Capital Disposals

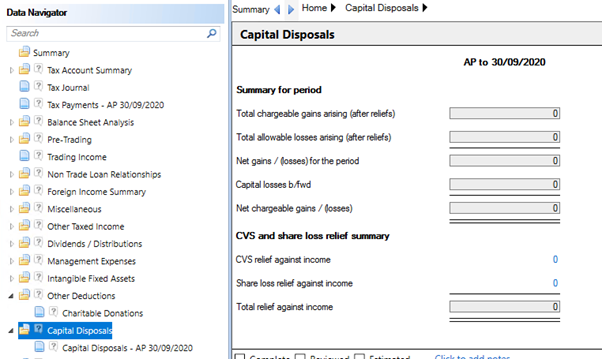

Capital Disposals is located within the Data Navigator.

The Summary for the period shows the total chargeable gains and the net chargeable gains / losses.

Access the Capital Disposal input for the accounting period in the Data Navigator.

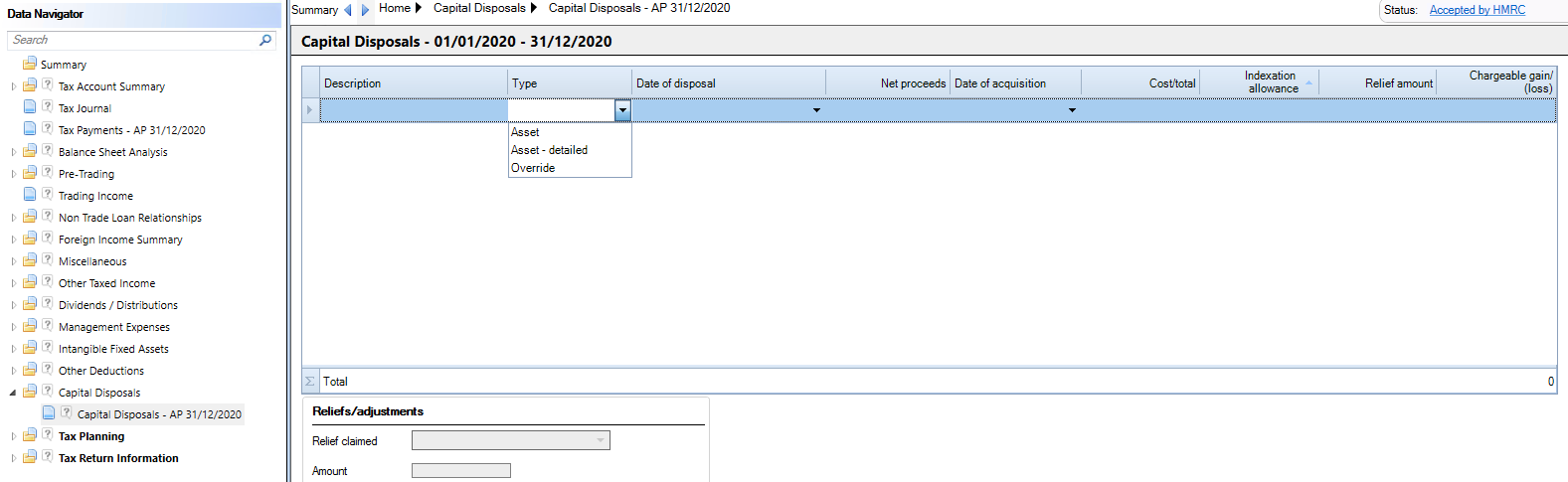

Enter a Description and select the Type.

Asset - For a basic capital disposal where there is a single date of expenditure.

Asset – detailed – where there are multiple dates of expenditure, acquisition and disposal costs.

Override – to enter a customised capital disposal calculation (e.g. shares, pre-1982 acquisitions).

Asset

Enter the Date of disposal, the Net proceeds, the Date of acquisition the Cost/total.

