loss analysis:

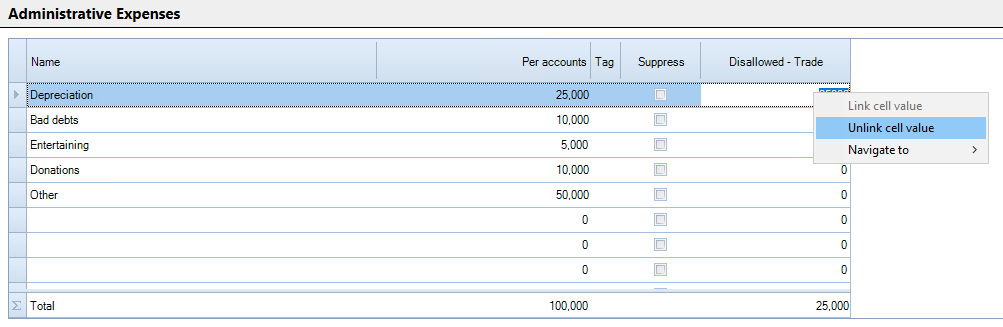

Open the profit and loss sub analysis analysis by clicking on the hyperlink e.g Administrative expenses or by selecting it from the Data Navigator.

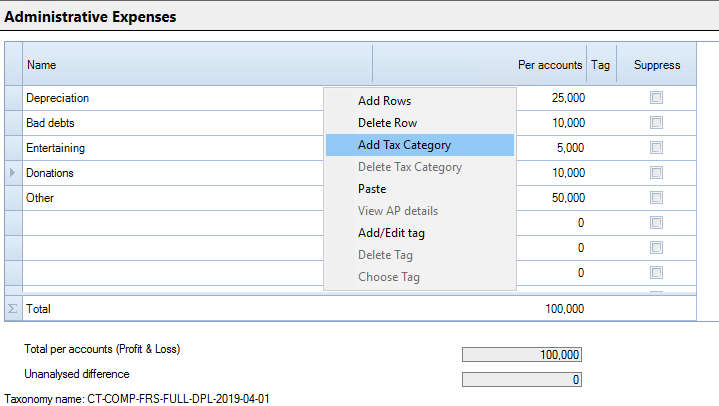

Right click and select Add Tax Category.

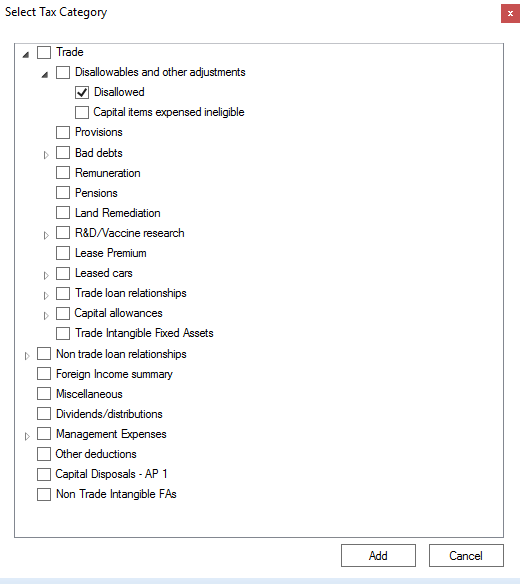

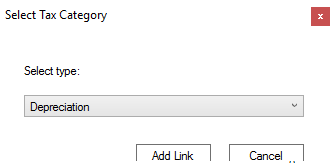

In the Select Tax Category wizard expand the contents tree, select the appropriate tax categories and click Add.

The tax categories selected will appear as columns in the analysis window.

Enter the amounts to adjust in the Tax Category columns and press the tab key.

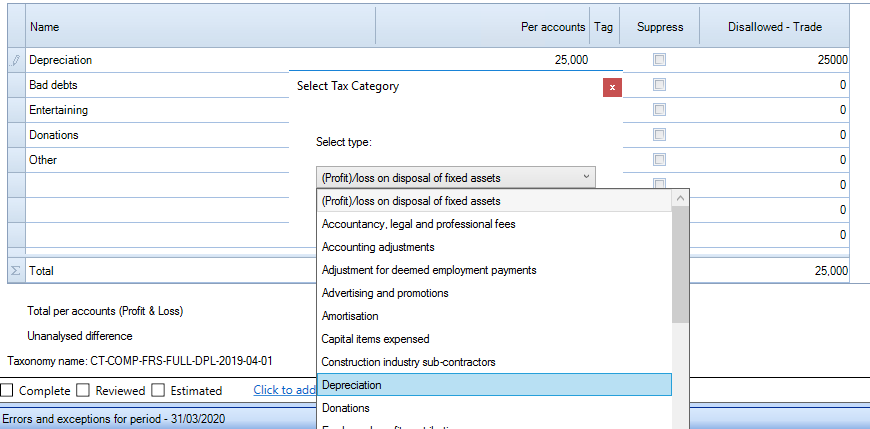

If analysing amounts relating to Disallowable adjustments or Allowable expenses within Management Expenses an extra selection is required after tabbing out of the field.

Select the tax category from the list.

And click Add link.

To unlink a value left click in the cell, highlight the value, right click and select Unlink cell value.

A warning message is displayed when the amount is not linked to an area in Corporation Tax.

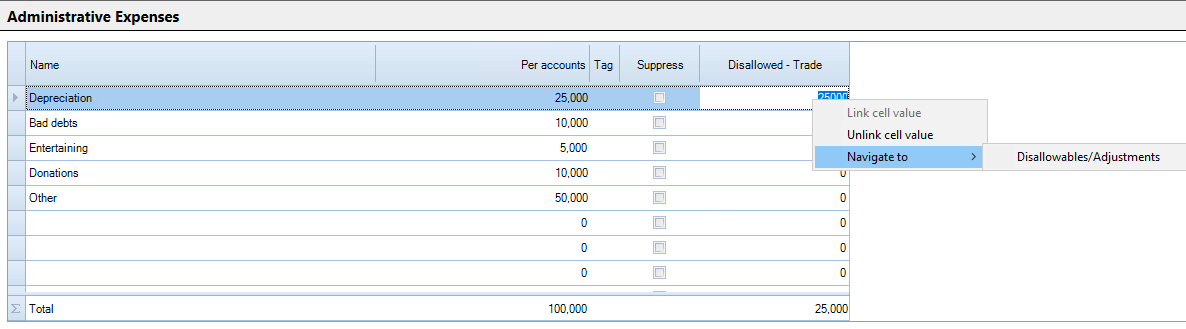

To navigate from a linked value in the Profit & Loss, highlight the value, right click and select Navigate to.