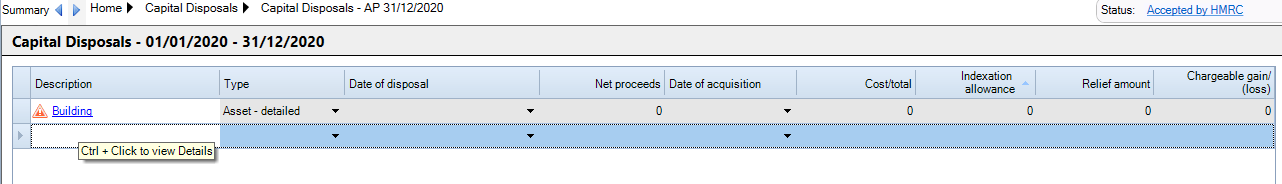

Asset – detailed

When Asset Detailed is selected the remainder of the row becomes uneditable and is populated from a detailed sub analysis. To access the detailed analysis hold the Ctrl key on the keyboard and click on the hyperlink that now appears in the Description column.

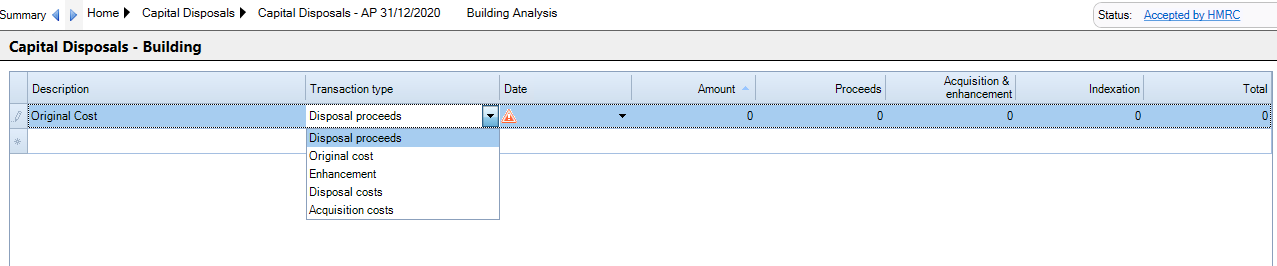

Enter the Description of Original Cost, Acquisition Costs, Enhancement, Disposal Proceeds and Disposal costs selected from the Transaction Type drop down menu.

Enter the Date and Amount for each transaction and tab to the next row.

The Total row will populate the analysed row on the Capita Disposal input statement.

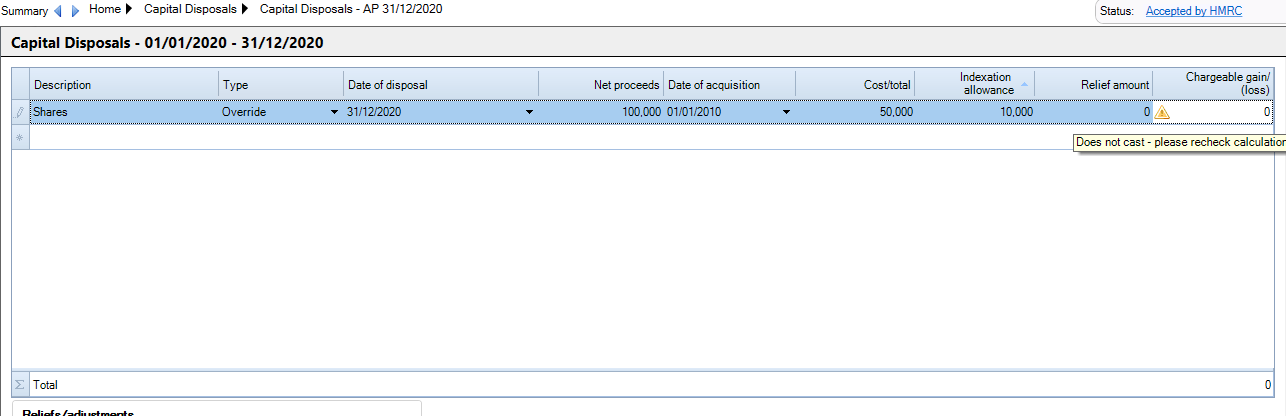

Override

Enter the Description, Date of disposal, Net proceeds, Date of Acquisition, Cost/Total, Indexation Allowance and Chargeable gain/(loss).

A Warning will appear if the Chargeable gain(loss) does not cast arithmetically with the input figures.